UK Drone Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End Use Industry, and Region, 2025-2033

UK Drone Market Overview:

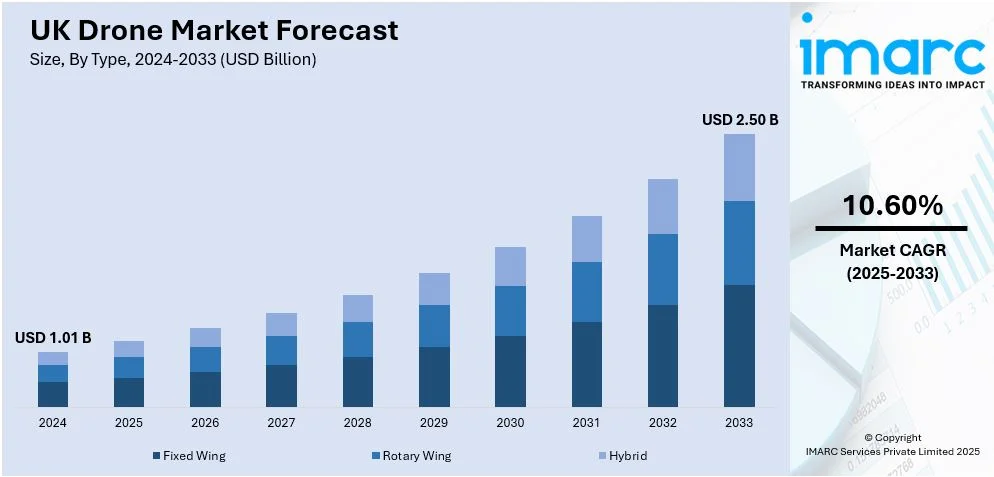

The UK drone market size reached USD 1.01 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.50 Billion by 2033, exhibiting a growth rate (CAGR) of 10.60% during 2025-2033. The market is propelled by the growing demand for drone delivery services in e-commerce and logistics, increasing use of drones in agriculture for crop monitoring and management, expanding applications in the construction and infrastructure sectors, and technological advancements in drone navigation and automation systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.01 Billion |

| Market Forecast in 2033 | USD 2.50 Billion |

| Market Growth Rate 2025-2033 | 10.60% |

UK Drone Market Trends:

Rising Demand for Drone Delivery Services

The growth of the UK drone market is primarily driven by the rising demand for drone delivery services particularly in the e-commerce and logistics industries. The rise of online shopping has created a need for faster and more efficient delivery methods. According to Gitnux, 87% of UK households are engaged in online shopping in 2020 with 31% of consumers making at least one online purchase every week. As a result, firms such as Amazon and UPS are experimenting with drones to improve last-mile delivery particularly in busy areas where congestion can challenge traditional payment methods. Drones can efficiently fly through cities and deliver packages right to the doorstep of consumers resulting in reduced time of delivery and additional savings on operations for companies. Moreover, the outbreak of COVID-19 heightened the requirement for contactless delivery increasing the usage of drones as they provide a safer method for delivering vital services such as medical essentials and groceries. This rising interest in drone delivery combined with advancements in drone technology is contributing significantly to the UK drone market growth.

Expanding Applications in Agriculture and Farming

The growing application of drones in farming and agriculture is having a huge impact on the UK drone market. Drones have many advantages for precision farming. Some of these are the capability to check crop health, control irrigation systems and evaluate soil conditions. Because of this, farmers are using drone technology to maximize yields, minimize waste of resources and boost efficiency overall. Drone technology is equipped with sensors and cameras that may capture data related to the health of plants and pest outbreaks and track climate impacts taking a toll on crop development in real-time. Farmers are then able to make faster and more effective choices. As per Catapult, by using the data collected through drone operations, farmers can decrease food wastage by as much as 50%. The use of drone technology helps in a more accurate application of fertilizers, pesticides, and water. This saves operational costs and augments productivity. This growing adoption of drones in agriculture is expected to drive the UK drone market share as farmers increasingly rely on advanced aerial technology for precision farming.

