UK Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

UK Family Offices Market Overview:

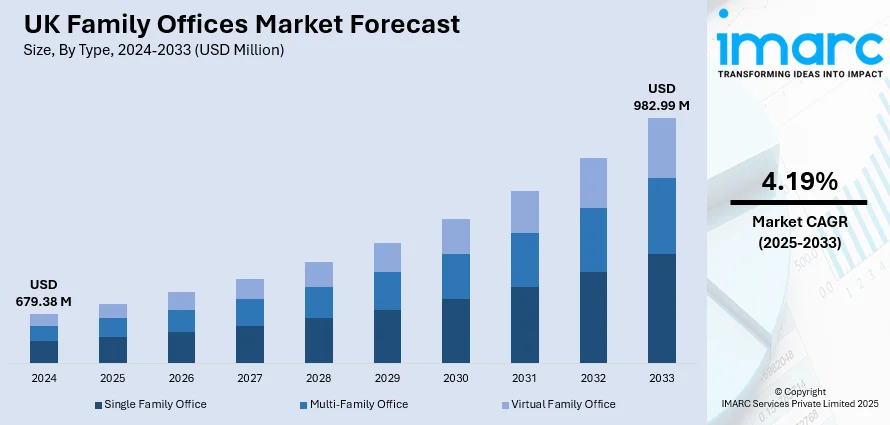

The UK family offices market size reached USD 679.38 Million in 2024. The market is projected to reach USD 982.99 Million by 2033, exhibiting a growth rate (CAGR) of 4.19% during 2025-2033. The market is changing by way of more direct investments, the embedding of philanthropy in sustainable approaches, and the embrace of cutting-edge technology for wealth management. All these changes are indicative of a shift towards increased control, transparency, and long-term effect in capital deployment. With an emphasis on financial returns and preserving legacy, these offices are enhancing their capacity to react to new opportunities while maintaining wealth across generations. Such progress is likely to propel the UK family offices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 679.38 Million |

| Market Forecast in 2033 | USD 982.99 Million |

| Market Growth Rate 2025-2033 | 4.19% |

UK Family Offices Market Trends:

Growing Emphasis on Direct Private Investments

Family offices in the UK are intensely shifting towards direct private investments, especially in areas like technology, healthcare, and renewable energy. This strategy enables them to circumvent intermediaries, establish more control over terms of investment, and harvest higher potential returns. By going directly to entrepreneurs and project developers, these offices can establish more robust strategic alliances and shape operational decision-making. Co-investment with other family offices is also becoming highly prevalent, increasing deal access and diversification. This growing focus on direct investment mirrors broader market expansion as wealth owners look to preserve capital while generating long-term value. This approach aligns with changing UK family offices market trends in support of proactive, active portfolio management and customized asset allocation that allows family offices to react quickly to market changes and emerging opportunities in both domestic and global markets.

To get more information on this market, Request Sample

Integration of Philanthropy and Sustainable Investment Strategies

A distinguishing feature of UK family offices is the convergence of philanthropy with sustainable investing, evincing a tilt towards purpose-based wealth management. These organizations are investing in projects that produce tangible environmental and social returns in addition to financial returns, focusing on causes such as climate change mitigation, social housing, and community development. Younger generations in affluent families tend to drive this change, seeking investments aligned with moral values and for long-term social good. More advanced reporting structures and impact measurement systems are allowing for more transparency, so that sustainability goals are fulfilled. This change makes a major contribution to UK family offices market growth, since it widens the investment scope beyond pure financial returns. It also reflects market trends towards integrating ESG practices within core portfolios, thus supporting both family legacy objectives and economic resilience overall through sustainable capital utilization.

Adoption of Cutting-Edge Technology for Wealth and Risk Management

UK family offices are increasingly embracing cutting-edge technology platforms to optimize operations, improve investment analysis, and bolster risk management systems. From portfolio management software and real-time analytics to cybersecurity systems and secure communication tools, technology is facilitating more rapid, better-informed decision-making. Artificial intelligence (AI) and machine learning (ML) are increasingly involved in finding market opportunities, predicting trends, and evaluating complex risks across asset classes. In addition, digital transformation is improving collaboration among family members, advisors, and investment partners, ensuring that strategies are implemented cost-efficiently and securely. As such capabilities grow, they are stimulating market expansion through enhanced operational flexibility and protection of multi-generational wealth. These innovations follow market trends that emphasize data-driven intelligence, anticipatory risk management, and the convergence of digital technologies to enable sustainable long-term wealth stewardship in a more complicated financial landscape.

UK Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

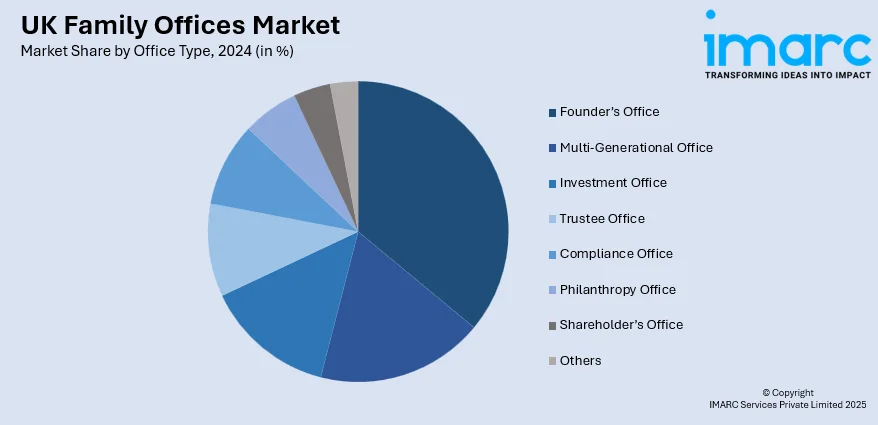

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equalities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Family Offices Market News:

- In December 2024, Henley Investments unveiled Henley Family Office (HFO) to serve international high-net-worth families in the UK real estate market. The business unit raised £250 million in mandates for residential, healthcare, retail, and hotel property in the United Kingdom.

- In November 2024, AYU introduced the Approved Family Office (AFO) Programme, a rigorous due diligence program aimed at confirming legitimate family offices overseeing more than $50 million in assets. The program ensures more trust and transparency in wealth management by awarding certified family offices an industry-accepted badge of authenticity.

UK Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the UK family offices market on the basis of type?

- What is the breakup of the UK family offices market on the basis of office type?

- What is the breakup of the UK family offices market on the basis of asset class?

- What is the breakup of the UK family offices market on the basis of service type?

- What is the breakup of the UK family offices market on the basis of region?

- What are the various stages in the value chain of the UK family offices market?

- What are the key driving factors and challenges in the UK family offices market?

- What is the structure of the UK family offices market and who are the key players?

- What is the degree of competition in the UK family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)