UK Data Center Market Size, Share, Trends and Forecast by Component, Type, Enterprise Size, End User, and Region, 2026-2034

UK Data Center Market Summary:

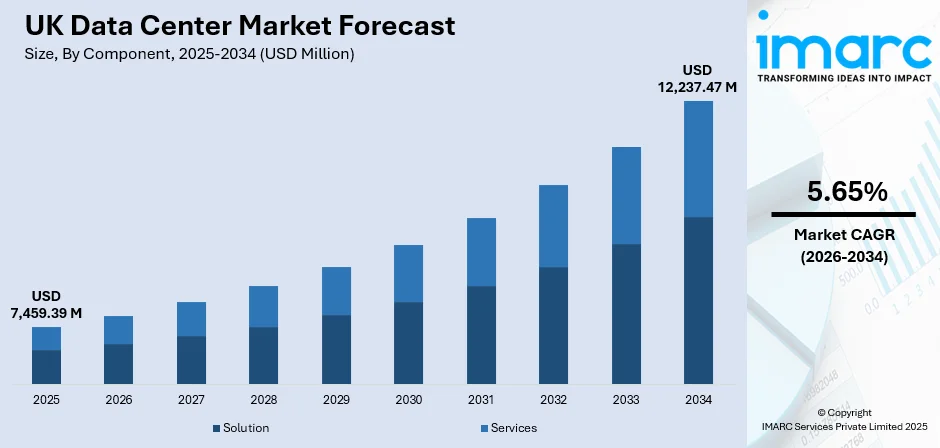

The UK data center market size was valued at USD 7,459.39 Million in 2025 and is projected to reach USD 12,237.47 Million by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

The market is driven by accelerating digital transformation across enterprises, widespread cloud computing adoption, and increasing deployment of advanced technologies including artificial intelligence and internet of things applications. The proliferation of high-speed connectivity networks and growing demand for real-time data processing capabilities are compelling organizations to expand their digital infrastructure investments. Rising smartphone penetration rates and expanding e-commerce activities continue to fuel data storage and processing requirements, strengthening the UK data centre market share.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 71% in 2025, driven by demand for unified data management, integrated infrastructure, and advanced software across hybrid environments.

- By Type: Hyperscale leads the market with a share of 45% in 2025, owing to strong cloud investments, rising AI workloads, and demand for scalable, high-capacity digital infrastructure.

- By Enterprise Size: Large enterprises represent the largest segment with a market share of 68% in 2025, due to higher digital transformation spending, multi-cloud complexity, and need for robust high-performance computing.

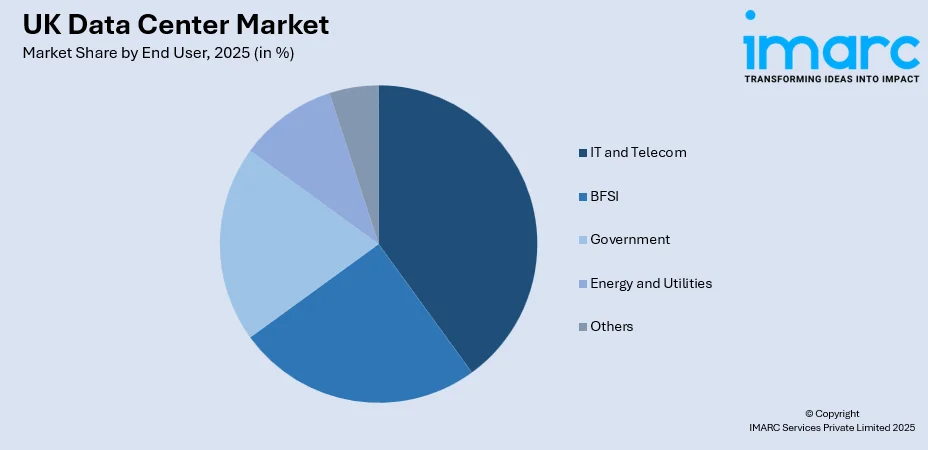

- By End User: IT and telecom dominate the market with a share of 38% in 2025, supported by network modernization, next-gen connectivity rollouts, expanding cloud services, and strong data processing needs.

- Key Players: The market compete through advanced facility design, energy-efficient operations, and robust cloud connectivity. Their strategies emphasise AI-optimised infrastructure, expanded colocation footprints, strong security capabilities, and differentiated service reliability to strengthen positioning in a rapidly evolving digital ecosystem.

