UK Digital Lending Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End User, and Region, 2025-2033

UK Digital Lending Market Overview:

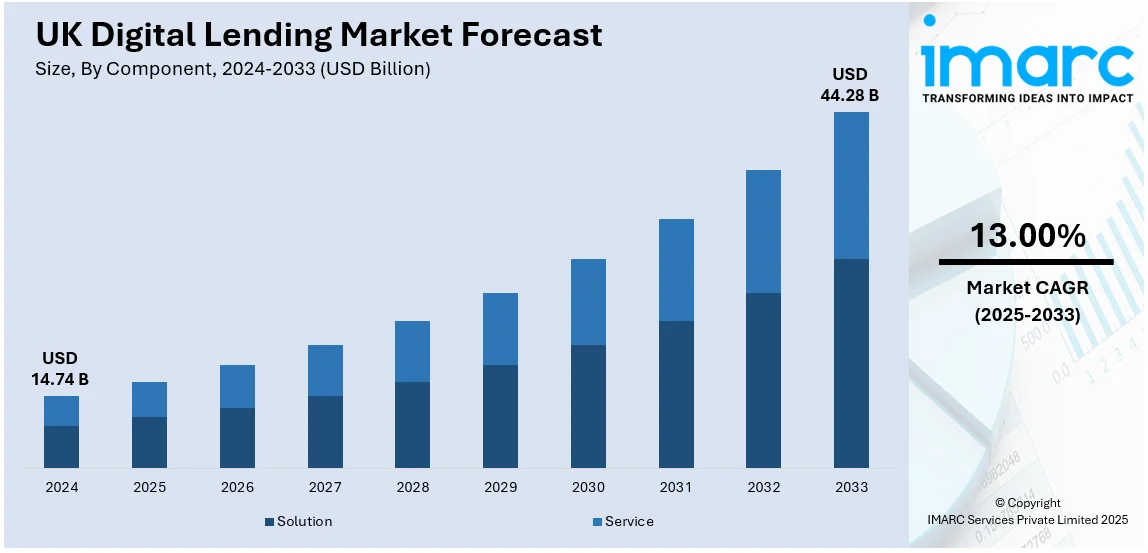

The UK digital lending market size reached USD 14.74 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 44.28 Billion by 2033, exhibiting a growth rate (CAGR) of 13.00% during 2025-2033. The market is driven by the growing number of financial services that offer more competition for lenders and result in better loan packages, lower interest rates, and enhanced customer services, along with the increasing number of new players entering the market in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.74 Billion |

| Market Forecast in 2033 | USD 44.28 Billion |

| Market Growth Rate (2025-2033) | 13.00% |

UK Digital Lending Market Trends:

Growing Number of Financial Services

According to the data published on the website of the World Economic Forum, the gross value of financial services sector was £243.7 billion in 2023. More financial services offer more competition for lenders, which can result in better loan packages, lower interest rates, and enhanced customer service. This competitive climate in the UK is driving digital lenders to innovate and differentiate themselves. New financial services attract a varied range of customers, including people who were previously underserved. Digital lenders can enter these new sectors, increasing their reach and demand for their products. The rising number of holistic financial services in the country enables digital lenders to provide packaged solutions, such as loans that include savings accounts or investing options. This connection has the potential to improve customer happiness and loyalty, encouraging more people to use digital financing choices.

As customers are becoming more acclimated to a wider choice of financial services in the UK, their expectations for convenience and accessibility in lending are rising. Digital lenders who provide frictionless online applications, rapid approvals, and personalized experiences are more likely to pique consumers' attention. Traditional banks and fintech companies are increasingly collaborating to provide integrated services. These alliances can improve the digital lending ecosystem by increasing customer options and encouraging innovations. The growth of financial services frequently coincides with greater educational resources, allowing people to better comprehend their alternatives. As financial literacy is increasing, more people are considering digital lending as a feasible choice.

Increased Competition

As new key players are entering the market, borrowers have access to a greater selection of loan solutions suited to their specific needs, including personal loans, business loans, and specialty financing options. Competing lenders frequently propose novel features, such as flexible repayment options, lower costs, or loyalty awards, to attract more customers. Increased competition often results in lower interest rates as lenders compete to attract borrowers. This reduces borrowing costs and encourages more people to seek digital loans. To differentiate themselves, digital lenders are investing in client service, providing simpler applications, faster responses, and tailored support, thereby improving the whole borrowing experience. For instance, in 2023, CRIF and iwoca collaborated to bring open banking-powered instant lending to UK SMEs. This partnership will help SMEs to use the free Credit Passport® service and apply in just 1 minute for an iwoca loan directly from their account, with the application pre-populated with all information from their credit profile. Competitive lenders frequently use proactive customer engagement techniques, such as educational tools and financial guidance, to foster trust and loyalty.