Increasing Use of Drones in Public Safety and Law Enforcement

The rising demand for drones in public safety and law enforcement activities is one of the significant factors propelling the growth of the UK drone market. From policing to dealing with emergency situations, police forces, fire departments and other types of emergency response are starting to use drones to do their job more efficiently. For instance, in July 2024, Hampshire and Isle of Wight Constabulary along with Thames Valley Police trialed innovative drone technology at the 2024 Isle of Wight Festival. The Drone as First Responder (DFR) provided real-time surveillance enhancing public safety and freeing officers for patrol duties offering insights for future policing applications. Drones provide a quick and cost-effective means to deliver tactical aerial reconnaissance, surveillance of large gatherings and assess hazardous situations without endangering personnel. Moreover, thermal imaging cameras on drones can find lost individuals using their heat signatures whether in a forest or out at sea. Drones are also being used in insurance surveys pipeline monitoring by oil companies, and tracking forest fires or insect infestations which are new areas for commercial aviation. These factors are collectively creating a positive UK drone market outlook.

UK Drone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kg, 25-170 kg and >170 kg.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the point of sale have also been provided in the report. This includes original equipment manufacturers (OEM) and aftermarket.

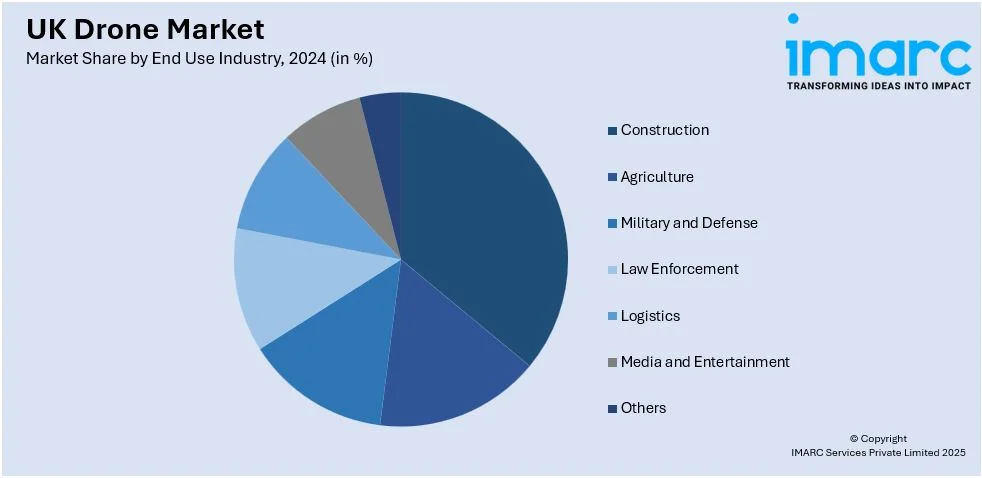

End Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Drone Market News:

- 19 September 2024: A new initiative in the UK is exploring the use of drone technology to improve pollination in strawberry crops, with the goal of increasing yields and fruit quality. The project, titled “Precision Pollination for Higher Strawberry Productivity and Quality,” aims to address challenges in controlled growing environments and is a collaboration between the UK Agri-Tech Centre, Angus Soft Fruits, and Polybee.

- 28 August 2024: Orkney I-Port operation, the first commercial drone postal service in Orkney, is confirmed to remain operational until February 2026. The venture was established in August 2023 by Royal Mail and Skysports, a leading drone company based in London.

UK Drone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 kg, 25-170 kg, >170 kg |

| Point of Sale Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK drone market performed so far and how will it perform in the coming years?

- What is the breakup of the UK drone market on the basis of type?

- What is the breakup of the UK drone market on the basis of component?

- What is the breakup of the UK drone market on the basis of payload?

- What is the breakup of the UK drone market on the basis of point of sale?

- What is the breakup of the UK drone market on the basis of end use industry?

- What is the breakup of the UK drone market on the basis of region?

- What are the various stages in the value chain of the UK drone market?

- What are the key driving factors and challenges in the UK drone market?

- What is the structure of the UK drone market and who are the key players?

- What is the degree of competition in the UK drone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK drone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK drone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)