UK Food Tech Market Size, Share, Trends and Forecast by Component, Application, Industry, and Region, 2025-2033

UK Food Tech Market Summary:

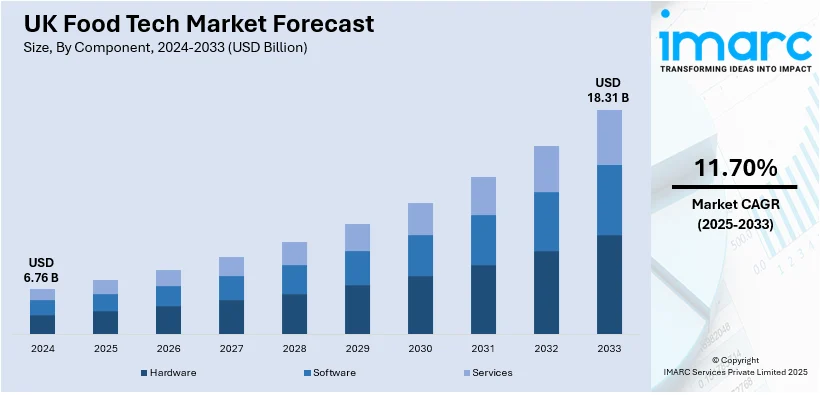

The UK food tech market size reached USD 6.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.31 Billion by 2033, exhibiting a growth rate (CAGR) of 11.70% during 2025-2033. Market expansion is fueled by advancements in Agritech and Biotechnology, alongside innovations reducing environmental impact and supporting personalized nutrition through AI and data analytics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.76 Billion |

| Market Forecast in 2033 | USD 18.31 Billion |

| Market Growth Rate (2025-2033) | 11.70% |

UK Food Tech Market Trends:

Rising Adoption of Sustainability and Alternative Proteins

The increasing adoption of sustainable food production, with a focus on plant-based and alternative proteins, is impelling the food tech UK market growth. As per Good Food Institute Europe, in 2022, in the UK, 83% of consumers were aware of at least one type of alternative protein product, compared to 77% in Spain, 70% in Germany, and 62% in France. As environmental concerns around traditional farming practices intensify, people are shifting towards eco-friendly options. This trend is encouraging the development of lab-manufactured meat, insect-based proteins, and plant-based substitutes. These innovations aim to reduce the environmental impact of food production, cutting down on water usage, carbon emissions, and land depletion. Companies are investing in alternative proteins to meet the high demand for more sustainable and ethical food choices. Startups and major food brands are improving taste, texture, and nutrition through advanced food science and technology UK tools such as precision fermentation and 3D food printing. Additionally, government initiatives supporting sustainability and food tech R&D funding further expand the UK food processing market. Supermarkets and restaurants respond to demand by offering more environmentally friendly items, increasing accessibility and awareness.

To get more information on this market, Request Sample

Growing Demand for Personalized Nutrition and AI

The rising demand for personalized nutrition, driven by innovations in artificial intelligence (AI) and data analytics, offers a promising outlook for UK food technology. In March 2024, the UK government unveiled an £800 million investment strategy to advance public services with technologies like AI. With a stronger emphasis on health and wellness, consumers are looking for tailored dietary solutions that fit their personal needs. AI-driven platforms analyze data such as genetics, lifestyle habits, and health objectives to create custom meal plans. Food companies use smart algorithms to offer product recommendations, from functional snacks to targeted supplements. Meal kit providers and delivery apps now use AI to diversify menus and improve user experience. In manufacturing, AI ensures precise ingredient use, minimizing waste and enhancing nutrition. These solutions appeal to health-focused consumers and are a defining part of modern food technology in UK.

Non-Thermal Food Processing

Non-thermal food processing methods like high-pressure processing (HPP), pulsed electric fields (PEF), and cold plasma are reshaping the UK food processing market. These technologies maintain food quality—taste, texture, and nutrients—while ensuring safety without high-heat treatments. As UK consumers demand clean-label products with fewer preservatives, food producers are adopting these methods to extend shelf life sustainably. These approaches align with green goals by reducing energy usage and food waste. The UK government is supporting these efforts through research initiatives and collaborations with academic institutions, establishing the country as a leader in innovative food tech UK manufacturing. Such progress ensures the UK stays competitive in next-generation food processing.

AI and Robotics

AI and robotics are revolutionizing UK food technology by enhancing productivity, safety, and supply chain efficiency. AI supports demand forecasting, nutrition personalization, and inventory optimization. Meanwhile, robotics handle repetitive tasks like packaging, inspection, and portioning. Labour shortages and the demand for higher precision have accelerated adoption. UK startups and global firms are increasingly turning to AI-integrated robotics to lower costs and improve quality. From agricultural automation to food delivery logistics, these technologies create a smarter, faster, and more resilient supply chain. This evolution underpins the broader transformation happening in food science and technology UK, driven by data, efficiency, and consumer preferences.