To get more information on this market Request Sample

The UK data centre market is experiencing robust expansion driven by the fundamental shift toward digitalization across all industry verticals. Organizations throughout the country are increasingly migrating their operations to cloud-based platforms, necessitating substantial investments in resilient data infrastructure. The government's recognition of data centres as critical national infrastructure has significantly bolstered investor confidence and accelerated facility development across multiple regions. Growing adoption of artificial intelligence applications, machine learning workloads, and edge computing solutions is creating unprecedented demand for high-performance processing capabilities. The expanding e-commerce ecosystem and digital banking services require secure, low-latency data centres positioned strategically throughout the nation. Additionally, stringent data protection regulations are compelling enterprises to establish local data processing facilities, ensuring compliance while maintaining operational efficiency. In December 2025, BT launched a sovereign-data platform designed for UK public-sector and enterprise clients, enabling fully domestic data storage and processing to strengthen compliance and meet rising security requirements. Moreover, the convergence of telecommunications advancements and enterprise digital strategies continues to reinforce market momentum.

UK Data Center Market Trends:

Sustainable Operations and Green Infrastructure Development

Environmental sustainability has emerged as a transformative priority shaping data centre development across the United Kingdom. Operators are increasingly incorporating renewable energy sources, advanced cooling technologies, and energy-efficient designs into their facility blueprints. For instance, in December 2025, the UK’s Renewable Energy Association launched a Data Center Coalition to accelerate clean-power adoption and shape sustainability policies for data-centre operators across the country. Further, the transition toward alternative fuels and carbon-neutral operations reflects the industry's commitment to environmental stewardship while addressing mounting regulatory pressures. Liquid cooling solutions are gaining prominence as organizations seek to manage the thermal challenges associated with high-density computing equipment. Additionally, facilities are implementing circular economy principles, including waste heat recovery systems that channel excess thermal energy to district heating networks.

Edge Computing Infrastructure Expansion

The proliferation of edge computing infrastructure represents a significant paradigm shift within the United Kingdom data centre landscape. As organizations increasingly require low-latency data processing capabilities closer to end-users, distributed computing facilities are emerging across urban and suburban locations nationwide. In May 2025, BT began evaluating the conversion of its nationwide tower and exchange assets into edge data-centre sites to meet rising demand for low-latency, distributed compute infrastructure. This decentralized approach supports time-sensitive applications including autonomous systems, smart city infrastructure, and real-time analytics platforms. Edge deployments are particularly relevant for industries requiring instantaneous data processing, such as financial services, healthcare diagnostics, and industrial automation. The integration of edge nodes with centralized hyperscale facilities creates hybrid architectures that optimize both performance and cost efficiency.

Artificial Intelligence Infrastructure Specialization

Data centre facilities are undergoing significant architectural evolution to accommodate the specialized requirements of artificial intelligence (AI) workloads. Purpose-built facilities featuring high-density rack configurations, enhanced power distribution systems, and sophisticated thermal management solutions are becoming increasingly prevalent. In January 2025, Nscale announced a £2 billion investment in the UK data centre industry, launching AI-ready facilities in Loughton with 50 MW capacity, and 45,000 GPUs. Furthermore, the computational intensity of machine learning model training and inference operations demands infrastructure capabilities far exceeding traditional enterprise applications. Operators are investing in advanced graphics processing units and specialized accelerator hardware configurations to serve this rapidly expanding market segment. The development of dedicated artificial intelligence campuses reflects the growing recognition that these workloads require fundamentally different infrastructure approaches compared to conventional computing operations.

Market Outlook 2026-2034:

The UK data centre market is poised for strong revenue growth, driven by sustained enterprise digitalization and accelerating cloud adoption. Rising investments in data infrastructure to support emerging technologies will fuel demand, while hyperscale developments and regional colocation expansions add significant capacity. Edge computing growth further meets distributed processing needs. Supportive government initiatives and heightened data sovereignty priorities create favorable conditions for market advancement. Increasing hybrid-cloud migration, AI adoption, and operator differentiation through sustainability and connectivity strengthen overall revenue prospects. The market generated a revenue of USD 7,459.39 Million in 2025 and is projected to reach a revenue of USD 12,237.47 Million by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

UK Data Center Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solution | 71% |

| Type | Hyperscale | 45% |

| Enterprise Size | Large Enterprises | 68% |

| End User | IT and Telecom | 38% |

Component Insights:

- Solution

- Services

The solution dominates with a market share of 71% of the total UK data center market in 2025.

