UK Medical Devices Market Report by Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, In-vitro Diagnostics, Minimally Invasive Surgery, Wound Management, Diabetes Care, Ophthalmic Devices, Dental Devices, Nephrology, General Surgery, and Others), End User (Hospitals & ASCs, Clinics, and Others), and Region 2025-2033

UK Medical Devices Market Overview:

The UK medical devices market size reached USD 18,008.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30,893.9 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by ongoing advancements in healthcare technology, aging population, rising adoption of digital health technologies, increasing healthcare expenditure, and growing focus on personalized treatment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18,008.9 Million |

|

Market Forecast in 2033

|

USD 30,893.9 Million |

| Market Growth Rate 2025-2033 | 6.18% |

UK Medical Devices Market Trends:

Shift Toward Digital Health Integration

The UK medical devices market is increasingly focused on integrating digital health solutions. The rise of telemedicine and mobile health applications has spurred demand for devices that enable remote monitoring and diagnostics. Wearable technology, such as smartwatches and fitness trackers, has expanded beyond lifestyle use into healthcare, with a focus on chronic disease management. As per DIGITAL HEALTH IN THE UK, NATIONAL ATTITUDES AND BEHAVIOUR RESEARCH UK, 38% of people have already used a health app. This trend is promoted by consumer demand along with a requirement for cost-cutting and better patient results by an endeavor undertaken by governments. The National Health Service in the UK is also supporting the promotion of embracing AI-based diagnostic tools by accelerating the evaluation of such devices. In response to this reality, companies in the medical devices industry are continually developing new innovations, including AI-enhanced wearable technologies and apps, which help patients better manage conditions such as diabetes, hypertension, and respiratory disorders. This correlates with a more holistic evolution toward prevention and personalization in healthcare.

Growth in Diagnostic Imaging

The diagnostic imaging sector in the UK is experiencing substantial growth, driven by advancements in imaging technologies and an increasing focus on early and accurate disease detection. As per Diagnostic Imaging Dataset Annual Statistical Release 2022/23, 45.0 million imaging tests were conducted in England in 2023, compared to 44.0 million in the 2022, an increase of 2.2%. Innovations in MRI, CT scans, and ultrasound are improving diagnostic capabilities, allowing for more precise and timely identification of conditions. The Department of Health and Social Care (DHSC) reports that investment in diagnostic imaging is a key priority for the NHS to address growing demand and improve patient outcomes. This investment will clearly prove that advanced imaging technologies can play a very crucial role in the strategy for tackling backlogs of diagnoses in the NHS while assuring patients of timely treatment. More than any other aspect, it is expected that ongoing advancements of diagnostic imaging will work to play a pivotal role in enhancing the efficiency and effectiveness of the whole UK healthcare system.

Growth in Home-Based Medical Devices

There is a growing demand for home-based medical devices in the UK, driven by the aging population and a shift toward decentralizing healthcare. Devices such as portable oxygen concentrators, blood glucose monitors, and remote heart rate monitors are becoming increasingly common. According to the Office for National Statistics (ONS), over 18.6% of the UK population is aged 65 years and older, which directly correlates with the need for at-home healthcare solutions. The NHS is increasingly promoting home-based medical care as a means to alleviate pressure on hospitals and clinics, especially during periods of high demand. The COVID-19 pandemic has accelerated this trend as the coronavirus required many patients to be placed under monitoring with disorders in the respiratory system. The trend is considered by medical device manufacturers through the development of more sophisticated and user-friendly devices that can safely be applied in non-clinical environments. Through these appliances, older persons would be able to live much more independently than they are nowadays while providing clinicians with near real-time data on the needs of patients monitored in situ.

UK Medical Devices Market News:

- On 9 January 2024, Abbott announced the launch of Lingo in the UK, a groundbreaking biowearable gadget and software designed to help people improve their overall health and well-being. Lingo monitors glucose spikes and drops in real time and gives personalized insights and coaching to help people adopt healthier habits and achieve better sleep, mood, attention, energy, and less spontaneous cravings.

- On 30 January 2023, the UK Focused Ultrasound Foundation (UK FUSF), dedicated to advancing the development and adoption of focused ultrasound in the UK, announced its formal launch. Focused ultrasound is a groundbreaking platform technology that uses ultrasound energy guided by real-time imaging to treat tissue deep in the body, without incisions or radiation.

