UK Big Data Market Size, Share, Trends and Forecast by Product, Technology, Service, End Use, and Region, 2025-2033

UK Big Data Market Overview:

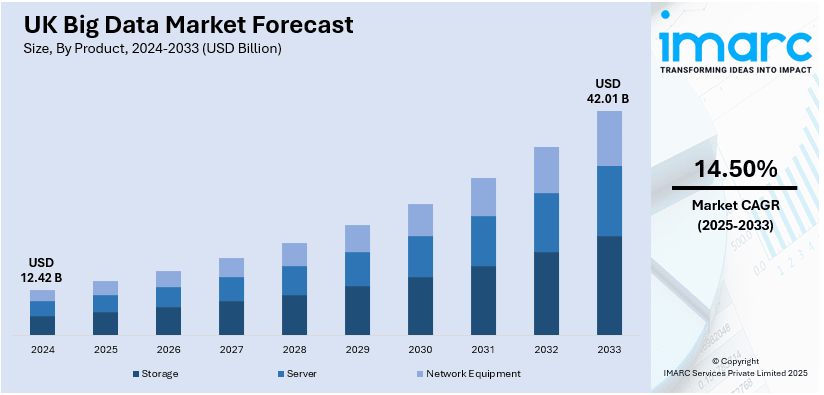

The UK big data market size reached USD 12.42 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.01 Billion by 2033, exhibiting a growth rate (CAGR) of 14.50% during 2025-2033. The UK big data market share is expanding, driven by the rising use of advanced analytics for improved decision-making, along with the increasing incorporation of cloud computing for scalable and cost-effective data management, enhancing real-time analytics and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.42 Billion |

| Market Forecast in 2033 | USD 42.01 Billion |

| Market Growth Rate (2025-2033) | 14.50% |

UK Big Data Market Trends:

Rapid Adoption of Advanced Analytics

The increasing adoption of advanced analytics is impelling the big data UK market growth. Organizations are employing sophisticated analytical techniques like artificial intelligence (AI) and machine learning (ML) to draw actionable insights from vast datasets. In September 2023, Big Data London 2023 took place on September 20-21 at the London Olympia, and highlighted the newest developments in data analytics, featuring breakthroughs in Generative AI, deep learning, and big data technologies. The occasion aimed to showcase more than 300 specialist speakers and 180 exhibitors, concentrating on data strategies, the effects of AI on sectors, new trends in ML, ways to leverage data innovations, talent acquisition, the contemporary data stack, MLOps, data privacy, and data governance. This trend is driven by the need for businesses to improve decision-making procedures, streamline operations, and elevate customer experiences. As companies face mounting competitive pressures, the ability to analyze data in real-time allows more agile responses to market demands. Furthermore, industries, such as finance, healthcare, and retail, are investing heavily in advanced analytics to gain predictive insights, thereby encouraging innovations and fueling the market growth. As technology continues to shift, the rapid integration of advanced analytics into mainstream business practices is expected to further solidify its role in strategic planning.

To get more information on this market, Request Sample

Rising Integration of Cloud Computing

The increasing integration of cloud computing with big data analytics is offering a favorable UK large data market outlook. The way data is processed and stored in the country is changing as a result of cloud computing's incorporation into the big data ecosystem. As cloud solutions have become more scalable, flexible, and economical, a high number of organizations are moving their data operations to cloud platforms. With the help of this trend, companies can handle and analyze enormous volumes of data without having to invest in large upfront infrastructure investments. Cloud computing renders real-time analytics possible and collaborative data access feasible, which encourages innovations and agility in businesses. Furthermore, the emergence of hybrid cloud solutions enables businesses to take advantage of public cloud resources while keeping control over sensitive data. With the continued development of cloud technology and its connection with big data initiatives, greater improvements in data processing capabilities are anticipated, which could eventually allow organizations to reach better informed decisions more quickly. Apart from this, government agencies are wagering on cloud computing projects, which is bolstering the market growth. In December 2024, the UK government granted a contract valued at up to GBP 1 Billion (USD 1.3 Billion) to tech services firms to assist different agencies and departments in transitioning to cloud services.

