UK Microgreens Market Size, Share, Trends and Forecast by Type, Farming Method, Distribution Channel, End Use, and Region, 2025-2033

UK Microgreens Market Overview:

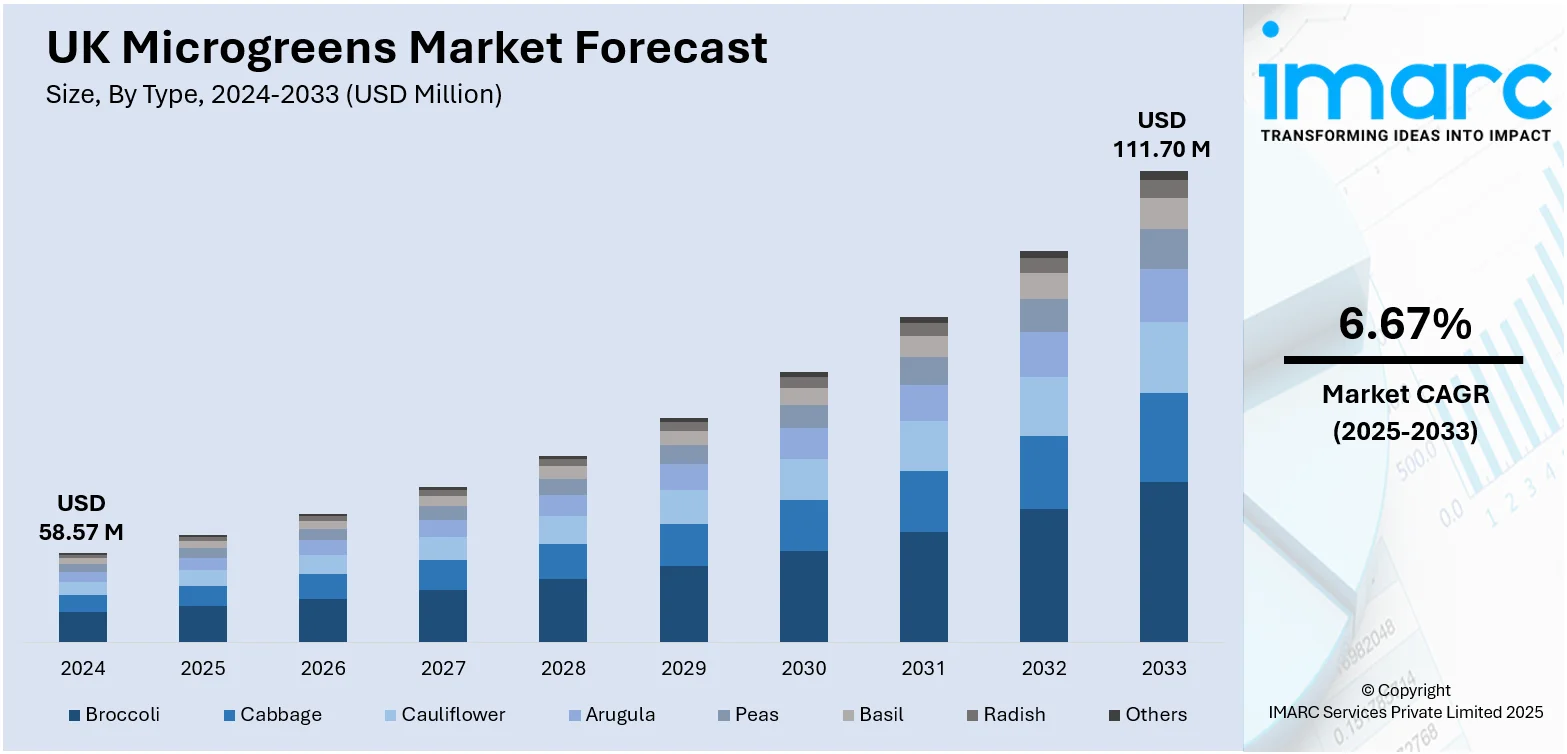

The UK microgreens market size reached USD 58.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 111.70 Million by 2033, exhibiting a growth rate (CAGR) of 6.67% during 2025-2033. Rising consumer demand for nutrient-rich, locally grown produce, increasing adoption of indoor farming technologies, and a shift toward plant-based diets are key factors propelling the market. Additionally, growing interest from upscale restaurants and health-conscious consumers continues to expand the UK microgreens market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 58.57 Million |

| Market Forecast in 2033 | USD 111.70 Million |

| Market Growth Rate 2025-2033 | 6.67% |

UK Microgreens Market Trends:

