UK InsurTech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

UK InsurTech Market Size and Share:

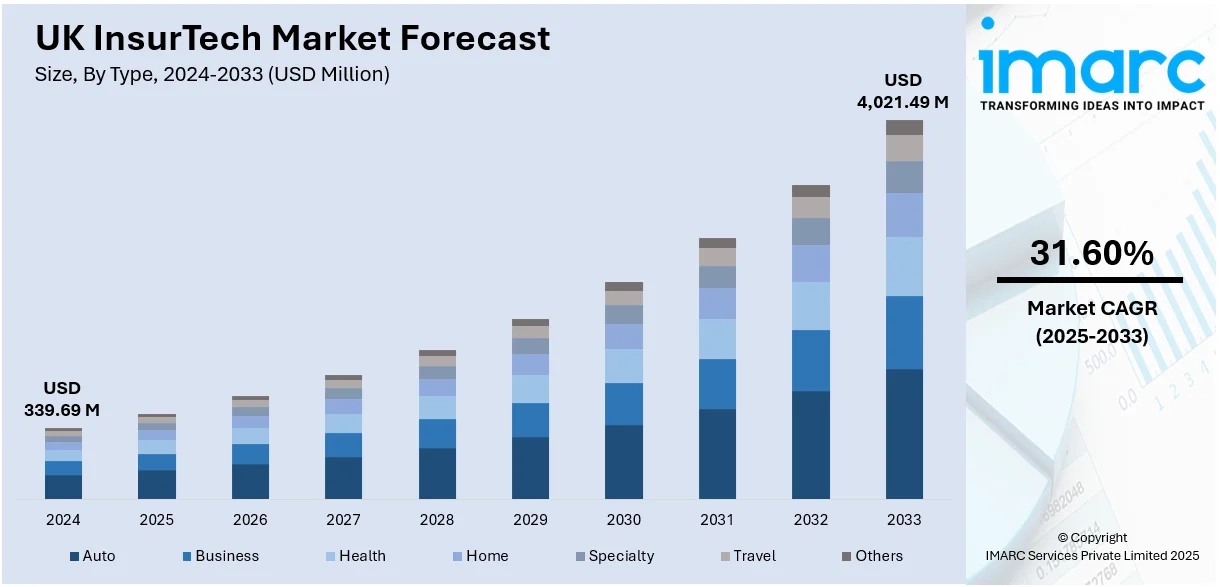

The UK InsurTech market size was valued at USD 339.69 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,021.49 Million by 2033, exhibiting a CAGR of 31.60% during 2025-2033. London currently dominates the market in 2024. This can be ascribed to its role as a global financial center, robust digital infrastructure, and concentration of tech-savvy enterprises. Strong government support, skilled talent, and widespread adoption of emerging technologies further enhance its leadership. These advantages solidify London’s position as the primary innovation and business hub, thereby boosting the UK InsurTech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 339.69 Million |

| Market Forecast in 2033 | USD 4,021.49 Million |

| Market Growth Rate (2025-2033) | 31.60% |

One of the key drivers of the UK InsurTech market is the growing demand for seamless, digital-first customer experiences. Consumers increasingly expect fast, transparent, and mobile-accessible services, prompting insurers to adopt technologies like artificial intelligence, machine learning, and chatbots to streamline processes such as quoting, underwriting, and claims management. The rise of embedded insurance, offered at the point of sale through non-insurance platforms, also plays a significant role, as it integrates insurance into everyday transactions. For instance, in May 2025, Earnix joined the British Insurance Brokers’ Association (BIBA) as an associate member to promote the adoption of AI and data analytics in UK insurance brokerages. The company aims to help brokers enhance pricing accuracy, compliance, and operational efficiency, especially amid rising regulatory demands and consumer expectations. Earnix will use its membership to influence industry discussions on technology’s role in insurance distribution. Furthermore, the UK’s relatively high digital literacy and smartphone penetration enhance consumer receptiveness to tech-enabled insurance offerings. These shifts have accelerated innovation and competition, pushing both startups and incumbents to improve their digital capabilities, personalize offerings, and create more customer-centric models.

