UK e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

UK e-KYC Market Overview:

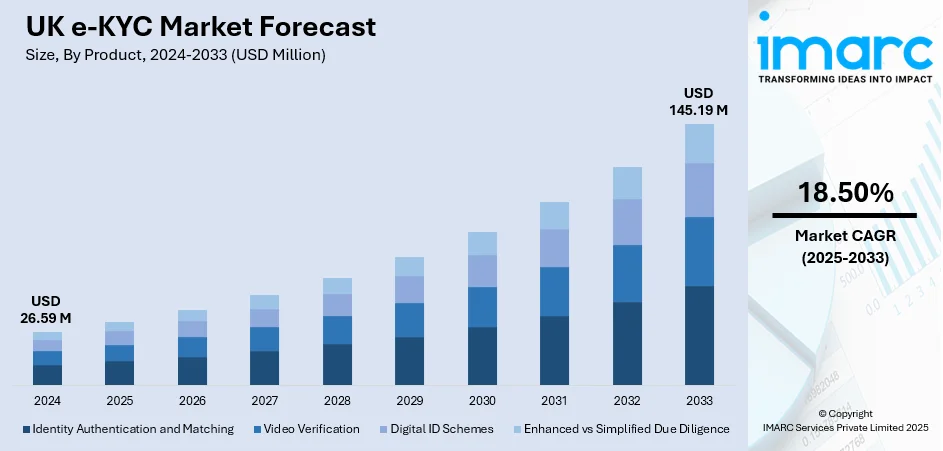

The UK e-KYC market size reached USD 26.59 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 145.19 Million by 2033, exhibiting a growth rate (CAGR) of 18.50% during 2025-2033. Increasing use of digital financial services is impelling the market growth. Besides this, the implementation of stringent compliance regulations, like those designed by the Financial Conduct Authority (FCA) and the European Union's Anti-Money Laundering (AML) directives, is making companies focus on the implementation of strong identity verification systems. Moreover, technological innovation in machine learning (ML) and artificial intelligence (AI) is playing a major role in expanding the UK e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.59 Million |

| Market Forecast in 2033 | USD 145.19 Million |

| Market Growth Rate 2025-2033 | 18.50% |

UK e-KYC Market Trends:

Rising Demand for Digital Financial Services

Increasing use of digital financial services in the UK is impelling the market growth. As people and enterprises are moving to online banking, mobile payments, and digital wallets, there is a greater need for fast and secure customer verification processes. Banks and fintech operators are increasingly applying e-know-your-customer (KYC) solutions to simplify onboarding, minimize fraud, and meet strict regulatory requirements. The push toward a cashless world speeds up the process where conventional face-to-face verification is not adequate. E-KYC offers a quicker and more convenient option to ensure customer identity is verified securely in real time. This need for speed and accurate verification solutions drives the market considerably as businesses look for scalable solutions that are compliant with regulations and improve the customer experience in a digital-first world. IMARC Group predicts that the UK digital payments market is projected to attain USD 11.20 Billion by 2033. This is expected to further increase the need for e-KYC facilities in the country.

To get more information on this market, Request Sample

Strict Regulatory Framework and Compliance

The regulatory environment of the UK is instrumental in shaping the e-KYC industry. The stringent compliance regulations, like those designed by the Financial Conduct Authority (FCA) and the European Union's Anti-Money Laundering (AML) directives, encourage companies to implement strong identity verification systems. E-KYC solutions assist companies by fulfilling such compliance easily with the assistance of automated, digital identity verification processes of customers, lowering the possibility of human errors and resulting in non-compliance fines. With the UK government and regulators consistently strengthening anti-money laundering regimes and customer due diligence processes, organizations are depending upon e-KYC solutions to remain compliant. The constant drive for greater regulatory scrutiny further drives the need for digital verification technology, which places e-KYC firmly in the role of a critical enabling solution for financial institutions, insurance companies, and other regulated sectors within the UK. In 2025, the UK Government officially declared its plan to revise the Money Laundering Regulations (MLRs) by the end of the year, with the goal of minimizing regulatory burdens and enhancing efficacy while upholding strong protections against financial crime. In its Sector Plan for Professional and Business Services, released as a component of the UK’s comprehensive Industrial Strategy, the Government recognized worries in the professional services sector regarding the complexity and burden of AML regulations.

Improvements in Artificial Intelligence (AI) and Machine Learning (ML)

Technological innovation in machine learning (ML) and artificial intelligence (AI) is playing a major role in contributing to the UK e-KYC market growth. AI and ML algorithms help in better and faster identity verification processes, detecting possible fraudulent transactions, and authenticating customers in real time. These technologies improve the capacity to scan large volumes of data efficiently and accurately, making it possible for businesses to make more informed decisions while minimizing the amount of manual effort required in checks for identity. AI-based facial recognition, biometric authentication, and document verification technology are being made available as part of e-KYC solutions, enhancing security as well as user experience. With AI and ML maturing, their influence on the UK e-KYC market increases, driving the creation of more advanced, scalable, and economical verification systems in industries.

UK e-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

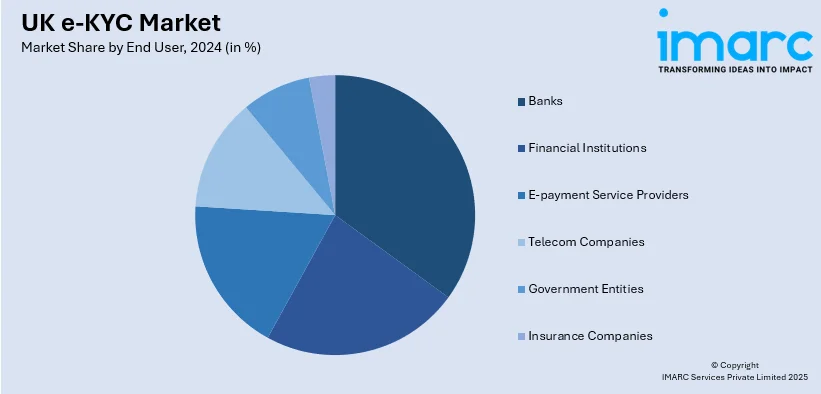

End User Insights:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK e-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the UK e-KYC market on the basis of product?

- What is the breakup of the UK e-KYC market on the basis of deployment mode?

- What is the breakup of the UK e-KYC market on the basis of end user?

- What is the breakup of the UK e-KYC market on the basis of region?

- What are the various stages in the value chain of the UK e-KYC market?

- What are the key driving factors and challenges in the UK e-KYC market?

- What is the structure of the UK e-KYC market and who are the key players?

- What is the degree of competition in the UK e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)