UK Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2026-2034

UK Aquaculture Market Summary:

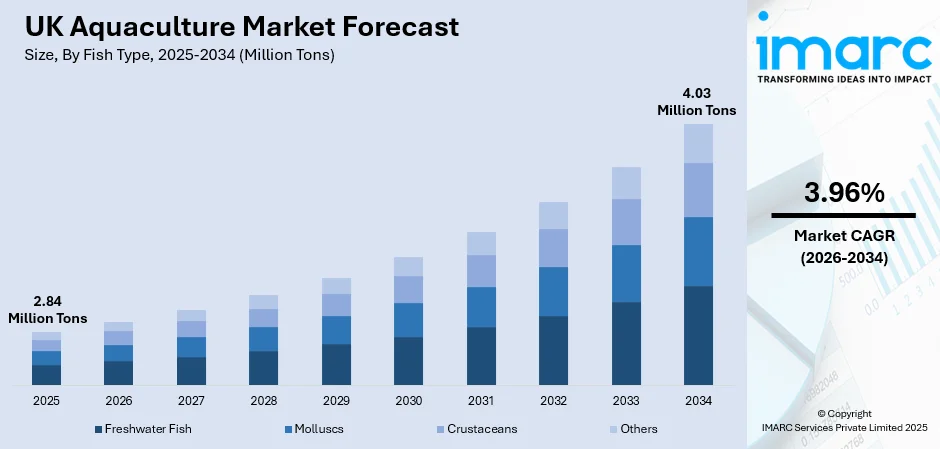

The UK aquaculture market size reached 2.84 Million Tons in 2025 and is projected to reach 4.03 Million Tons by 2034, growing at a compound annual growth rate of 3.96% from 2026-2034.

The UK aquaculture market is experiencing significant growth driven by rising health consciousness among consumers seeking protein-rich dietary alternatives and sustainable food sources. The industry benefits from strong government support through initiatives like the Fisheries and Seafood Scheme. Scotland's salmon farming sector, representing the country's leading food export, continues to drive market expansion alongside growing shellfish production. Technological advancements in recirculating aquaculture systems and precision farming techniques are enhancing production efficiency while supporting environmental sustainability goals across the UK aquaculture market share.

Key Takeaways and Insights:

- By Fish Type: Freshwater fish dominates the market with a share of 46.24% in 2025, driven by established trout farming operations, lower production costs, and strong consumer preference for domestically farmed freshwater species across traditional retail channels.

- By Environment: Fresh water leads the market with a share of 46.22% in 2025, attributed to abundant freshwater resources, lower operational complexity, established infrastructure for trout and carp farming, and growing investment in land-based recirculating aquaculture systems.

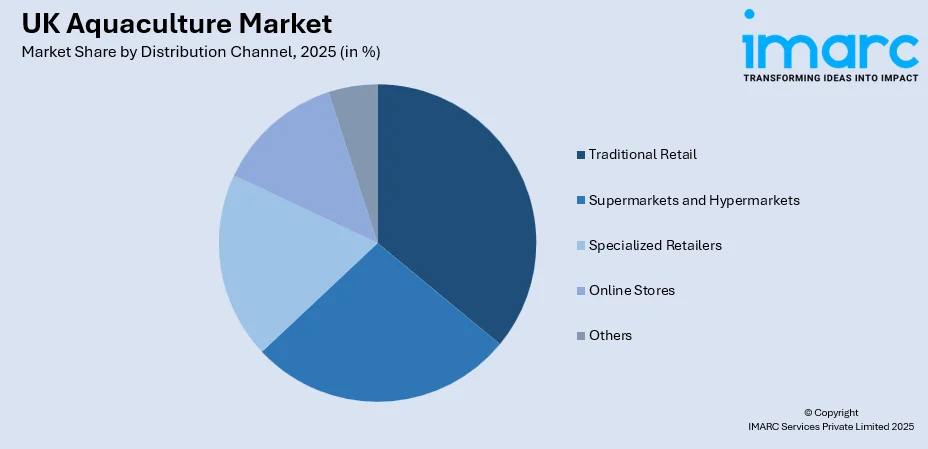

- By Distribution Channel: Traditional retail represents the largest segment with a market share of 32.06% in 2025, supported by consumer trust in established fishmongers, premium product positioning, and personalized service that appeals to quality-conscious seafood purchasers.

- Key Players: The UK aquaculture market demonstrates moderate competitive intensity with established multinational corporations competing alongside regional producers. Major industry participants focus on sustainable production practices, technological innovation, and vertical integration strategies to strengthen market positioning and meet evolving regulatory requirements.

