UK Financial Analytics Market Size, Share, Trends and Forecast by Type, Component, Application, Organization Size, Vertical, and Region, 2025-2033

UK Financial Analytics Market Overview:

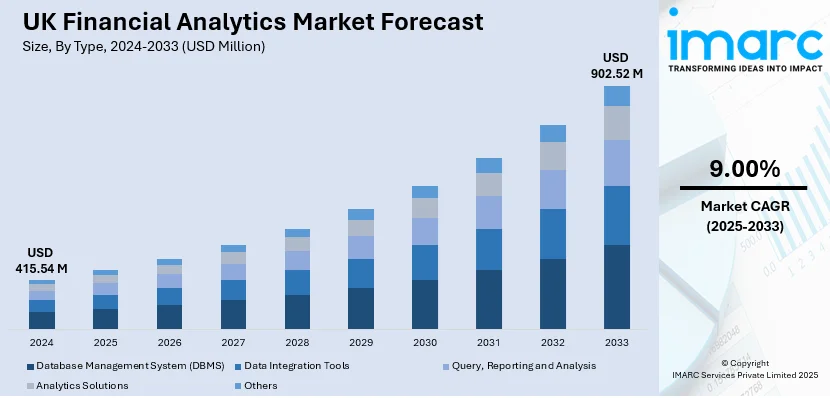

The UK financial analytics market size reached USD 415.54 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 902.52 Million by 2033, exhibiting a growth rate (CAGR) of 9.00% during 2025-2033. The increasing demand for real-time data insights, rising adoption of cloud-based solutions, heightened regulatory compliance requirements, advancements in artificial intelligence (AI) and big data technologies, the growing need for risk management, and the expanding role of analytics in decision-making across financial sectors are some of the key factors positively impacting the UK financial analytics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 415.54 Million |

| Market Forecast in 2033 | USD 902.52 Million |

| Market Growth Rate (2025-2033) | 9.00% |

UK Financial Analytics Market Trends:

Increasing Adoption of Cloud-based Financial Analytics Solutions

One of the most notable trends influencing the UK financial analytics market growth is the growing adoption of cloud-based financial analytics solutions. UK financial institutions are increasingly adopting cloud-based platforms due to their scalability, flexibility, and cost-effectiveness from traditional on-premise systems. These solutions give the organization access to a variety of data from various sources available in real-time, which allows for quick, accurate decision-making. They also help any business lower operating costs, process simplifications, and handle financial information more efficiently. Aside from this, the cloud always comes equipped with advanced security features and data encryption which are very critical for the financial sector. As financial firms continue to digitalize their operations, the demand for cloud-based financial analytics is expected to rise, contributing to the market's expansion. On May 14, 2024, Caseware International introduced Caseware Financials, a cloud-based financial reporting product designed for the UK market. The new application reduces the preparation, review, and distribution process for compliant year-end financial statements by providing automatic drafting, built-in review instruments, and multi-user collaboration capabilities.

The Integration of Artificial Intelligence (AI) and Machine Learning (ML) into Financial Processes

The adoption of AI and ML technologies in financial processes is another important trend that pocitively influences UK financial analytics market outlook. According to the latest report published in November 2024 by the Bank of England, about 75% of businesses employ artificial intelligence (AI), and another 10% are planning to include it within some years. These advanced technologies are transforming the way financial analytics is conducted, allowing institutions to derive deeper insights from data. AI and ML algorithms enable the automation of data processing, identifying patterns, and predicting future trends, which improves the accuracy and speed of financial analysis. For example, AI-powered tools can detect anomalies in transactions, offering early warnings for potential fraud. At the same time, ML models can forecast trends and historical data to suggest potential market directions to financial firms for strategic planning. Companies are investing heavily in research and improvements as predictive insights become more valuable for performance improvement and risk management, and it also helps to remain competitive. This is revolutionizing the industry, boosting innovations, and giving firms their much-needed competitive advantage.

Rising Focus on Regulatory Compliance and Risk Management

The UK financial analytics market is seeing growing adoption due to increasing government focus on financial services and risk management. For instance, in February 2025, the UK's Office of Financial Sanctions Implementation (OFSI) released its first financial services sector threat assessment, highlighting key compliance risks, including under-reporting of sanctions breaches and sophisticated evasion tactics. This underscores the urgent need to focus on the financial sector. Also, in response to stringent regulatory requirements such as Basel III, Markets in Financial Instruments Directive (MiFID) II, and General Data Protection Regulation (GDPR), financial institutions are investing in robust analytics tools that can help ensure compliance and manage risks more effectively. Financial analytics solutions enable organizations to monitor regulatory changes, assess their impact, and adjust their operations accordingly. Furthermore, advanced analytics tools help firms identify potential risks, such as market volatility or liquidity issues, and develop mitigation strategies. With the regulatory environment becoming increasingly complex, financial institutions are turning to analytics to stay compliant and safeguard their operations, providing an impetus to market growth.