Another critical factor substantiating the UK InsurTech market growth is the supportive regulatory and investment environment. The UK’s Financial Conduct Authority (FCA) has created innovation-friendly frameworks, including regulatory sandboxes that allow InsurTech firms to test products under supervision. This proactive approach encourages experimentation and reduces entry barriers. In parallel, strong venture capital interest continues to fund early-stage and growth-stage companies, facilitating expansion and technological development. The UK's status as a global financial services hub adds further credibility and access to talent. Strategic collaborations between traditional insurers and startups also drive momentum, enabling legacy firms to modernize while giving InsurTechs market reach. Combined, these elements form a robust ecosystem encouraging sustained growth and innovation.

UK InsurTech Market Trends:

Rising Usage of Digital Channels

The UK insurtech market growth is driven by the increasing integration of digital technologies. Consumer demands for immediate access to insurance products, compelling insurers to shift from traditional methods to digital approaches, fuel the emerging market. Due to its performance highlighted in PYMNTS Intelligence’s “How the World Does Digital” report, the U.K. is positioned sixth among 11 countries surveyed, which includes European neighbors like Italy, Spain, France, Germany, and the Netherlands. This transition not only simplifies processes like policy enrollment and claim management but also enhances the customer journey. As digital transformation accelerates across various industries, insurance providers are adopting platforms that offer user-friendly interfaces, rapid responses, and real-time analytics. These digital platforms cater to consumer preferences for ease of access and personalization, steering users towards technological solutions in insurance. It not only assists the insurers in catering to the needs of the consumers but also eliminates potential costs that are involved in several exercises which were previously carried out manually. Accordingly, in February 2025, UK-based OneID raised USD 20 Million to expand its bank-verified digital identity platform. Supporting 12-second, document-free onboarding for 90% of UK adults, OneID enhances fraud prevention and streamlines digital onboarding through partnerships with Adobe and NatWest for business banking solutions.

Growing Consumer Demand for Personalization

Customers expect products that meet their unique needs and their lifestyle, and insurtech companies are leveraging big data and artificial intelligence to offer such tailored products. According to an industry report, 95% of firms in the insurance sector are currently using AI, the highest adoption rate among industries. Within the sector, general insurance accounts for 10% of total AI use cases across various business functions. From car insurance with variable rates as a function of mileage to health insurance adjusted by activity level, tailored products have become a key driver of competitive advantage in the insurance industry. The trend allows the companies to obtain a more retained customer base while reducing risk with improved underwriting. The phenomenon of providing customized insurance products highly enhances the experience of customers, thereby resulting in increased retention rates among consumers. Insurtech companies are making this happen through embracing flexible policies that enable customers to buy just what they want, as opposed to a uniform product. This strategy follows the increasing demand for personalization among consumers, which in turn reinforces the relationship between tailored offerings and enhanced customer loyalty.

Increasing Investment in Insurtech Startups

Venture capital companies and institutional investors are increasingly recognizing the promise of technology-based insurance solutions, and this has resulted in a huge amount of capital flowing into the industry. The UK is home to nearly a quarter of Europe's insurtech companies. This capital enables startups to speed up the creation of new products, ranging from AI-driven risk assessments to blockchain-based claims management systems. With additional funds, these firms can expand their operations, fund research and development, and compete more vigorously with conventional insurers. As such, in April 2025, UK InsurTech Marshmallow raised USD 90 Million, reaching a USD 2 Billion valuation. Backed by Portage Capital and BlackRock, the firm insures one million drivers and plans to expand beyond car insurance into financial services and new insurance products. This increase in investment is not only transforming the insurance industry but also stimulating partnerships between conventional insurance firms and technology-based startups, which are central to incorporating innovative technologies such as machine learning and IoT into conventional insurance practices. Additionally, as the regulatory agencies adapt to the speedy evolution of technology, they are developing systems that further promote the development and innovation in the UK insurtech market outlook.

UK InsurTech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK InsurTech market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type, service, and technology.

Analysis by Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Health insurance stand as the largest type in 2024, holding around 24.8% of the market. Rising healthcare costs globally have increased consumer demand for financial protection against medical expenses. In many regions, governments are encouraging private health insurance to ease the burden on public healthcare systems. Technological advancements in telemedicine and digital health services have also made insurance-linked health services more accessible and appealing. Furthermore, aging populations in many countries are driving demand for long-term health coverage. These factors collectively contributed to health insurance capturing the largest share of the market in 2024.