Expansion of Controlled Environment Agriculture (CEA)

The adoption of controlled environment agriculture (CEA) is significantly influencing the UK microgreens market growth. With urban areas facing limited arable land and unpredictable weather patterns, CEA offers reliable, year-round cultivation of microgreens using hydroponics and vertical farming techniques. These methods reduce water usage and eliminate the need for pesticides, aligning with sustainable agricultural goals. Urban farming startups and established agritech companies are investing in automated growing systems, light optimization, and climate controls to maximize yields. This trend supports localized production, reducing carbon emissions from transportation while ensuring fresher, higher-quality produce. As the UK government continues to support innovation in agri-tech, the integration of AI and IoT in CEA is expected to further enhance productivity in the UK microgreens market. For instance, Ripe Robotics offers advanced fruit-picking automation with its AI-driven robot "Eve,". The company aims to solve labour shortages in horticulture using modular, scalable robots that pick apples and stone fruit. Their long-term goal is to fully automate fruit farming using AI-powered analytics and robotics.

To get more information on this market, Request Sample

Growing Demand from the Hospitality and Foodservice Sector

As per industry reports, the United Kingdom's full service restaurants market is projected to be valued at USD 33.49 Billion in 2025 and is anticipated to grow to USD 47.52 Billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.25% over the 2025–2030 period. The increasing use of microgreens in fine dining and upscale restaurants is a significant trend within the UK microgreens market. Chefs and foodservice providers are incorporating microgreens into dishes for their flavor, color, and high nutritional value. As consumer expectations for aesthetically pleasing, health-focused meals grow, microgreens are becoming a preferred garnish and ingredient across premium food outlets. Their short cultivation cycle allows for on-demand supply, which is particularly advantageous for restaurants aiming for freshness and sustainability. Furthermore, the rise in gourmet and farm-to-table dining experiences supports this demand, contributing to the overall UK microgreens market growth. With foodservice providers seeking unique ingredients that align with health and wellness trends, the role of microgreens is set to become increasingly prominent.

UK Microgreens Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on type, farming method, distribution channel, and end use.

Type Insights:

- Broccoli

- Cabbage

- Cauliflower

- Arugula

- Peas

- Basil

- Radish

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes broccoli, cabbage, cauliflower, arugula, peas, basil, radish, and others.

Farming Method Insights:

- Indoor Vertical Farming

- Commercial Greenhouses

- Others

A detailed breakup and analysis of the market based on the farming method have also been provided in the report. This includes indoor vertical farming, commercial greenhouses, and others.

