UK CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

UK CCTV Camera Market Overview:

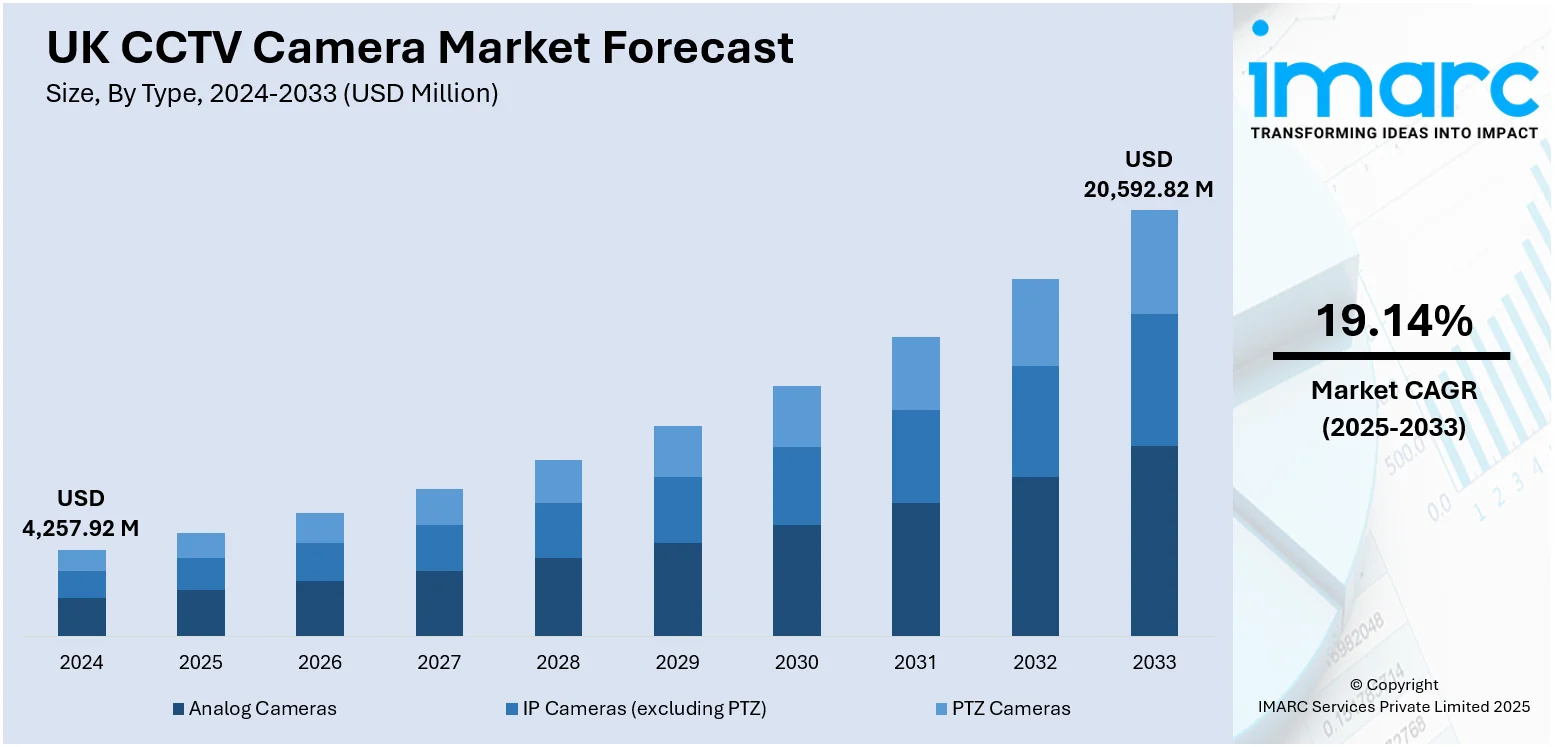

The UK CCTV camera market size reached USD 4,257.92 Million in 2024. Looking forward, the market is projected to reach USD 20,592.82 Million by 2033, exhibiting a growth rate (CAGR) of 19.14% during 2025-2033. The market is experiencing steady growth driven by increasing concerns around public safety, rising urbanization, and the adoption of smart surveillance systems across commercial and residential sectors. Technological advancements, such as AI-powered video analytics and remote monitoring, are further enhancing demand. Government initiatives supporting infrastructure security, along with rising safety concerns and smart surveillance adoption, are contributing to market expansion and positively influencing the UK CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,257.92 Million |

| Market Forecast in 2033 | USD 20,592.82 Million |

| Market Growth Rate 2025-2033 | 19.14% |

UK CCTV Camera Market Trends:

Growing Demand for Smart Surveillance

The growing need for advanced security solutions is fueling the development of smart surveillance systems across the UK. Companies, government agencies, and residential users are increasingly embracing AI-based CCTV cameras that incorporate features like facial recognition, behavioral analytics, and real-time motion detection. For instance, in February 2025, a UK NHS Trust teaching hospital upgraded its security by installing 25 i-PRO X-Series AI cameras integrated with Milestone’s VMS boosting surveillance across its campus. The technology enhances existing non-AI systems reducing false alarms and allowing customized detection for specific objects particularly in sensitive areas like emergency entrances. These advanced systems provide proactive monitoring facilitating quicker responses to threats and enhancing overall situational awareness. In commercial settings they assist in minimizing theft, overseeing employee behavior, and managing crowd control while in home environments they deliver reassurance through remote access and immediate alerts. The combination of smart surveillance with mobile applications and cloud services further enhances convenience and adaptability. As security issues become more intricate, the focus on automation and data-driven insights is propelling UK CCTV camera market growth, positioning smart camera technologies as a pivotal aspect of contemporary surveillance frameworks.

