UK Fitness and Gym Market Size, Share, Trends and Forecast by Service Type, Business Model, End User and Region, 2025-2033

UK Fitness and Gym Market Overview:

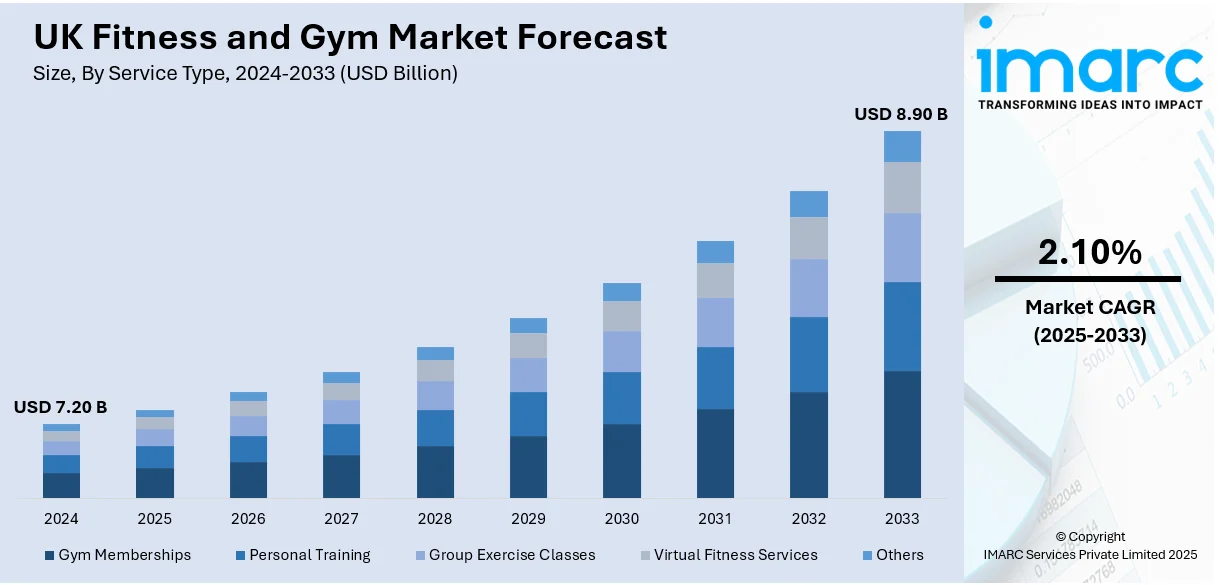

The UK fitness and gym market size reached USD 7.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.90 Billion by 2033, exhibiting a growth rate (CAGR) of 2.10% during 2025-2033. The UK fitness and gym market is experiencing strong growth, fueled by rising health awareness, boutique and budget gyms, digital and hybrid fitness, and a focus on wellness. The expansion of eco-friendly gyms and wearable fitness tech further boosts market share, according to ukactive, Sport England, and 4GLOBAL. Membership increased by 6.1% in 2024, totaling 11.5 million members, up from the previous year.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.20 Billion |

| Market Forecast in 2033 | USD 8.90 Billion |

| Market Growth Rate 2025-2033 | 2.10% |

UK Fitness and Gym Market Trends:

Rise of Digital and Hybrid Fitness

The rise of digital and hybrid fitness has transformed the manner in which customers exercise by fusing the convenience of technology with the old-school gym environment. Fitness apps, live streaming, and on-demand content allow consumers to access numerous types of exercise from yoga to high-intensity interval training (HIIT) within the walls of their own homes. This shift has also enabled gyms to extend beyond the confines of their physical therapy area, so they can interact with members globally. Hybrid fitness models have driven the UK fitness industry and gym market outlook towards flexibility in schedules but also toward customization through the use of AI-based fitness routines, progress tracking, and virtual personal trainers. The digital fitness has been felt through the recent exercise trends report UK, which points to the increasing trend towards hybrid models as consumers want convenience and flexibility. For example, in October 2023, Dyaco UK and Hybrid Fitness in Loughton launched their collaboration to introduce a flagship fitness center. This partnership introduces the latest technology to provide state-of-the-art cardio equipment, strength training equipment, and innovative group fitness solutions to enrich members' training experience. The alliance seeks to develop the best fitness hub in Loughton with a focus on health and wellness.

