UK Beauty and Wellness Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Price Range, Target Consumers, and Region, 2026-2034

UK Beauty and Wellness Market Summary:

The UK beauty and wellness market size was valued at USD 57.70 Billion in 2025 and is projected to reach USD 73.56 Billion by 2034, growing at a compound annual growth rate of 2.74% from 2026-2034.

The UK beauty and wellness market is advancing steadily as consumers prioritize holistic self-care routines and seek innovative product formulations that deliver visible results. Growing awareness of ingredient transparency, rising demand for sustainable packaging solutions, and the expansion of omnichannel retail strategies are reshaping purchasing behaviors across all demographics. Retailers are investing in experiential store concepts and personalized services to enhance customer engagement. Social media platforms continue to accelerate product discovery, driving rapid adoption of viral trends and facilitating direct brand-consumer interactions. Premium and dermatological skincare segments are experiencing notable traction as consumers increasingly view beauty expenditures as essential investments in their wellbeing. The convergence of technology and personal care is enabling advanced diagnostic tools and customized product recommendations, strengthening consumer confidence and fostering brand loyalty across the UK beauty and wellness market share.

Key Takeaways and Insights:

-

By Product Type: Skin care dominates the market with a share of 33% in 2025, owing to heightened consumer focus on preventive skincare routines, the proliferation of science-backed formulations, and growing demand for anti-aging and hydration products.

-

By Distribution Channel: Offline stores lead the market with a share of 40% in 2025. This dominance is driven by consumer preference for tactile product experiences, expert in-store consultations, and the expansion of dedicated beauty retail destinations.

-

By Price Range: Mass market represents the biggest segment with a market share of 36% in 2025, reflecting widespread consumer demand for affordable yet effective beauty solutions that deliver quality results without premium price points.

-

By Target Consumers: Women exhibit a clear dominance in the market with 54% share in 2025, driven by extensive product portfolios catering to diverse skincare concerns, makeup preferences, and evolving wellness needs across all age groups.

