UK Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

UK Hot Sauce Market Overview:

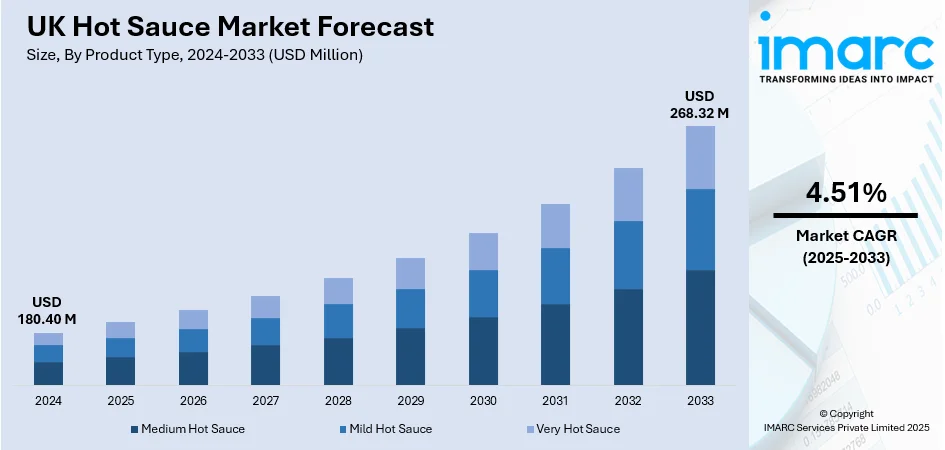

The UK hot sauce market size reached USD 180.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 268.32 Million by 2033, exhibiting a growth rate (CAGR) of 4.51% during 2025-2033. UK consumers are increasingly testing out global food products, which is having a huge impact on the consumption of spicy sauces. Moreover, social media websites and pop culture sensations are rising awareness about various unique food products via marketing tactics. This, along with the rising transition towards various healthy and premium food products, is expanding the UK hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 180.40 Million |

| Market Forecast in 2033 | USD 268.32 Million |

| Market Growth Rate 2025-2033 | 4.51% |

UK Hot Sauce Market Trends:

Broadening Palates with International Culinary Discovery

UK consumers are increasingly testing out global food products, which is having a huge impact on the demand for hot sauces. As individuals keep sampling flavors from cuisines like Mexican, Korean, Caribbean, and Thai, they are adding more variety of spicy condiments to their day-to-day meals. Hot sauce is now being mixed into pasta, sandwiches, breakfast foods, and even snacks. Urban food culture is contributing to this trend in large part, where food trucks, fusion eateries, and multicultural populations are shaping local palates. Younger generations, especially, are expressing a high degree of interest in bold flavor profiles and bold heat levels. This changing taste is also causing manufacturers and retailers to broaden their hot sauce portfolios. With British consumers constantly adopting international cuisine, the market for hot sauce is gaining prominence as people are embracing a diverse variety of flavor profiles. In 2025, An innovative Scottish food ingredients producer has capitalized on the UK's rising demand for spicy tastes with the debut of its new 'sau-ci o.t.t® Spicy Jalapeño' savory topping. In response to the growing interest in creative, heat-based flavors, Macphie’s 'sau-ci o.t.t®' merges sweet and tangy elements with jalapeños and specifically chosen spices, providing a taste experience influenced by the increasing appeal of spicier dishes.

To get more information on this market, Request Sample

Influence of Social Media and Pop Culture

Social media websites and pop culture sensations are having an important influence on raising awareness and popularity of hot sauces throughout the UK. People are observing viral food challenges, spice challenges, and influencer reviews that highlight various heat levels and specialty flavor combinations. Gen Z and millennials are posting about their experiences on social media, creating curiosity and stimulating others to taste new products. Celebrity alliances and branded hot sauces from popular personalities are attracting attention and driving demand. This growing social chatter is making the hot sauce trendy and collectible, rather than a necessary kitchen product. Owing to the high demand the retailers are granting more shelf space to bold packaging, creative branding, and interesting flavors. This online push is further transforming consumer habits and propelling the UK hot sauce market growth. In 2024, a UK-based sauce brand Sauce Shop unveiled two limited-edition sauces in partnership with Aldi. The new products comprise Truffalo Hot Sauce and Burnt Pineapple Sauce, which are made in the UK and have all natural ingredients.

Moving to Premium and Health-Conscious Options

Consumers are favoring hot sauces that provide a premium experience, with shoppers choosing small-batch, hand-made, and health-oriented options in many cases. Consumers are reading labels consciously, selecting sauces from natural ingredients, and looking for alternatives that complement their dietary needs. The demand for sauces with lower sugar, no artificial additives, or fermented components is rising, as health awareness becomes a top priority. Moreover, people are gravitating toward artisan brands that offer unique flavor profiles, such as smoked, truffle-infused, or fruit-blended sauces. These premium sauces are often viewed as gourmet products, suitable for gifting or entertaining. This is driving manufacturers to experiment with fearless flavor pairings, eco-friendly packaging, and storytelling about the origins of ingredients. As consumers continue to look for a balance between flavor and health, the market for upscale, clean-label hot sauces is growing at a rapid rate, establishing new benchmarks in the UK market.

UK Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

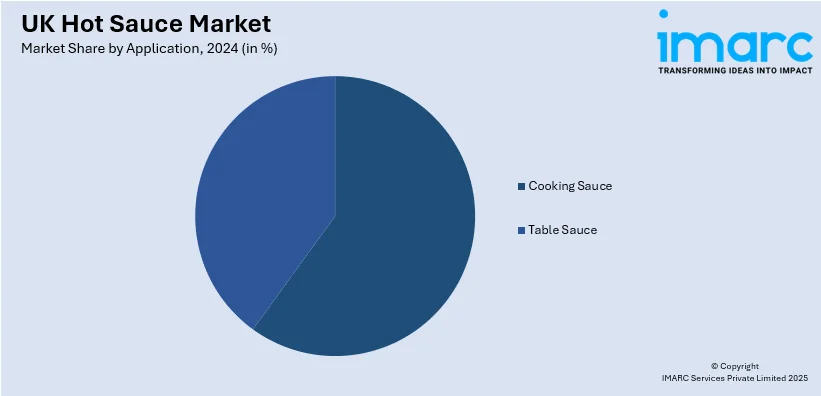

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the UK hot sauce market on the basis of product type?

- What is the breakup of the UK hot sauce market on the basis of application?

- What is the breakup of the UK hot sauce market on the basis of packaging?

- What is the breakup of the UK hot sauce market on the basis of distribution channel?

- What is the breakup of the UK hot sauce market on the basis of end use?

- What is the breakup of the UK hot sauce market on the basis of region?

- What are the various stages in the value chain of the UK hot sauce market?

- What are the key driving factors and challenges in the UK hot sauce market?

- What is the structure of the UK hot sauce market and who are the key players?

- What is the degree of competition in the UK hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)