UK Micro Mobility Market Size, Share, Trends and Forecast by Type, Propulsion Type, Sharing Type, Speed, Age Group, Ownership, and Region, 2025-2033

UK Micro Mobility Market Overview:

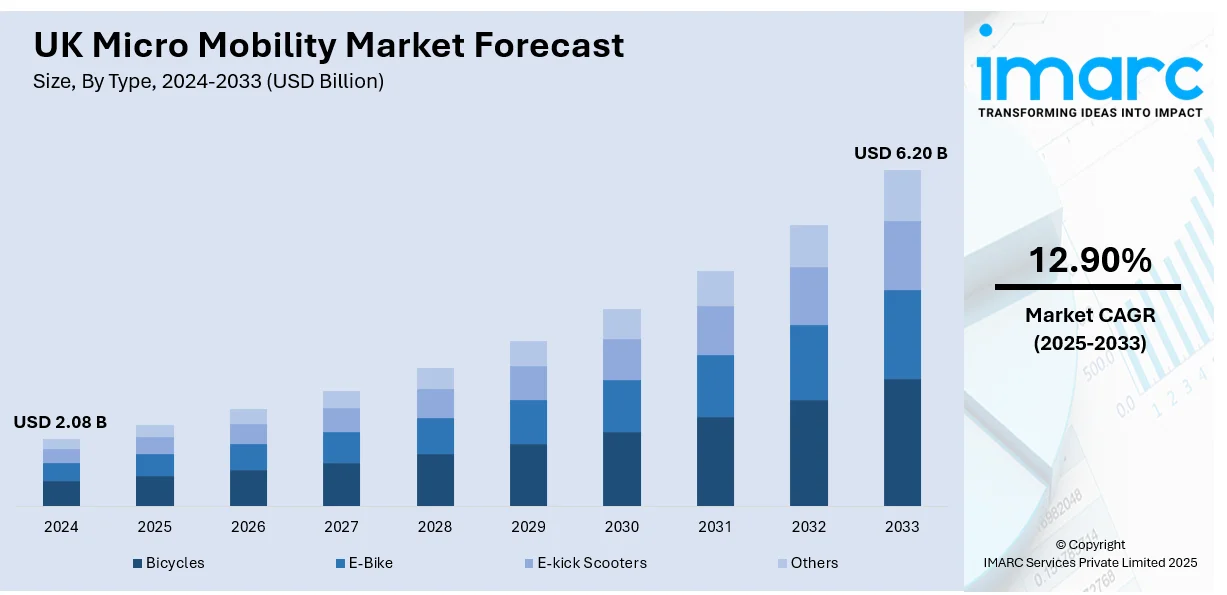

The UK micro mobility market size reached USD 2.08 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.20 Billion by 2033, exhibiting a growth rate (CAGR) of 12.90% during 2025-2033. Rapid urbanization, the rising need for sustainable transportation solutions, increasing government support for reducing emissions, the growing popularity of e-scooters and e-bikes, advancements in technology, and infrastructure improvements are some major factors propelling the UK micro mobility market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.08 Billion |

| Market Forecast in 2033 | USD 6.20 Billion |

| Market Growth Rate (2025-2033) | 12.90% |

UK Micro Mobility Market Trends:

Rising Sustainability and Environmental Concerns

A strong push toward reducing carbon emissions and promoting eco-friendly transportation options is a key driver in the UK micro mobility market outlook. Micro-mobility solutions including e-scooters and e-bikes offer a lower carbon footprint as compared to traditional vehicles, aligning with the UK’s environmental goals and policies. For instance, March 2024 witnessed British e-scooter maker Swifty Scooters unveil UK’s inaugural road-legal e-scooter, a landmark moment in British transport history. The GO GT500 has a 25-mile range, 24 mph top speed, and a 24v 500-watt custom motor that can be fast charged in a matter of hours. The vehicle is officially classed as a Stand-On Moped by the Driver and Vehicle Standards Agency (DVSA), which links it to the same safety and regulatory standards as a vehicle in the L1e category. Swifty's G500 and new GT500 utilize a new Lithium FerroPhosphate (LFP) cell. Rare earth metals such as cobalt and nickel are also omitted in the 15Ah battery, which incorporates the same chemistry that Tesla implemented to prevent thermal runaway. Swifty now sells fleets to companies, including Meta, and hopes to secure more B2B partnerships with the GO GT500, which costs £0.006p per mile.

Rapid Urbanization and Traffic Congestion

As urban areas become more congested, micro-mobility solutions provide a convenient and efficient alternative for short-distance travel. They help alleviate traffic congestion and offer flexible, quick transportation options within cities. Therefore, this is positively influencing the UK micro mobility market share. In June 2024, INRIX, Inc., published its 2023 Global Traffic Scorecard, which identified and ranked congestion in nearly 950 cities across 37 countries by what it calls the Impact Ranking, which reflects the total impact of congestion relative to population. London topped the Traffic Scorecard in Europe and came third in the world, with drivers wasting a total of 99 hours in congestion, three percent more than pre-pandemic delays and two percent more than in 2022. The overall bill for London was £3.8 Billion, or £902 per driver on average. For the UK, this meant losing out on £7.5 Billion, £718 Million more than in 2022. Last year, the typical UK driver spent 61 hours lost in traffic – a 7% rise on 2022’s 57 hours – with the capital contributing about half (50%) of all traffic delays across the UK. UK cities with the most affected drivers in terms of hours lost this year include London (99 hours), Birmingham (60 hours), and Bristol (62 hours). Sheffield Urban and Rochester left the UK top 10 for 2022, falling to 11th and 14th places, respectively, while Manchester and Hertford-Harlow both nudged up three places into 8th and 9th spots.