Competition encourages investments in technology, resulting in more robust and user-friendly digital platforms. Enhanced mobile apps and websites improve both the application process and the overall user experience. Lenders are using sophisticated analytics and artificial intelligence (AI) to improve their underwriting processes, resulting in faster judgments and more accurate evaluations of borrower risk. Regulatory organizations may respond to greater competition by improving the environment for fintech companies, fostering innovations, and the introduction of new loan alternatives.

UK Digital Lending Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, and end user.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Deployment Mode Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

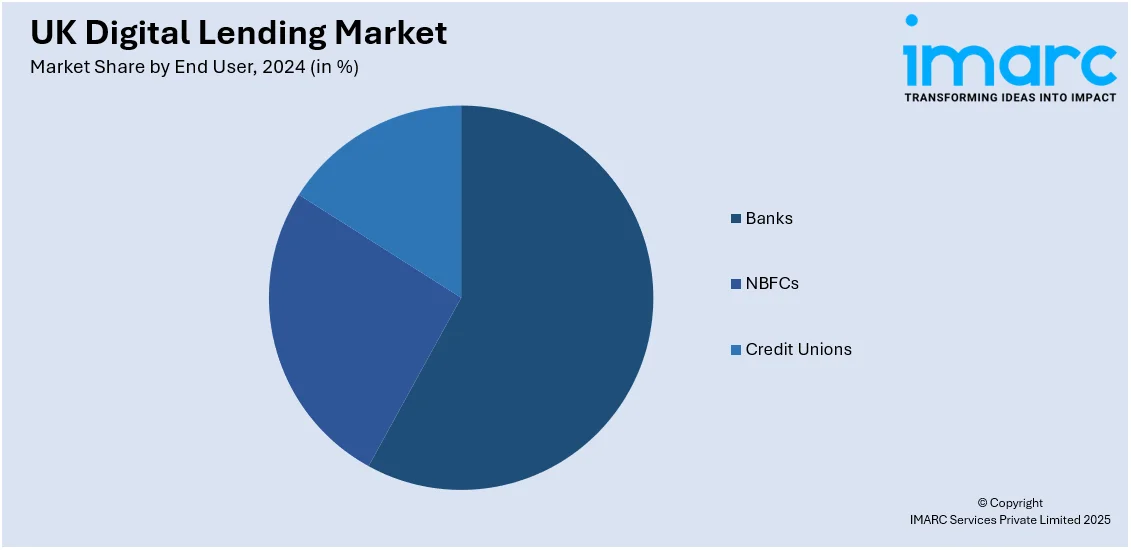

End User Insights:

- Banks

- NBFCs

- Credit Unions

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks, NBFCs, and credit unions.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Digital Lending Market News:

- In December 2024, UK digital bank Zopa secured £68m in funding to support its expansion, including launching a current account in 2025 and developing a Generative AI product. The funding round was led by A.P. Moller Holding, aiming to further enhance Zopa's financial services.

- In October 2024, Afin Bank, a new digital bank, secured a UK banking license and planned to begin offering lending services in 2025. It aimed to serve the African diaspora in the UK, particularly individuals struggling to access mortgages due to nationality or credit history. The bank was set to offer savings products and residential and buy-to-let mortgages for customers in England and Wales.

UK Digital Lending Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Deployment Modes Covered | On-Premises, Cloud |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered | Banks, NBFCs, Credit Unions |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK digital lending market performed so far and how will it perform in the coming years?

- What is the breakup of the UK digital lending market on the basis of component?

- What is the breakup of the UK digital lending market on the basis of deployment mode?

- What is the breakup of the UK digital lending market on the basis of enterprise size?

- What is the breakup of the UK digital lending market on the basis of end user?

- What is the breakup of the UK digital lending market on the basis of region?

- What are the various stages in the value chain of the UK digital lending market?

- What are the key driving factors and challenges in the UK digital lending market?

- What is the structure of the UK digital lending market and who are the key players?

- What is the degree of competition in the UK digital lending market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK digital lending market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK digital lending market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK digital lending industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)