UK Anti-Money Laundering Market Size, Share, Trends and Forecast by Component, Product, Deployment, Enterprise Size, End Use, and Region, 2025-2033

UK Anti-Money Laundering Market Overview:

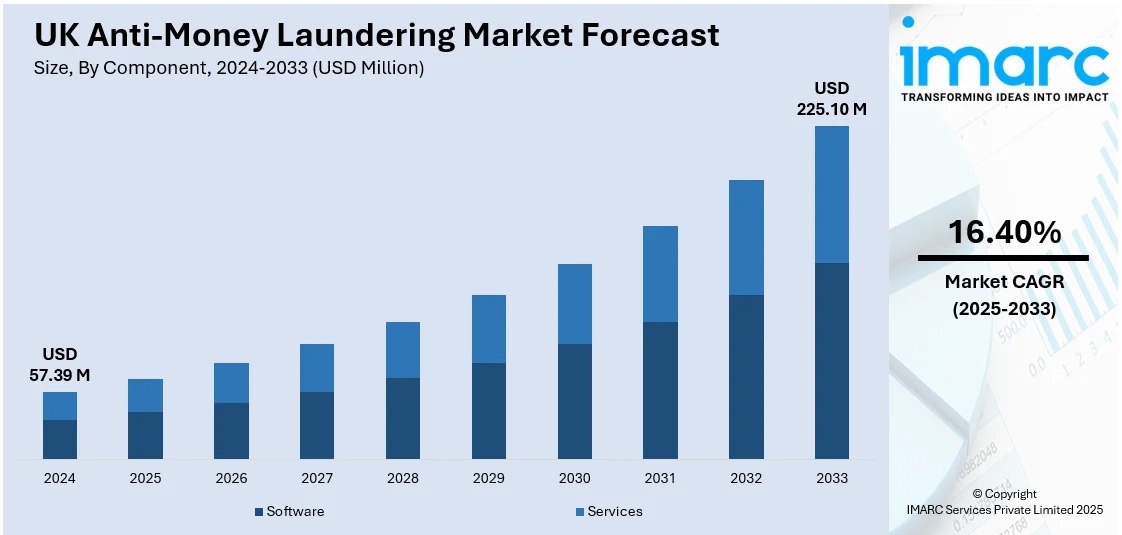

The UK anti-money laundering market size reached USD 57.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 225.10 Million by 2033, exhibiting a growth rate (CAGR) of 16.40% during 2025-2033. The market is growing because of stricter regulations, increased corporate liability, advanced technological adoption, rising cross-border transactions, financial globalization, enhanced due diligence requirements, and stronger enforcement measures aimed at preventing money laundering, fraud, and illicit financial activities in the UK’s evolving regulatory landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.39 Million |

| Market Forecast in 2033 | USD 225.10 Million |

| Market Growth Rate 2025-2033 | 16.40% |

UK Anti-Money Laundering Market Trends:

Strengthened Legislative Framework and Corporate Accountability

The UK’s anti-money laundering (AML) market is witnessing notable growth due to enhanced legislative measures aimed at curbing financial crime. Regulatory authorities are tightening compliance requirements, increasing corporate liability, and expanding the scope of AML enforcement. Businesses across financial services, legal, and corporate sectors are facing stricter obligations to prevent illicit financial activities, driving demand for advanced AML solutions. Enhanced due diligence, transaction monitoring, and risk assessment protocols are becoming essential to ensure compliance with evolving regulations. The Economic Crime and Corporate Transparency Act 2023, effective from October 2023, is a pivotal development in the UK's fight against financial crime. The Act introduced major reforms, expanding corporate liability for money laundering and fraud and making companies accountable for preventing such offenses or facing penalties. It also strengthened law enforcement powers to seize and recover crypto assets linked to illicit activities, reflecting the government's focus on tackling emerging financial crime risks. These reforms are compelling organizations to invest in AI-driven AML technologies, automated compliance tools, and blockchain-based fraud detection systems to mitigate risks effectively. The increasing regulatory scrutiny is fostering a culture of proactive compliance, ensuring that financial institutions and corporations enhance their monitoring capabilities to detect and prevent financial crimes more efficiently.