To get more information on this market Request Sample

The UK aquaculture industry has emerged as a critical component of the nation's food security strategy and agricultural economy, with Scotland maintaining its position as one of the world's leading producers of farmed Atlantic salmon. The sector makes substantial contributions to the broader Scottish economy while supporting thousands of jobs across rural and coastal communities. According to the Scottish Fish Farm Production Survey 2024 published by the Scottish Government, Atlantic salmon production reached 192,000 tonnes, representing a significant 27% increase over the previous year's output. This remarkable growth demonstrates the industry's resilience and expansion capacity. The sector continues to attract investment in sustainable technologies, including recirculating aquaculture systems and precision farming solutions, positioning the UK as a leader in environmentally responsible aquaculture practices.

UK Aquaculture Market Trends:

Adoption of Recirculating Aquaculture Systems and Land-Based Farming

The UK aquaculture sector is witnessing accelerated investment in recirculating aquaculture systems (RAS) that offer controlled environments for fish production with minimal environmental impact. These advanced systems enable producers to farm species year-round while significantly reducing water consumption and eliminating concerns about marine pollution and wild fish interactions. Land-based RAS facilities also provide greater biosecurity, protecting farmed stocks from disease transmission while allowing operations to be established closer to consumer markets.

Digital Transformation and Precision Aquaculture Technologies

Precision aquaculture technologies incorporating artificial intelligence, Internet of Things sensors, and advanced data analytics are transforming farming operations across the UK. These digital solutions enable real-time monitoring of water quality parameters, automated feeding systems based on fish behavior analysis, and predictive modeling for disease prevention. The Scottish Aquaculture Innovation Centre has been supporting research and development initiatives for over ten years, driving technological advancement that enhances production efficiency while improving fish health and welfare outcomes throughout the sector.

Growing Focus on Environmental Sustainability and Certification Standards

Environmental sustainability has become a central priority for UK aquaculture producers responding to consumer demand for responsibly sourced seafood products. The Scottish salmon sector has committed to achieving net zero emissions by 2045, implementing cleaner energy solutions and reducing carbon footprints across production operations. Research commissioned by the Scottish Shellfish Marketing Group and the University of Edinburgh confirmed that Scottish farmed oysters deliver the lowest Global Warming Potential among all major farmed protein sources in the UK, supporting the growing market appeal of sustainably produced aquaculture products.

Market Outlook 2026-2034:

The UK aquaculture market is positioned for sustained growth through 2033, driven by increasing domestic seafood demand, government investment in sustainable farming infrastructure, and technological innovation in production systems. British fish production is projected to rise, supported by expansion in both marine and freshwater farming operations. The sector continues to benefit from strategic initiatives including the Fisheries and Seafood Scheme, which has allocated £27 Million across more than 1,300 projects supporting industry development. The market generated a revenue of 2.84 Million Tons in 2025 and is projected to reach a revenue of 4.03 Million Tons by 2034, growing at a compound annual growth rate of 3.96% from 2026-2034.

UK Aquaculture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Fish Type | Freshwater Fish | 46.24% |

| Environment | Fresh Water | 46.22% |

| Distribution Channel | Traditional Retail | 32.06% |

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The freshwater fish dominates with a market share of 46.24% of the total UK aquaculture market in 2025.

The freshwater fish segment maintains its leading position within the UK aquaculture market, supported by well-established production infrastructure and strong domestic demand for species including rainbow trout and carp. The British Trout Association reports that approximately 290 trout farms across the UK produce around 17,000 tonnes annually, with approximately 75% directed toward table consumption. The segment benefits from lower operational complexity compared to marine aquaculture, with freshwater farms operating in controlled inland environments that offer protection from marine disease transmission and environmental fluctuations.

Investment in freshwater aquaculture technology continues to strengthen segment performance, with producers implementing advanced recirculating aquaculture systems that enable year-round production while minimizing environmental impact. These systems allow farmers to maintain optimal water conditions regardless of seasonal variations, improving growth rates and product consistency. The growing consumer preference for locally sourced, sustainably produced protein alternatives further supports freshwater fish market expansion, as these operations typically demonstrate lower carbon footprints and reduced transportation distances compared to imported seafood products.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

The fresh water leads with a share of 46.22% of the total UK aquaculture market in 2025.

Freshwater aquaculture environments dominate the UK market, benefiting from abundant natural water resources including rivers, lakes, and purpose-built pond systems that support diverse farming operations. The segment encompasses both traditional flow-through systems and advanced recirculating aquaculture facilities that maximize water efficiency while maintaining optimal growing conditions. Scotland's freshwater production sector produced 44.6 million smolts in 2024, demonstrating the critical role of freshwater environments in supporting the broader salmon farming value chain. These facilities provide essential juvenile fish production before transfer to marine growing sites.

