UK Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

UK Commercial Insurance Market Overview:

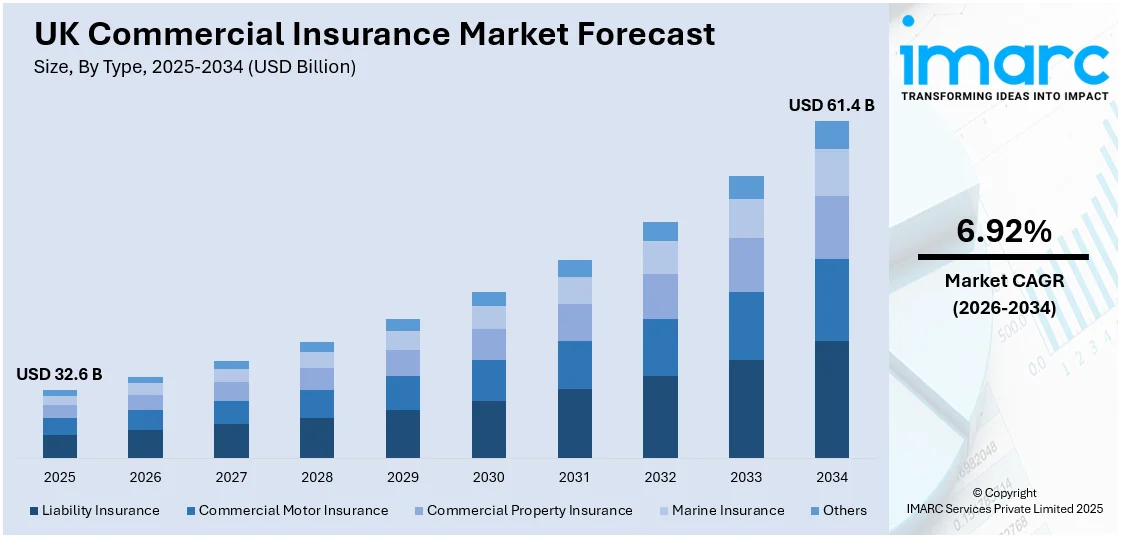

The UK commercial insurance market size reached USD 32.6 Billion in 2025. The market is projected to reach USD 61.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.92% during 2026-2034. The market is expanding as businesses increasingly adopt digital solutions to improve efficiency and streamline operations. Rising demand for specialized coverage, such as cyber insurance, and evolving risk management strategies are driving the market. This growth supports the overall UK commercial insurance market share across diverse industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 32.6 Billion |

| Market Forecast in 2034 | USD 61.4 Billion |

| Market Growth Rate 2026-2034 | 6.92% |

UK Commercial Insurance Market Trends:

Shift Towards Cyber Insurance Solutions

As companies increasingly depend on digital technologies, the need for cyber insurance in the UK commercial insurance sector has grown exponentially. With the rise in cyberattacks, data breaches, and other cyber threats online, businesses are acknowledging that they need financial safeguards against cyber threats. The increasing occurrence and sophistication of cyberattacks are encouraging businesses to invest in data breach, system failure, and other cyber events specifically covered policies. They are responding by creating specialized coverage that caters to the distinct needs of these different types of businesses, from small businesses to huge multinational firms. The heightened regulatory attention on data protection, including the GDPR, has also had a big role to play in fueling the need for cyber insurance. Further, the development of remote work has also introduced new risks, and as such, the need for strong cyber protection. With businesses still dealing with emerging cyber threats, these insurance products are likely to gain greater traction, making cyber insurance an important part of contemporary commercial insurance portfolios.

