UK Cloud Migration Market Size, Share, Trends and Forecast by Type of Deployment, Enterprise Size, Type of Service, End-User Vertical, and Region, 2025-2033

UK Cloud Migration Market Overview:

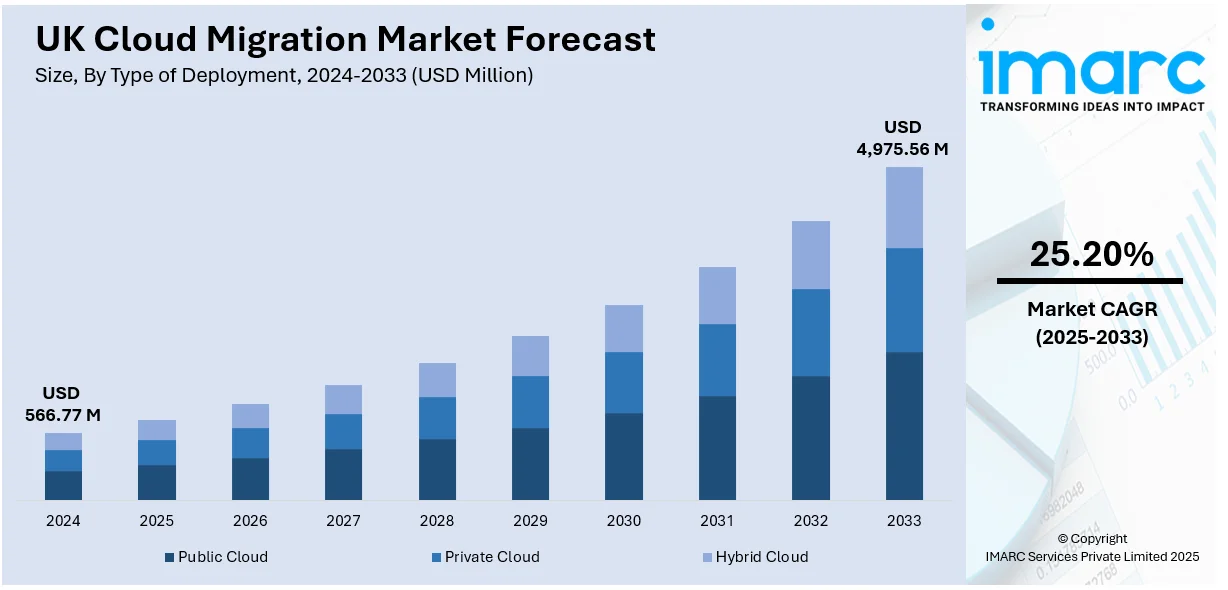

The UK cloud migration market size reached USD 566.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,975.56 Million by 2033, exhibiting a growth rate (CAGR) of 25.20% during 2025-2033. The market is witnessing significant growth, mainly driven by intensified organizational demand for hybrid and multi-cloud systems and improved security measures. In addition, firms are focusing on digital transformation, regulatory adherence, and adaptability to maintain operational efficiency, which, in turn, is fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 566.77 Million |

| Market Forecast in 2033 | USD 4,975.56 Million |

| Market Growth Rate 2025-2033 | 25.20% |

UK Cloud Migration Market Trends:

Increased Adoption of Hybrid and Multi-Cloud Strategies

The UK cloud migration market is currently witnessing a substantial inclination towards hybrid and multi-cloud strategies. According to industry reports, the adoption of hybrid multi-cloud models in the UK is projected to rise from 19% in 2024 to 26% within the next three years. As organizations seek flexibility, many are combining on-premises, public, and private solutions to evade vendor lock-in and upgrade workloads. Moreover, this trend is chiefly driven by the demand for cost-efficiency, seamless data incorporation, and improved security. In addition, UK businesses are rapidly utilizing multi-cloud infrastructures to balance regulatory adherence and performance, especially in segments such as healthcare and finance. Cloud service providers are actively capitalizing on this by providing customized hybrid solutions that cater to the particular business requirements, facilitating portability while managing control over crucial operations as well as data. Furthermore, this trend highlights an evolving market that prefers both innovation and resilience.

Growing Emphasis on Cloud Security and Compliance

As UK businesses are opting for cloud migration, ensuring regulatory adherence and data security has become a central focus. Numerous regulations in the country have created strict data protection demands, particularly for sectors like government, finance, and healthcare. Moreover, this regulatory pressure has resulted in an elevated demand for cloud providers providing cutting-edge security features such as real-time threat surveillance, encryption, and identity management. In addition, UK enterprises are heavily investing in cybersecurity systems incorporated with cloud solutions to manage risks and avoid breaches. Furthermore, the shift highlights a deeper insight that cloud adoption must align with resilient security structure to secure critical information and retain consumer trust. For instance, in September 2024, Titan Data Solutions announced a new partnership with Vawlt to strengthen data protection strategies, including disaster recovery, backup, ransomware protection, data security, and compliance, through an integrated distributed hybrid multi-cloud storage platform. This collaboration seeks to enhance channel recruitment and engagement, promoting the adoption of Vawlt’s supercloud storage technology across the UK.