-

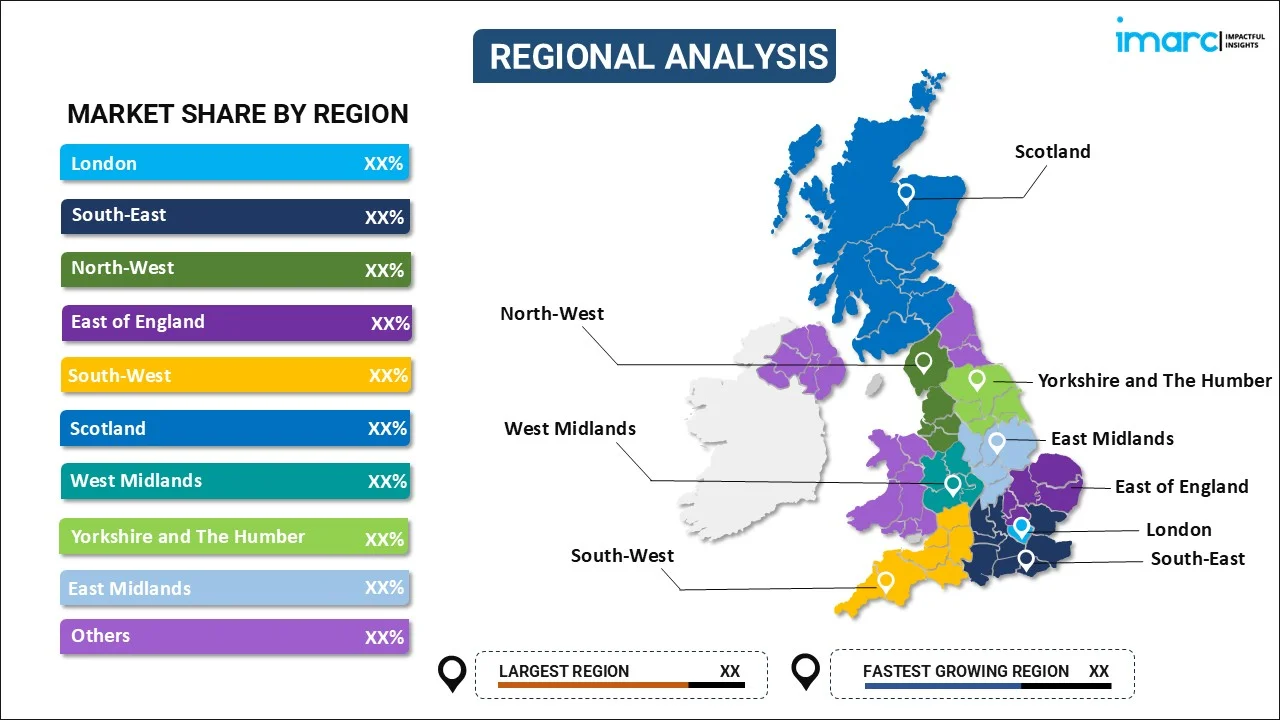

By Region: London is the largest region with 25% share in 2025, supported by high consumer spending power, concentration of premium retail destinations, diverse demographics, and strong presence of flagship beauty stores.

-

Key Players: Leading companies drive the UK beauty and wellness market by expanding product portfolios, investing in sustainable formulations, strengthening omnichannel distribution networks, and leveraging social media marketing to enhance brand visibility and consumer engagement.

The UK beauty and wellness market demonstrates remarkable resilience amid economic fluctuations. The sector's expansion is underpinned by evolving consumer attitudes that increasingly categorize beauty products as essential rather than discretionary purchases. Health and beauty specialists maintain competitive advantages through curated product assortments that accommodate diverse budget constraints while capitalizing on social media-driven trends. Multi-brand retailers enable consumers to explore products across price tiers within single shopping destinations, fostering experimentation and brand switching behavior. The expansion of in-store beauty services, such as cosmetics applications, skincare consultations, and treatment-based products, improves customer satisfaction and increases foot traffic to physical retail establishments. Digital platforms complement brick-and-mortar operations by facilitating product discovery, enabling virtual try-on technologies, and providing personalized recommendations based on consumer preferences and purchase history. Strategic partnerships between retailers and emerging beauty brands accelerate market innovation and address evolving consumer demands.

UK Beauty and Wellness Market Trends:

Social Media-Driven Product Discovery and Purchasing

Social media platforms are fundamentally transforming how British consumers discover and purchase beauty products. The powerful convergence of entertainment and commerce continues shaping the UK beauty and wellness market growth. Influencer-led content generates significant engagement, with masterclasses and tutorial videos driving immediate product interest. Brands strategically leverage user-generated content to build authenticity and community connections. Real-time purchasing integrations enable seamless transitions from content consumption to transaction completion, reducing friction in the customer journey and accelerating purchase decisions.

Rise of Clean Beauty and Sustainable Formulations

Consumer demand for clean beauty products continues accelerating as awareness of ingredient safety and environmental impact deepens. British shoppers increasingly seek formulations free from harmful chemicals while prioritizing sustainable packaging solutions. The Body Shop achieved complete vegan product formulation across its entire range in early 2024, demonstrating industry commitment to ethical standards. Refillable packaging systems and plastic-free alternatives are gaining market traction as sustainability becomes integral to purchase decisions. Brands emphasizing transparency in sourcing practices and manufacturing processes strengthen consumer trust and differentiation.

Experiential Retail Transformation and Store Innovation

Beauty retailers are reimagining physical spaces as immersive destinations rather than transactional environments. Charlotte Tilbury opened its largest flagship store featuring its first Skin Spa in London's Covent Garden in January 2025, exemplifying the industry shift toward service-integrated retail concepts. Brands invest in creating photogenic spaces designed for social media sharing, extending store experiences into digital engagement. Interactive technologies, personalized consultations, and treatment offerings transform shopping visits into memorable experiences that foster customer loyalty and differentiate physical retail from online channels.

Market Outlook 2026-2034:

The UK beauty and wellness market is positioned for sustained expansion driven by evolving consumer preferences and innovative retail strategies. Industry players are investing in technological advancements, personalized product offerings, and sustainable practices to capture emerging opportunities. The market generated a revenue of USD 57.70 Billion in 2025 and is projected to reach a revenue of USD 73.56 Billion by 2034, growing at a compound annual growth rate of 2.74% from 2026-2034. The convergence of digital innovation and experiential retail will reshape competitive dynamics, while sustainability imperatives drive product reformulation and packaging innovation. Premium segments continue attracting investment as consumers demonstrate willingness to pay for efficacy-proven formulations and luxury experiences.

