UK Consumer Finance Market Report by Type (Secured Consumer Finance, Unsecured Consumer Finance), Application (Bank & Financial Corporations, Non-Banking Financial Companies (NBFCs)), and Region 2025-2033

UK Consumer Finance Market Overview:

The UK consumer finance market size reached USD 1,307.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2,102.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The market is primarily driven by the rise in digital banking adoption, rapid expansion of Buy Now, Pay Later (BNPL) services, growing emphasis on financial wellness tools and education, and increasing efforts to enhance financial inclusion through mobile payments, contactless transactions, and personalized financial planning solutions aimed at improving consumer control and literacy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,307.2 Billion |

|

Market Forecast in 2033

|

USD 2,102.0 Billion |

| Market Growth Rate 2025-2033 | 5.42% |

UK Consumer Finance Market Trends:

Digital Transformation of Financial Services

The digital transformation of financial services is significantly altering the landscape of the UK consumer finance market. The increasing adoption of mobile banking applications, online loan platforms, and automated advisory services is driven by their enhanced convenience and operational efficiency. This shift towards digital solutions is redefining consumer engagement with financial institutions, offering streamlined access to financial products and services. Traditional banks are accelerating their digitalization efforts to keep pace with fintech companies that offer faster and more tailored financial solutions. The increased adoption of mobile payments and contactless transactions further strengthened the role of technology in consumer finance, promoting a cashless society while enhancing consumer experience.

Growth of Buy Now, Pay Later (BNPL) Services

The Buy Now, Pay Later (BNPL) sector is seeing rapid growth in the UK, particularly among younger consumers who value flexible payment options. These services offer a convenient alternative to traditional credit cards by allowing users to spread payments over time without immediate interest charges. BNPL has been embraced by retailers across various sectors, from fashion to electronics, due to its ability to drive higher sales and reduce cart abandonment. As the sector grows, regulators are working to enhance consumer protection and promote financial transparency, ensuring that users can make informed decisions. The rise of BNPL reflects changing consumer preferences for credit and payment flexibility, with more retailers and service providers adopting these solutions to cater to changing market demands.

Increased Focus on Financial Wellness and Education

As financial literacy becomes a priority in the UK, there is a growing emphasis on financial wellness tools and educational initiatives within the consumer finance market. Financial institutions are introducing services that provide consumers with insights into their spending habits, personalized budgeting tools, and savings plans. With economic uncertainty on the rise, consumers are seeking greater control over their financial health, driving demand for products that promote responsible borrowing and long-term financial planning. Additionally, government-backed initiatives and financial education programs aim to equip individuals with the skills needed to navigate complex financial products, further augmenting the focus on sustainable finance and informed decision-making.

UK Consumer Finance Market News:

- August 14, 2023: Novuna Consumer Finance partnered with UK retailer Victoria Plum to offer flexible finance options, allowing customers to borrow up to £50,000 for home renovations with repayment terms of up to five years. These financing solutions, including interest-free and interest-bearing options, are integrated into Victoria Plum's design and installation services, featuring a soft credit check tool that doesn't affect credit scores.

- August 12, 2024: Amazon and Barclays introduced a co-branded credit card in the UK, offering no annual fee, rewards on Amazon and everyday purchases, and additional benefits like pre-sale event access, with the option to redeem points for Amazon gift cards.

UK Consumer Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

To get more information on this market, Request Sample

- Secured Consumer Finance

- Unsecured Consumer Finance

The report has provided a detailed breakup and analysis of the market based on the type. This includes secured consumer finance and unsecured consumer finance.

Application Insights:

- Bank & Financial Corporations

- Non-Banking Financial Companies (NBFCs)

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bank & financial corporations and non-banking financial companies (NBFCs).