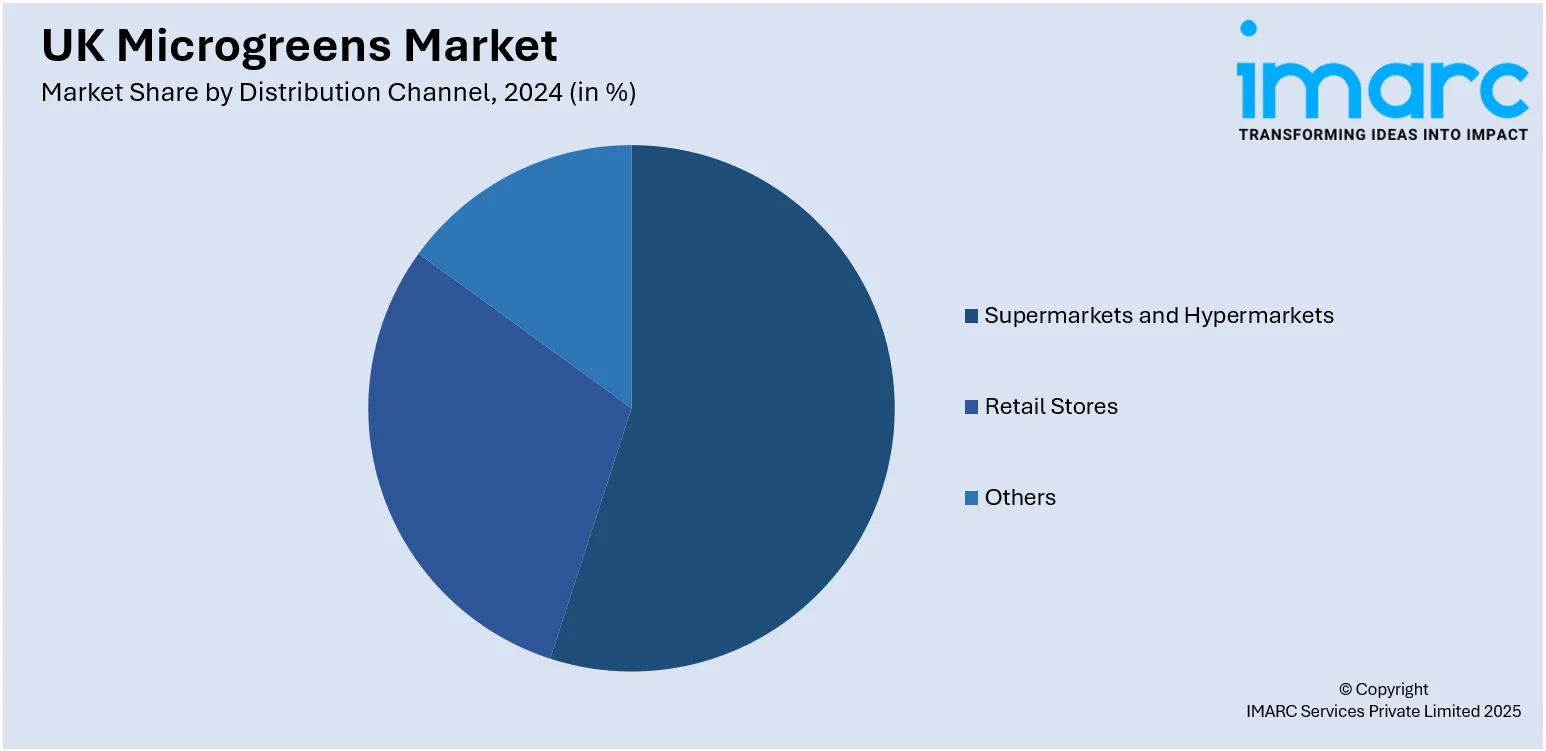

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, retail stores, and others.

End Use Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and commercial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Microgreens Market News:

- In May 2025, Fresh and Tasty (FT) Microgreens relocated to a new three-acre site at Glanllyn Farm in North Wales. The business, known for offering over 50 varieties of microgreens and microherbs, has expanded its operations with larger polytunnels and repurposed shipping containers. This upgrade supports increased production of edible flowers and sets the stage for future cultivation of fruits, vegetables, and flavoured oils. Now operating under the name Fresh and Tasty Microfarm, the company remains committed to sustainable growth while serving local venues.

- In March 2024, Ro-Gro launched the world’s first biofortified B12 pea shoots using ultrasonic aeroponic technology in collaboration with leading UK research institutes. Grown sustainably in vertical farms, the shoots offer a full RDA of B12 in just 15g, targeting plant-based consumers.

UK Microgreens Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Broccoli, Cabbage, Cauliflower, Arugula, Peas, Basil, Radish, Others |

| Farming Methods Covered | Indoor Vertical Farming, Commercial Greenhouses, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Retail Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK Microgreens market performed so far and how will it perform in the coming years?

- What is the breakup of the UK Microgreens market on the basis of type?

- What is the breakup of the UK Microgreens market on the basis of farming method?

- What is the breakup of the UK Microgreens market on the basis of distribution channel?

- What is the breakup of the UK Microgreens market on the basis of end use?

- What is the breakup of the UK Microgreens market on the basis of region?

- What are the various stages in the value chain of the UK Microgreens market?

- What are the key driving factors and challenges in the UK Microgreens market?

- What is the structure of the UK Microgreens market and who are the key players?

- What is the degree of competition in the UK Microgreens market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK Microgreens market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK Microgreens market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK Microgreens industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)