UK Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2026-2034

UK Foreign Exchange Market Summary:

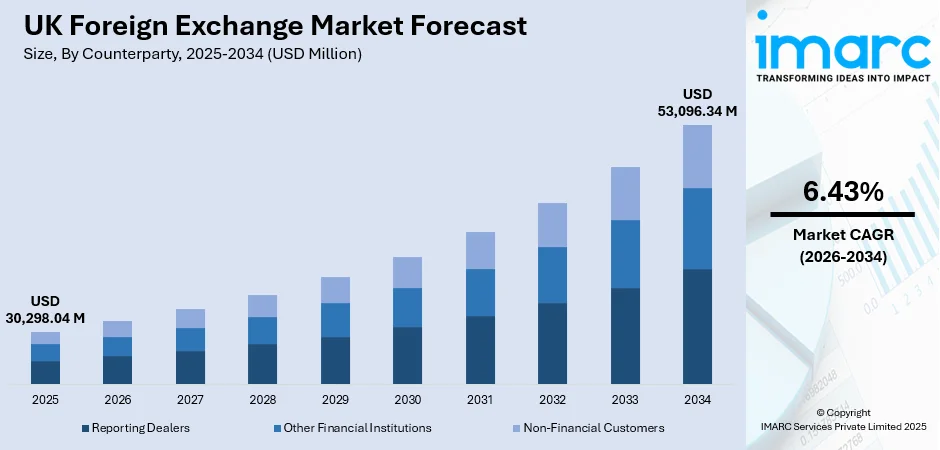

The UK foreign exchange market size was valued at USD 30,298.04 Million in 2025 and is projected to reach USD 53,096.34 Million by 2034, growing at a compound annual growth rate of 6.43% from 2026-2034.

The UK maintains its position as the world's preeminent foreign exchange trading hub, commanding nearly two-fifths of global currency trading activity. London's strategic geographic positioning bridging Asian and North American trading sessions, combined with deep institutional liquidity pools, sophisticated trading infrastructure, and a robust regulatory framework under the Financial Conduct Authority, continues to attract major banks, hedge funds, asset managers, and fintech innovators. The market benefits from unparalleled concentration of reporting dealers, extensive cross-border payment flows, and the sterling's continued importance in international trade settlement, collectively driving sustained growth in the UK foreign exchange market share.

Key Takeaways and Insights:

-

By Counterparty: Reporting dealers dominate the market with a share of 42% in 2025, driven by major banks and financial institutions providing essential market-making services and liquidity provision.

-

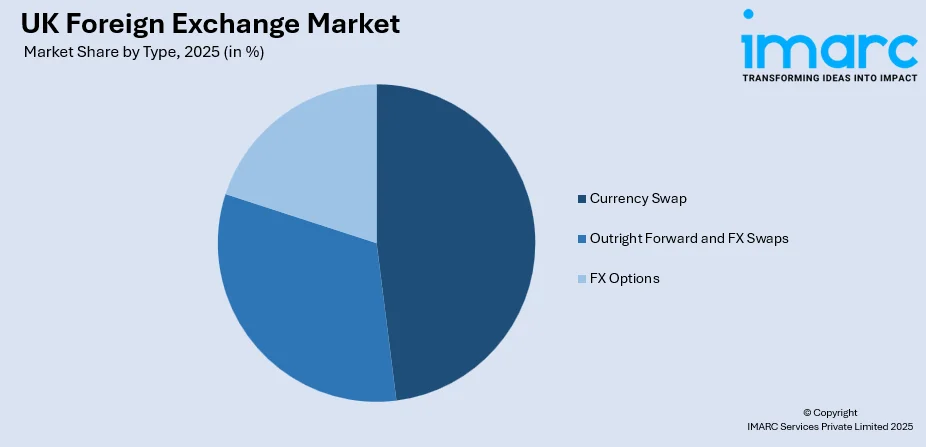

By Type: Currency Swap leads the market with a share of 40.24% in 2025, owing to increasing demand for cross-currency hedging instruments and corporate risk management strategies.

-

Key Players: The UK foreign exchange market exhibits high competitive intensity, with global banking institutions dominating trading volumes through their London-based operations, alongside emerging fintech challengers and electronic trading platforms reshaping market dynamics.

