UK B2B E-commerce Market Size, Share, Trends and Forecast by Deployment Type, Application, and Region, 2026-2034

UK B2B E-commerce Market Summary:

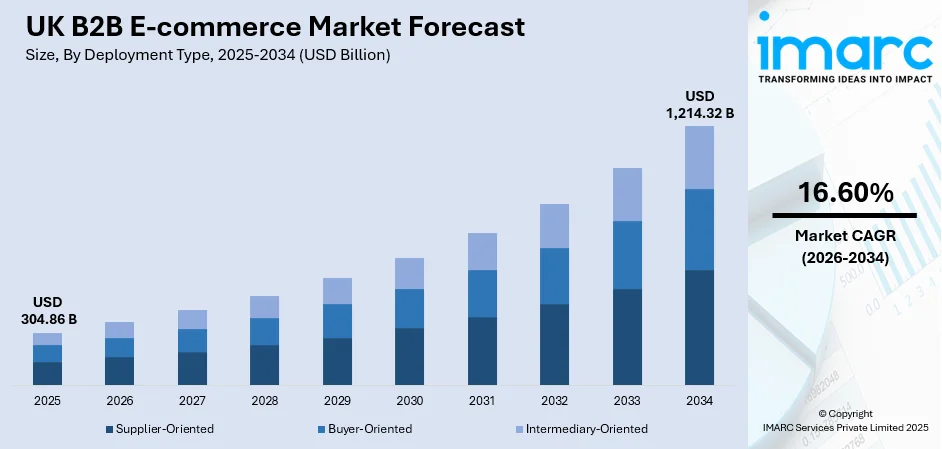

The UK B2B e-commerce market size was valued at USD 304.86 Billion in 2025 and is projected to reach USD 1,214.32 Billion by 2034, growing at a compound annual growth rate of 16.60% from 2026-2034.

The UK B2B e-commerce market is experiencing robust expansion, driven by accelerating digital transformation across industries and evolving procurement preferences among business buyers. Organizations are increasingly adopting online platforms to streamline purchasing workflows, enhance supply chain visibility, and reduce operational costs. The proliferation of mobile commerce solutions and integration of artificial intelligence (AI) into procurement processes are reshaping buyer expectations, while favorable regulatory frameworks and growing cross-border trade opportunities further strengthen the market share.

Key Takeaways and Insights:

- By Deployment Type: Supplier-oriented dominates the market with a share of 39% in 2025, driven by manufacturers and wholesalers establishing direct digital channels to reach business customers. This model enables suppliers to showcase comprehensive product catalogues, offer negotiated pricing, and maintain direct relationships with procurement teams across industries.

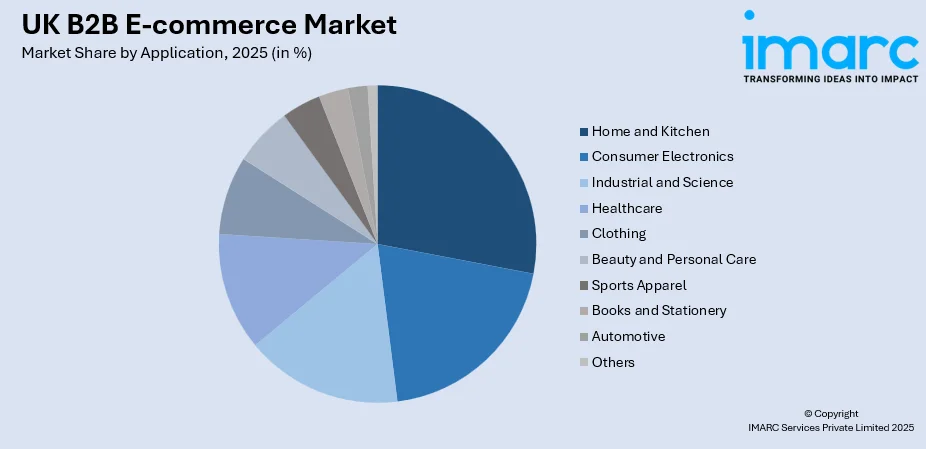

- By Application: Home and kitchen lead the market with a share of 18% in 2025, reflecting strong demand from hospitality businesses, retailers, and commercial establishments sourcing furnishings, appliances, and kitchenware through digital procurement platforms for operational efficiency and cost optimization.

- By Region: London represents the largest region with 20% share in 2025, benefiting from its position as a global financial hub with extensive corporate headquarters, technology startups, and established logistics infrastructure supporting digital commerce operations.

