UK Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

UK Higher Education Market Overview:

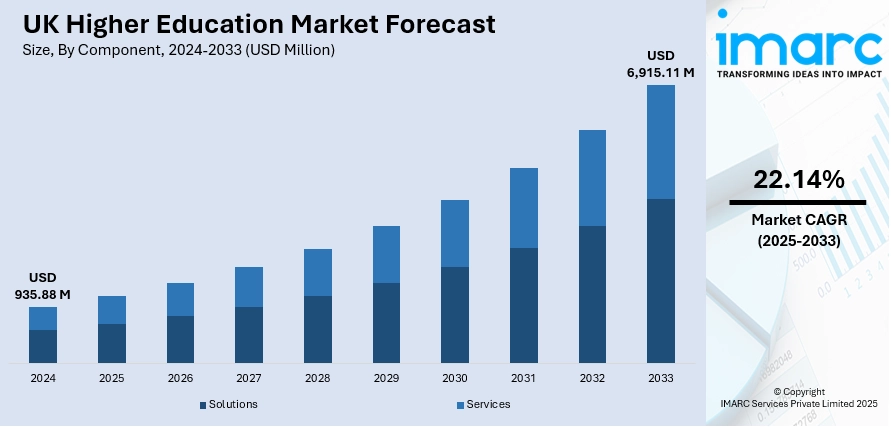

The UK higher education market size reached USD 935.88 Million in 2024. The market is projected to reach USD 6,915.11 Million by 2033, exhibiting a growth rate (CAGR) of 22.14% during 2025-2033. The market is driven by rising demand for flexible, digital learning models, fueled by changing student expectations and post-pandemic technological adoption, enabling broader access for non-traditional learners. Further, the prioritization of employability is pushing universities to deepen industry partnerships, integrating apprenticeships and skills-based curricula to align with labor market needs. Government emphasis on graduate outcomes and ROI is accelerating institutional innovation, further augmenting the UK higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 935.88 Million |

| Market Forecast in 2033 | USD 6,915.11 Million |

| Market Growth Rate 2025-2033 | 22.14% |

UK Higher Education Market Trends:

Escalating Demand for Flexible and Online Learning Options

The market is experiencing a significant shift toward flexible and online learning, driven by changing student preferences and technological advancements. The COVID-19 pandemic hastened the transition to digital education, leading numerous institutions to provide hybrid or entirely online degree programs in order to reach a wider audience. The UK higher education sector is witnessing perpetual development, with over 3 million students in the academic year 2022/23, and the significance of digital education is increasingly important in meeting a range of learning needs. During the academic year 2023/24, the roll in further education increased by 4.1% to a total of 3.11 million, as online learning platforms enable the flexible and scalable provision of education nationwide. The percentage of individuals aged 16 to 24 who are not engaged in education, employment, nor training (NEET) fell by 0.4% during the second quarter of 2024, marking the success of the measures aimed at integrating digital tools as incentives to stimulate young students in their studies. Working professionals, international students, and mature learners are increasingly seeking part-time, modular, or distance learning options to balance education with other commitments. Universities are investing in advanced learning management systems (LMS), virtual classrooms, and AI-driven tools to enhance engagement and accessibility. Additionally, micro-credentials and short courses are gaining popularity as learners look for cost-effective, skill-specific qualifications. This trend is reshaping traditional campus-based education, pushing institutions to innovate and expand their digital offerings while maintaining academic quality. As competition grows, universities must ensure their online programs are robust, interactive, and industry-relevant to attract and retain students.

To get more information on this market, Request Sample

Rising Focus on Employability and Industry Partnerships

The growing emphasis on employability and stronger industry collaborations is also supporting the UK higher education market growth. In 2024, 87.6% of UK graduates between the ages of 16 and 64 were in employment, with 67.9% in high-skilled jobs, highlighting a growing focus on employability in higher education in the UK. The median nominal salary for graduates was £42,000 (approximately USD 56,960.40). At the same time, postgraduates earned £47,000 (approximately USD 63,750.80), highlighting the financial benefits of higher education in the UK and the sector's role in workforce development. The graduate job market is constantly changing, and the Department for Education is increasingly emphasizing interdisciplinary skills and employability in response to the changing needs of the labor market. Students are increasingly prioritizing degrees that offer clear career pathways, leading universities to integrate work placements, apprenticeships, and employer-led projects into curricula. Institutions are forming strategic partnerships with businesses, tech firms, and public sector organizations to align courses with labor market demands. Degree apprenticeships, which combine academic study with paid work experience, are gaining traction as a viable alternative to traditional degrees. Additionally, universities are embedding career development modules, entrepreneurship training, and soft skills programs to enhance graduate employability. With the UK government advocating for skills-based education, institutions are under pressure to demonstrate graduate outcomes and return on investment. This trend is driving universities to innovate in course design, ensuring graduates possess the technical and transferable skills needed in a rapidly changing job market.

UK Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others), and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the learning type have also been provided in the report. This includes online and offline.

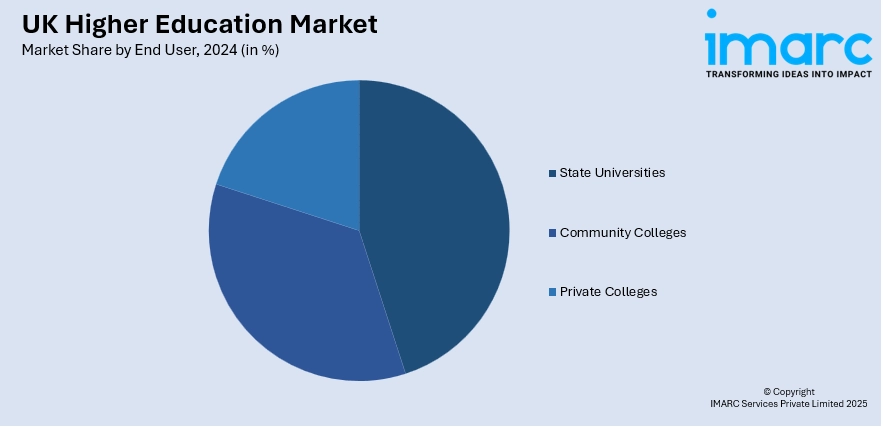

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Higher Education Market News:

- June 10, 2025: The University of Birmingham launched a comprehensive global framework with the objective of integrating sustainability into learning, in line with UNESCO's Education for Sustainable Development (ESD) goals for 2030. This agenda appeals to policymakers to integrate sustainability into all fields of study. 70% of university students across the world support the integration of sustainability education in every discipline, and 84% of youth express their worry about climate change, identifying the paramount need for cross-disciplinary training in sustainability. The policy briefing offers UK recommendations, such as incorporating sustainability into teacher education and school curricula, to encourage climate literacy in future generations and address international sustainability challenges through higher education.

UK Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the UK higher education market on the basis of component?

- What is the breakup of the UK higher education market on the basis of deployment mode?

- What is the breakup of the UK higher education market on the basis of course type?

- What is the breakup of the UK higher education market on the basis of learning type?

- What is the breakup of the UK higher education market on the basis of end user?

- What is the breakup of the UK higher education market on the basis of region?

- What are the various stages in the value chain of the UK higher education market?

- What are the key driving factors and challenges in the UK higher education market?

- What is the structure of the UK higher education market and who are the key players?

- What is the degree of competition in the UK higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)