UK Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

UK Bottled Water Market Summary:

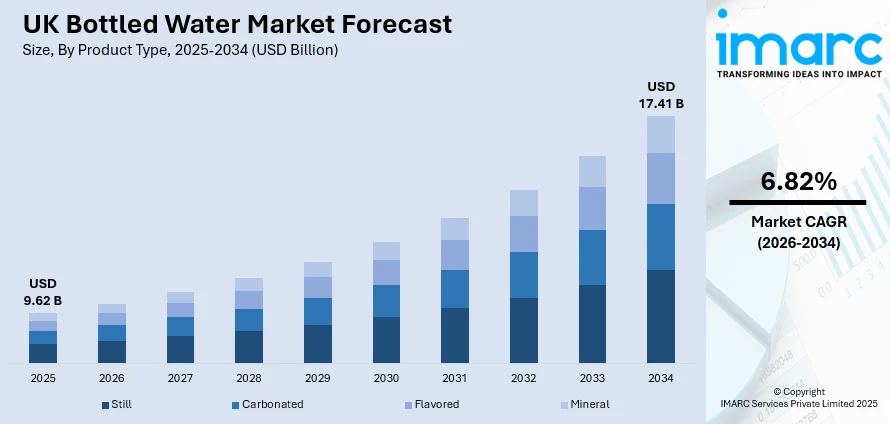

The UK bottled water market size was valued at USD 9.62 Billion in 2025 and is projected to reach USD 17.41 Billion by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

The UK bottled water market is experiencing robust expansion driven by heightened health consciousness among consumers who increasingly prefer water over sugary beverages. Rising demand for premium, flavored, and functional waters with distinctive mineral profiles or added electrolytes is reshaping the competitive landscape. Regional variations in tap water quality, particularly hard water concerns in certain areas, continue to support bottled water adoption. Convenience-oriented consumption patterns, supported by extensive distribution through supermarkets, convenience stores, and online channels, reinforce the UK bottled water market share.

Key Takeaways and Insights:

- By Product Type: Still water segment dominated the market with approximately 50.21% revenue share in 2025, driven by widespread consumer preference for pure hydration options and growing health consciousness that positions still water as the leading alternative to carbonated and sugary beverages.

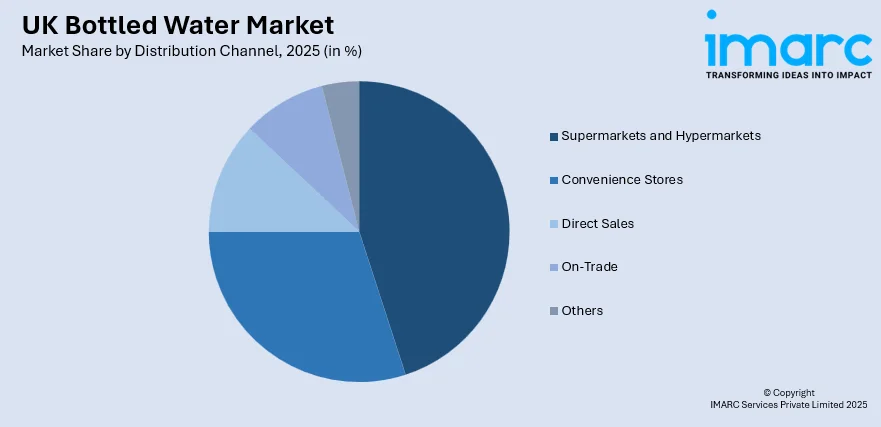

- By Distribution Channel: Supermarkets and hypermarkets accounted for the largest revenue share of approximately 45.33% in 2025. This dominance is driven by extensive product variety, competitive pricing strategies, promotional offers, and consumer preference for one-stop shopping convenience.

- By Packaging Type: PET bottles dominated the market with a revenue share of 80.28% in 2025, owing to their lightweight nature, cost-effectiveness, shatter-resistant properties, and recyclability that aligns with growing sustainability consciousness.