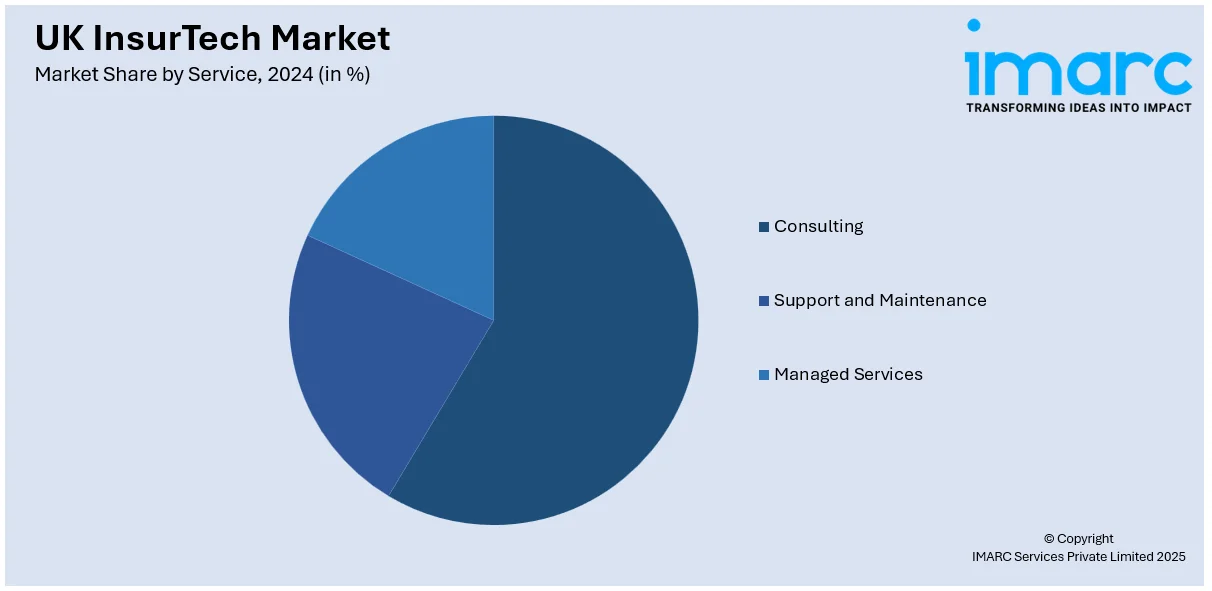

Analysis by Service:

- Consulting

- Support and Maintenance

- Managed Services

Managed services leads the market with around 25.7% of market share in 2024 due to increasing demand for cost-effective, scalable IT solutions across industries. As businesses continue to digitalize operations, managed services offer essential support in maintaining and securing complex IT infrastructures without the need for large in-house teams. This model allows companies to focus on core activities while outsourcing IT management, cybersecurity, cloud services, and compliance monitoring to specialized providers. The rise of remote work and hybrid environments has also boosted the need for reliable, 24/7 managed IT support. Furthermore, managed service providers (MSPs) enable access to advanced technologies and skilled expertise, helping organizations stay competitive and agile in a rapidly evolving digital landscape, thus driving significant market adoption.

Analysis by Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing dominated the market in 2024 with around 40.0% market share due to its scalability, cost-efficiency, and flexibility. As digital transformation accelerates across industries, cloud platforms enable organizations to store, process, and access data on-demand without heavy investments in physical infrastructure. The surge in remote work, data analytics, and AI adoption has further fueled demand for cloud-based solutions. Enterprises increasingly rely on cloud services for disaster recovery, real-time collaboration, and streamlined software deployment. Additionally, the growing adoption of hybrid and multi-cloud strategies enhances operational agility and security. Cloud providers also offer continuous updates and support, reducing the burden on internal IT teams. These benefits have positioned cloud computing as a foundational technology, leading market growth in 2024.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