UK Micro Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, propulsion type, sharing type, speed, age group, and ownership.

Type Insights:

- Bicycles

- E-Bike

- E-kick Scooters

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bicycles, e-bike, e-kick scooters, and others.

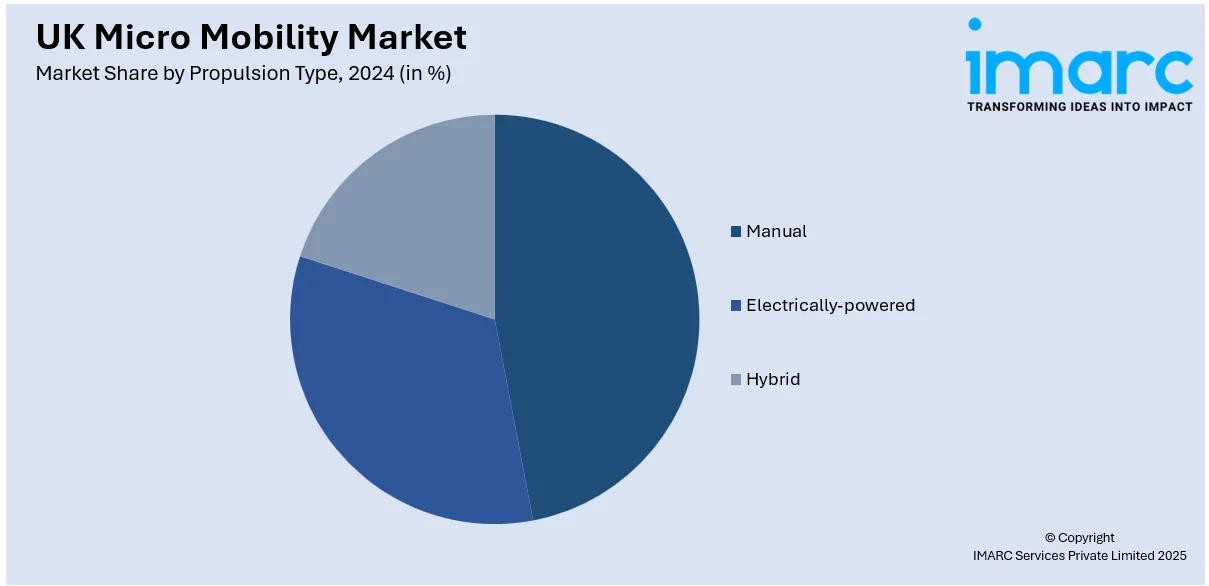

Propulsion Type Insights:

- Manual

- Electrically-powered

- Hybrid

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes manual, electrically-powered, and hybrid.

Sharing Type Insights:

- Docked

- Dock-less

The report has provided a detailed breakup and analysis of the market based on the sharing type. This includes docked and dock-less

Speed Insights:

- Less than 25 Kmph

- Above 25 Kmph

A detailed breakup and analysis of the market based on the speed have also been provided in the report. This includes less than 25 kmph and above 25 kmph.

Age Group Insights:

- 15-34

- 35-54

- 55 and Above

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 15-34, 35-54, and 55 and above.

Ownership Insights:

- Business-To-Business

- Business-To-Consumer

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes business-to-business and business-to-consumer.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Micro Mobility Market News:

- In July 2024, Nissan formed a partnership with the industry leader Silence to provide clean, compact, and agile nanocars to consumers, facilitating urban drivers' initial steps towards electric mobility. Beginning in October 2024, Nissan will serve as the UK distributor for the Silence Nano S04 and e-motorcycles, following their introduction in France, Italy, and Germany. The strategy for UK distribution partnerships is currently under review.

- In September 2023, Bo, a developer based in the UK specializing in urban micro-mobility vehicles, officially announced the commencement of production and the detailed specifications of its inaugural vehicle, the Bo M. This model marks the beginning of a series of lightweight electric vehicles from Bo. After two years of dedicated development and engineering enhancements, the Bo M is now set to enter production, equipped with a variety of technological innovations and improvements.

UK Micro Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bicycles, E-Bike, E-kick Scooters, Others |

| Propulsion Types Covered | Manual, Electrically-powered, Hybrid |

| Sharing Types Covered | Docked, Dock-less |

| Speeds Covered | Less than 25 Kmph, Above 25 Kmph |

| Age Groups Covered | 15-34, 35-54, and 55, Above |

| Ownerships Covered | Business-To-Business, Business-To-Consumer |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK micro mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the UK micro mobility market on the basis of type?

- What is the breakup of the UK micro mobility market on the basis of propulsion type?

- What is the breakup of the UK micro mobility market on the basis of sharing type?

- What is the breakup of the UK micro mobility market on the basis of speed?

- What is the breakup of the UK micro mobility market on the basis of age group?

- What is the breakup of the UK micro mobility market on the basis of ownership?

- What is the breakup of the UK micro mobility market on the basis of region?

- What are the various stages in the value chain of the UK micro mobility market?

- What are the key driving factors and challenges in the UK micro mobility market?

- What is the structure of the UK micro mobility market and who are the key players?

- What is the degree of competition in the UK micro mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK micro mobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK micro mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK micro mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)