UK Financial Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, component, application, organization size, and vertical.

Type Insights:

- Database Management System (DBMS)

- Data Integration Tools

- Query, Reporting and Analysis

- Analytics Solutions

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes database management system (DBMS), data integration tools, query, reporting and analysis, analytics solutions, and others.

Component Insights:

- Solutions

- Financial Function Analytics

- Financial Market Analytics

- Services

- Managed Services

- Professional Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes solutions (financial function analytics and financial market analytics) and services (managed services and professional services).

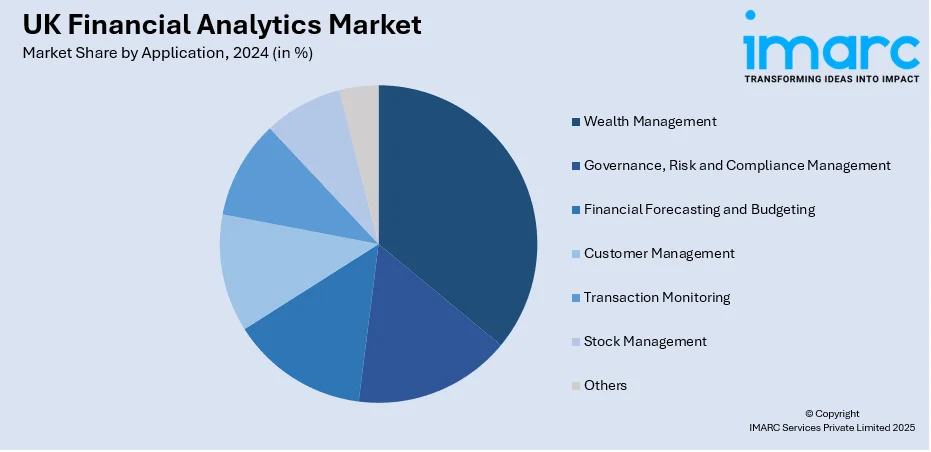

Application Insights:

- Wealth Management

- Governance, Risk and Compliance Management

- Financial Forecasting and Budgeting

- Customer Management

- Transaction Monitoring

- Stock Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes wealth management, governance, risk and compliance management, financial forecasting and budgeting, customer management, transaction monitoring, stock management, and others.

Organization Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium enterprises.

Vertical Insights:

- BFSI

- Telecom and IT

- Manufacturing

- Government

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, telecom and IT, manufacturing, government, education, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Financial Analytics Market News:

- On May 2023, together with UK Finance, Glassbox, a top supplier of digital experience analytics for web and mobile applications, is now offering its digital experience solution at a discounted price. By analyzing user interactions on web or mobile apps, Glassbox's Digital Experience Intelligence (DXI) technology helps businesses recognize customer issues and gather information necessary to test and validate consumer results.

- On February 2024, CRIF launched ESG Analytics to help UK financial institutions understand the compliance of companies, customers, or suppliers they work with to ESG principles. The service uses over 130 proprietary key indicators from public and private data sources to assess a business's environmental, social, and governance (ESG) profile.

UK Financial Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Database Management System (DBMS), Data Integration Tools, Query, Reporting and Analysis, Analytics Solutions, Others |

| Components Covered |

|

| Applications Covered | Wealth Management, Governance, Risk and Compliance Management, Financial Forecasting and Budgeting, Customer Management, Transaction Monitoring, Stock Management, Others |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Verticals Covered | BFSI, Telecom and IT, Manufacturing, Government, Education, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK financial analytics market performed so far and how will it perform in the coming years?

- What is the breakup of the UK financial analytics market on the basis of type?

- What is the breakup of the UK financial analytics market on the basis of component?

- What is the breakup of the UK financial analytics market on the basis of application?

- What is the breakup of the UK financial analytics market on the basis of organization size?

- What is the breakup of the UK financial analytics market on the basis of vertical?

- What is the breakup of the UK financial analytics market on the basis of region?

- What are the various stages in the value chain of the UK financial analytics market?

- What are the key driving factors and challenges in the UK financial analytics market?

- What is the structure of the UK financial analytics market and who are the key players?

- What is the degree of competition in the UK financial analytics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK financial analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK financial analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK financial analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)