In 2024, London accounted for the largest market share due to its status as a global financial hub, strong digital infrastructure, and concentration of major corporations and tech firms. The city’s mature regulatory environment and access to a highly skilled workforce have attracted significant investments in sectors like fintech, insurance, cloud services, and AI. London also benefits from a high density of startups and innovation centers, fostering rapid adoption of emerging technologies For instance, in March 2025, Emerald Holding, Inc. acquired Insurtech Insights, marking its entry into the insurance technology sector. The London-based firm organizes major global insurtech conferences, promoting digital transformation and innovation. The deal aligns with Emerald’s strategy to expand into high-growth markets, enhancing its event management capabilities and boosting 2024 revenues by 4.2%. Besides this, its well-connected transport and communication networks further support efficient business operations. Government initiatives promoting digital transformation and smart city development have also boosted demand for advanced IT and managed services.

Competitive Landscape:

The UK InsurTech market is characterized by rapid innovation, regulatory support, and strong investor interest. A tech-savvy consumer base and demand for digital insurance solutions have fueled growth across personal and commercial lines. Key trends include embedded insurance, usage-based products, AI-driven underwriting, and claims automation. For instance, in April 2025, Apollo and Moonrock launched a new drone insurance facility offering liability coverage up to USD 100 Million and property damage cover up to USD 22.5 Million. Targeting drones and eVTOL aircraft, the initiative supports growing demand in aviation innovation. Moonrock manages distribution, while Apollo leads underwriting with support from key insurers. The market benefits from open finance frameworks and regulatory sandboxes, fostering experimentation and product development. Traditional insurers are increasingly partnering with or acquiring startups to modernize operations. Overall, the UK InsurTech market forecast indicates that the market is projected to remain dynamic, with continued growth driven by customer expectations, digital transformation, and the integration of emerging technologies.

The report provides a comprehensive analysis of the competitive landscape in the UK InsurTech market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: UK-based Jove launched its first fully digital insurance program in partnership with Chubb. Targeted at tech professionals and contractors, the platform offers flexible, contract-specific coverage with international support. Powered by Chubb Studio, it highlights the shift toward tailored, digital-first insurance solutions in the InsurTech space.

- May 2025: AXA UK launched digital-first motor insurance with Lloyds Banking Group, offering two comprehensive cover levels via Lloyds Bank. The partnership enables online policy management, 24/7 claims, and add-ons like breakdown cover, aiming to meet growing demand for flexible, customer-centric motor insurance.

- May 2025: Esure Group launched an all-in-one insurance app in partnership with Caura. The app enables users to manage motor and home policies, book MOTs, pay road taxes, and handle vehicle admin digitally.

- March 2025: Accenture acquired UK-based Altus Consulting to enhance its InsurTech and financial services capabilities. Altus brings insurance, pensions, and investment expertise, along with data-driven tools and digital transformation skills.

- February 2025: CLARK launched Polly’s Digital Pathway in the UK, offering a fully digital life insurance journey. Aimed at younger, phone-averse users, the AI-driven platform delivers real-time, tailored coverage.

- January 2025: Urban Jungle partnered with travel insurance specialist PJ Hayman announced to launch customizable, AI-driven travel insurance underwritten by Canopius. Urban Jungle’s new digital offering supports single and annual trips, reinforcing its shift toward a broader, multiline InsurTech platform.

UK InsurTech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, and Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Blockchain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK InsurTech market from 2019-2033.

- The UK InsurTech market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK InsurTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK InsurTech market was valued at USD 339.69 Million in 2024.

The UK InsurTech market is projected to exhibit a CAGR of 31.60% during 2025-2033, reaching a value of USD 4021.49 Million by 2033.

Key factors driving the UK InsurTech market include increasing digital adoption, evolving consumer expectations for personalized services, regulatory support for innovation, rising demand for cost-effective insurance solutions, and advancements in AI, data analytics, and machine learning. These elements foster a competitive environment, encouraging startups and incumbents to modernize insurance delivery.

London accounted for the largest share of the market in 2024 due to its position as a global financial hub, strong infrastructure, access to top talent, and a thriving tech ecosystem. The city's favorable regulatory environment and its central role in international business also contributed significantly to its market dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)