- Key Players: Leading platforms drive the UK B2B e-commerce market by investing in technology infrastructure, enhancing user experiences, expanding product portfolios, and forging strategic partnerships to capture growing digital procurement demand across diverse industry sectors.

To get more information on this market Request Sample

The UK B2B e-commerce market is undergoing substantial transformation, as businesses increasingly prioritize digital procurement channels for operational efficiency and competitive advantage. According to the Office for National Statistics, UK online retail sales reached a record £ 127 Billion in 2024, with B2B transactions representing a significant and growing portion of overall digital commerce activity. The market benefits from strong technological infrastructure, with 5G rollout reducing page-load times and enhancing mobile commerce experiences. Business buyers are demonstrating growing comfort with digital self-service purchasing. The integration of AI for personalized product recommendations, dynamic pricing, and automated inventory management is accelerating adoption rates among enterprises seeking streamlined procurement processes. Furthermore, the UK government's supportive digital economy policies and the emergence of specialized B2B platforms tailored to specific industry verticals are creating new opportunities for market participants to capture incremental market growth.

UK B2B E-commerce Market Trends:

AI Integration and Personalization

The adoption of AI across B2B e-commerce platforms is fundamentally reshaping procurement experiences in the UK market. Organizations are leveraging AI-powered tools for personalized product recommendations, predictive inventory management, and automated customer service through intelligent chatbots. As of May 2025, over a third of shoppers in the UK were utilizing AI for assistance in shopping, representing a 39% rise compared to 2024, according to Adyen’s annual Retail Report. B2B platforms are deploying machine learning (ML) algorithms to analyze purchasing patterns, optimize pricing strategies, and enhance search relevance, enabling buyers to complete complex procurement tasks efficiently.

Mobile-First Commerce and Self-Service Portals

Mobile commerce is becoming increasingly central to B2B purchasing behavior, as business buyers demand flexibility and convenience in procurement workflows. UK businesses are responding by developing responsive platforms optimized for mobile devices, enabling procurement teams to review catalogues, approve purchase orders, and track deliveries remotely. Self-service portals offering real-time inventory visibility, order history access, and automated reordering capabilities are gaining traction among enterprise customers seeking operational efficiency.

Digital Payment Solutions and Flexible Financing

The integration of sophisticated digital payment solutions and flexible financing options is transforming B2B transaction experiences in the UK market. Business buyers increasingly expect seamless payment processes comparable to consumer e-commerce, with options for invoice financing, trade credit, and digital wallets. According to a survey of 500 companies in the UK and Europe, 82% of B2B purchasers indicated that the availability of payment terms was either significant or highly significant when selecting a new B2B vendor. Platforms are partnering with fintech providers to offer embedded financing, real-time payment tracking, and automated reconciliation capabilities that streamline cash flow management for both buyers and sellers.

Market Outlook 2026-2034:

The UK B2B e-commerce market is positioned for sustained expansion throughout the forecast period, as digital transformation initiatives accelerate across industry sectors. The market generated a revenue of USD 304.86 Billion in 2025 and is projected to reach a revenue of USD 1,214.32 Billion by 2034, growing at a compound annual growth rate of 16.60% from 2026-2034. Continued investments in AI, enhanced mobile commerce capabilities, and sophisticated payment solutions will drive adoption among businesses seeking procurement efficiency. The emergence of specialized vertical marketplaces catering to specific industries, combined with government support for digital economy initiatives, creates favorable conditions for market participants. Growing emphasis on supply chain resilience and cross-border trade facilitation further strengthens the outlook for UK B2B e-commerce expansion.

UK B2B E-commerce Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Deployment Type |

Supplier-Oriented |

39% |

|

Application |

Home and Kitchen |

18% |

|

Region |

London |

20% |

Deployment Type Insights:

- Supplier-Oriented

- Buyer-Oriented

- Intermediary-Oriented

Supplier-oriented dominates with a market share of 39% of the total UK B2B e-commerce market in 2025.

The supplier-oriented deployment model has established clear market leadership in the UK B2B e-commerce landscape, driven by manufacturers and wholesalers establishing proprietary digital storefronts to engage directly with business customers. This model enables suppliers to maintain control over branding, pricing strategies, and customer relationships while offering comprehensive product catalogues with detailed specifications. It also allows faster response to customer inquiries, order customization, and improved after-sales support through direct digital interaction.

