UK Hydrogen Energy Market Size, Share, Trends and Forecast by Production Method, Type, Application, and Region, 2025-2033

UK Hydrogen Energy Market Overview:

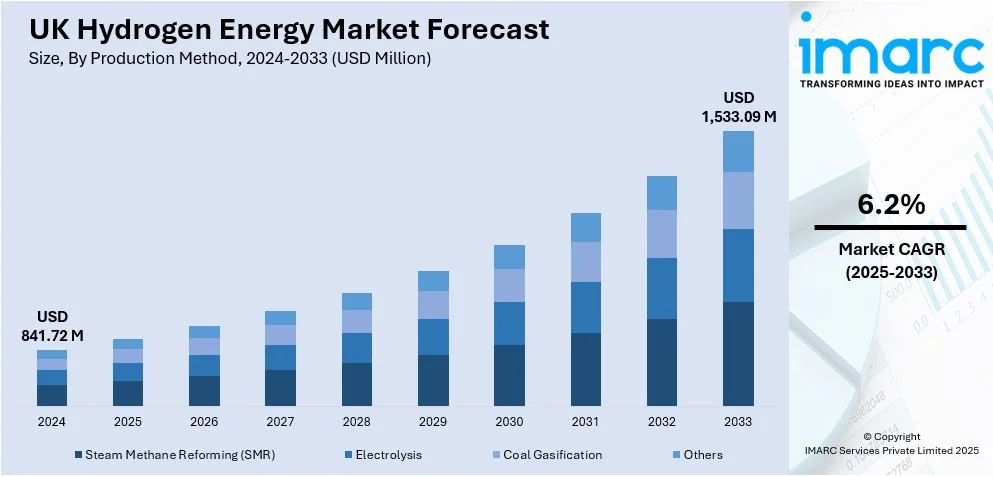

The UK hydrogen energy market size reached USD 841.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,533.09 Million by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The rising push for decarbonization, the growing government support through policies and funding, the increasing need for cleaner alternatives to fossil fuels, significant advancements in hydrogen production technologies, and the rising demand for sustainable energy in industries are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 841.72 Million |

| Market Forecast in 2033 | USD 1,533.09 Million |

| Market Growth Rate 2025-2033 | 6.2% |

UK Hydrogen Energy Market Trends:

Rising Decarbonization Goals

The UK's goal of reaching net-zero emissions by 2050 includes promoting hydrogen as a cleaner energy source to replace fossil fuels. For instance, in February 2024, the UK government announced funding for seven projects to produce low-carbon hydrogen, offering over GBP 21 Million in support. Spanning from Suffolk to Shetland, these projects will generate green fuel for buses, trucks, and trains while assisting local businesses in transitioning away from natural gas. Anticipated to create numerous skilled jobs, they will also encourage private investment in areas previously dependent on high-carbon industries. The announcement occurred during the second Hydrogen Investor Forum, where industry leaders explored expanding economic prospects in the UK. Additionally, the government has initiated a call for evidence on the hydrogen and carbon capture, usage, and storage (CCUS) components of the Green Industries Growth Accelerator. Launched during the last Autumn Statement, the GBP 960 million initiative aims to accelerate advanced manufacturing in offshore wind, networks, CCUS, hydrogen, and nuclear sectors. Efforts are also underway to enhance hydrogen transport and storage infrastructure, bolstering supply chains and ensuring long-term energy security.

Growing Government Support

Government policies, financial support, and strategic investments in hydrogen infrastructure and research are driving the widespread use of hydrogen energy in sectors such as transport and industry. In June 2024, Hydrogen UK, a prominent hydrogen trade association, introduced its manifesto with significant policy suggestions for the next government to unlock the sector’s potential. The document includes guidance covering both the initial 100 days in office and long-term strategies. Among its recommendations is the creation of a ministerial role dedicated to hydrogen, ensuring sector growth and coordinated policymaking across various departments. To sustain industry progress, it also emphasizes the importance of expediting investment decisions for leading hydrogen projects, paving the way for further advancements. Similarly, in February 2024, EET Hydrogen released a statement of principles in collaboration with the UK government’s Department for Energy Security and Net Zero for its HPP1 low-carbon hydrogen plant. This development signifies a significant milestone in the ongoing negotiations between EET Hydrogen and the government, outlining key agreements reached so far.