To get more information on this market, Request Sample

Sustainability and Eco-Friendly Gyms

Sustainability is also gaining attention in the fitness industry, and as a result, eco-friendly gyms across the United Kingdom are being set up. Gyms try to minimize their carbon footprint using energy-saving equipment like treadmills and bikes that generate electricity as you exercise. The buildings are constructed using sustainable materials like recycled floors and eco-friendly building practices. Also, the majority of these gyms focus on water saving, waste handling, and the utilization of alternative energy. Green gyms promote environmentally friendly behavior among members by providing refillable water stations and advocating for green gym equipment. Such initiatives are driving the fitness industry growth UK, particularly with increasing consumer demand for sustainable practices. This movement is also reflected in the broader UK health and fitness market, where the focus on sustainability is attracting new members seeking eco-friendly fitness options. For example, in September 2023, purpose-driven gym chain the Gym Group reached carbon-neutral status, with it being the first UK gym chain to do so. Having committed to cutting carbon emissions by 50% by 2030 and reaching net zero by 2045, the group is actively investing in high-quality offsetting projects. Its strategy is to use 100% renewable energy, replace lighting systems with upgraded ones, and introduce efficient waste management. These initiatives support their dedication to sustainability and environmental stewardship, further propelling the UK fitness and gym market growth.

Growth of Private Fitness Providers

The rise in private sector involvement has brought innovation to the UK fitness app market. Independent gyms and boutique fitness studios are increasingly popular, offering personalized services and flexible membership options, moving away from traditional gym chains. Private fitness providers are innovating with niche offerings such as yoga, CrossFit, and wellness-focused programs, catering to specific customer needs. The growing demand for unique and tailored fitness experiences allows private gyms to thrive, drawing in customers looking for improved customer service and more intimate environments. These shifts in consumer preferences are reflected in fitness industry statistics UK, showing that smaller, more personalized fitness providers are experiencing growth at a faster rate than traditional gyms.

Changing Consumer Focus in Fitness

Consumers in the UK are increasingly prioritizing wellness and holistic health, shifting away from purely aesthetic goals. As fitness trends evolve, more individuals are focusing on overall well-being, including mental health, flexibility, and recovery. The desire for workouts that support long-term health, stress reduction, and balance is influencing the types of fitness services people engage with. This has resulted in a growth in demand for activities such as Pilates, mindfulness classes, and functional training, which integrate mental and physical health. With this shift, the fitness industry UK has seen a rise in diverse fitness offerings beyond just physical exercise. Additionally, the growing popularity of wellness-focused programs is reflected in the gym membership statistics UK, showing that members are increasingly engaging with services that focus on mental and physical well-being.

UK Fitness and Gym Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service type, business model, and end user.

Service Type Insights:

- Gym Memberships

- Personal Training

- Group Exercise Classes

- Virtual Fitness Services

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes gym memberships, personal training, group exercise classes, virtual fitness services, and others.

Business Model Insights:

- Low-Cost Gyms

- Station Based

- Free Floating

The report has provided a detailed breakup and analysis of the market based on the business model. This includes low-cost gyms, station-based, and free floating.