The environmental benefits of freshwater aquaculture systems continue to drive segment growth, as these operations face fewer regulatory constraints compared to marine cage farming and avoid complex interactions with wild fish populations. The Biotechnology and Biological Sciences Research Council has allocated £4.6 Million through the Sustainable Aquaculture Partnerships for Innovation fund to support research addressing freshwater aquaculture challenges including disease prevention and animal welfare enhancement. This investment reflects growing recognition of freshwater environments as sustainable platforms for expanding UK aquaculture production capacity.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The traditional retail exhibits a clear dominance with a 32.06% share of the total UK aquaculture market in 2025.

Traditional retail channels maintain significant market presence in UK aquaculture distribution, serving consumers who prioritize personalized service, product expertise, and premium quality assurance. Independent fishmongers and traditional fish markets continue to attract loyal customer bases seeking freshness guarantees and knowledgeable recommendations regarding species selection and preparation methods. UK retail seafood sales reached over £4.65 Billion in 2024, with chilled products representing 62% of total value according to Seafish data, highlighting consumer preference for fresh aquaculture products accessed through traditional retail outlets.

The traditional retail segment differentiates through superior product quality, traceability transparency, and value-added services that larger retail formats cannot easily replicate. These retailers typically maintain direct relationships with local producers and processors, enabling shorter supply chains that preserve product freshness while supporting regional aquaculture operations. Independent fishmongers and traditional markets continue to attract loyal customer bases seeking personalized expertise, freshness guarantees, and knowledgeable recommendations regarding species selection and preparation methods.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the leading hub for seafood consumption and distribution in the UK, characterized by high disposable incomes, diverse culinary preferences, and premium foodservice demand. The capital's hospitality sector drives significant aquaculture product consumption, although Billingsgate Market, the UK's largest seafood wholesale hub, is scheduled for closure by 2028 following the City of London Corporation's decision in November 2024.

The South East region benefits from proximity to London markets and established processing infrastructure, supporting efficient distribution of aquaculture products to urban consumers. Oyster farming traditions along the Kent coast, particularly around Whitstable, contribute to regional aquaculture heritage and premium product positioning within domestic and export markets.

The North West region maintains significance through established processing facilities that serve national distribution networks, with the region contributing to frozen seafood supply chains. Liverpool's historical port infrastructure supports import handling and distribution logistics for aquaculture products entering from international sources.

The East of England region encompasses coastal aquaculture operations and freshwater farming facilities that supply regional markets. The Centre for Environment, Fisheries and Aquaculture Science (CEFAS) based in Lowestoft provides research and regulatory support for aquaculture development across the region and nationally.

The South West region demonstrates strong potential for aquaculture development, with mussel and oyster farming operations along the Devon and Cornwall coastlines. The region hosts England's largest mussel farm off Brixham, which achieved Europe's first Best Aquaculture Practice certification, highlighting the area's commitment to sustainable shellfish production standards.

Aquaculture production in Scotland is high as Scottish salmon maintains its position as the UK's leading food export, with record-breaking export values achieved in 2024, substantially exceeding previous highs and reinforcing the nation's reputation for premium quality aquaculture products.

The West Midlands serves primarily as a consumption center with limited aquaculture production, though freshwater ornamental fish farming contributes to regional agricultural output. Birmingham's foodservice and retail sectors drive demand for aquaculture products distributed through national supply chains.

Yorkshire and The Humber region supports both trout farming operations and processing facilities serving northern markets. Traditional trout farms operate throughout central and southern Scotland and North Yorkshire, contributing to regional freshwater aquaculture output and employment.

The East Midlands region maintains modest aquaculture activity focused on freshwater species production for recreational fisheries and limited food production. Regional markets are primarily served by products distributed from major production centers in Scotland and coastal areas.

Market Dynamics:

Growth Drivers:

Why is the UK Aquaculture Market Growing?

Rising Health Consciousness and Demand for Protein-Rich Dietary Alternatives

Consumer awareness regarding the health benefits of seafood consumption continues to drive UK aquaculture market expansion, with fish recognized as an excellent source of omega-3 fatty acids, high-quality protein, and essential vitamins. Health campaigns and nutritional research highlighting cardiovascular and cognitive benefits encourage households and foodservice establishments to increase seafood incorporation in meal planning. Older demographic segments demonstrate particularly strong seafood consumption patterns, with research indicating that health considerations prompt dietary choices prioritizing nutrient-rich options. The Marine Stewardship Council's 2024 UK and Ireland Market Report indicated strong sales of certified seafood products, reflecting consumer commitment to both health and sustainability objectives.