Heightening Demand for Cloud-Native Applications

The magnifying demand for cloud-native applications is steering the UK cloud migration market as various companies seek to rejuvenate their IT infrastructures. Cloud-native development, which leverages serverless architectures, microservices, and containers, supports firms in deploying robust, scalable, and agile applications faster. Moreover, UK companies, especially in industries such as technology, retail, and finance, are rapidly adopting this approach to improve user experiences, innovate actively, and lower operational costs. In addition, cloud service providers are responding by providing platforms that aid the container orchestration tools such as Kubernetes, fostering more seamless transitions to cloud-native ecosystems. For instance, in April 2024, Civo, a UK-based cloud computing firm, introduced a cloud GPU service utilizing Nvidia A100 GPUs, available through its London region. This offering enables customers to access GPUs for both compute and Kubernetes, specifically designed to support high-demand workloads. Furthermore, Civo customers will have the opportunity to run their cloud GPU workloads on Deep Green servers equipped with A100 GPUs, contributing to sustainability efforts by providing free heat to communities across the UK. Furthermore, this trend reflects the increasing focus on operational agility as well as digital transformation across numerous UK sectors.

UK Cloud Migration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type of deployment, enterprise size, type of service, and end-user vertical.

Type of Deployment Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the type of deployment. This includes public cloud, private cloud, and hybrid cloud.

Enterprise Size Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium enterprises (SMEs) and large enterprises.

Type of Service Insights:

- PaaS

- Iaas

- SaaS

A detailed breakup and analysis of the market based on the type of service have also been provided in the report. This includes PaaS, IaaS, and SaaS.

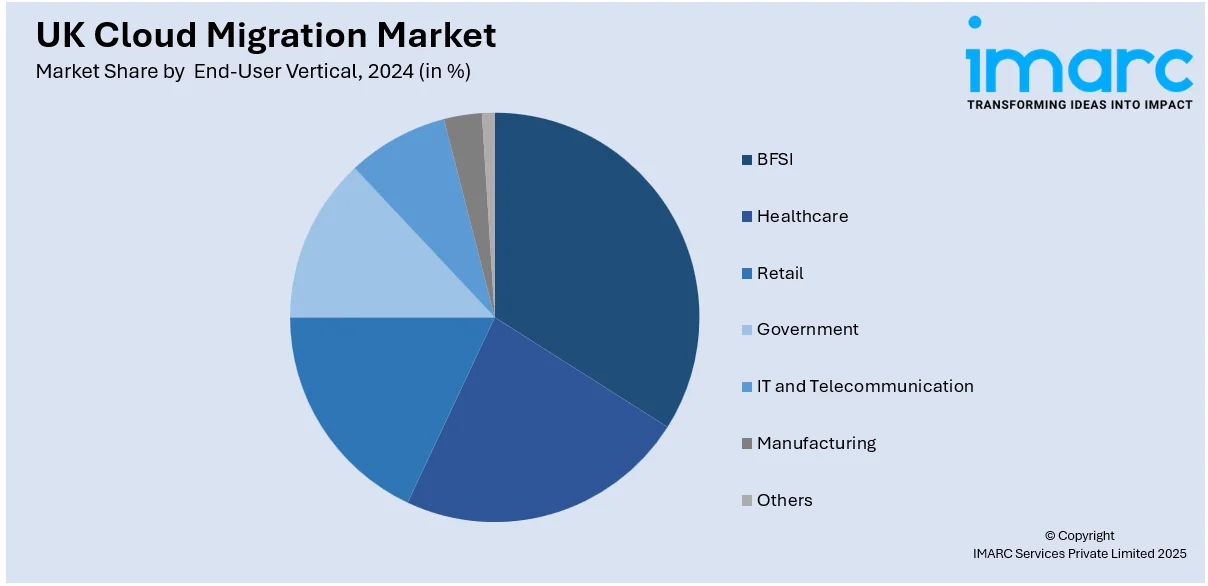

End-User Vertical Insights:

- BFSI

- Healthcare

- Retail

- Government

- IT and Telecommunication

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end-user vertical have also been provided in the report. This includes BFSI, healthcare, retail, government, IT and telecommunication, manufacturing, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Cloud Migration Market News:

- In August 2024, DataVita, a major cloud and connectivity services provider, entered a strategic partnership with Hewlett Packard Enterprise, an IT specialist company, to launch National Cloud, a UK sovereign cloud service designed for large enterprises, tech startups, and public sector organizations. This new platform provides customers across the UK with a reliable infrastructure, ensuring full control over their data while maximizing its value.

- In March 2025, Oracle announced plans to invest USD 5 Billion over five years to expand its Cloud Infrastructure (OCI) in the UK, supporting the government's AI vision. This will enhance AI services, multicloud capabilities, and sovereign cloud solutions. The investment aims to assist industries like healthcare, financial services, and defense in digital transformation, providing improved performance, security, and operational efficiency. Oracle’s distributed cloud will offer public, dedicated, hybrid, and multicloud services, promoting AI-driven innovation and technological advancement across various sectors.

UK Cloud Migration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Deployments Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Enterprise Sizes Covered | Small and Medium Enterprises (SMEs), Large Enterprises |

| Type of Services Covered | PaaS, IaaS, SaaS |

| End-User Verticals Covered | BFSI, Healthcare, Retail, Government, IT and Telecommunication, Manufacturing, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK cloud migration market performed so far and how will it perform in the coming years?

- What is the breakup of the UK cloud migration market on the basis of type of deployment?

- What is the breakup of the UK cloud migration market on the basis of enterprise size?

- What is the breakup of the UK cloud migration market on the basis of type of service?

- What is the breakup of the UK cloud migration market on the basis of end-user vertical?

- What is the breakup of the UK cloud migration market on the basis of end use?

- What are the various stages in the value chain of the UK cloud migration market?

- What are the key driving factors and challenges in the UK cloud migration market?

- What is the structure of the UK cloud migration market and who are the key players?

- What is the degree of competition in the UK cloud migration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK cloud migration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK cloud migration market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK cloud migration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)