- Key Players: The UK bottled water market exhibits strong competitive intensity, with established multinational beverage corporations competing alongside regional natural source water producers across premium, mid-range, and value-oriented price segments.

To get more information on this market Request Sample

The UK bottled water market continues its recovery trajectory following pandemic disruptions, with volumes rebounding strongly driven by private label and lower-priced brands amid ongoing cost-of-living pressures. The market benefits from water's inherent health halo positioning, with consumers actively seeking sugar-free hydration alternatives. Branded premium waters maintain appeal among health-conscious consumers seeking enhanced hydration experiences. Sustainability remains central to market evolution, with leading brands preparing for the upcoming Deposit Return Scheme (DRS) for drinks containers, scheduled to launch in October 2027 across England, Scotland and Northern Ireland. Innovation in flavored and functional water categories creates opportunities for market expansion into new consumer segments seeking variety without compromising health objectives.

UK Bottled Water Market Trends:

Rising Health Consciousness and Sugar Reduction

Consumer health awareness is fundamentally reshaping beverage preferences across the United Kingdom. Growing concerns about sugar intake and its associated health implications are driving consumers toward bottled water as a cleaner hydration alternative. The trend of alcohol moderation, particularly among younger demographics, presents significant opportunities for bottled water to be positioned as a sophisticated alcohol substitute in social settings and hospitality venues. Indeed, a 2025 report from Drinkaware finds that 49% of young adults now choose “no & low-alcohol” drinks to moderate their drinking, nearly double the share in 2018.

Sustainability and Circular Packaging Innovation

Environmental consciousness is driving transformative changes in bottled water packaging strategies. Brands are accelerating adoption of recycled materials, lightweight container designs, and circular packaging systems. In 2025, the UK Government reaffirmed that its nationwide Deposit Return Scheme (DRS) for drinks containers, including plastic bottles, cans, and cartons, will launch in October 2027, prompting manufacturers to upgrade packaging systems and recycling logistics. The upcoming deposit return scheme is compelling manufacturers to innovate packaging and operational infrastructure. Industry leaders are investing in carbon neutrality initiatives and exploring alternative materials including aluminum cans and paper-based cartons to address consumer sustainability concerns.

Premium and Functional Water Expansion

Consumer demand for enhanced hydration experiences is fueling growth in premium and functional water categories. Products featuring added electrolytes, vitamins, natural flavors, and distinctive mineral profiles are gaining traction among health-focused consumers. In October 2025, Powerade, part of The Coca-Cola Company, launched “Power Water,” a zero‑sugar, electrolyte‑enhanced flavored water positioned beyond just sports hydration, signalling the mainstreaming of functional water offerings. Flavored still water ranges have emerged as bridge products capturing demand from consumers seeking variety without the drawbacks of sugary alternatives, enabling brands to expand into the substantial flavored water category.

Market Outlook 2026-2034:

Market growth will be underpinned by continued health consciousness driving water consumption over sugary beverages, ongoing premiumization trends in functional and flavored waters, and sustainability-driven packaging innovations. The implementation of the deposit return scheme will reshape collection infrastructure and potentially enhance recycling rates. Retail sales channels, particularly supermarkets and e-commerce platforms, will continue driving accessibility while on-trade channels benefit from hospitality sector recovery. Regional variations in tap water quality will sustain demand in hard water areas. The market generated a revenue of USD 9.62 Billion in 2025 and is projected to reach a revenue of USD 17.41 Billion by 2034, growing at a compound annual growth rate of 6.82% from 2026-2034.

UK Bottled Water Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Still | 50.21% |

| Distribution Channel | Supermarkets and Hypermarkets | 45.33% |

| Packaging Type | PET Bottles | 80.28% |

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The still dominates with a market share of 50.21% of the total UK bottled water market in 2025.