Government Investment and Supportive Policy Framework for Industry Development

Strategic government initiatives provide substantial support for UK aquaculture industry growth through funding programs, research partnerships, and regulatory frameworks designed to promote sustainable expansion. Scotland's aquaculture strategy targets production growth to approximately 350,000 tonnes of salmon annually by 2030, alongside shellfish expansion to 21,000 tonnes, supported by favorable natural conditions and established industry infrastructure. These ambitious targets are further reinforced by coordinated efforts between industry stakeholders, academic institutions, and government bodies working collaboratively to address challenges related to environmental sustainability, fish health, and workforce development across the sector.

Technological Innovation in Sustainable Production Systems and Precision Farming

Advancement in aquaculture technology is transforming production efficiency and environmental performance across the UK industry, enabling sustainable growth while meeting evolving regulatory requirements. Recirculating aquaculture systems represent a particularly significant innovation, allowing land-based production that eliminates concerns about marine interactions and reduces water consumption through continuous treatment and reuse. Precision aquaculture incorporating artificial intelligence, IoT sensors, and automated feeding systems enhances production optimization while improving fish health outcomes. The Scottish Aquaculture Innovation Centre continues to drive research and development supporting technological advancement throughout the sector.

Market Restraints:

What Challenges the UK Aquaculture Market is Facing?

Stringent Environmental Regulations and Compliance Requirements

The UK aquaculture sector operates under increasingly rigorous environmental regulations requiring significant compliance investment and operational adjustments. The Scottish Environment Protection Agency implemented its Sea Lice Framework from February 2024, establishing wild salmon protection zones and introducing tighter controls for finfish farm operators. These regulations restrict development opportunities in sensitive areas and require enhanced monitoring and management systems that increase operational costs for producers.

Disease Management Challenges and Sea Lice Control Costs

Sea lice infestations represent a persistent challenge for marine salmon aquaculture, requiring continuous investment in prevention and treatment solutions that impact production economics. The industry has transitioned toward non-medicinal treatments including thermal, mechanical, and freshwater methods, though these approaches introduce welfare considerations and operational complexity. Treatment costs, both direct and indirect through mortality and growth impacts, remain significant factors affecting farm profitability and competitive positioning.

Economic Pressures from Cost-of-Living Crisis and Market Volatility

The cost-of-living crisis has affected UK seafood consumption patterns, with consumers demonstrating price sensitivity that impacts demand for premium aquaculture products. Supply chain disruptions and input cost inflation have pressured producer margins while rising retail prices potentially constrain market growth. Additionally, potential US tariffs on UK goods threaten export competitiveness, particularly for high-value salmon products targeting international markets.

Competitive Landscape:

The UK aquaculture market exhibits a moderately consolidated competitive structure in the salmon farming segment. The industry demonstrates significant vertical integration, with leading producers controlling multiple stages of the value chain from hatchery operations through processing and distribution. Competition increasingly centers on sustainability credentials, technological innovation, and operational efficiency as companies seek to meet evolving regulatory requirements while maintaining profitability. Smaller operators focus on niche positioning through organic certification, premium quality differentiation, and regional market specialization. The shellfish and freshwater segments demonstrate greater fragmentation, with numerous small-scale producers serving local markets alongside emerging technology-focused enterprises targeting sustainable production innovation.

Recent Developments:

- November 2024: Three-Sixty Aquaculture completed a £3.5 Million Series A funding round led by PrimeStar Industries to expand its RAS-based prawn farming facility in Neath, Wales. The investment supports commercialization of the UK's first sushi-grade prawn farm with plans to scale operations to over 2,000 tonnes annually.

UK Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK aquaculture market size reached 2.84 Million Tons in 2025.

The UK aquaculture market is expected to grow at a compound annual growth rate of 3.96% from 2026-2034 to reach 4.03 Million Tons by 2034.

The freshwater fish segment held the largest market share at 46.24% in 2025, driven by established trout farming infrastructure, lower production costs compared to marine aquaculture, and strong domestic consumer preference for locally farmed freshwater species.

Key factors driving the UK aquaculture market include rising health consciousness among consumers seeking protein-rich dietary alternatives, substantial government investment through programs like the Fisheries and Seafood Scheme, and technological innovation in sustainable production systems including recirculating aquaculture and precision farming technologies.

Major challenges include stringent environmental regulations including SEPA's Sea Lice Framework requiring significant compliance investment, ongoing disease management challenges and sea lice control costs affecting salmon farming economics, and economic pressures from the cost-of-living crisis impacting consumer seafood demand and producer margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)