UK Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

UK Carbon Black Market Overview:

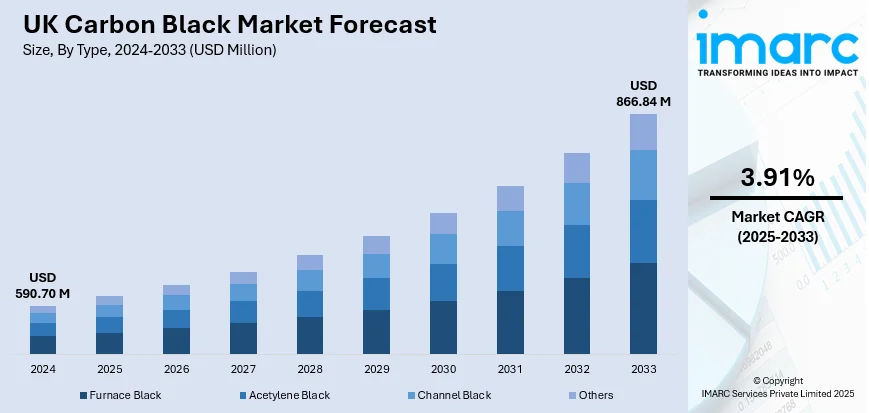

The UK carbon black market size reached USD 590.70 Million in 2024. Looking forward, the market is projected to reach USD 866.84 Million by 2033, exhibiting a growth rate (CAGR) of 3.91% during 2025-2033. The market is driven by significant tire and vehicle production standards demanding high-performance carbon variants, alongside regulatory mandates that elevate specialty grade adoption. Simultaneously, regulatory emphasis on emissions reduction and feedstock innovation fosters sustainable manufacturing and broad compliance alignment, further augmenting the UK carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 590.70 Million |

| Market Forecast in 2033 | USD 866.84 Million |

| Market Growth Rate 2025-2033 | 3.91% |

UK Carbon Black Market Trends:

Expanded Usage in Plastics, Coatings, and Inks

The United Kingdom is witnessing a pronounced increase in the utilization of carbon black across plastics, coatings, and printing ink industries, beyond its conventional role in tire and rubber applications. Plastics processors in automotive interiors, medical containers, and household packaging have adopted advanced carbon black formulations for their consistent pigment dispersion, UV stability, and tailored conductivity. The coatings sector benefits from carbon black’s ability to impart high jetness, weather resistance, and gloss retention in architectural and industrial finishes, particularly for coastal infrastructure and transport fleets. Ink manufacturers are also prioritizing grades with controlled particle morphology to ensure crisp imaging and abrasion resistance in high-speed digital and offset print runs. For instance, in July 2025, Cambridgeshire-based Linx Printing Technologies introduced a plastic-adherent ink formulated to deliver long-lasting codes on PET, OPP, HDPE, and other low surface energy substrates, while eliminating the need for plasma treatment and maintaining compliance with PFAS- and CMR-free standards. This emphasis on quality, stability, and surface compatibility has heightened interest in specialty carbon black that meets strict compositional and performance criteria. This diversified application base is a key enabler of UK carbon black market growth.

To get more information on this market, Request Sample

Strategic Integration in Sustainable and High-Value Manufacturing

Sustainability directives and circular economy goals in the UK are prompting downstream manufacturers to reevaluate raw material inputs, including the carbon black they source. Recyclable and bio-based polymer applications increasingly demand carbon black grades with minimal environmental impact and full traceability. To align with these priorities, producers are offering lower-emission manufacturing processes and post-consumer recycled feedstock without compromising performance metrics. In December 2024, SSH Recycling received approval to build a tire recycling plant in Linwood, near Glasgow, with operations set to begin in 2027. The facility will process 100,000 tons of waste tires annually, equal to over 1 million commercial and nearly 4 million passenger tires, and operate on a carbon-negative basis, preventing approximately 2.7 tons of CO₂ emissions per ton of waste. Simultaneously, the UK’s innovation-led approach to industrial development places a premium on materials that extend product lifespans and enable lightweighting, particularly in transportation, construction, and electronics. Carbon black’s ability to enhance UV stability, reduce thermal degradation, and support electrical conductivity aligns well with these objectives. Furthermore, integration into additive manufacturing, smart coatings, and fiber-reinforced composites is expanding its relevance beyond conventional uses. With national policies emphasizing material efficiency and environmental compliance, the adoption of engineered carbon black solutions across UK industries continues to intensify. This broader strategic alignment reflects carbon black’s indispensable role in future-ready manufacturing ecosystems.

UK Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

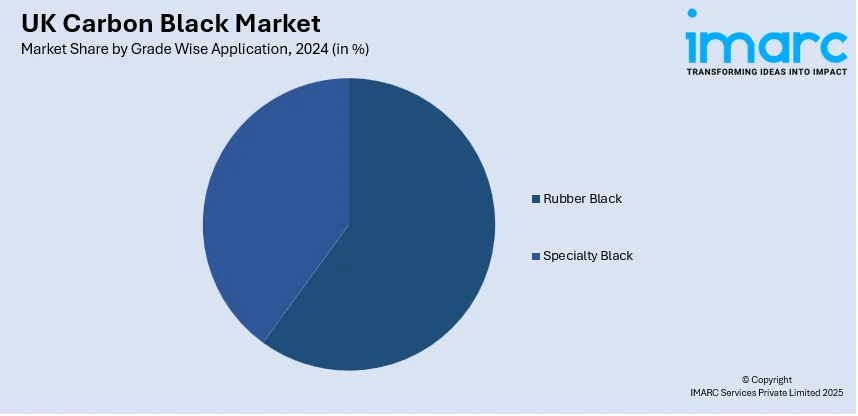

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Carbon Black Market News:

- In November 2024, Reoil formed a strategic partnership with HARKE Chemicals to expand the distribution of recovered carbon black (rCB) and tyre pyrolysis oil across Europe and the United Kingdom. The agreement enhances access to Reoil’s “ReBlack” product line, derived from end-of-life tyres, offering circular alternatives to conventional carbon black and supporting emissions reduction in rubber, plastic, and coating industries.

UK Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the UK carbon black market on the basis of type?

- What is the breakup of the UK carbon black market on the basis of grade wise application?

- What is the breakup of the UK carbon black market on the basis of region?

- What are the various stages in the value chain of the UK carbon black market?

- What are the key driving factors and challenges in the UK carbon black market?

- What is the structure of the UK carbon black market and who are the key players?

- What is the degree of competition in the UK carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)