Growing Globalization and Cross-Border Transactions

Globalization has greatly increased the range of businesses, financial institutions, and capital markets, leading to a more interconnected financial system. As a major player in the global financial world, the UK is heavily involved in international transactions, presenting various possibilities and dangers. One of the main outcomes of growing globalization and increasing cross-border transactions is the increasing danger of money laundering across borders, requiring more stringent Anti-Money Laundering (AML) regulations and procedures. As per the Bank of England, cross border payments in the UK are estimated to increase from $150 Trillion in 2017 to more than $250 Trillion by 2027. In a worldwide economy, individuals involved in money laundering can take advantage of areas with less strict anti-money laundering measures, developing intricate financial transactions that are hard to follow. Moving funds across different countries with varying regulatory standards can present challenges in terms of detection and investigation. Criminals frequently utilize offshore banking, shell companies, and anonymous ownership structures to hide the source of illegal funds. These techniques are often employed alongside the substantial financial infrastructure of the UK, making it a major focus for money laundering operations from various global regions.

UK Anti-Money Laundering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, product, deployment, enterprise size, and end use.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Product Insights:

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes compliance management, currency transaction reporting, customer identity management, and transaction monitoring.

Deployment Insights:

- Cloud

- On-premise

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud and on-premise.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises.

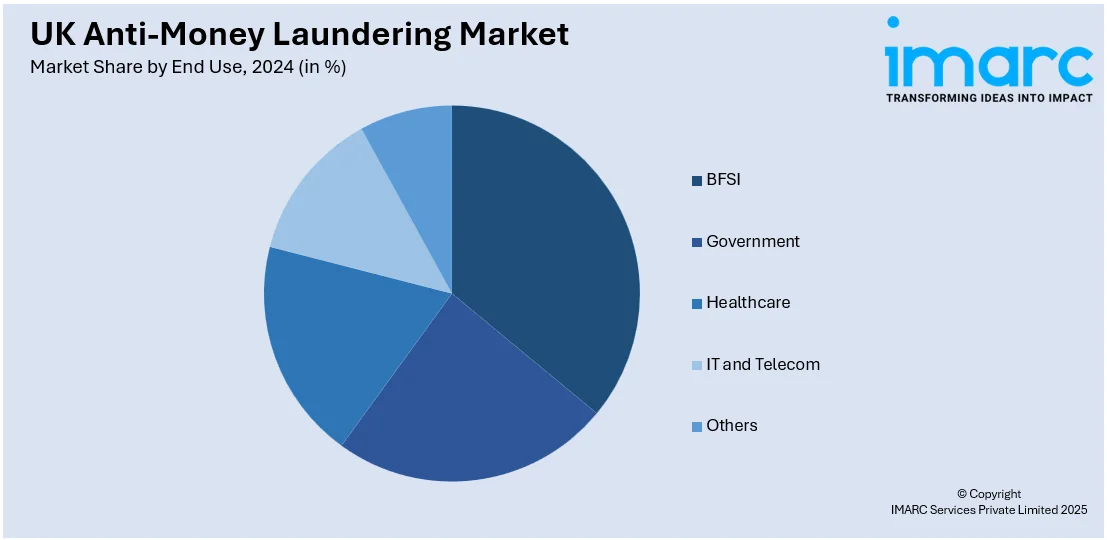

End Use Insights:

- BFSI

- Government

- Healthcare

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes BFSI, government, healthcare, IT and telecom, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Anti-Money Laundering Market News:

- In May 2024, First AML, the anti-money laundering scaleup, collaborated with Armalytix, the Open Banking technology platform, which streamlined the collection of data for the professional and financial services industries, to boost its source of wealth capabilities and source of funds.

- In March 2024, Wolters Kluwer Tax & Accounting (TAA) U.K. introduced an anti-money laundering module (AML) as part of CCH iFirm, its cloud-based practice management and compliance software solution. Wolters Kluwer CCH iFirm AML smoothly connects with CCH Central, the on-premises system from Wolters Kluwer TAA, minimizing the necessity to re-enter data into another system and facilitating a quicker AML compliance process and client onboarding.

UK Anti-Money Laundering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Products Covered | Compliance Management, Currency Transaction Reporting, Customer Identity Management, Transaction Monitoring |

| Deployments Covered | Cloud, On-premise |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | BFSI, Government, Healthcare, IT and Telecom, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK anti-money laundering market performed so far and how will it perform in the coming years?

- What is the breakup of the UK anti-money laundering market on the basis of component?

- What is the breakup of the UK anti-money laundering market on the basis of product?

- What is the breakup of the UK anti-money laundering market on the basis of deployment?

- What is the breakup of the UK anti-money laundering market on the basis of enterprise size?

- What is the breakup of the UK anti-money laundering market on the basis of end use?

- What is the breakup of the UK anti-money laundering market on the basis of region?

- What are the various stages in the value chain of the UK anti-money laundering market?

- What are the key driving factors and challenges in the UK anti-money laundering market?

- What is the structure of the UK anti-money laundering market and who are the key players?

- What is the degree of competition in the UK anti-money laundering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK anti-money laundering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK anti-money laundering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK anti-money laundering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)