UK Beauty and Wellness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Skin Care |

33% |

|

Distribution Channel |

Offline Stores |

40% |

|

Price Range |

Mass Market |

36% |

|

Target Consumers |

Women |

54% |

|

Region |

London |

25% |

Product Type Insights:

To get detailed segment analysis of this market, Request Sample

- Skin Care

- Hair Care

- Makeup

- Personal Care

- Fragrances

Skin care dominates with a market share of 33% of the total UK beauty and wellness market in 2025.

The skin care segment maintains its leadership position driven by heightened consumer awareness of preventive skincare routines and growing demand for science-backed formulations. British consumers increasingly invest in comprehensive skincare regimens that address multiple concerns simultaneously, from hydration and anti-aging to barrier protection and brightening. The segment benefits from innovation in active ingredient delivery systems, with brands incorporating retinoids, hyaluronic acid, and peptides into accessible formulations. In 2024, Boots reported selling one product from its own-brand skincare range every two seconds, demonstrating sustained mass-market demand for affordable yet effective skincare solutions across demographic groups.

Premiumization trends further strengthen the skin care segment as consumers demonstrate willingness to invest in dermatologist-recommended products and clinical-grade formulations. The dermo cosmetic subsegment continues expanding as shoppers seek products that bridge pharmaceutical efficacy with cosmetic elegance. Korean beauty influences persist, with K-beauty products experiencing viral popularity at major UK retailers. Personalization technologies enable brands to offer customized skincare recommendations based on individual skin analysis, enhancing consumer engagement and purchase confidence. The intersection of skincare with wellness concepts amplifies segment appeal, positioning products as investments in holistic self-care rather than purely cosmetic purchases.

Distribution Channel Insights:

- Offline Stores

- Online Stores

- Direct Sales

- Saloon and Spas

Offline stores lead with a share of 40% of the total UK beauty and wellness market in 2025.

Offline retail channels demonstrate remarkable resilience as beauty specialists invest heavily in store transformation and experiential offerings. The tactile nature of beauty products drives consumer preference for physical testing before purchase, particularly for color cosmetics and fragrances. Multi brand stores offer competitive advantages through curated assortments that accommodate varying budget constraints while enabling product discovery across brands. Superdrug announced plans to open 25 new stores in 2025 and refurbish 65 existing locations, creating approximately 600 new retail jobs and reinforcing confidence in brick-and-mortar beauty retail across the United Kingdom.

In-store services increasingly differentiate physical retail experiences from online alternatives. Beauty studios offering treatments such as ear piercing, manicures, and skincare consultations generate incremental revenue while driving customer traffic to stores. Expert advice from trained beauty specialists enhances consumer confidence and facilitates premium product sales. Flagship store concepts incorporate interactive technologies, personalized services, and photogenic spaces designed for social media content creation. The integration of pharmacy services within beauty retail environments capitalizes on consumer trust in healthcare professionals, positioning stores as holistic wellness destinations rather than purely transactional spaces.

Price Range Insights:

- Mass Market

- Mid Market

- Premium

- Luxury

Mass market exhibits a clear dominance with a 36% share of the total UK beauty and wellness market in 2025.

The mass market segment maintains its dominant position as value-conscious consumers seek effective beauty solutions without premium price points. Cost-of-living pressures have accelerated adoption of affordable alternatives, with nearly one-third of British consumers actively purchasing product dupes that replicate premium formulations at accessible prices. Supermarket and drugstore retailers strengthen mass market presence through private-label ranges that deliver quality comparable to branded alternatives. Boots reported a fourteen percent year-on-year increase in premium beauty sales in 2024, yet mass market products remain foundational to overall category performance and consumer accessibility.

The lipstick effect continues influencing purchasing patterns as consumers maintain beauty expenditures despite economic constraints. Affordable indulgences provide psychological benefits that support demand resilience across price-sensitive demographics. Mass market brands leverage social media virality to generate awareness without premium marketing investments, enabling competitive positioning against prestige alternatives. Product innovation within the segment increasingly mirrors premium formulation advances, narrowing efficacy gaps while maintaining price advantages. Retailers emphasize value propositions through loyalty programs, promotional activities, and bundle offerings that maximize consumer purchasing power within constrained budgets.

