UK Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2026-2034

UK Children's Entertainment Centers Market Summary:

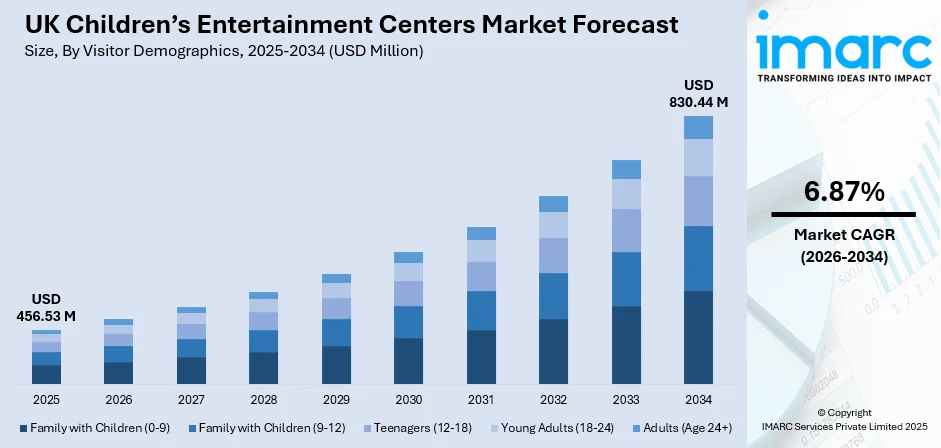

The UK children's entertainment centers market size was valued at USD 456.53 Million in 2025 and is projected to reach USD 830.44 Million by 2034, growing at a compound annual growth rate of 6.87% from 2026-2034.

The UK children's entertainment centers market is experiencing robust expansion, as families are prioritizing experiential recreation and developmental play opportunities for children. Rising disposable incomes and the integration of entertainment venues within shopping centers are strengthening the market foundation. Technological advancements incorporating immersive attractions and the ongoing popularity of birthday party celebrations continue to reshape the market dynamics.

Key Takeaways and Insights:

- By Visitor Demographics: Family with children (0-9) dominates the market with a share of 40% in 2025, driven by strong parental demand for safe, engaging environments that support early childhood development through physical play and social interaction.

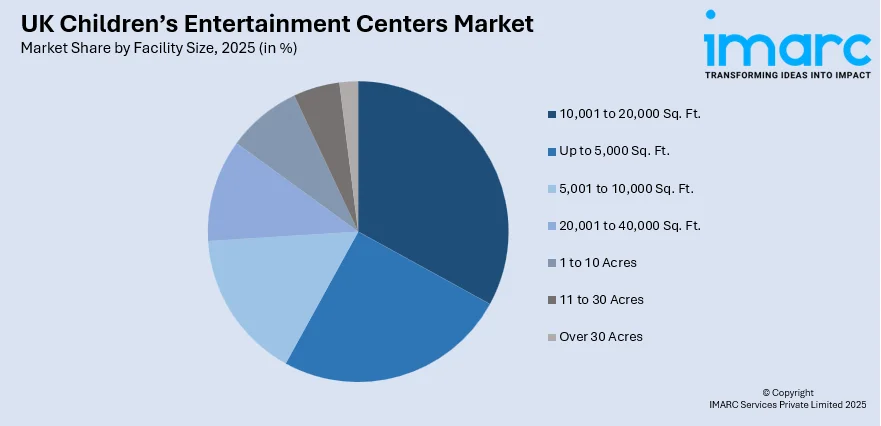

- By Facility Size: 10,001 to 20,000 sq. ft. leads the market with a share of 25% in 2025, offering optimal space for diverse attraction combinations while maintaining operational efficiency and accessible visitor experiences across urban and suburban locations.

- By Revenue Source: Entry fees and ticket sales represent the largest segment with a market share of 45% in 2025, reflecting the core business model of admission-based revenue generation that underpins children's entertainment center operations throughout the United Kingdom.

- By Activity Area: Physical play activities prevail the market with a share of 35% in 2025, owing to continued parental preference for active recreation that promotes fitness, motor skill development, and social engagement among children.

- Key Players: The UK children's entertainment centers market features a diverse competitive landscape with operators expanding model offerings, investing in technology-enhanced attractions, and strengthening franchise networks to capture the growing family recreation demand.

To get more information on this market, Request Sample

The UK children's entertainment centers market is advancing, as operators are embracing innovations to create attractive family destinations. A notable example of this progress is the August 2025 transformation of Sobell Leisure Centre in Islington, London, into a dynamic Active Multi-Zone featuring the UK's largest Interactive Strike Arena, trampoline and inflatable park, and immersive soft play zone for younger children, developed in collaboration with Rugged Interactive. The growing awareness about childhood obesity and increasing integration of edutainment elements are contributing to favorable conditions for sustained market expansion.