Still water maintains its dominant position within the UK bottled water market, driven by consumer preference for pure, unflavored hydration options that align with health-conscious lifestyles. The segment benefits from widespread perception as the healthiest beverage choice, serving as a direct substitute for tap water in regions where consumers have taste or quality concerns. According to the 2025 annual report of the British Soft Drinks Association (BSDA), “Packaged Water – Still” accounted for 77.4% of packaged bottled water sales in the UK, far out‑pacing sparkling water and bulk/home‑office delivery water. Still water products span all price tiers from economy private label offerings to premium natural mineral waters, ensuring broad accessibility across diverse consumer demographics.

The category appeals to consumers seeking straightforward hydration without carbonation, added flavors, or functional ingredients. Still water consumption occasions range from daily household use to on-the-go convenience purchases, workplace hydration, and fitness-related consumption. The segment's versatility and universal appeal position it as the foundation of the broader bottled water market, with consistent demand patterns that demonstrate resilience across economic cycles and seasonal variations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

The supermarkets and hypermarkets lead with a share of 45.33% of the total UK bottled water market in 2025.

Supermarkets and hypermarkets represent the primary retail channel for bottled water distribution across the United Kingdom. These outlets offer extensive product variety spanning premium imported brands to value-oriented private label options, enabling consumers to select products matching their preferences and budgets. Major retailers leverage promotional strategies, multipack offerings, and strategic shelf placement to drive bottled water sales volumes consistently throughout the year.

The convenience of one-stop shopping combined with competitive pricing ensures supermarkets maintain their leadership position in the distribution landscape. These channels benefit from high footfall, extensive geographic coverage, and established consumer shopping habits that make bottled water a routine purchase item. The growth of click-and-collect services and home delivery options further strengthens supermarket channel dominance by extending accessibility beyond physical store visits.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The PET bottles dominate with a market share of 80.28% of the total UK bottled water market in 2025.

PET plastic bottles maintain overwhelming dominance in bottled water packaging owing to their cost-effectiveness, lightweight properties, and shatter-resistant durability. The material enables efficient transportation and storage while providing clarity that allows consumers to assess product quality visually. PET bottles offer versatility across multiple size formats from single-serve portions to large household containers, accommodating diverse consumption occasions and purchasing preferences. For example, Buxton, one of the UK’s leading bottled water brands, converted its entire range to bottles made from 100% recycled PET (excluding labels and caps), underscoring how PET remains central even as packaging becomes more sustainable.

Manufacturers are increasingly incorporating recycled PET content to address environmental concerns and meet sustainability commitments. The recyclability of PET material positions it favorably within circular economy frameworks, with brands transitioning toward higher recycled content proportions. Innovation in lightweight bottle designs reduces material usage while maintaining structural integrity, demonstrating the packaging format's adaptability to evolving sustainability requirements and consumer expectations.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the largest bottled water market in the United Kingdom with residents demonstrating strong preference for packaged water alternatives. The capital's notoriously hard water, resulting from chalk and limestone geology, drives consumer preference for bottled options due to taste concerns and limescale issues. Dense population concentration, extensive retail infrastructure, and higher disposable incomes further support premium water consumption patterns.

The South East region demonstrates moderate bottled water consumption compared to other areas. Despite proximity to London, superior tap water quality in certain localities reduces reliance on packaged alternatives. Affluent demographics support premium and imported water brands, while commuter populations drive convenience-oriented single-serve purchases at transport hubs and workplace locations throughout the region.

The North West exhibits elevated bottled water consumption rates among households. Urban centers including Manchester and Liverpool generate substantial demand through extensive retail networks and vibrant hospitality sectors. Regional tap water variations influence consumer preferences, with bottled water positioned as a reliable hydration choice across diverse socioeconomic segments throughout the region.