The solution segment maintains its dominant position within the UK data centre market, commanding the largest revenue share as enterprises increasingly demand integrated infrastructure platforms. In October 2025, Equinix announced a £3.9 billion investment to build a 250+ MW AI‑ready data centre campus in Hertfordshire, strengthening the UK’s digital infrastructure and supporting sovereign AI growth ambitions. Comprehensive solutions encompassing server hardware, storage systems, networking equipment, and management software enable organizations to deploy scalable, efficient data processing environments. The growing complexity of enterprise IT architectures necessitates sophisticated solution offerings that seamlessly integrate diverse technology components while ensuring operational reliability.

Advanced solution deployments incorporate automation capabilities, orchestration frameworks, and analytics tools that enhance operational efficiency and resource utilization. Organizations are prioritizing vendors offering comprehensive solution portfolios that address evolving requirements including hybrid cloud integration, security enhancement, and performance optimization. The solution segment benefits from continued enterprise investments in infrastructure modernization and the ongoing transition toward software-defined data centre architectures that maximize flexibility and agility.

Type Insights:

- Colocation

- Hyperscale

- Edge

- Others

The hyperscale leads with a share of 45% of the total UK data center market in 2025.

The hyperscale segment captures the leading market share, driven by the exponential growth in cloud services consumption and artificial intelligence workload deployment. These massive facilities offer unparalleled economies of scale, enabling operators to deliver cost-effective computing resources to enterprise customers. The construction of purpose-built hyperscale campuses across the United Kingdom reflects sustained demand for large-scale infrastructure capable of supporting cloud platforms and digital services. For instance, in November 2025, Colt DCS received approval to invest £2.5 billion in West London, expanding its Hayes campus with three hyperscale data centres and an Innovation Hub to support the UK’s AI economy.

Hyperscale facilities incorporate innovative design approaches including modular construction methodologies, advanced cooling systems, and renewable energy integration that enhance operational efficiency. The segment benefits from substantial investment commitments by major technology providers establishing regional presence to serve local enterprise customers. Additionally, hyperscale operators are pioneering sustainability initiatives that establish industry benchmarks for environmental performance while supporting ambitious carbon neutrality objectives.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The large enterprises exhibit a clear dominance with a 68% share of the total UK data center market in 2025.

Large enterprises represent the predominant customer segment within the UK data centre market, driven by their extensive digital infrastructure requirements and substantial technology investment budgets. According to sources, in April 2025, Pulsant acquired two SCC data centres in Birmingham and Fareham, expanding its UK network to 12 sites and strengthening its platformEDGE colocation and edge infrastructure offerings. Moreover, these organizations demand high-performance facilities offering advanced connectivity, robust security measures, and comprehensive compliance certifications. The complexity of large enterprise operations necessitates sophisticated data centre partnerships supporting mission-critical applications across multiple geographies.

Corporate digital transformation strategies are accelerating large enterprise adoption of colocation and managed services offerings that complement existing infrastructure investments. Financial services, telecommunications, and healthcare organizations demonstrate particularly strong demand for premium facilities featuring redundant systems and guaranteed service level agreements. The segment continues expanding as large enterprises pursue hybrid cloud strategies requiring reliable local data processing capabilities integrated with global cloud platforms.

End User Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Government

- Energy and Utilities

- Others

The IT and telecom dominate with a market share of 38% of the total UK data center market in 2025.

The IT and telecom sector represents the largest end-user segment, reflecting the fundamental role of data centres in enabling digital communications and technology services. Telecommunications operators require extensive infrastructure to support network operations, content delivery, and value-added service platforms serving millions of subscribers. Information technology companies similarly depend upon data centre facilities for software development, application hosting, and enterprise service delivery.

The deployment of next-generation connectivity services intensifies IT and telecommunications demand for strategically positioned data centre facilities offering superior connectivity and network diversity. Operators within this segment prioritize locations featuring direct access to internet exchange points and diverse fiber routes ensuring optimal performance. The convergence of telecommunications and cloud services creates additional growth drivers as providers expand their data centre footprints to support integrated service offerings.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the UK's most influential data centre hub, holding the largest share due to unmatched connectivity, proximity to major financial institutions, and extensive internet exchange points. Its mature ecosystem, skilled talent pool, and global business environment attract international operators establishing regional bases while supporting multinational enterprises through high-density, mission-critical infrastructure. In October 2025, Telehouse began construction of its £275 million West Two data centre at London Docklands, supporting AI and high-density workloads with 100% renewable energy and BREEAM Excellent design.