UK Hydrogen Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on production method, type, and application.

Production Method Insights:

- Steam Methane Reforming (SMR)

- Electrolysis

- Coal Gasification

- Others

The report has provided a detailed breakup and analysis of the market based on the production method. This includes steam methane reforming (SMR), electrolysis, coal gasification, and others.

Type Insights:

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

The report has provided a detailed breakup and analysis of the market based on the type. This includes grey hydrogen, blue hydrogen, and green hydrogen.

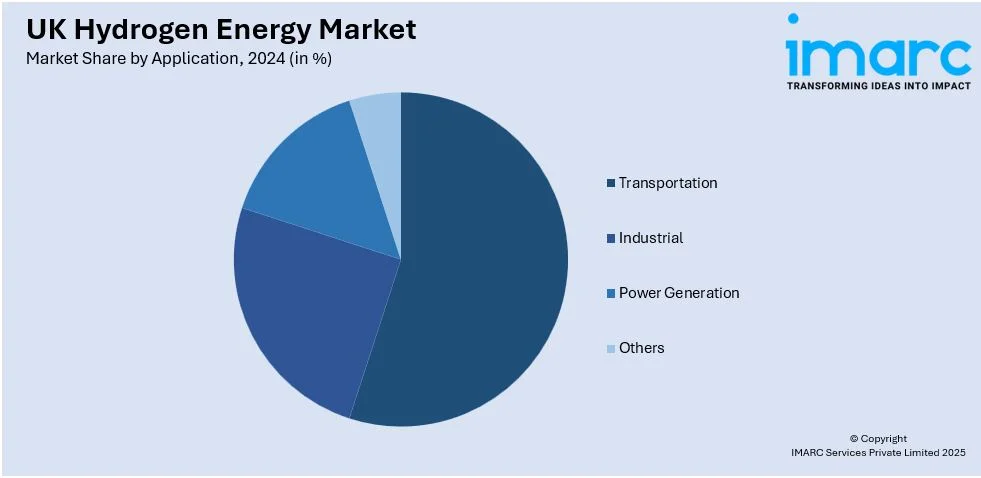

Application Insights:

- Transportation

- Industrial

- Power Generation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation, industrial, power generation, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and the Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Hydrogen Energy Market News:

- In February 2024, the Kraft Heinz Company entered into an agreement with Carlton Power, a UK-based energy infrastructure developer, to explore the potential construction of a renewable green hydrogen facility at its Kitt Green manufacturing site in Wigan, Greater Manchester.

- In September 2023, the UK and Germany formalized an agreement to expedite the growth of the global hydrogen industry. Both governments plan to enhance the role of low-carbon hydrogen in their energy systems, setting an example for expanding sustainable and net-zero markets. They pledged to collaborate on advancing innovative renewable hydrogen technologies, fostering job creation, and encouraging low-carbon investments.

UK Hydrogen Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Production Methods Covered | Steam Methane Reforming (SMR), Electrolysis, Coal Gasification, Others |

| Types Covered | Grey Hydrogen, Blue Hydrogen, Green Hydrogen |

| Applications Covered | Transportation, Industrial, Power Generation, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and the Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK hydrogen energy market performed so far and how will it perform in the coming years?

- What is the breakup of the UK hydrogen energy market on the basis of production method?

- What is the breakup of the UK hydrogen energy market on the basis of type?

- What is the breakup of the UK hydrogen energy market on the basis of application?

- What are the various stages in the value chain of the UK hydrogen energy market?

- What are the key driving factors and challenges in the UK hydrogen energy market?

- What is the structure of the UK hydrogen energy market and who are the key players?

- What is the degree of competition in the UK hydrogen energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK hydrogen energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK hydrogen energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK hydrogen energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)