The dominance of supplier-oriented platforms reflects growing recognition among UK businesses that direct digital channels provide superior opportunities for relationship building and margin optimization. These platforms typically offer advanced features, including customer-specific pricing, contract management, and integration with enterprise resource planning (ERP) systems. The model particularly benefits suppliers serving specialized industrial sectors where technical expertise and product customization requirements necessitate close customer engagement throughout the procurement journey, enabling suppliers to differentiate through value-added services beyond transactional convenience.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Home and Kitchen

- Consumer Electronics

- Industrial and Science

- Healthcare

- Clothing

- Beauty and Personal Care

- Sports Apparel

- Books and Stationery

- Automotive

- Others

Home and kitchen lead with a share of 18% of the total UK B2B e-commerce market in 2025.

Home and kitchen have emerged as the leading application within the UK B2B e-commerce market, reflecting sustained demand from hospitality establishments, commercial kitchens, retailers, and property developers procuring furnishings, appliances, and housewares through digital channels. UK wholesale kitchenware suppliers are experiencing significant digital adoption, with platforms offering comprehensive catalogues, spanning cookware, small appliances, tableware, and commercial kitchen equipment. The segment benefits from established distribution networks and growing preference among procurement professionals for online sourcing of standardized product categories.

The segment's prominence is further reinforced by the UK hospitality sector's expansion, driving demand for kitchen equipment and furnishings from restaurants, hotels, and catering companies. As per IMARC Group, the UK hospitality market size reached USD 57,531.3 Million in 2024. B2B platforms serving this category increasingly offer value-added services, including bulk pricing, credit facilities, and next-day delivery, to commercial addresses. The integration of detailed product specifications, compatibility information, and customer reviews enhances purchasing confidence among business buyers seeking quality assurance for durable goods that impact operational efficiency and customer experiences.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

London exhibits a clear dominance with a 20% share of the total UK B2B e-commerce market in 2025.

London maintains its position as the leading region for B2B e-commerce activity in the UK, benefiting from its status as a global financial center and technology hub. The capital hosts high concentration of corporate headquarters, technology companies, and venture capital investment in Europe, creating substantial demand for digital procurement solutions across diverse industries. AI startups based in London secured a record USD 3.5 Billion in venture capital during 2024. This indicated a 52% rise compared to the amounts raised in 2023 (USD 2.3B).

The region's advanced logistics infrastructure, including extensive warehouse networks and same-day delivery capabilities, supports efficient B2B fulfilment operations critical for commercial customers. London's diverse economy, spanning financial services, professional services, creative industries, and technology, creates varied procurement requirements that B2B platforms address through specialized vertical marketplaces and comprehensive general merchandise offerings. The presence of major e-commerce platform headquarters and tech ecosystem further accelerates digital commerce innovations and adoption among regional businesses.

Market Dynamics:

Growth Drivers:

Why is the UK B2B E-commerce Market Growing?

Accelerating Digital Transformation Across Industries

The widespread adoption of digital transformation strategies across UK businesses is fundamentally reshaping procurement practices and driving substantial growth in B2B e-commerce. Organizations are increasingly recognizing that digital procurement channels offer significant advantages in operational efficiency, cost reduction, and supply chain visibility compared to traditional purchasing methods. Companies are implementing ERP integrations, automated purchasing workflows, and data analytics capabilities that enable informed decision-making while reducing administrative burdens on procurement teams across manufacturing, retail, healthcare, and professional services sectors. Cloud-based platforms enable real-time inventory tracking, order management, and supplier performance monitoring across complex supply chains. Digital marketplaces also support faster vendor onboarding and standardized procurement processes. Enhanced transparency improves compliance, audit readiness, and spend control for organizations. Together, these capabilities are accelerating the shift towards scalable, data-driven B2B purchasing models across the UK economy.

Evolving Buyer Expectations and Generational Shifts

The emergence of millennial and Generation Z professionals in procurement decision-making roles is transforming expectations for B2B purchasing experiences in the UK market. These demographics bring consumer-grade expectations for intuitive interfaces, mobile accessibility, and personalized recommendations to their professional purchasing activities. Business buyers increasingly demand seamless digital experiences comparable to consumer e-commerce, including comprehensive product information, real-time inventory visibility, and convenient self-service capabilities. The generational shift is accelerating the adoption of digital procurement tools as younger professionals favor online research and purchasing over traditional sales representative interactions. Platforms that deliver intuitive user experiences, rapid response times, and personalized content are capturing market share from legacy systems that fail to meet evolving buyer expectations. This shift is also encouraging suppliers to invest in user-centric design, AI-driven personalization, and omnichannel engagement to align with modern procurement preferences.