The South East acts as a strategic expansion zone absorbing overflow demand from London's capacity-constrained market. Locations along the M4 and M25 corridors offer strong connectivity, power access, and favourable development conditions. Competitive land availability and planning flexibility support large-scale builds, making the region attractive for operators seeking scalable deployment near the capital.

The North West exhibits strong growth, supported by established facilities, regional investment initiatives, and improving connectivity. Its lower operational costs compared to southern regions attract cost-sensitive enterprises, while the area’s manufacturing heritage provides a skilled technical workforce. Expanding digital innovation clusters further enhance its appeal for data centre development and regional processing needs.

The East of England benefits from proximity to London and strong links to the Cambridge technology ecosystem. High-performance computing demand from research and innovation institutions drives market momentum, while favourable land prices and strong power availability attract operators seeking expansion options outside congested metropolitan zones.

The South West is emerging as a promising data centre region supported by renewable energy access, competitive land costs, and strengthening connectivity infrastructure. Its geographic characteristics enable disaster recovery and business continuity capabilities, appealing to organizations implementing resilient, distributed infrastructure strategies across wider national networks.

Scotland offers significant potential due to abundant renewable energy resources, a cool climate that improves cooling efficiency, and supportive public initiatives. Its access to wind and hydroelectric power aligns with sustainability goals, while its geographic position provides advantages for transatlantic routes and Northern European connectivity.

The West Midlands gains from its central location enabling efficient reach to national markets, with Birmingham’s rise as a secondary tech hub boosting demand for regional data processing. Infrastructure improvements and economic development programs continue to enhance its suitability for operators targeting enterprise clusters across the Midlands.

Yorkshire and The Humber provides competitive development economics and expanding demand from technology activity in cities like Leeds and Sheffield. Improving connectivity infrastructure and ample land availability support facility construction, strengthening the region’s role in linking northern commercial centres to national data networks.

The East Midlands offers growth potential through its central logistics-focused economy, competitive land costs, and increasing power availability. Its strategic location supports distributed infrastructure models, while improving connectivity enhances attractiveness for operators meeting data needs of manufacturing and supply-chain industries.

Other UK regions contribute to market diversity through emerging facilities serving localized enterprise needs and strengthening national connectivity. Wales and Northern Ireland show activity driven by regional incentives and specific connectivity strengths, while smaller markets address niche requirements for distributed data processing across the broader UK infrastructure landscape.

Market Dynamics:

Growth Drivers:

Why is the UK Data Center Market Growing?

Accelerating Enterprise Digital Transformation Initiatives

Organizations across the United Kingdom are fundamentally reimagining their operational models through comprehensive digital transformation programs that create sustained data centre demand. This transformation extends beyond simple technology adoption to encompass complete business process redesign, customer engagement modernization, and workforce enablement strategies. Enterprises are establishing digital-first approaches that require robust, scalable infrastructure capable of supporting innovative applications and services. For instance, in December 2025, Google Cloud’s Waltham Cross data centre in Hertfordshire, UK, will be fully operational, providing high-performance, low-latency cloud infrastructure to support enterprise AI workloads. Additionally, the shift toward remote and hybrid work arrangements has permanently elevated infrastructure requirements, compelling organizations to expand their data processing capabilities. Industry sectors including financial services, healthcare, retail, and manufacturing are implementing sophisticated digital platforms requiring reliable, high-performance computing environments.

Government Support and Critical National Infrastructure Recognition

The United Kingdom government's designation of data centres as critical national infrastructure represents a transformative policy development accelerating market growth. As per sources, in September 2025, the UK government officially classified data centres as “critical national infrastructure,” granting enhanced regulatory protections, faster planning approvals, and coordinated emergency response support, boosting investor confidence and market development. This classification provides enhanced regulatory protections, expedited planning approvals, and coordinated emergency response capabilities that strengthen investor confidence. Government digital strategies emphasize the strategic importance of domestic data processing capabilities for economic competitiveness and national security considerations. Public sector digitalization programs generate substantial demand for compliant, secure data centre facilities meeting stringent government requirements. Infrastructure investment incentives and regional development initiatives encourage data centre construction beyond traditional metropolitan locations, supporting geographic diversification.