Target Consumers Insights:

- Women

- Men

- Gen Z

- Millennials

- Baby Boomers

Women represent the leading segment with a 54% share of the total UK beauty and wellness market in 2025.

The women's segment continues dominating the beauty and wellness market through extensive product portfolios addressing diverse skincare concerns, makeup preferences, and wellness needs across life stages. Female consumers demonstrate higher category engagement, frequency of purchase, and willingness to experiment with new products and brands. Multi-step skincare routines remain prevalent among women, supporting consumption across cleansers, serums, moisturizers, and targeted treatments. The breadth of product categories catering specifically to female consumers reinforces sustained market leadership within this demographic segment.

Women's wellness priorities extend beyond traditional beauty into holistic self-care encompassing mental wellbeing, sleep optimization, and stress management. Fragrance emerges as a significant category driver, with female consumers building scent wardrobes to match moods and occasions. Anti-aging products maintain strong demand among mature consumers, while younger demographics prioritize preventive skincare and ingredient transparency. Social media influence particularly shapes purchasing decisions among female consumers, with platforms driving product discovery and trend adoption. Inclusive product development addressing diverse skin tones and hair types strengthens brand relevance across the multicultural British consumer base.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London holds the largest share with 25% of the total UK beauty and wellness market in 2025.

London maintains its position as the epicenter of British beauty retail through concentration of flagship stores, premium shopping destinations, and diverse consumer demographics with significant spending power. The capital attracts major beauty retailers seeking to establish brand presence and showcase innovative retail concepts that subsequently roll out across the broader United Kingdom. International beauty brands prioritize London for market entry strategies, leveraging the city's global visibility and trendsetting consumer base to build awareness before expanding nationwide. The concentration of fashion, media, and entertainment industries within London creates a sophisticated consumer environment that embraces beauty innovation and premium positioning. Sephora is focusing on expanding across the UK with plans to open twenty stores by 2027, illustrating London's strategic importance for international beauty brand expansion into the British market.

Flagship locations serve as experiential destinations where brands invest in immersive store designs, personalized services, and exclusive product launches. London's multicultural population drives demand for inclusive product ranges addressing diverse skin tones and hair types, influencing broader industry formulation strategies. The capital's robust tourism sector generates additional footfall to beauty retail destinations, while high employment rates in professional services support discretionary spending on premium beauty and wellness products.

Market Dynamics:

Growth Drivers:

Why is the UK Beauty and Wellness Market Growing?

Expansion of E-Commerce and Digital Retail Channels

The proliferation of digital commerce platforms significantly accelerates market growth by enhancing product accessibility and consumer convenience. E-commerce channels enable brands to reach consumers beyond geographical constraints of physical retail networks, democratizing access to diverse product offerings. Data analytics capabilities facilitate personalized recommendations based on browsing history and purchase behavior, improving conversion rates and customer satisfaction. Direct-to-consumer models empower emerging brands to build relationships without traditional retail intermediaries, fostering innovation and market competition. Social commerce integration through platforms such as TikTok Shop and Instagram enables seamless transitions from content engagement to transaction completion, capitalizing on impulse purchase behavior driven by influencer endorsements and viral trends.

Rising Consumer Focus on Health and Holistic Wellness

Increasing prioritization of personal wellbeing drives sustained demand for beauty and wellness products positioned as essential investments in self-care rather than discretionary purchases. Nearly half of British consumers now consider health and beauty products essential, elevating category resilience against economic fluctuations. Pharmaceuticals, hair care, body care, and fragrances demonstrate particularly strong demand resilience, with consumers maintaining or increasing spending despite cost-of-living pressures. The intersection of beauty with broader wellness concepts strengthens consumer engagement, as products delivering both aesthetic and therapeutic benefits command premium positioning. Consumer willingness to reallocate spending from other discretionary categories toward beauty reinforces market fundamentals. In January 2024, ASDA launched its inaugural supermarket spa at its Islington location in London, offering beauty services paired with nutritious meals to enhance shopper wellness, exemplifying the growing convergence of beauty, health, and lifestyle experiences.

