UK Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UK Home Decor Market Overview:

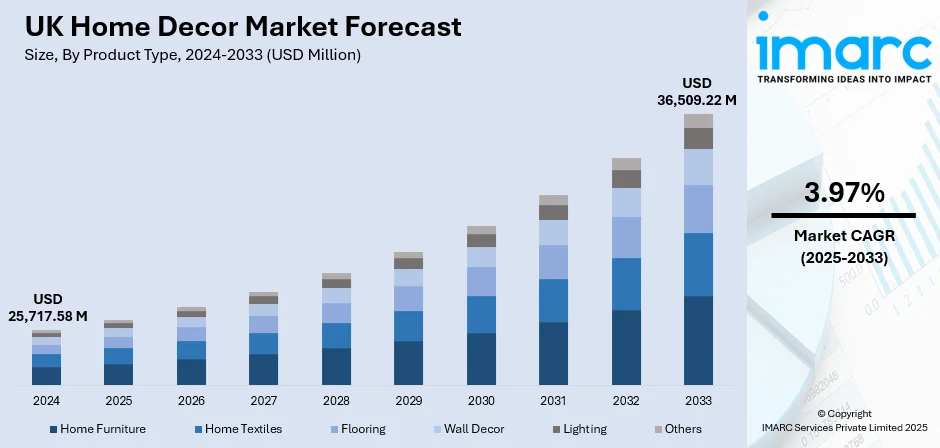

The UK home decor market size reached USD 25,717.58 Million in 2024. The market is projected to reach USD 36,509.22 Million by 2033, exhibiting a growth rate (CAGR) of 3.97% during 2025-2033. The market is being driven by rising disposable incomes, growing urbanization, increased focus on interior aesthetics, and the surge in home renovation activities post-pandemic. Additionally, the influence of social media and eco-conscious consumer preferences are positively impacting the UK home decor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25,717.58 Million |

| Market Forecast in 2033 | USD 36,509.22 Million |

| Market Growth Rate 2025-2033 | 3.97% |

UK Home Decor Market Trends:

Increased Influence of E-Commerce and Digital Channels

The rapid expansion of e-commerce platforms is significantly shaping the UK home decor market growth. Digital retail channels have become essential, offering convenience, wider selections, and immersive online shopping experiences. Virtual reality (VR) and augmented reality (AR) tools now allow consumers to visualize decor products in real-time home settings, enhancing engagement and confidence in purchases. Online marketplaces and direct-to-consumer (DTC) brands are leveraging data analytics to personalize recommendations, which is improving conversion rates and customer loyalty. Additionally, social commerce and influencer marketing are playing prominent roles, especially among younger demographics. The shift towards mobile-first purchasing and seamless omnichannel integration further reflects changing shopping habits. These digital innovations are helping to increase the accessibility and reach of the UK home decor market growth. For instance, in January 2025, Graham & Brown, a UK-based home décor company, launched a B2B e-commerce site on BigCommerce, resulting in rapid adoption and expansion across the UK, Ireland, and Europe. The platform streamlined operations with self-service tools, reducing inbound calls and order backlogs. Key features include Quick Order tools, real-time credit balance visibility, and custom wallpaper mural creation. This digital shift enhanced customer experience, operational efficiency, and growth, aligning with the company's global ambitions.

To get more information on this market, Request Sample

Preference for Multifunctional and Compact Furniture

According to industry reports, the urbanization rate in the United Kingdom reached 84.88% in 2024, marking a nearly three percentage point rise over the past decade. The trend towards urban living and smaller residential spaces is driving consumer demand for space-saving and multifunctional décor in the UK home décor market. City dwellers are increasingly favoring compact furniture with built-in storage, convertible designs, and modular systems, prioritizing utility without sacrificing style. This shift is especially prominent among younger populations living in apartments or shared spaces. Manufacturers are prioritizing innovation in design to cater to this demand, incorporating foldable, stackable, and transformable features that enhance room versatility. Minimalist styles and neutral palettes are also trending, reflecting a desire for simplicity and functionality. The growing popularity of home offices and remote work has further reinforced the demand for adaptive interiors, fueling UK home decor market growth in this segment.

UK Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

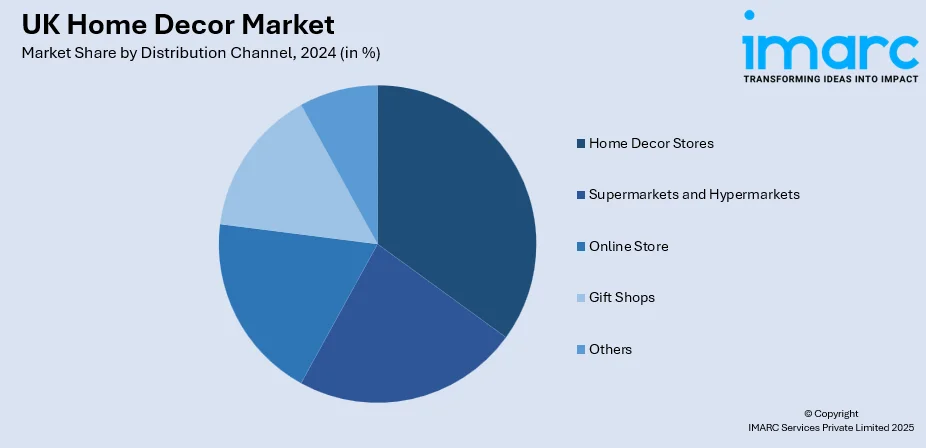

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Home Decor Market News:

- In December 2024, Redfin launched its AI-powered home design tool, Redfin Redesign, to help homeowners and buyers decorate homes with holiday-inspired decor. Using Roomvo's AI, the tool allows users to add festive elements like lights and garlands to home images. Available on desktop and iOS, it aims to enhance buyer experiences and attract more tours, with listings seeing a 170% increase in tour requests.

- In June 2024, Trampoline, a B2B home décor platform, raised USD 5 Million in Seed funding to digitize access to design-led home décor for independent retailers. The India-UK company offers a full-stack service, from design to delivery, with personalized curation, low MOQs, and flexible payment terms. Leveraging supply chains in India and SE Asia, Trampoline aims to disrupt the traditional model by enabling retailers to access high-quality, handcrafted products. The funding will enhance sourcing, product development, and supply chain capabilities.

UK Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK home decor market performed so far and how will it perform in the coming years?

- What is the breakup of the UK home decor market on the basis of product type?

- What is the breakup of the UK home decor market on the basis of distribution channel?

- What is the breakup of the UK home decor market on the basis of region?

- What are the various stages in the value chain of the UK home decor market?

- What are the key driving factors and challenges in the UK home decor market?

- What is the structure of the UK home decor market and who are the key players?

- What is the degree of competition in the UK home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)