To get more information on this market Request Sample

The UK foreign exchange market continues to demonstrate exceptional resilience and growth trajectory, reinforcing London's status as the global epicentre of currency trading. According to the Bank of England's BIS Triennial Survey results published in September 2025, average daily turnover in the UK foreign exchange market reached USD 4,745 billion in April 2025, representing a significant increase from USD 3,735 billion recorded in April 2022. The market's growth is underpinned by expanding cross-border trade flows, increasing demand for currency hedging instruments, and the proliferation of algorithmic trading strategies. The concentration of reporting dealers in London provides unmatched depth and liquidity, facilitating efficient price discovery and narrow bid-ask spreads that attract institutional investors worldwide.

UK Foreign Exchange Market Trends:

Digital Transformation and Electronic Trading Expansion

The UK foreign exchange market is experiencing accelerated digital transformation through advanced electronic trading platforms, artificial intelligence-powered analytics, and automated execution systems. Major financial institutions are investing substantially in low-latency trading infrastructure to enhance execution speeds and reduce operational costs. According to the Foreign Exchange Joint Standing Committee (FXJSC) April 2025 survey, FX spot volumes increased by 42% compared to October 2024, reflecting growing adoption of electronic trading channels. The Bank of England continues supporting innovation through its regulatory sandbox framework, enabling fintech firms to test novel trading solutions under controlled conditions.

Growing Institutional Demand for Currency Derivatives

Currency derivatives trading is witnessing substantial growth as institutional investors and corporate treasuries increasingly seek sophisticated hedging instruments to manage foreign exchange exposure. The International Swaps and Derivatives Association (ISDA) reported that European interest rate derivatives traded notional rose by 24.9% to USD 248 Trillion in 2024, with sterling-denominated contracts climbing 43% to USD 38.3 Trillion. Asset managers and pension funds are deploying cross-currency swaps and forward contracts to optimize liability-driven investment frameworks, while multinational corporations utilize currency options to protect against adverse exchange rate movements in volatile market conditions.

Regional Financial Services Expansion Beyond London

The UK financial services sector is experiencing significant regional diversification as major institutions establish operations in cities beyond London. According to the EY Scotland Attractiveness Survey 2025, Scotland attracted 11 financial services foreign direct investment projects in 2024, representing a decade-high figure, with Edinburgh securing six projects alongside Manchester as joint top cities outside London. The government's Financial Services Growth and Competitiveness Strategy announced in July 2025 supports fintech clusters in Leeds and Manchester, while Edinburgh's long-established asset management cluster continues expanding, creating new employment opportunities and strengthening regional economic contributions.

Market Outlook 2026-2034:

The UK foreign exchange market is positioned for sustained expansion throughout the forecast period, driven by increasing global trade volumes, growing demand for currency hedging instruments, and continued technological innovation in trading platforms. The integration of artificial intelligence and algorithmic trading solutions is enhancing execution efficiency and price discovery across market segments. The Financial Conduct Authority's recognition of the revised 2024 FX Global Code in November 2025 reinforces market integrity standards and enhances participant confidence. The market generated a revenue of USD 30,298.04 Million in 2025 and is projected to reach a revenue of USD 53,096.34 Million by 2034, growing at a compound annual growth rate of 6.43% from 2026-2034.

UK Foreign Exchange Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Counterparty | Reporting Dealers | 42% |

| Type | Currency Swap | 40.24% |

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-Financial Customers

The reporting dealers segment dominates with a market share of 42% of the total UK foreign exchange market in 2025.

Reporting dealers comprising major global banks and financial institutions constitute the dominant counterparty segment in the UK foreign exchange market. These entities function as primary market makers, providing essential liquidity and facilitating large-scale trading activities across all currency pairs.Their market leadership stems from extensive global networks, sophisticated trading platforms capable of processing high transaction volumes, and the ability to handle complex financial instruments including currency swaps, forwards, and options. According to the Bank of England's 2025 BIS Triennial Survey, 51 institutions, primarily commercial and investment banks, participated in the UK survey, underscoring the segment's institutional depth.

The reporting dealers segment benefits from regulatory frameworks requiring detailed transaction reporting, which has enhanced market transparency and reinforced their central role in price discovery mechanisms. Major reporting dealers maintain 24-hour trading desks in London, leveraging the city's strategic time zone positioning to serve clients across Asia, Europe, and the Americas. The segment's dominance is further strengthened by prime brokerage relationships with hedge funds and institutional investors, enabling these counterparties to access superior pricing and execution quality through the dealers' established market infrastructure.