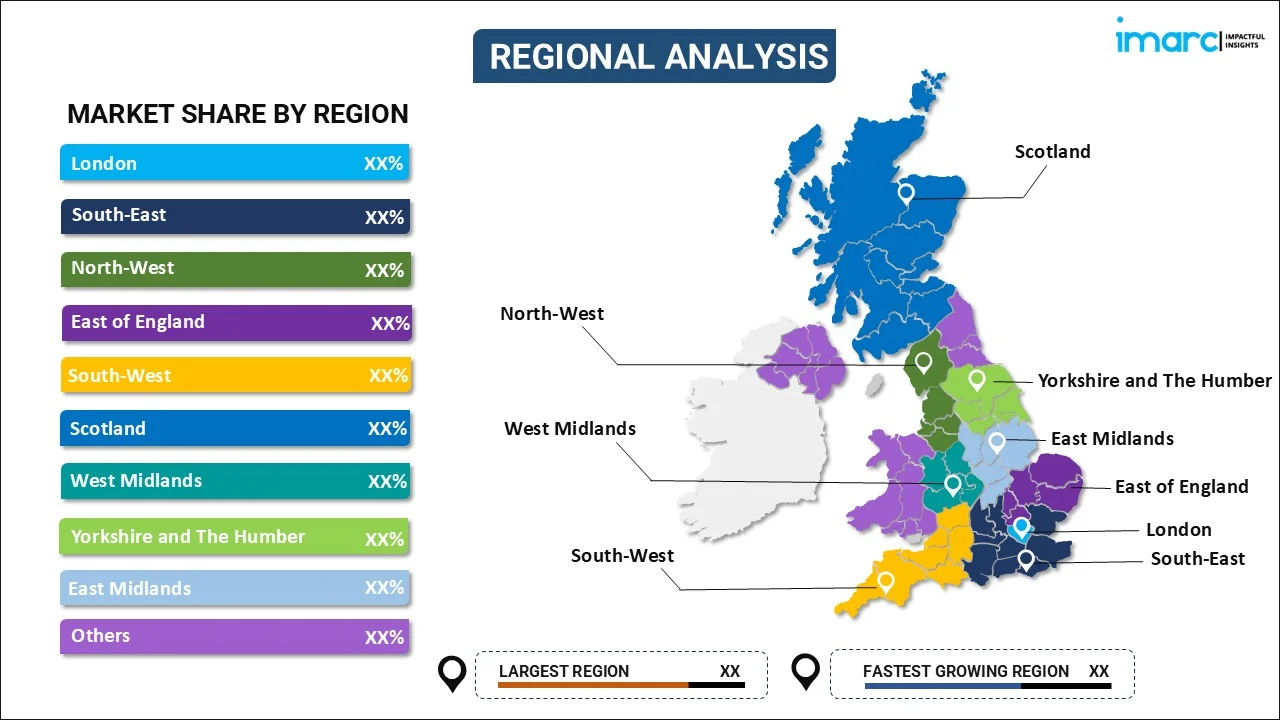

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Barclays Bank UK PLC

- HSBC Group

- Santander UK plc.

- Kensington Mortgage Company Limited

- Lloyds Bank plc

- Mitsubishi HC Capital UK PLC.

- Nationwide Building Society

- Virgin Money UK PLC

UK Consumer Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Secured Consumer Finance, Unsecured Consumer Finance |

| Applications Covered | Bank & Financial Corporations, Non-Banking Financial Companies (NBFCs) |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Companies Covered | Barclays Bank UK PLC, HSBC Group, Santander UK plc., Kensington Mortgage Company Limited, Lloyds Bank plc, Mitsubishi HC Capital UK PLC., Nationwide Building Society, Virgin Money UK PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK consumer finance market performed so far and how will it perform in the coming years?

- What is the breakup of the UK consumer finance market on the basis of type?

- What is the breakup of the UK consumer finance market on the basis of application?

- What are the various stages in the value chain of the UK consumer finance market?

- What are the key driving factors and challenges in the UK consumer finance?

- What is the structure of the UK consumer finance market and who are the key players?

- What is the degree of competition in the UK consumer finance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK consumer finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK consumer finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK consumer finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)