East of England maintains moderate bottled water adoption among residents. The region benefits from relatively good tap water quality while supporting bottled water demand through growing population centers and expanding retail presence. Agricultural communities and rural areas demonstrate increasing convenience-driven purchases as distribution networks extend coverage across previously underserved locations.

The South West region shows moderate bottled water consumption aligned with broader national patterns. Tourism-driven demand during summer months boosts seasonal sales across coastal destinations and heritage attractions. Local natural spring water producers compete effectively alongside national brands, leveraging regional provenance marketing to differentiate premium offerings in the marketplace.

Scotland demonstrates distinctive market characteristics with consumers frequently preferring tap water over bottled alternatives due to naturally soft, high-quality water sourced from mountain reservoirs and lochs. Despite lower overall consumption rates, Scotland hosts significant domestic production facilities. Premium Scottish natural source waters leverage provenance and purity credentials in national and export markets.

West Midlands exhibits substantial bottled water demand driven by Birmingham's metropolitan population and surrounding urban conurbations. Regional tap water quality perceptions support bottled water adoption, with extensive supermarket and convenience store networks ensuring widespread product availability across diverse community demographics throughout the densely populated region.

Yorkshire and The Humber maintains moderate bottled water consumption among households. The region balances generally acceptable tap water quality with growing health consciousness driving bottled water adoption. Major cities including Leeds, Sheffield, and Hull support diverse retail channels while local spring water producers contribute to regional market supply availability.

East Midlands demonstrates elevated bottled water consumption, ranking among higher-consuming regions nationally. Urban centers including Nottingham, Leicester, and Derby generate consistent demand through retail and hospitality channels. Regional water quality variations and growing health awareness continue driving consumer preference for packaged water alternatives across the region.

Remaining UK regions including Wales, Northern Ireland, and North East England contribute collectively to the broader market landscape. These areas demonstrate varying consumption patterns influenced by local tap water quality, population density, and retail infrastructure development. Regional producers serve local markets while national distribution networks ensure brand availability.

Market Dynamics:

Growth Drivers:

Why is the UK Bottled Water Market Growing?

Escalating Health Consciousness and Sugar Reduction Initiatives

Consumer health awareness has emerged as a fundamental driver reshaping beverage consumption patterns across the United Kingdom. Growing recognition of sugar's negative health implications has prompted widespread dietary shifts away from carbonated soft drinks, fruit juices, and energy beverages toward bottled water alternatives. The UK health and wellness market size reached USD 125.59 Billion in 2024 and is expected to grow to USD 181.66 Billion by 2033, reflecting a CAGR of 3.76% during 2025‑2033. Public health campaigns and government initiatives targeting obesity and related health conditions have reinforced water's positioning as the healthiest hydration choice. Younger demographics demonstrate particular sensitivity to health messaging, driving generational shifts in beverage preferences. The trend of alcohol moderation creates additional opportunities for bottled water positioning as sophisticated alternatives in social and dining contexts.

Convenience-Oriented Lifestyle and On-the-Go Consumption

Modern lifestyle patterns characterized by increased mobility, extended working hours, and time constraints are driving demand for portable, ready-to-consume beverages. Meanwhile, in response to concerns over emerging pollutants and long‑term water security, the UK government launched Plan for Water in 2023, pledging significant infrastructure investments and regulatory reforms to deliver “clean and plentiful water” to homes and businesses. Bottled water's inherent convenience as a grab-and-go hydration solution aligns perfectly with contemporary consumer needs. Single-serve formats proliferate across convenience stores, transport hubs, vending machines, and workplace canteens, ensuring accessibility throughout daily routines. The expansion of e-commerce and subscription delivery services further enhances convenience by enabling scheduled home deliveries of multipack formats. Urban professionals and commuters represent particularly receptive segments, valuing immediate availability and portion-controlled packaging that fits seamlessly into active lifestyles.