UK Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

To get more information on this market, Request Sample

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- IVD

- MIS

- Wound Management

- Diabetes Care

- Ophthalmic Devices

- Dental Devices

- Nephrology

- General Surgery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes orthopedic devices, cardiovascular devices, diagnostic imaging, in-vitro diagnostics, minimally invasive surgery, wound management, diabetes care, ophthalmic devices, dental devices, nephrology, general surgery, and others.

End User Insights:

- Hospitals & ASCs

- Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals & ASCs, clinics, and others.

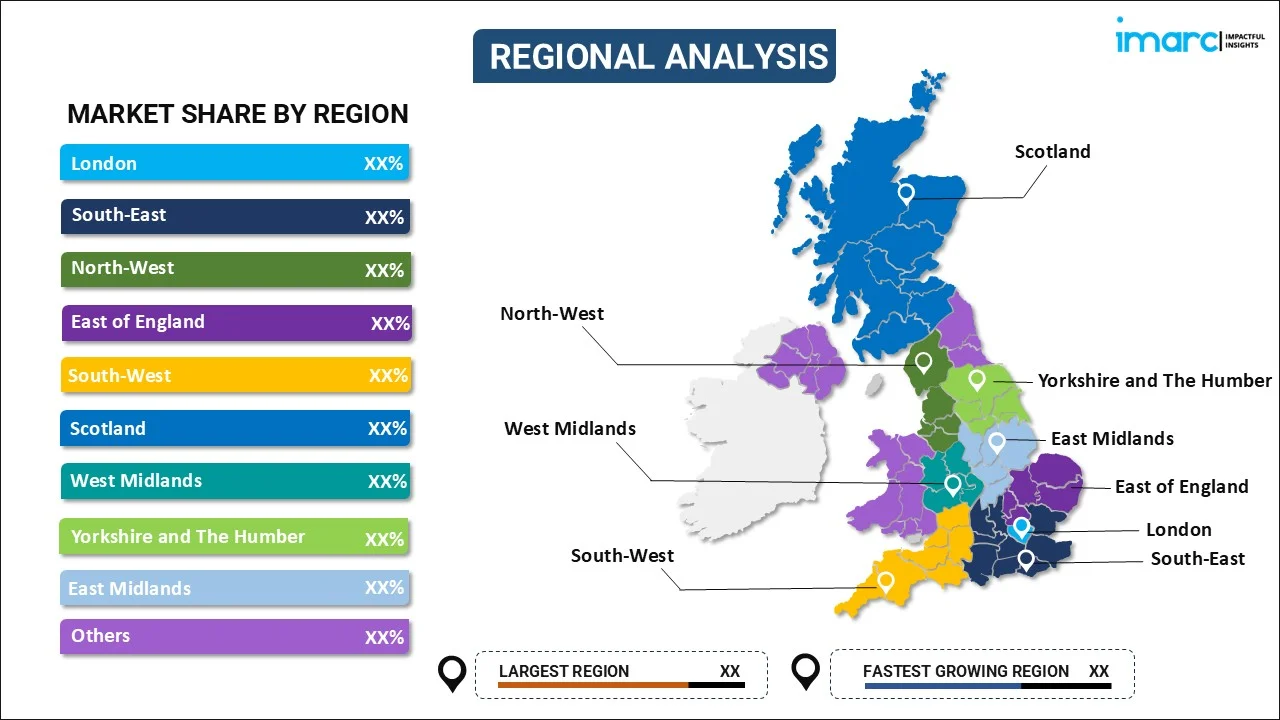

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, In-vitro Diagnostics, Minimally Invasive Surgery, Wound Management, Diabetes Care, Ophthalmic Devices, Dental Devices, Nephrology, General Surgery, Others |

| End Users Covered | Hospitals & ASCs, Clinics, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK medical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the UK medical devices market on the basis of type?

- What is the breakup of the UK medical devices market on the basis of end user?

- What are the various stages in the value chain of the UK medical devices market?

- What are the key driving factors and challenges in the UK medical devices?

- What is the structure of the UK medical devices market and who are the key players?

- What is the degree of competition in the UK medical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK medical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)