Emerging Technology Adoption and Artificial Intelligence Proliferation

The rapid adoption of artificial intelligence (AI), machine learning (ML), and advanced analytics applications generates unprecedented demand for specialized computing infrastructure throughout the United Kingdom. Organizations are deploying sophisticated algorithms requiring substantial computational resources for model training, inference operations, and continuous improvement cycles. In November 2025, Nebius launched its first UK GPU cluster at Ark Data Centres’ Longcross Park, deploying 4,000 Nvidia HGX B300 GPUs to support AI workloads and advanced high-performance computing. Further, these workloads exhibit fundamentally different infrastructure requirements compared to traditional enterprise applications, necessitating purpose-built facilities with enhanced power densities and thermal management capabilities. The proliferation of internet of things devices create additional processing demands as organizations collect, analyze, and act upon real-time operational data. Edge computing deployments supporting time-sensitive applications complement centralized infrastructure investments, creating multi-tier architecture requirements.

Market Restraints:

What Challenges the UK Data Center Market is Facing?

Power Grid Infrastructure Constraints and Energy Availability

The availability of adequate electrical power represents a significant constraint affecting data centre development across certain United Kingdom regions. Grid connection delays and capacity limitations can extend project timelines substantially, creating uncertainty for operators and enterprise customers. Rising energy costs impact operational economics while competing demands from other industrial sectors strain existing power infrastructure. The transition toward renewable energy sources introduces additional complexity as operators navigate intermittency challenges and grid balancing requirements.

Planning Permission Complexities and Regulatory Hurdles

Data centre developments face increasingly rigorous planning approval processes that can delay project implementation and increase development costs. Local authority concerns regarding visual impact, noise emissions, and community effects require comprehensive mitigation strategies and stakeholder engagement programs. Environmental assessments and sustainability requirements add procedural complexity while varying regional planning policies create inconsistent approval pathways. These regulatory considerations particularly affect developments in densely populated areas where data centre demand is highest.

Skilled Workforce Availability and Talent Competition

The data centre industry confronts persistent challenges securing qualified professionals possessing specialized technical expertise essential for facility operations. Competition for skilled engineers, technicians, and operational staff intensifies as market expansion creates additional employment opportunities across multiple operators. Training and development programs require substantial investment while workforce mobility introduces retention challenges affecting operational continuity. The specialized nature of data centre operations demands unique skill combinations spanning electrical, mechanical, and information technology disciplines.

Competitive Landscape:

The UK data centre market exhibits moderate consolidation with established operators maintaining significant market presence while emerging entrants introduce additional competitive dynamics. Market participants differentiate through facility quality, connectivity offerings, sustainability credentials, and service capabilities addressing diverse customer requirements. Strategic positioning emphasizes geographic coverage, with operators expanding beyond traditional metropolitan locations to capture growing regional demand. Investment in advanced infrastructure technologies including liquid cooling systems, renewable energy integration, and automation capabilities establishes competitive advantages supporting customer acquisition and retention. Partnership strategies with telecommunications providers, cloud platforms, and technology vendors enhance service portfolios while expanding customer access channels. Operators increasingly emphasize environmental performance metrics and sustainability certifications that resonate with enterprise customers prioritizing responsible technology partnerships. The competitive environment favors participants demonstrating operational excellence, financial stability, and innovation capabilities addressing evolving market requirements.

Recent Developments:

- In September 2025, Vantage Data Centers opened its second London campus, LHR2, in Park Royal, adding 20MW of IT capacity. The facility features one of Europe’s largest public art installations during the London Design Festival, integrates sustainable BREEAM Excellent-certified systems, and supports the UK’s expanding digital and hyperscale infrastructure needs.

UK Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Colocation, Hyperscale, Edge, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Users Covered | BFSI, IT and Telecom, Government, Energy and Utilities, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK data center market size was valued at USD 7,459.39 Million in 2025.

The UK data center market is expected to grow at a compound annual growth rate of 5.65% from 2026-2034 to reach USD 12,237.47 Million by 2034.

The solution segment led the market with a 71% share, driven by rising enterprise demand for integrated infrastructure platforms, advanced data management capabilities, enhanced security features, and efficient tools that support seamless processing, governance, and optimization of rapidly expanding digital environments across hybrid ecosystems.

Key factors driving the market include accelerating digital transformation initiatives across enterprises, expanding cloud computing adoption, increasing artificial intelligence workload deployment, government recognition of critical national infrastructure status, rising demand for data sovereignty compliance, and continuous investments in next-generation connectivity services.

Major challenges include power grid infrastructure constraints causing connection delays, planning permission complexities extending project timelines, skilled workforce shortages across specialized technical disciplines, rising energy costs impacting operational economics, environmental sustainability pressures, and competitive intensity for prime development locations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)