UK Children's Entertainment Centers Market Trends:

Integration of Immersive Technologies in Play Environments

The UK children's entertainment centers sector is witnessing accelerating adoption of virtual reality (VR), augmented reality (AR), and interactive gaming technologies to enhance visitor engagement. As per IMARC Group, the UK VR market size reached USD 1.8 Billion in 2024. Operators are incorporating motion sensors and gamification elements that blend physical activity with digital experiences. These technology-driven attractions appeal to digitally native younger generation while encouraging physical movement and social interaction among visitors.

Expansion of Large-Scale Indoor Adventure Destinations

Operators are investing substantially in expansive multi-attraction venues that serve as destination entertainment facilities for families. These comprehensive centers combine trampolines, inflatables, ninja courses, soft play areas, and arcades within single locations offering diverse experiences for all age groups. Flip Out was set to open the UK's biggest indoor trampoline and adventure park in Leeds in September 2025, spanning 100,000 square feet with over 150 interconnected trampolines, an 18,000 square foot inflatable zone, and numerous complementary attractions, reflecting the industry's evolution towards large-format entertainment destinations.

Growing Emphasis on Community-Accessible Family Entertainment

Local authorities and shopping centers are increasingly developing free and affordable family entertainment programs to support community engagement and child wellbeing. These initiatives address accessibility concerns while building loyalty among family visitors. In July 2025, Stockport launched an extensive free summer program, featuring daily events across cultural venues, parks, and town center locations, including beach setups, museum visits, creative workshops, and outdoor play activities designed to engage children during school holidays without cost barriers.

Market Outlook 2026-2034:

The market is positioned for sustained growth, as operators continue to invest in facility expansions, technological enhancements, and diversified attraction portfolios. The market generated a revenue of USD 456.53 Million in 2025 and is projected to reach a revenue of USD 830.44 Million by 2034, growing at a compound annual growth rate of 6.87% from 2026-2034. The market is driven by favorable demographic trends, rising disposable incomes, and the growing parental emphasis on developmental play experiences. Shopping mall integrations and increasing adoption of immersive entertainment technologies will support continued market development throughout the forecast period.

UK Children's Entertainment Centers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Visitor Demographics | Family with Children (0-9) | 40% |

| Facility Size | 10,001 to 20,000 Sq. Ft. | 25% |

| Revenue Source | Entry Fees and Ticket Sales | 45% |

| Activity Area | Physical Play Activities | 35% |

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

Family with children (0-9) dominates with a market share of 40% of the total UK children's entertainment centers market in 2025.

Families with young children represent the primary visitor demographic for UK children's entertainment centers, driven by parental recognition of the developmental benefits associated with structured play environments. The segment benefits from the growing concerns about screen time and the enduring importance of birthday celebrations as social milestones for young families.

Parents increasingly seek venues offering safe, supervised spaces where children can engage in physical activities, develop motor skills, and build social capabilities through interactive play. In November 2025, Putney Leisure Centre was set to unveil a new soft play zone for toddlers younger than five in London. Filled with sensory areas and creative play zones, it was an ideal spot for toddlers to explore, climb, and crawl. This interim setup was merely the start, with a lasting soft play space for children under five expected in summer 2026, and families were invited to provide their input to influence the ultimate design.

Facility Size Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

10,001 to 20,000 sq. ft. leads with a share of 25% of the total UK children's entertainment centers market in 2025.

Medium-sized entertainment centers occupying between 10,001 and 20,000 sq. ft. represent the optimal balance between attraction diversity and operational efficiency within the UK market. These facilities accommodate sufficient play equipment variety, including soft play structures, trampolines, climbing elements, and party spaces while maintaining manageable staffing requirements and rental costs.

The size range enables integration within shopping centers, retail parks, and leisure complexes across both urban and suburban locations, supporting accessibility for family visitors. Operators benefit from flexibility to incorporate themed environments, sensory play areas, and food service capabilities within these dimensions while ensuring adequate visitor flow and safety supervision throughout operating hours. This format also supports flexible zoning, higher visitor turnover, and easier crowd management. As a result, operators achieve faster break-even, stronger margins, and consistent customer flow.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

Entry fees and ticket sales exhibit a clear dominance with a 45% share of the total UK children's entertainment centers market in 2025.

Admission-based revenue generation remains the foundational business model for UK children's entertainment centers, with entry fees and ticket sales making up the main income stream. The revenue stream benefits from strong birthday party demand, with operators increasingly adopting online booking systems and membership programs to enhance revenue predictability and customer retention.