Intensifying Retail Competition and Store Investment

Escalating competition among beauty retailers stimulates market innovation, service enhancement, and store network expansion. Established players invest in transforming existing locations while extending footprints into underserved markets, improving consumer accessibility. New market entrants introduce competitive pressure that elevates industry standards for customer experience and product curation. Specialty beauty retailers dedicate increasing floor space to the category, recognizing its traffic-driving potential and margin contribution. Department stores enhance beauty hall offerings to compete with dedicated beauty destinations, creating additional consumer touchpoints. The competitive intensity encourages retailers to differentiate through exclusive brand partnerships, innovative service offerings, and technology integration. Marks and Spencer, John Lewis, and other multi-sector retailers expand beauty ranges and allocate greater in-store space to the category, evidencing recognition of beauty's strategic importance for overall retail performance and customer attraction.

Market Restraints:

What Challenges the UK Beauty and Wellness Market is Facing?

Persistent Inflationary Pressures and Cost-of-Living Constraints

Ongoing inflationary pressures constrain consumer purchasing power, prompting trade-down behaviors and increased price sensitivity across demographic segments. Higher energy costs, persistent wage pressures, and increased regulated costs collectively squeeze household budgets, limiting discretionary spending capacity. Value growth deceleration reflects softening price increases as inflationary momentum moderates, reducing revenue contribution from price expansion. Consumers increasingly seek affordable alternatives and promotional opportunities, intensifying competitive pressure on margin structures and brand positioning strategies.

Declining Export Performance and Trade Complexities

Reduced export volumes constrain growth potential for the UK beauty and personal care manufacturers seeking international market expansion. Exports to the European Union single market have declined steadily in recent years, while shipments to non-European markets have similarly decreased. Trade complexities following Brexit create administrative burdens and cost barriers that disproportionately impact smaller manufacturers with limited resources for navigating regulatory requirements. The majority of the UK beauty exports continue flowing to European destinations, amplifying vulnerability to continental trade friction and regulatory divergence.

Intensifying Dupe Culture and Brand Value Dilution

Accelerating adoption of product dupes threatens premium brand positioning and pricing power within the market. A growing proportion of British consumers actively purchase affordable alternatives that replicate premium product characteristics, driven by social media promotion and cost-consciousness. This trend commoditizes innovation investments as formulation advances quickly disseminate across price tiers. Premium brands face heightened pressure to demonstrate tangible value differentiation justifying price premiums, requiring enhanced marketing investments and product substantiation efforts that impact profitability.

Competitive Landscape:

The UK beauty and wellness market features intensifying competition among established retail leaders, international entrants, and emerging direct-to-consumer brands. Major health and beauty specialists maintain dominant market positions through extensive store networks, competitive pricing strategies, and diversified product assortments spanning mass to premium tiers. International retailers are expanding physical presence while investing in store redesigns that enhance customer experience and brand perception. Competition increasingly centers on experiential differentiation, omnichannel integration, and exclusive brand partnerships that attract consumer attention. Strategic investments in beauty services, technology-enabled personalization, and sustainable practices strengthen competitive positioning while addressing evolving consumer expectations for holistic shopping experiences beyond transactional product acquisition.

UK Beauty and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Personal Care, Fragrances |

| Distribution Channels Covered | Offline Stores, Online Stores, Direct Sales, Saloon and Spas |

| Price Ranges Covered | Mass Market, Mid Market, Premium, Luxury |

| Target Consumers Covered | Women, Men, Gen Z, Millennials, Baby Boomers |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK beauty and wellness market size was valued at USD 57.70 Billion in 2025.

The UK beauty and wellness market is expected to grow at a compound annual growth rate of 2.74% from 2026-2034 to reach USD 73.56 Billion by 2034.

Skin care dominated the market with a share of 33%, driven by heightened consumer focus on preventive skincare routines, the proliferation of science-backed formulations, and growing demand for anti-aging products.

Key factors driving the UK beauty and wellness market include e-commerce expansion, rising consumer focus on holistic wellness, intensifying retail competition, social media-driven product discovery, and growing demand for sustainable beauty solutions.

Major challenges include persistent inflationary pressures constraining consumer spending, declining export performance following Brexit trade complexities, intensifying dupe culture threatening premium brand positioning, and rising operational costs impacting retail profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)