Expanding Role of AI, Real-time Analytics, and IoT

The UK biggest data market is being reshaped by the combined rise of artificial intelligence, real-time analytics, and IoT adoption. Companies increasingly rely on AI to extract predictive insights, automate processes, and detect anomalies, allowing them to act faster in competitive environments. Real-time analytics is becoming essential across industries like finance, healthcare, and retail, where instant decision-making improves efficiency and customer service. Meanwhile, the growing number of IoT devices, from smart homes to industrial systems, is generating massive volumes of high-speed data that demand advanced processing capabilities. This integration of AI and IoT is creating strong demand for scalable, secure big data platforms UK capable of handling complex, unstructured data flows. In the UK, these technologies are accelerating innovation, operational agility, and customer engagement, positioning the market for significant growth in the near future.

UK Big Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product, technology, service, and end use.

Product Insights:

- Storage

- Server

- Network Equipment

The report has provided a detailed breakup and analysis of the market based on the products. This includes storage, server, and network equipment.

Technology Insights:

- Analytics

- Database

- Visualization

- Distribution Tools

- Others

A detailed breakup and analysis of the market based on the technologies have also been provided in the report. This includes analytics, database, visualization, distribution tools, and others.

Service Insights:

- Consulting

- Deployment and Maintenance

- Training and Development

The report has provided a detailed breakup and analysis of the market based on the services. This includes consulting, deployment and maintenance, and training and development.

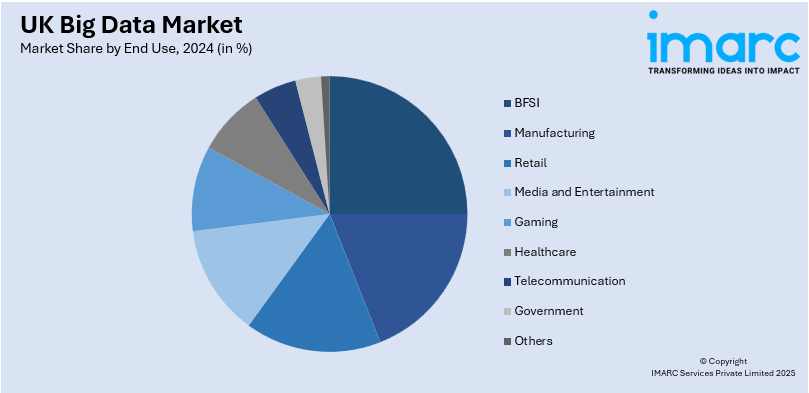

End Use Insights:

- BFSI

- Manufacturing

- Retail

- Media and Entertainment

- Gaming

- Healthcare

- Telecommunication

- Government

- Others

A detailed breakup and analysis of the market based on the end uses have also been provided in the report. This includes BFSI, manufacturing, retail, media and entertainment, gaming, healthcare, telecommunication, government, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

UK Big Data Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Big Data Market News:

- In October 2024, the Technology Secretary welcomed new commitments from US-based firms to build data‑center infrastructure in the UK, aimed at accelerating AI innovation. These investments will expand computing and storage capacity, underpin next-generation AI deployment in sectors such as healthcare, and generate jobs during construction and operation.

- In August 2024, the Big Data London event was announced, marking it as the largest data program in the UK. It was scheduled to take place on September 18-19. It sought to showcase the 'Dataops and Data Observability Theatre,' offering thought leadership and best practice workshops from some of the world’s most inventive data teams to confront the data quality crisis directly.

- In April 2024, the government published the Smart Data Roadmap, detailing actions through 2025 across sectors including banking, energy, retail, and transport. It explained how Smart Data enables individuals and businesses (with consent) to access data, fostering new services, enhancing competition, and supporting economic growth.

UK Big Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Storage, Server, Network Equipment |

| Technologies Covered | Analytics, Database, Visualization, Distribution Tools, Others |

| Services Covered | Consulting, Deployment and Maintenance, Training and Development |

| End Uses Covered | BFSI, Manufacturing, Retail, Media and Entertainment, Gaming, Healthcare, Telecommunication, Government, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK big data market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK big data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK big data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Big data in the UK refers to the collection, storage, and analysis of vast, complex datasets from sources like IoT, social media, healthcare, and finance. It supports real-time decision-making, innovation, regulatory compliance, and business growth across industries.

The UK big data market was valued at USD 12.42 Billion in 2024.

The UK big data market is projected to exhibit a CAGR of 14.50% during 2025-2033, reaching USD 42.01 Billion by 2033.

The UK big data market is driven by rising adoption of cloud platforms, demand for real-time analytics, growth in IoT-generated data, regulatory compliance requirements, expansion of AI applications, and increasing need for data-driven decision-making across finance, healthcare, retail, and manufacturing sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)