UK Blockchain Gaming Market Size, Share, Trends and Forecast by Game Type, Platform, and Region, 2025-2033

UK Blockchain Gaming Market Overview:

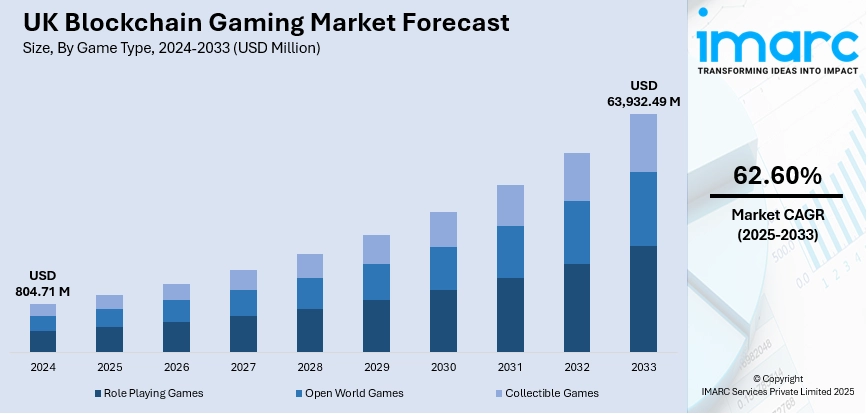

The UK blockchain gaming market size reached USD 804.71 Million in 2024. The market is projected to reach USD 63,932.49 Million by 2033, exhibiting a growth rate (CAGR) of 62.60% during 2025-2033. The market is driven by rising investor interest, technological innovation in Web3, increased smartphone usage, and growing demand for digital ownership via NFTs. Enhanced internet infrastructure and supportive regulatory discussions also support the expanding UK blockchain gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 804.71 Million |

| Market Forecast in 2033 | USD 63,932.49 Million |

| Market Growth Rate 2025-2033 | 62.60% |

UK Blockchain Gaming Market Trends:

Integration of Digital Wallets and Payment Gateways

A significant trend influencing the UK blockchain gaming market growth is the seamless integration of digital wallets and advanced payment gateways. This development enables players to securely store, transact, and exchange in-game digital assets or cryptocurrencies within gaming ecosystems. Such integration supports real-time trading of non-fungible tokens (NFTs) and rewards, enhancing user convenience and engagement. Blockchain gaming platforms in the UK are increasingly partnering with fintech firms to provide embedded financial services such as staking, micro-transactions, and crypto-to-fiat conversions. This trend also encourages mainstream adoption by reducing technical barriers for non-crypto-savvy users. As security and compliance standards improve, the interoperability between games and wallets continues to evolve, reinforcing user trust and supporting sustainable UK blockchain gaming market growth. For instance, in June 2025, Velobet Casino launched new 2025 promotions for UK players, including a £500,000 Velo Marathon, a 330% welcome bonus package, and a 160% crypto bonus. With over 6,000 games, fast crypto transactions, and a dynamic sportsbook, it caters to modern gamblers. Promotions feature no wagering requirements, fast withdrawals, and crypto support. Velobet also offers a loyalty program, social media giveaways, and responsible gaming tools.

To get more information on this market, Request Sample

Emergence of Play-and-Earn Economic Models

The shift from traditional play-to-win structures to play-and-earn (P&E) models represents a key trend within the UK blockchain gaming market growth trajectory. These models allow players to generate real-world income through participation, gameplay achievements, and asset trading. Unlike earlier iterations focused on high entry costs and speculative returns, newer P&E games in the UK are adopting more balanced and sustainable tokenomics. By tying rewards to skill, community contribution, or user retention, developers create more equitable ecosystems that attract long-term users rather than short-term speculators. This shift has prompted investment from traditional gaming studios exploring blockchain capabilities. With the UK's mature fintech and gaming sectors converging, the P&E model is expected to significantly shape the future direction of the UK blockchain gaming market growth. For instance, in March 2024, Illuvium raised $12M in Series A funding led by King River Capital, Arrington Capital, Animoca Capital, and Spartan to develop an interoperable blockchain gaming universe. The company plans three games: Illuvium Arena (autobattler), Illuvium Overworld (open-world creature collector), and Illuvium Zero (cross-platform city builder). Over 1 million players have registered, with Illuvium Zero in alpha for NFT landowners, integrating NFTs and in-game resource trading.

UK Blockchain Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on game type and platform.

Game Type Insights:

- Role Playing Games

- Open World Games

- Collectible Games

The report has provided a detailed breakup and analysis of the market based on the game type. This includes role playing games, open world games, and collectible games.

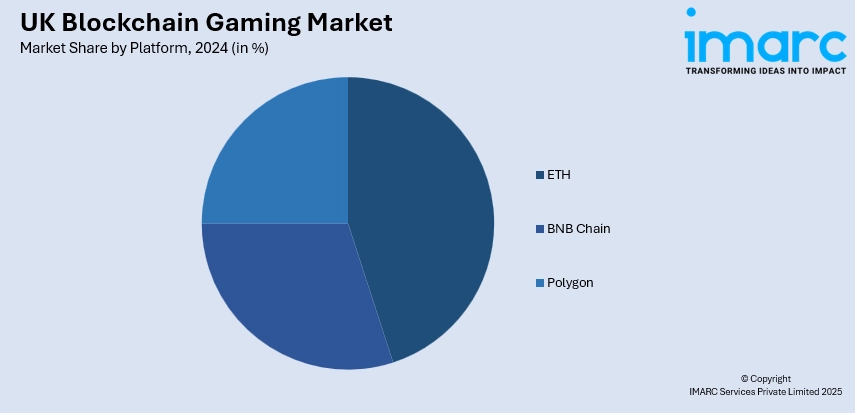

Platform Insights:

- ETH

- BNB Chain

- Polygon

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes ETH, BNB chain, and polygon.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Blockchain Gaming Market News:

- In May 2025, MyStake was named the top UK Bitcoin casino for 2025, highlighting its leadership in the growing crypto gambling space. The platform offers over 6,000 games, fast crypto transactions, and a UK-focused interface. Supporting Bitcoin, Ethereum, and more, it ensures secure, provably fair play with minimal KYC requirements. MyStake also emphasizes responsible gambling through tools like deposit limits, session controls, and self-exclusion, positioning itself as a user-centric and compliant platform in the UK’s evolving digital gaming market.

UK Blockchain Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Game Types Covered | Role Playing Games, Open World Games, Collectible Games |

| Platforms Covered | ETH, BNB Chain, Polygon |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK blockchain gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the UK blockchain gaming market on the basis of game type?

- What is the breakup of the UK blockchain gaming market on the basis of platform?

- What is the breakup of the UK blockchain gaming market on the basis of region?

- What are the various stages in the value chain of the UK blockchain gaming market?

- What are the key driving factors and challenges in the UK blockchain gaming market?

- What is the structure of the UK blockchain gaming market and who are the key players?

- What is the degree of competition in the UK blockchain gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK blockchain gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK blockchain gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK blockchain gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positiobns of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)