Type Insights:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

The currency swap segment leads with a share of 40.24% of the total UK foreign exchange market in 2025.

Currency swaps represent the leading instrument type within the UK foreign exchange market, driven by increasing corporate demand for cross-currency hedging solutions and liability management strategies. These derivative instruments enable counterparties to exchange principal and interest payments in different currencies, providing effective mechanisms for managing foreign exchange exposure on international debt portfolios. The Bank for International Settlements reported that FX swaps remained the most traded instrument globally in April 2025, with average daily turnover rising to USD 4 Trillion, reflecting sustained institutional demand for currency swap products.

Multinational corporations utilize currency swaps to optimize their debt structures, converting foreign currency borrowings into domestic currency obligations at favourable terms. Asset managers deploy cross-currency basis swaps to manage portfolio currency exposures efficiently, while pension funds increasingly incorporate these instruments into liability-driven investment frameworks. Financial institutions continue developing innovative swap structures tailored to specific client requirements, enabling businesses to access international capital markets while mitigating exchange rate risks and reducing overall financing costs across diverse geographic operations.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The demand for foreign exchange is increasing in London due to the city's strategic time zone positioning bridges Asian and North American trading sessions, while its concentration of major banks, hedge funds, and institutional investors provides unmatched market depth and liquidity, attracting participants from across the globe seeking superior execution and pricing.

The South East region serves as London's extended financial corridor, hosting significant back-office operations, technology centres, and corporate treasury functions. Major financial institutions maintain substantial presence in locations such as Reading and Milton Keynes, supporting the capital's trading activities.

Manchester leads the North West as a prominent regional financial hub, hosting expanding fintech clusters, major bank operations centres, and corporate treasury functions that support foreign exchange trading activities for domestic and international clients.

The East of England region attracts expanding financial services operations, with sector leaders planning regional expansion. Cambridge's technology corridor supports fintech innovation while established centres provide operational support for London-based trading desks and compliance functions.

Bristol represents a major financial services centre in the South West, employing substantial numbers in financial and related professional services. The city hosts significant insurance operations, accounting clusters, and emerging fintech enterprises serving regional and national markets.

Scotland ranks as the top UK destination outside London for financial services foreign direct investment, attracting growing project numbers annually. Edinburgh's long-established asset management cluster manages significant fund assets, while Glasgow's financial centre continues strengthening its position in global rankings.

Birmingham, the largest city and a core part of the West Midlands metropolitan county in UK, serves as a significant regional financial hub, attracting major global banks establishing technology and engineering operations. The city benefits from strong infrastructure, skilled graduate talent, and growing fintech presence supporting currency trading activities.

Leeds, part of the Yorkshire and the Humber region in UK, emerges as a leading financial services centre outside London, hosting expanding fintech operations and corporate treasury functions. The region attracts growing investment in foreign exchange and payment technology innovations.

The East Midlands region provides supporting financial services infrastructure for the broader UK market. Nottingham and Leicester host growing financial operations, business services centres, and emerging fintech enterprises, contributing to the region's expanding role in the national financial ecosystem.

Market Dynamics:

Growth Drivers:

Why is the UK Foreign Exchange Market Growing?

Strategic Geographic Positioning and Time Zone Advantage

London's unique geographic positioning between Asian and North American time zones creates an unparalleled advantage for foreign exchange trading activities. The city's trading hours overlap significantly with both Tokyo and New York sessions, enabling near-continuous market coverage and facilitating seamless cross-border transactions. This strategic positioning attracts global financial institutions seeking to centralize their trading operations in a location offering maximum market access. According to the BIS 2025 Triennial Survey, sales desks in four locations (the United Kingdom, United States, Singapore, and Hong Kong) accounted for 75% of foreign exchange trading, with the UK maintaining the largest single-country of global turnover.

Robust Regulatory Framework and Market Infrastructure Excellence

The Financial Conduct Authority's comprehensive regulatory framework provides market participants with confidence in trading conduct standards and investor protection measures. The regulatory sandbox enables innovative fintech firms to test novel solutions under controlled conditions, fostering innovation while maintaining market integrity. Client funds segregation requirements, regular compliance monitoring, and transparent pricing mechanisms create a trusted environment attracting both institutional investors and retail market participants to UK-based foreign exchange platforms.