Plant-Based and Alternative Proteins

As plant-based eating gains popularity, the UK is seeing a surge in demand for alternative proteins derived from peas, soy, mycelium, and insects. This movement is powered by growing concerns over health, sustainability, and animal welfare. Innovative food tech startups are using cultured meat production, precision fermentation, and hybrid protein solutions to meet the needs of flexitarians and vegans. Government funding is also bolstering sustainable food efforts. Agritech and biotechnology help streamline protein production while conserving resources. Supermarkets and food chains are broadening their plant-based selections. These developments position the UK as a frontrunner in global food technology in UK and demonstrate the country’s leadership in sustainable, tech-driven food innovation.

UK Food Tech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on component, application, and industry.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the components. This includes hardware, software, and services.

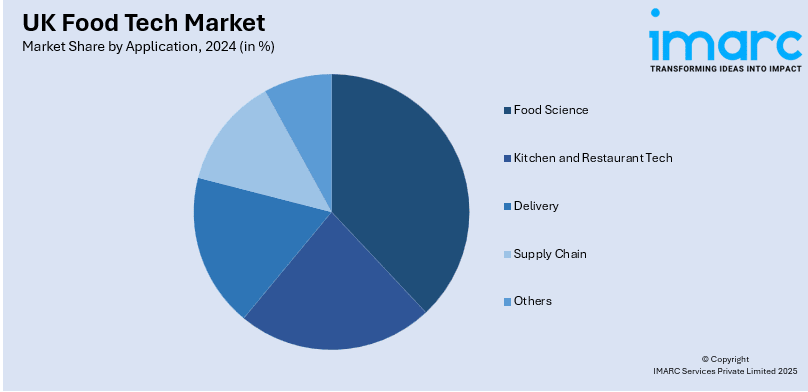

Application Insights:

- Food Science

- Kitchen and Restaurant Tech

- Delivery

- Supply Chain

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes food science, kitchen and restaurant tech, delivery, supply chain, others

Industry Insights:

- Fish, Meat, and Seafood

- Fruits and Vegetables

- Grain and Oil

- Dairy Products

- Beverages

- Bakery and Confectionery

- Others

The report has provided a detailed breakup and analysis of the market based on the industries. This includes fish, meat, and seafood, fruits and vegetables, grain and oil, dairy products, beverages, bakery and confectionery, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Food Tech Market News:

- In July 2025, the UK government funded the Queen of Greens initiative to develop a mapping tool that improves access to fresh produce in low-income areas like Liverpool and Knowsley. Led by the University of Liverpool, the tool targets social housing residents in “food deserts.” The initiative is part of a £8.5 million national food equality program, which includes subsidised restaurants and community food markets. The project aims to measure health and social impacts while promoting healthier diets and equitable food access.

- In June 2025, Just Eat launched JET Go, its new Delivery‑as‑a‑Service platform across the UK. Through JET Go, brands, starting with nationwide partner Co‑op, can take orders via their own websites or apps while relying on Just Eat’s couriers to fulfil on-demand, same‑day, or scheduled deliveries. The service meets growing consumer demand, with 80% of customers preferring same‑day delivery and 75% expecting it regularly. JET Go also powers Co‑op’s Peckish app, enabling independent grocers to offer branded, last‑mile delivery.

- In May 2025, US-based DoorDash agreed to acquire UK-listed Deliveroo for £2.4 billion. Despite turning its first profit in March, Deliveroo opted for acquisition, marking a shift from its earlier growth-focused strategy. The deal reflects global consolidation in food tech, with DoorDash gaining Deliveroo’s tech stack, local insights, and AI capabilities.

- In September 2024, Appleby Creamery, a small-batch cheese producer in the UK’s Lake District, adopted IoT technology to improve efficiency and sustainability. Partnering with CENSIS under the Digital Dairy Chain initiative, the system monitors energy use, temperature, and equipment conditions every 15 minutes, providing real-time alerts and data insights. This enhances quality, reduces waste, and supports better use of renewable energy. The project aims to inspire similar dairy businesses to embrace digital transformation and is backed by UK Research and Innovation’s Strength in Places Fund.

UK Food Tech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Applications Covered | Food Science, Kitchen and Restaurant Tech, Delivery, Supply Chain, Others |

| Industries Covered | Fish, Meat, and Seafood, Fruits and Vegetables, Grain and Oil, Dairy Products, Beverages, Bakery and Confectionery, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK food tech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK food tech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK food tech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK food tech market reached a value of USD 6.76 Billion in 2024.

The market is projected to reach USD 18.31 Billion by 2033, growing at a CAGR of 11.70% during 2025-2033.

Key growth drivers include advancements in agritech and biotechnology, rising demand for personalized nutrition using AI and data analytics, increased adoption of plant-based and alternative proteins, and innovations in non-thermal food processing. Consumer preference for sustainable, healthy, and tech-enabled food solutions is also significantly contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)