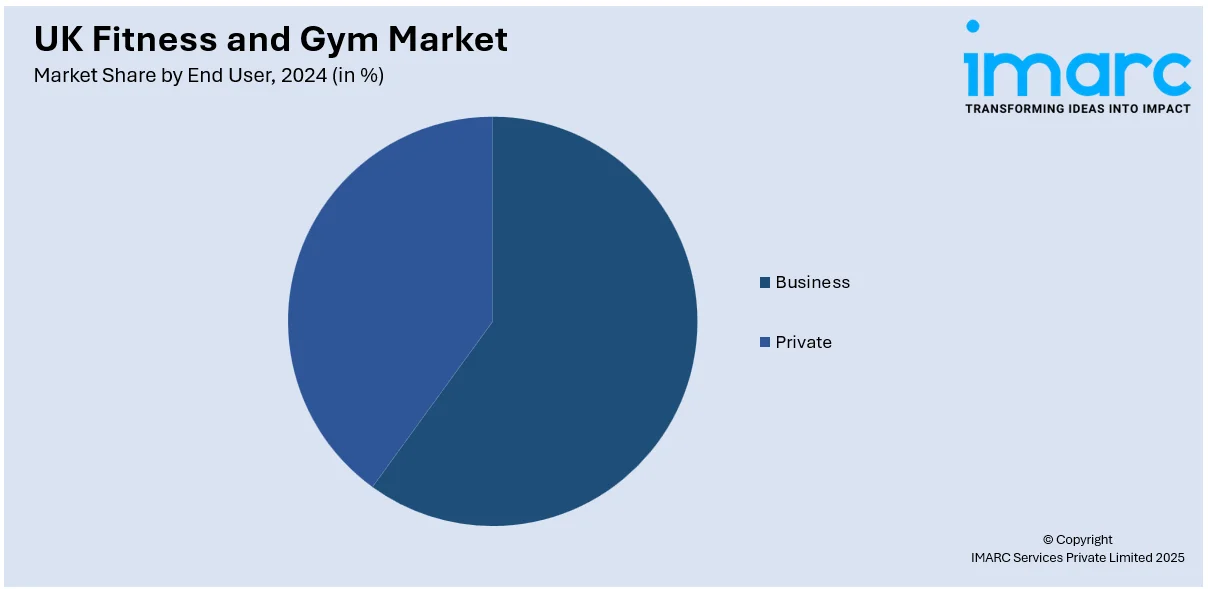

End User Insights:

- Business

- Private

The report has provided a detailed breakup and analysis of the market based on the end user. This includes business and private.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Fitness and Gym Market News:

- In May 2025, Sunny Health & Fitness acquired JLL Fitness, a UK-based brand known for its durable and high-performance fitness equipment. This move strengthens Sunny’s presence in the UK market and enhances its position in the connected fitness sector. With over 13 years of expertise, JLL's reputation for reliable equipment, combined with Sunny's innovation, promises to make fitness more accessible and quality-driven in the UK.

- In July 2025, ukactive announced the theme for National Fitness Day 2025: "Powered by You!" Scheduled for Wednesday, 24 September 2025, the event will encourage millions across the UK to engage in physical activity. With activities hosted at fitness and leisure facilities nationwide, the campaign emphasizes the role of individuals, communities, and organizations in promoting the importance of staying active. The personalized tagline underscores the impact of everyone in fostering a culture of fitness.

- In July 2024, Gymbox partnered with Raza Sana and Haringey Council to launch a community street gym in Tottenham, aiming to transform the lives of disadvantaged young people through fitness and calisthenics. The project includes free exercise classes and the Gymbox Academy, which offers training and qualifications for those on the 1st Rep programme. This initiative is part of Gymbox's broader effort to invest in local park gyms and support individuals from all backgrounds in entering the fitness industry.

- In November 2023, Fitness Superstore, the UK's top specialist fitness equipment retailer, partnered with Zack George, renowned CrossFit athlete and 2020's UK's Fittest Man. Zack joins the Body Power ProTeam, equipping his gyms with top-notch gear from Body Power and REP Fitness. The collaboration aims to create valuable fitness content for all levels. With 11 showrooms across the UK, Fitness Superstore offers a wide range of home fitness products and expert advice.

UK Fitness and Gym Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Gym Memberships, Personal Training, Group Exercise Classes, Virtual Fitness Services, Others |

| Business Models Covered | Low-Cost Gyms, Station Based, Free Floating |

| End Users Covered | Business, Private |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK fitness and gym market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK fitness and gym market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK fitness and gym industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fitness and gym market in the UK reached USD 7.20 Billion in 2024.

The UK fitness and gym market is projected to exhibit a CAGR of 2.10% during 2025-2033, reaching USD 8.90 Billion by 2033.

The UK fitness and gym market is driven by rising health consciousness, demand for personalized training, digital fitness offerings, and flexible membership models. Increased awareness of mental health benefits, the popularity of boutique fitness studios, and post-pandemic recovery also contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)