UK Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

UK Animal Feed Market Overview:

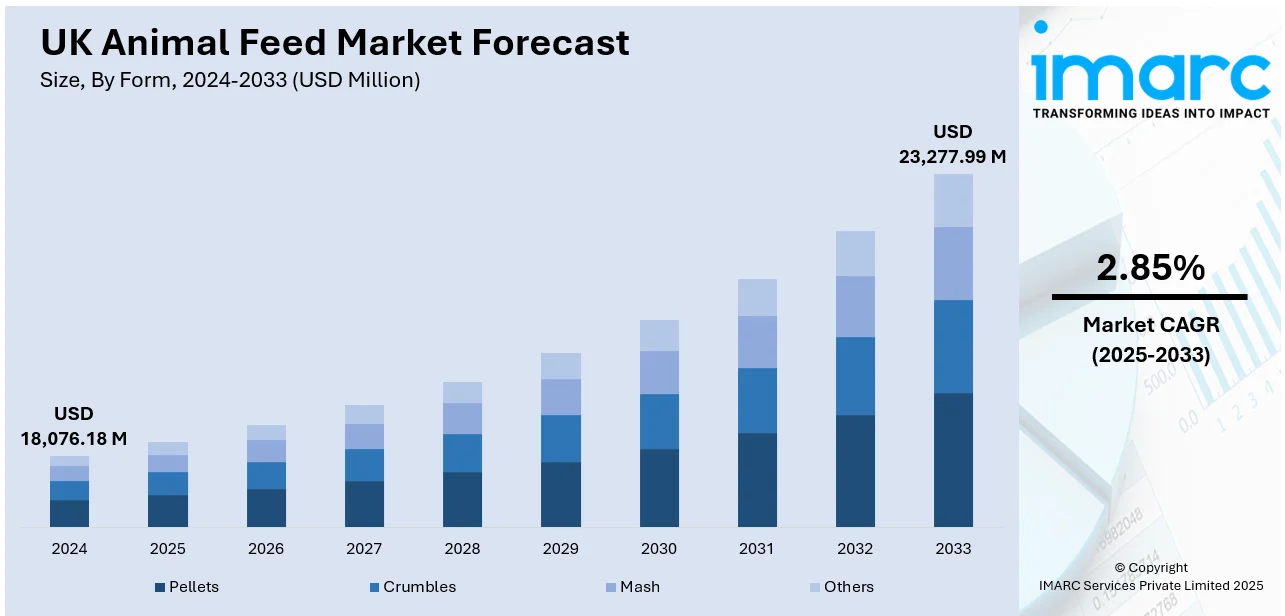

The UK animal feed market size reached USD 18,076.18 Million in 2024. The market is projected to reach USD 23,277.99 Million by 2033, exhibiting a growth rate (CAGR) of 2.85% during 2025-2033. The market is expanding as demand for sustainable and innovative feed solutions rises. The shift towards alternative proteins and more eco-friendly ingredients is driving growth. This trend supports the UK animal feed market share, especially in livestock and pet food segments, fostering long-term industry development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18,076.18 Million |

| Market Forecast in 2033 | USD 23,277.99 Million |

| Market Growth Rate 2025-2033 | 2.85% |

UK Animal Feed Market Trends:

Sustainability Drives UK Animal Feed Market Growth

In recent years, sustainability has become a driving force in the UK animal feed market growth. In addition, there has been a significant move towards more sustainable practices in the feed sector in the wake of growing concerns on climate change and environmental degradation. Moreover, with soymeal and other conventional protein sources under attack for their high carbon footprint, there is a rising call for alternative ingredients that not only have a lesser impact on the environment but are also addressing the food supply chain's overall sustainability. For example, in February 2025, England and Wales opened up a public consultation to reform livestock feed controls, specifically the potential to introduce non-ruminant Processed Animal Protein (PAP) into poultry and pig feeding. The move, previously banned for more than 20 years on the grounds associated with BSE, brings the UK into line with European science backing the safety of PAP. If approved, the addition of PAP to feed products is likely to diminish emissions and enhance overall animal agriculture sustainability. In making the feed industry more sustainable, this action could revolutionize the UK animal feed industry, promoting further expansion through the use of more efficient, lower-impact protein sources.