Families primarily visit these venues to access play zones, rides, and activity areas, making admission the natural first point of purchase. Unlike food, merchandise, or events, ticket sales generate immediate, predictable revenue with every visitor and scale directly with footfall. Operators also use dynamic pricing strategies, such as peak-hour rates, weekend premiums, family bundles, and holiday pricing, to maximize returns. This model reduces dependence on secondary purchases and ensures steady cash flow even during short visit durations.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

Physical play activities represent the leading segment with a 35% share of the total UK children's entertainment centers market in 2025.

Physical play activities, encompassing soft play structures, trampolines, climbing walls, ball pits, slides, and obstacle courses, represent the dominant attraction category within UK children's entertainment centers. These activity areas directly address parental priorities around child physical development, fitness, and active recreation in controlled indoor environments.

The segment benefits from broad age appeal spanning toddlers through teenagers, with operators designing multi-level play frames, interconnected bounce zones, and challenging obstacle courses to accommodate varying capability levels. Government initiatives promoting childhood physical activities and addressing rising obesity rates further strengthen demand for venues prioritizing movement-based entertainment over sedentary alternatives. To address inactivity and assist families in keeping children active throughout the year, in November 2025, the UK Government initiated 'Let's Move! ', a new campaign backed by Sport England designed to assist parents in finding easy, enjoyable, and stress-free methods to incorporate movement into their daily routine, beginning with as little as 10 minutes of activity.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London holds prominence due to its dense urban population, tourism traffic, and high disposable incomes. Children’s entertainment centers here emphasize premium experiences, branded themes, indoor play parks, and edutainment concepts integrated into large malls, high streets, and entertainment complexes.

The South East benefits from affluent suburban population and strong family-oriented residential developments. Demand is driven by birthday party venues, soft play zones, and educational entertainment formats. Centers are often located in retail parks, shopping malls, and community-oriented commercial hubs.

The North West experiences steady growth supported by large urban centers, such as Manchester and Liverpool. Entertainment centers typically focus more on value-oriented offerings, such as trampoline parks, activity zones, and indoor playgrounds that attract both local families and regional visitors.

In the East of England, the market is shaped by expanding towns and rising family settlements. Children’s centers emphasize educational play, interactive activities, and affordable indoor formats. The growth is supported by housing development, regional retail expansion, and increasing demand for structured leisure options for children.

The South West combines tourism-led demand with local family consumption. Holiday destinations drive seasonal traffic for amusement centers, activity parks, and play zones, while towns support community-based indoor facilities. Centers often align offerings with tourism trends and school vacation cycles.

In Scotland, the market is concentrated around key cities, such as Glasgow, Edinburgh, and Aberdeen. Due to weather conditions, indoor entertainment centers dominate, offering soft play areas, discovery zones, and recreational learning environments that cater to families seeking year-round entertainment solutions.

The West Midlands benefits from industrial cities and large residential concentrations. Shopping centers serve as key locations for children’s entertainment centers, with demand driven by budget-friendly attractions, such as arcade games, play zones, and experience-based family entertainment formats.

Yorkshire and the Humber supports a balanced combination of urban and suburban demand. Entertainment centers emphasize accessible pricing, birthday parties, and community-driven play facilities. Regional cities and retail hubs contribute to stable footfall across indoor playgrounds and family-oriented leisure destinations.

The East Midlands market is influenced by growing mid-sized cities and new residential developments. Children’s entertainment centers focus on affordable experiences, activity-led engagement, and school-oriented programs, with expansion largely tied to retail growth and improving local infrastructure.

Market Dynamics:

Growth Drivers:

Why is the UK Children's Entertainment Centers Market Growing?

Rising Government Focus on Childhood Physical Activities and Health

Government initiatives addressing childhood obesity and promoting physical activity are creating favorable conditions for the market growth across the UK. Policy emphasis on reducing sedentary behavior and encouraging active recreation aligns directly with the core value proposition offered by play centers, trampoline parks, and adventure facilities. In November 2025, the UK government announced a comprehensive strategy to tackle childhood obesity, including substantial investments in sport and physical activity programs for children. Entertainment centers positioned as venues promoting physical movement benefit from this policy environment, with parents increasingly viewing attendance as supporting child health objectives alongside recreational enjoyment.

Growing Birthday Parties and Celebration Culture

The enduring cultural importance of children's birthday celebrations continues to drive strong demand for entertainment center party packages and group booking services. With increasing disposable incomes, UK parents demonstrate consistent willingness to invest in memorable celebration experiences for their children, with birthday parties representing a significant revenue opportunity for center operators. As per the Trading Economics, disposable personal income in the United Kingdom rose to 443916 GBP Million in Q2 2025, up from 442635 GBP Million in Q1 2025. Centers offering dedicated party rooms, customizable packages, and themed experiences benefit from this cultural emphasis on milestone celebrations throughout childhood years.