Expanding Fintech Ecosystem and Technological Innovation

The UK's thriving fintech ecosystem accelerates innovation in foreign exchange trading technologies, payment solutions, and digital banking services. The Chancellor's October 2025 announcement of a new Scale-up Unit provides bespoke regulatory support for high-potential financial services firms. London's concentration of technology talent, venture capital availability, and progressive regulatory environment positions the UK as a global leader in developing next-generation trading platforms, artificial intelligence-powered analytics, and automated execution systems.

Market Restraints:

What Challenges the UK Foreign Exchange Market is Facing?

Increasing Global Competition from Emerging Financial Centres

The UK foreign exchange market faces intensifying competition from rapidly developing financial centres in Asia and the Middle East. Singapore, Hong Kong, and emerging hubs such as Dubai are investing significantly in financial infrastructure and offering competitive regulatory environments to attract trading activities, potentially eroding London's dominant market share over time.

Regulatory Compliance Complexity and Operational Costs

Financial institutions operating in the UK foreign exchange market face substantial regulatory compliance requirements including transaction reporting obligations, capital adequacy standards, and conduct rules. These compliance burdens create operational costs that may disproportionately affect smaller market participants and emerging fintech entrants attempting to establish competitive positions.

Currency Volatility and Geopolitical Uncertainty Impacts

Sterling exchange rate volatility driven by domestic economic conditions and global geopolitical developments creates uncertainty for market participants. Trade policy changes, interest rate differentials, and political events generate periods of elevated volatility that can disrupt normal trading patterns and increase hedging costs for corporate treasuries and institutional investors.

Competitive Landscape:

The UK foreign exchange market exhibits high competitive intensity characterized by the dominance of global banking institutions operating sophisticated London-based trading operations. Major players command significant market shares through their extensive dealer networks, advanced trading platforms, and established client relationships. These institutions compete on execution quality, pricing efficiency, and technological capabilities while navigating comprehensive regulatory requirements. The competitive landscape is increasingly influenced by electronic trading platforms and fintech innovators offering alternative execution channels and automated trading solutions.

Recent Developments:

November 2025: The Financial Conduct Authority recognized the revised 2024 versions of the FX Global Code and UK Money Markets Code under its code recognition scheme, reinforcing market integrity standards and best practice guidelines for wholesale foreign exchange market participants operating in the United Kingdom.

UK Foreign Exchange Market News:

- June 2025: The Bank of England formally renewed its Statement of Commitment to the FX Global Code, aligning with the revised version published in December 2024. The renewal reaffirms that the Bank’s internal procedures and conduct in foreign exchange markets continue to conform with the Code’s global principles of good practice. In addition, the Bank strongly encouraged FX market participants, including its counterparties, to adopt the updated Code to maintain fair, transparent, and robust market standards.

- May 2025: The United Kingdom and India signed a landmark free trade agreement, described by the UK government as its most economically significant bilateral deal since exiting the EU. The pact reduces levies on approximately 90 percent of British exports, while granting nearly full duty‑free access to Indian exports to the UK. It is projected to boost bilateral trade and reinforce and deepen the strategic economic partnership.

UK Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK foreign exchange market was valued at USD 30,298.04 Million in 2025.

The UK foreign exchange market is expected to grow at a compound annual growth rate of 6.43% from 2026-2034 to reach USD 53,096.34 Million by 2034.

Reporting dealers dominated the market with a 42% share in 2025, driven by major banks and financial institutions providing essential market-making services, liquidity provision, and sophisticated trading infrastructure enabling efficient price discovery.

Key factors driving the UK foreign exchange market include London's strategic time zone positioning bridging Asian and North American markets, robust FCA regulatory framework providing market confidence, expanding fintech ecosystem accelerating trading technology innovation, and deep institutional liquidity pools attracting global market participants.

Major challenges include increasing competition from emerging Asian and Middle Eastern financial centres, substantial regulatory compliance costs affecting smaller market participants, currency volatility driven by geopolitical developments, and evolving post-Brexit trading arrangements impacting cross-border market access.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)