To get more information on this market, Request Sample

Innovation Shapes UK Animal Feed Market Trends

Innovation has emerged as a key factor shaping the market trends, particularly in response to increasing consumer demand for sustainable and ethical food options. Technological advancements are driving the sector toward more efficient and environmentally friendly solutions. In February 2025, Meatly, a pioneer in cultivated meat, made headlines by launching "Chick Bites," the world’s first pet food made from cultivated chicken meat, in collaboration with THE PACK. This breakthrough product marks a significant step forward in providing an alternative to traditional meat-based pet food, addressing both sustainability and animal welfare concerns. As more consumers seek sustainable and cruelty-free alternatives in pet care, products like "Chick Bites" offer a solution that aligns with these growing preferences. The introduction of cultivated meat represents a paradigm shift in pet food production, demonstrating the potential for scaling up sustainable protein sources within the broader animal feed market. Meatly’s innovation highlights the increasing role of technological advancements in the industry, signaling a future where animal feed, including pet food, becomes more sustainable. This shift towards alternative protein sources and innovative manufacturing techniques is set to transform the UK animal feed market, influencing both consumer choices and industry practices in the coming years.

UK Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

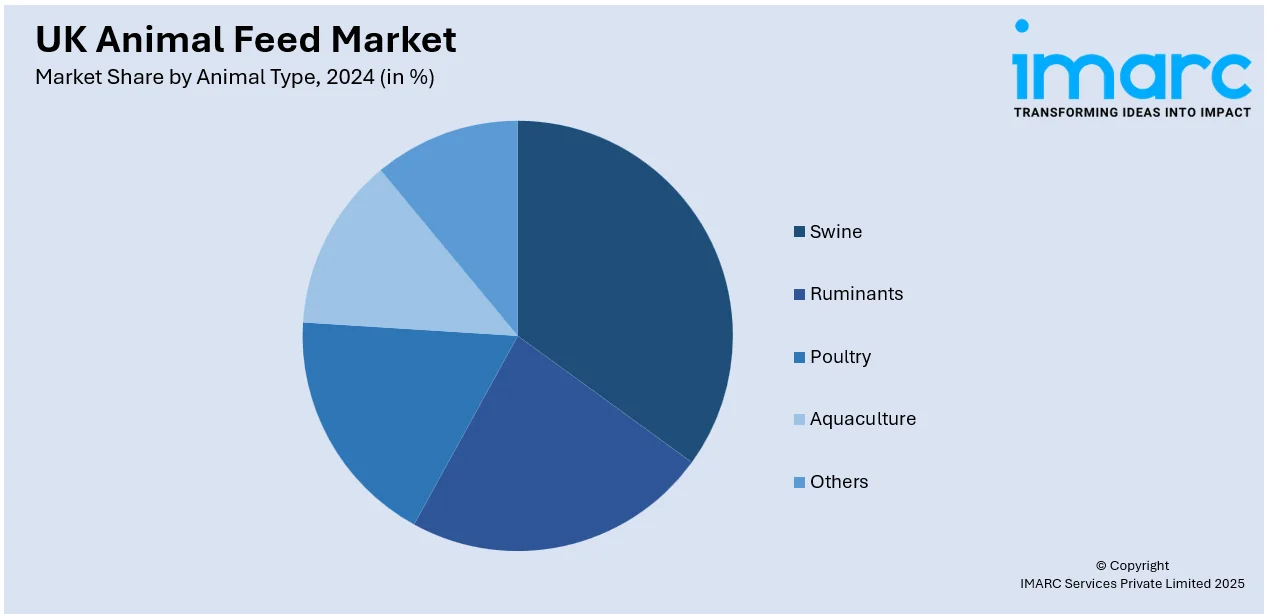

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Animal Feed Market News:

- May 2025: SugaRich strengthened its position in the UK animal feed market through the acquisition of McGuinness Feeds Ltd. This move enhanced SugaRich's market presence, leveraging McGuinness's expertise and infrastructure. The acquisition solidified SugaRich’s role in sustainable feed solutions and boosted industry growth.

- February 2025: England and Wales launched a consultation on livestock feed regulations, proposing the inclusion of non-ruminant Processed Animal Protein (PAP) in poultry and pig feed. This move aimed to improve animal nutrition, welfare, and sustainability while aligning the UK with European standards.

UK Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the UK animal feed market on the basis of form?

- What is the breakup of the UK animal feed market on the basis of animal type?

- What is the breakup of the UK animal feed market on the basis of ingredient?

- What is the breakup of the UK animal feed market on the basis of region?

- What are the various stages in the value chain of the UK animal feed market?

- What are the key driving factors and challenges in the UK animal feed market?

- What is the structure of the UK animal feed market and who are the key players?

- What is the degree of competition in the UK animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)