Increasing Urban Population and Shopping Mall Integration

Expanding urban population and the growing integration of entertainment facilities within shopping centers and retail developments are strengthening market accessibility and visitor traffic. Shopping mall operators recognize children's entertainment centers as anchor tenants capable of driving family footfall and extending visitor dwell time across retail environments. In July 2025, Tee’s Game Factory became the newest establishment in the Mall Wood Green, a shopping center situated on the upper floor beside Cineworld, London. It is an engaging indoor theme park filled with all kinds of attractions, including interactive games for kids, a 360 photo booth, a magic photo booth, arcade games, a bowling machine, and boxing punch machines.

Market Restraints:

What Challenges the UK Children's Entertainment Centers Market is Facing?

Competition from Home and Mobile Gaming

The proliferation of affordable home gaming consoles, mobile devices, and streaming entertainment options presents ongoing competition for children's leisure time and family recreation spending. Children increasingly engage with digital entertainment accessible within home environments, potentially reducing the demand for out-of-home entertainment experiences. Operators must continuously innovate attraction offerings and emphasize unique experiential value propositions to compete effectively against convenient home-based alternatives.

High Initial Investments and Operational Costs

Establishing and maintaining children's entertainment centers requires substantial capital investment in specialized equipment, safety compliance measures, premises rental, and staffing requirements. Large-format facilities, incorporating trampolines, soft play structures, and technology-enhanced attractions, demand significant upfront expenditure before generating operational revenue. Rising energy costs, insurance premiums, and regulatory compliance obligations further pressure operational margins for center operators.

Increasing Ticket Prices Affecting Affordability

Entry price increases implemented to offset rising operational costs risk reducing accessibility for price-sensitive family households. Economic pressures on household budgets may constrain discretionary spending on entertainment activities, particularly affecting visitation frequency among middle-income families. Operators face challenging balance between maintaining profitability through pricing adjustments while preserving broad market accessibility and competitive positioning.

Competitive Landscape:

The UK children's entertainment centers market exhibits a dynamic competitive environment, characterized by established franchise operators, independent venue owners, and leisure facility management companies pursuing expansion and innovation strategies. Competition centers on attraction diversity, facility quality, safety standards, customer experience, and pricing accessibility. Major operators are expanding their networks through new facility openings, franchise development, and strategic location selection within high-traffic retail and leisure destinations. Technology integration, unique theming, and comprehensive service offerings differentiate leading players within increasingly sophisticated market conditions. Operators continue to invest in staff training, safety protocols, and visitor experience enhancements to build reputation and encourage repeat visitation among family customers.

Recent Developments:

- In October 2025, Family Centre Huron Heights and YMCA Child Care celebrated their grand opening at St. Anne’s Catholic School on Huron Street, London, to offer affordable, educational, and safe childcare for families. Managed by Childreach, the facility included 10 infant, 30 toddler, and 48 preschool full-time spots. The expansion featured sensory-friendly zones, play areas, and an integrated kitchen for family use.

- In October 2025, ZooTown, London's most adventurous play area at the London Zoo, was launched young wildlife documentary host, Aneeshwar Kunchala, who took on the role of Mayor of ZooTown. ZooTown included various themed role-play areas where kids could engage in activities like preparing animal meals in the Keeper Kitchen, combating germs in the Science Lab, or tracking wildlife at the Field Conservation Station. Families could benefit from a fantastic deal with children’s Zoo tickets priced at only £10.

- In July 2025, SANDS GREAT, a new children’s beach club, was launched in Shepherd’s Bush, Westfield London. Families could partake in a variety of immersive games, interactive areas, and photo moments. Children could also indulge in a ‘sensory sandcastle’ experience, featuring kinetic sand along with the visuals, sounds, and scents of the beach.

UK Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK children's entertainment centers market size was valued at USD 456.53 Million in 2025.

The UK children's entertainment centers market is expected to grow at a compound annual growth rate of 6.87% from 2026-2034 to reach USD 830.44 Million by 2034.

Family with children (0-9) dominated the visitor demographic segment with a market share of 40%, driven by strong parental demand for safe developmental play environments that support physical activities and social skill development.

Key factors driving the UK children's entertainment centers market include rising government focus on childhood physical activities, strong birthday party celebration culture, shopping mall integration, technological advancements in attractions, and increasing parental preference for supervised recreational environments.

Major challenges include competition from home and mobile gaming alternatives, high initial investments and operational costs, increasing ticket prices affecting affordability, staffing constraints, regulatory compliance requirements, and economic pressures on household discretionary spending.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)