To get more information on this market, Request Sample

Integration with Smart City Infrastructure

The UK government's initiative to develop smart cities is significantly increasing the demand for advanced CCTV systems. Surveillance cameras are being embedded into urban infrastructure to facilitate real-time monitoring of traffic, public spaces, and transportation networks. For instance, in December 2024, Cumbria Police launched a new AI-enhanced CCTV system to enhance public safety during Neighbourhood Policing Week. Capable of rapidly analyzing extensive footage it identifies objects without compromising individual identities. These systems are crucial for enhancing road safety, lowering crime rates, and managing emergency responses more effectively. In line with smart transportation strategies high-definition and AI-enabled cameras are being installed at intersections, transit hubs, and public venues to provide situational awareness and data-driven insights. This integration improves urban safety and supports predictive analytics for infrastructure planning. Furthermore, local councils are implementing smart surveillance as part of environmental and community management initiatives. The connection between CCTV technology and broader digital infrastructure projects is creating long-term opportunities and contributing to the ongoing growth of the UK CCTV market.

UK CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

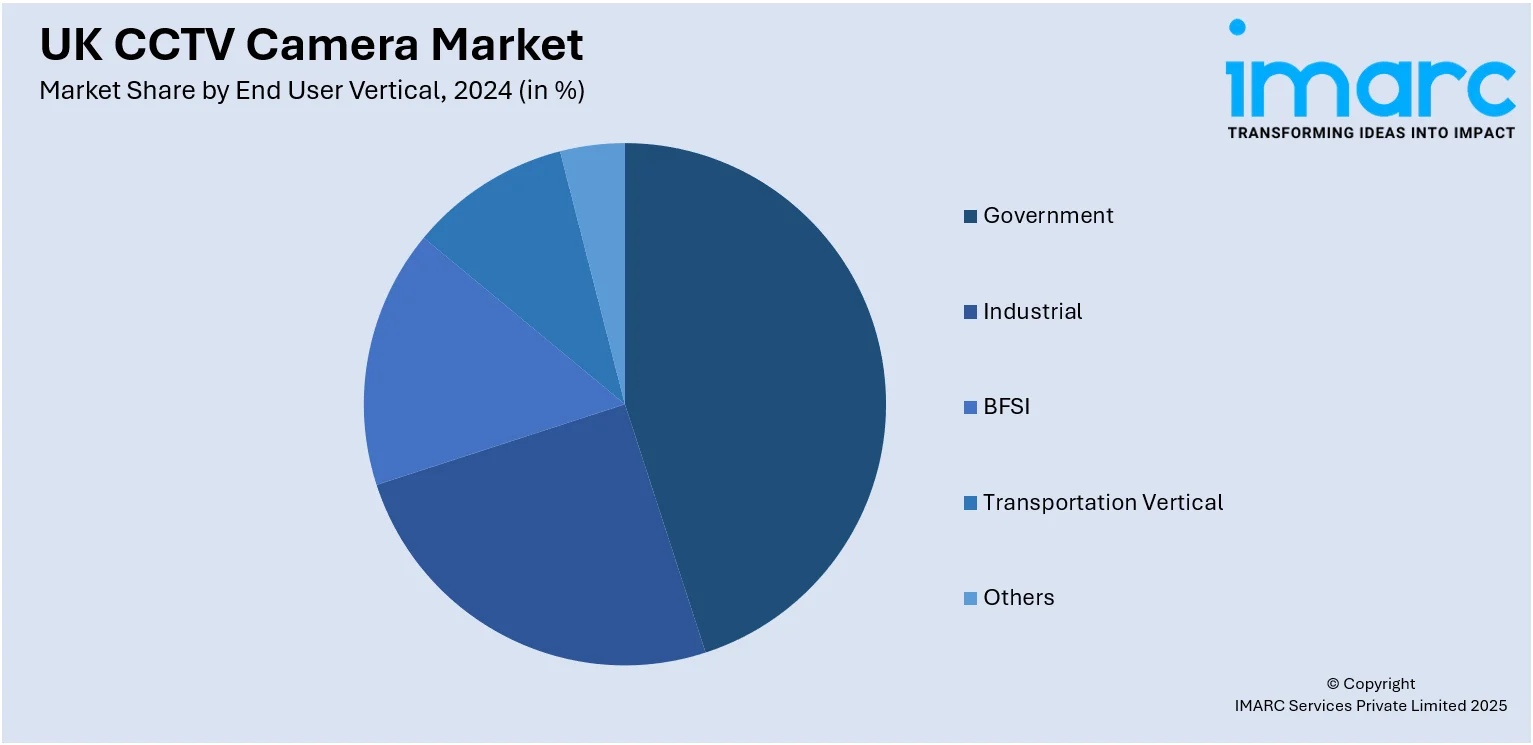

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK CCTV Camera Market News:

- In March 2025, Asda announced the launch of a two-month trial of Live Facial Recognition technology, integrated into existing CCTV systems, at five Greater Manchester stores. This move aims to bolster safety amid rising retail crime.

- In December 2024, London's CCTV network underwent a major upgrade, featuring over 300 new and enhanced cameras, with a £30 Million investment from Mayor Sadiq Khan. This initiative aims to improve public safety and incident response, offering clearer footage for the Met Police to identify and prosecute offenders effectively.

UK CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the UK CCTV camera market on the basis of type?

- What is the breakup of the UK CCTV camera market on the basis of end user vertical?

- What is the breakup of the UK CCTV camera market on the basis of region?

- What are the various stages in the value chain of the UK CCTV camera market?

- What are the key driving factors and challenges in the UK CCTV camera market?

- What is the structure of the UK CCTV camera market and who are the key players?

- What is the degree of competition in the UK CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)