To get more information on this market Request Sample

Increased Digitalization in Commercial Insurance

The UK commercial insurance sector has experienced a dramatic transformation towards digitalization, motivated by both customer requirements and the need for business efficiency. Concurrent with this, companies are more and more choosing digital platforms to automate their insurance operations, from buying policies to settling claims. Insurers are embracing artificial intelligence, automation, and data analytics to deliver customized products designed to meet various business requirements. It is not just elevating customer experience, however, enhancing the capacity of insurers to evaluate risk correctly and speedily. As a result, the UK commercial insurance market growth is being propelled by the adoption of digital platforms that allow for faster underwriting, claims processing, and customer support. The emergence of InsurTech is pushing the limits further, developing innovative products that reduce operational expenses and enhance market access. The shift to digital has also increased competition, with more competitors emerging in the market and providing more flexible and personalized insurance policies. This technological advancement is aligning insurers to better address the specific needs of businesses, making insurance more accessible and effective for SMEs and large enterprises alike.

UK Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

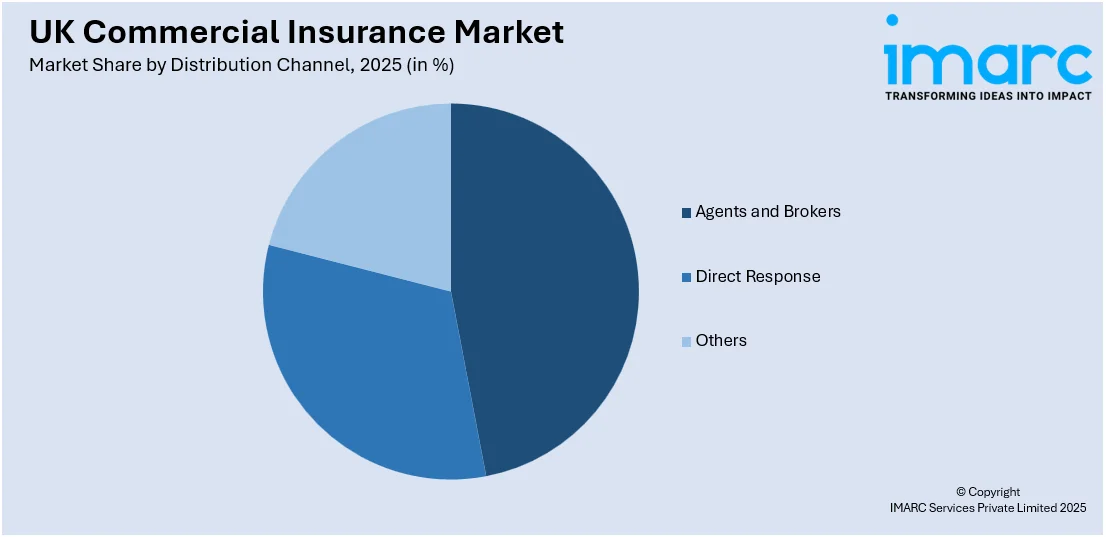

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Commercial Insurance Market News:

- June 2025: Aon launched a new platform, Aon Broker Copilot, to modernize the commercial insurance placement process. The platform utilized artificial intelligence and predictive analytics to enhance risk pricing, streamline decision-making, and improve broker-carrier engagements, significantly impacting the UK commercial insurance market by increasing efficiency and client outcomes.

- February 2025: Aviva's Global Corporate & Specialty (GCS) division launched two new business lines: Political Violence and Terrorism (PVT) and Accident and Health, available through Probitas on the Lloyd’s market. This move aligned with Aviva's strategy to enhance its position as a dual-platform London Market insurer, broadening commercial insurance offerings and improving risk protection.

UK Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the UK commercial insurance market on the basis of type?

- What is the breakup of the UK commercial insurance market on the basis of enterprise size?

- What is the breakup of the UK commercial insurance market on the basis of distribution channel?

- What is the breakup of the UK commercial insurance market on the basis of industry vertical?

- What is the breakup of the UK commercial insurance market on the basis of region?

- What are the various stages in the value chain of the UK commercial insurance market?

- What are the key driving factors and challenges in the UK commercial insurance market?

- What is the structure of the UK commercial insurance market and who are the key players?

- What is the degree of competition in the UK commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK commercial insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)