Government Support and Favorable Regulatory Environment

The UK government's commitment to fostering a thriving digital economy creates a supportive environment for B2B e-commerce growth through investment programs, regulatory frameworks, and infrastructure development. The Digital Growth Grant program allocated £11,694,000 between 2023 and 2025 to support digital startups and scaleups, with evaluation indicating positive employment impacts and economic value creation. Government initiatives supporting 5G infrastructure deployment are enhancing mobile commerce capabilities, with research suggesting ubiquitous high-speed connectivity could contribute significant additional retail revenues. In addition, pro-innovation policies encourage cloud adoption, data sharing, and cross-border digital trade for businesses. Support for small and medium enterprises (SMEs) helps accelerate their transition to online procurement and sales channels. Improved digital skills programs strengthen workforce readiness for e-commerce adoption. Together, these initiatives reduce barriers to entry and create a resilient ecosystem that supports long-term B2B e-commerce expansion across the UK.

Market Restraints:

What Challenges is the UK B2B E-commerce Market Facing?

Cybersecurity Threats and Data Protection Concerns

The growing sophistication of cyber threats presents a major challenge for UK B2B e-commerce platforms that manage sensitive commercial data and financial transactions. Rising incidents of ransomware, phishing, and system breaches increase operational risks and potential business disruption. Organizations must comply with strict data protection regulations and prepare for new cybersecurity legislation, adding regulatory complexity. To safeguard customer information and maintain trust, companies are required to invest heavily in advanced security systems, continuous threat monitoring, and employee awareness programs. These ongoing security demands raise operational costs and require constant technology upgrades.

Legacy System Integration Complexity

Many UK businesses face significant challenges integrating modern B2B e-commerce platforms with existing enterprise systems, including legacy ERP software, inventory management tools, and financial applications. The complexity of connecting disparate systems creates implementation delays, increases project costs, and can result in data inconsistencies that undermine operational efficiency. Organizations often struggle with fragmented technology stacks requiring substantial investment in integration middleware, custom development, and ongoing maintenance to achieve seamless data flows across procurement workflows.

Digital Skills Gap and Workforce Development

The UK faces persistent challenges in developing sufficient digital talent to support expanding B2B e-commerce operations, with shortages in technical roles, including software development, data analytics, and cybersecurity. Companies struggle to recruit and retain qualified professionals capable of managing sophisticated e-commerce platforms, implementing AI-powered tools, and optimizing digital customer experiences. The skills gap constrains growth potential and forces organizations to compete intensively for limited talent while investing heavily in training programs and external consulting services.

Competitive Landscape:

The UK B2B e-commerce market features a dynamic competitive landscape with global marketplace operators, specialized vertical platforms, and enterprise software providers competing for market share. Leading participants differentiate through technology innovations, industry expertise, customer service excellence, and ecosystem partnerships. Companies are investing in AI capabilities, mobile commerce optimization, and payment solution integration to enhance buyer experiences and operational efficiency. Strategic acquisitions, platform partnerships, and geographic expansion initiatives characterize competitive dynamics as participants seek to strengthen market positions and capture growing digital procurement demand.

Recent Developments:

- In May 2025, DHL eCommerce UK and Evri announced a major merger, creating one of the UK's largest parcel delivery businesses. The new company would handle over 1 Billion parcels and 1 Billion business letters annually, significantly strengthening logistics infrastructure supporting B2B e-commerce fulfilment operations across the UK.

UK B2B E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | Supplier-Oriented, Buyer-Oriented, Intermediary-Oriented |

| Applications Covered | Home and Kitchen, Consumer Electronics, Industrial and Science, Healthcare, Clothing, Beauty and Personal Care, Sports Apparel, Books and Stationery, Automotive, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK B2B e-commerce market size was valued at USD 304.86 Billion in 2025.

The UK B2B e-commerce market is expected to grow at a compound annual growth rate of 16.60% from 2026-2034 to reach USD 1,214.32 Billion by 2034.

Supplier-oriented dominated the market with a share of 39%, driven by manufacturers and wholesalers establishing direct digital channels to reach business customers, maintain pricing control, and build lasting procurement relationships.

Key factors driving the UK B2B e-commerce market include accelerating digital transformation initiatives, evolving buyer expectations from millennial and Gen Z procurement professionals, government support for digital economy development, and technological advancements in AI and mobile commerce.

Major challenges include escalating cybersecurity threats and data protection requirements, complexity of integrating e-commerce platforms with legacy enterprise systems, digital skills shortages, and the need for substantial technology investment to meet evolving buyer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)