UK Energy-as-a-Service Market Size, Share, Trends and Forecast by Service Type, End User, and Region, 2025-2033

UK Energy-as-a-Service Market Overview:

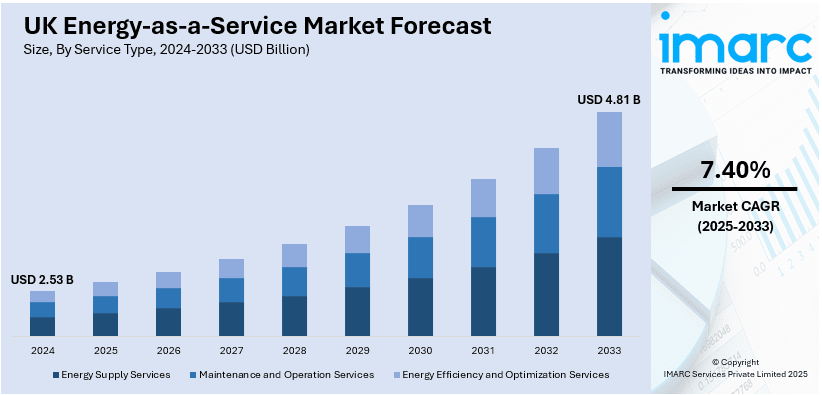

The UK energy-as-a-service market size reached USD 2.53 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.81 Billion by 2033, exhibiting a growth rate (CAGR) of 7.40% during 2025-2033. The market is driven by the shift towards renewable energy, supported by government initiatives and grid modernization. Providers offer flexible solutions like energy management systems, storage, and virtual power plants to integrate renewables. The adoption of smart grid technologies also enhances efficiency and contributes to the expansion of the UK energy-as-a-service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.53 Billion |

| Market Forecast in 2033 | USD 4.81 Billion |

| Market Growth Rate 2025-2033 | 7.40% |

UK Energy-as-a-Service Market Trends:

Transition to Renewable Energy Sources

The UK's energy-as-a-service sector is being notably advanced by the swift shift towards renewable energy sources, fueled by the necessity to achieve climate objectives and lower carbon emissions. The governing body’s drive for clean energy options, such as solar, wind, and other renewable technologies, is transforming the energy sector. Energy-as-a-service providers are taking advantage of this change by providing scalable and flexible options that enable both businesses and individuals to utilize renewable energy without requiring substantial initial capital investment. These services typically encompass energy management systems, virtual power plants, and energy storage solutions, which are crucial for incorporating renewable energy sources into the national grid and residences. A significant instance of this shift took place in 2025 when the UK government and Ofgem introduced an innovative reform aimed at expediting clean energy grid connections. This reform sought to release £40 billion in yearly private investment by focusing on ready-to-go renewable energy initiatives and eliminating inactive "zombie projects" from the grid connection list. The project aimed not only to minimize connection delays but also to improve energy security and promote economic development. With these reforms facilitating enhanced integration of renewable energy, energy-as-a-service providers are taking on a crucial role in assisting the UK in achieving its significant decarbonization goals, streamlining the adoption process of renewable energy and promoting improved efficiency within the energy sector.

Advancements in Grid Modernization and Smart Grids

The continuous upgrade of the electricity grid is a key factor supporting the UK energy-as-a-service market growth, as it facilitates a more efficient, dependable, and adaptable energy system. Technologies in smart grids that integrate sensors, automated systems, and sophisticated data analysis are transforming energy distribution. These technologies enable communication between both individuals and utilities, allowing for immediate tracking and enhancement of energy utilization. As a result, energy suppliers are able to provide more tailored and efficient services, facilitating the integration of renewable energy sources, minimizing energy waste, and effectively balancing energy loads. The grid's modernization is enhancing the overall reliability of energy systems while also facilitating the implementation of localized energy solutions, including microgrids and distributed energy resources. In 2025, the UK government initiated the Great Grid Partnership, a significant initiative meant to implement the Great Grid Upgrade, focused on transforming the electricity grid to accommodate 50 GW of offshore wind capacity by 2030. This £9 billion initiative aims to boost grid infrastructure expansion five times over the next six years relative to the previous thirty years, enhancing energy security and lowering costs. As these efforts gain traction, energy-as-a-service providers are utilizing advanced grid technologies to deliver innovative services that improve grid resilience and efficiency, increasing the demand for decentralized energy solutions and aiding the sector's growth.

UK Energy-as-a-Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type and end user.

Service Type Insights:

- Energy Supply Services

- Maintenance and Operation Services

- Energy Efficiency and Optimization Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy supply services, maintenance and operation services, and energy efficiency and optimization services.

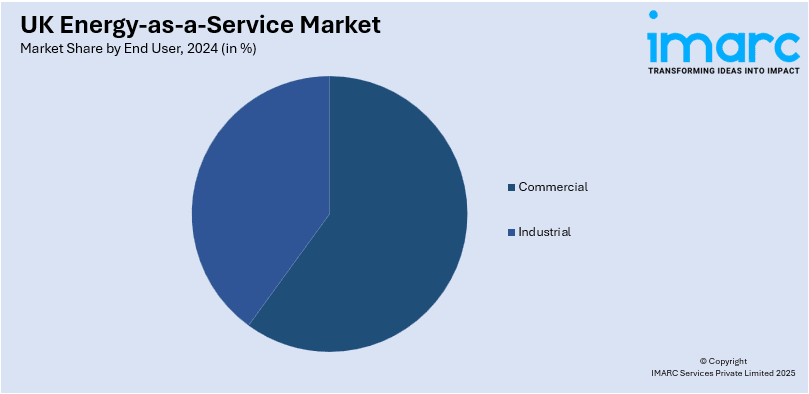

End User Insights:

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and industrial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Energy-as-a-Service Market News:

- In January 2024, Heatio partnered with E.ON and Energy Systems Catapult to launch an Energy as a Service (EaaS) solution under the Green Home Finance Accelerator. The 20-year subscription model removed upfront costs for installing heat pumps, solar panels, or battery storage, with monthly payments around £150. The service aimed to lower emissions and energy bills for 350 homes in North West England.

UK Energy-as-a-Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Supply Services, Maintenance and Operation Services, Energy Efficiency and Optimization Services |

| End Users Covered | Commercial, Industrial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK energy-as-a-service market performed so far and how will it perform in the coming years?

- What is the breakup of the UK energy-as-a-service market on the basis of service type?

- What is the breakup of the UK energy-as-a-service market on the basis of end user?

- What is the breakup of the UK energy-as-a-service market on the basis of region?

- What are the various stages in the value chain of the UK energy-as-a-service market?

- What are the key driving factors and challenges in the UK energy-as-a-service?

- What is the structure of the UK energy-as-a-service market and who are the key players?

- What is the degree of competition in the UK energy-as-a-service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK energy-as-a-service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK energy-as-a-service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK energy-as-a-service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)