Regional Tap Water Quality Concerns and Taste Preferences

Variations in municipal tap water quality across United Kingdom regions significantly influence bottled water adoption. Certain areas face particularly hard water conditions resulting from chalk and limestone geological formations, causing limescale accumulation and affecting taste perception. Consumer surveys indicate substantial dissatisfaction with tap water taste or quality among UK households, driving preference for packaged alternatives. Older properties with legacy plumbing infrastructure raise additional concerns about potential contamination issues. While tap water meets safety standards, subjective taste preferences and concerns about treatment processes and emerging contaminants continue motivating bottled water purchases among quality-conscious consumers.

Market Restraints:

What Challenges the UK Bottled Water Market is Facing?

Environmental Sustainability Criticism and Plastic Waste Concerns

Growing environmental consciousness places significant pressure on the bottled water industry regarding plastic packaging waste. Consumer awareness of ocean pollution, microplastic contamination, and carbon footprint implications increasingly influences purchasing decisions. Environmental advocacy groups actively campaign against single-use plastic bottles, promoting tap water and reusable containers as sustainable alternatives. This scrutiny compels manufacturers to invest substantially in recycled materials and circular economy initiatives.

Competition from Water Filtration and Refill Alternatives

Home water filtration systems and public refill infrastructure present growing competition to bottled water consumption. Filter jugs, under-sink systems, and advanced purification technologies enable consumers to address tap water quality concerns without recurring bottled water purchases. Municipal refill station networks expanding across urban centers provide free access to filtered drinking water. Environmentally conscious consumers increasingly view reusable bottles with home filtration as sustainable alternatives.

Deposit Return Scheme Implementation Challenges

The scheduled implementation of the UK Deposit Return Scheme introduces operational complexities and cost implications for bottled water producers and retailers. Establishing reverse vending machine infrastructure, adapting packaging with compliant labeling, and managing deposit logistics requires substantial capital investment. Smaller producers may face disproportionate compliance burdens relative to larger competitors. Consumer behavior adaptation during scheme transition periods presents additional market uncertainty.

Competitive Landscape:

The UK bottled water market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational beverage corporations alongside prominent domestic natural source water producers. Global players leverage extensive distribution networks, marketing resources, and portfolio diversification across still, carbonated, flavored, and functional water categories. Domestic producers differentiate through provenance credentials, emphasizing British origins and natural mineral content to appeal to consumers valuing local sourcing. Private label products from major retailers represent a significant and growing competitive force, offering value-oriented alternatives that have captured substantial market share. Competition intensifies around sustainability initiatives, with brands seeking differentiation through recycled packaging commitments, carbon neutrality programs, and circular economy participation. Innovation in premium and functional water formulations creates opportunities for brand distinction in higher-margin segments.

Recent Developments:

- In November 2025, Re:Water signed a five-year, multi-million-pound supply deal with Ball Corporation to secure tens of millions of aluminium bottles as it scales across retail, catering, and hospitality. The partnership strengthens Re:Water’s sustainable packaging leadership.

- In February 2025, BE WTR launched a new localised bottling facility in London, supplying filtered and sustainably bottled water to restaurants, hospitality, workplaces, and premium retail. The plant supports a low-carbon model by reducing transport emissions and eliminating single-use plastics.

UK Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK bottled water market size was valued at USD 9.62 Billion in 2025.

The UK bottled water market is expected to grow at a compound annual growth rate of 6.82% from 2026-2034 to reach USD 17.41 Billion by 2034.

Still water dominated the market with approximately 50.21% revenue share, driven by consumer preference for pure hydration options and health consciousness positioning still water as the leading beverage alternative.

Key factors driving the UK bottled water market include rising health consciousness and sugar reduction trends, convenience-oriented consumption patterns, regional tap water quality concerns, and growing demand for premium and functional water products.

Major challenges include environmental sustainability criticism regarding plastic packaging waste, competition from home water filtration systems and public refill infrastructure, deposit return scheme implementation complexities, and cost-of-living pressures driving consumers toward value-oriented private label alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)