UK Offshore Wind Market Expected to Reach USD 35.21 Billion by 2033 - IMARC Group

UK Offshore Wind Market Statistics, Outlook and Regional Analysis 2025-2033

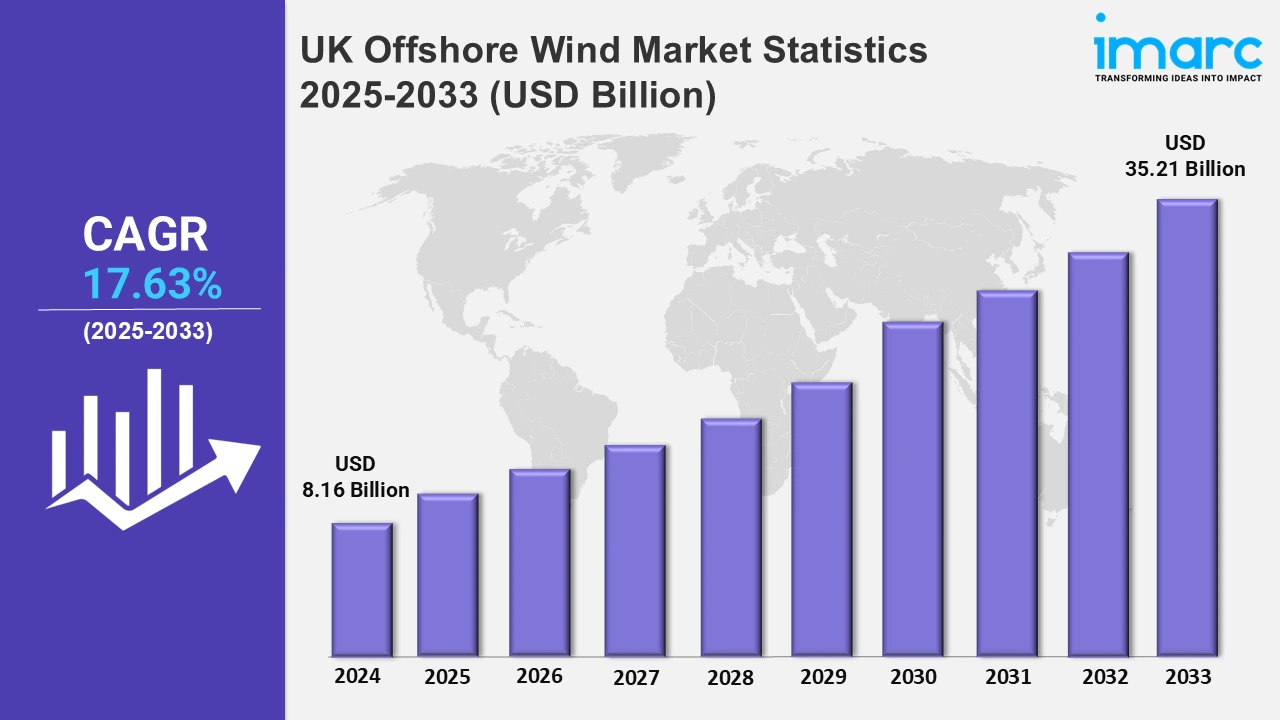

The UK offshore wind market size was valued at USD 8.16 Billion in 2024, and it is expected to reach USD 35.21 Billion by 2033, exhibiting a growth rate (CAGR) of 17.63% from 2025 to 2033.

To get more information on this market, Request Sample

The UK offshore wind market is experiencing significant growth, driven by technological advancements in turbine design and energy storage, which are reducing costs and improving efficiency. The country’s geographical advantages, including consistent wind speeds and vast coastal areas, create an ideal environment for the development of large-scale offshore wind farms. Private sector involvement through strategic partnerships and joint ventures is accelerating project timelines, enabling faster deployment of innovative technologies. For instance, in March 2024, RWE, a leading offshore wind company, acquired three UK projects from Vattenfall. The projects; namely Norfolk Vanguard West, Norfolk Vanguard East, and Norfolk Boreas, have a planned capacity of 1.4 GW individually. Located off Norfolk's coast, they have secured seabed rights, grid connections, and all necessary permits, ensuring readiness for development. Furthermore, increased government support and investment in renewable energy infrastructure are fostering expansion in the sector.

Market trends indicate a shift towards larger turbines, floating wind technology, and hybrid energy systems that integrate offshore wind with hydrogen production. These advancements aim to maximize energy output and address grid intermittency challenges. Significant investments in infrastructure, including subsea cabling and ports, further support the rapid expansion of offshore wind capacity. Financial incentives like Contracts for Difference (CfD) are fostering competitive pricing while ensuring long-term revenue stability for developers. For instance, in September 2024, the UK’s sixth Contracts for Difference (CfD) allocation round supported offshore wind developers with approximately 5.3 GW of new capacity, covering both floating and bottom-fixed offshore wind projects. Additionally, public support for renewable energy and corporate sustainability initiatives are driving demand for green energy, positioning the UK as a global leader in offshore wind innovation and deployment.

UK Offshore Wind Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

London Offshore Wind Market Trends:

London acts as the financial nucleus of the UK offshore wind market, hosting key investors, policymakers, and renewable energy consultancies. Its role in funding, strategic planning, and technological innovation underpins national offshore wind development, making it indispensable for attracting global investments and shaping the market’s regulatory framework.

South East Offshore Wind Market Trends:

The South East supports offshore wind development through advanced manufacturing facilities and strong logistical infrastructure. Proximity to operational wind farms and ports enhances its role in project assembly and maintenance. Regional academic institutions drive innovation, while established transport links facilitate efficient supply chain operations for the offshore wind sector.

North West Offshore Wind Market Trends:

The North West plays a pivotal role in the UK offshore wind market, with its coastal geography hosting major wind farm projects. Regional ports and supply chains provide critical support for operations and maintenance, while the area’s industrial base and skilled workforce contribute to turbine production and installation efficiency.

East of England Offshore Wind Market Trends:

The East of England is a hub for offshore wind projects, benefiting from vast coastal access and excellent wind conditions. It hosts key wind farms and advanced port facilities, supporting logistics and maintenance. A robust local supply chain and workforce make it integral to the UK’s renewable energy objectives.

South West Offshore Wind Market Trends:

The South West is emerging as a leader in floating offshore wind, leveraging its deep waters and strong wind resources. Port upgrades and collaborative research initiatives position the region as a hub for innovation and logistics, strengthening its role in advancing the UK’s renewable energy infrastructure.

Scotland Offshore Wind Market Trends:

Scotland is a frontrunner in the UK offshore wind market, utilizing abundant wind resources and pioneering floating wind technology. Strong government support, extensive port infrastructure, and a skilled workforce drive its dominance, making Scotland a cornerstone of the UK’s renewable energy strategy.

West Midlands Offshore Wind Market Trends:

The West Midlands supports the offshore wind market through advanced manufacturing and engineering expertise. As a key supplier of turbine components, the region plays a crucial role in the sector’s supply chain. Research initiatives in renewable energy technologies further enhance its contributions to offshore wind development.

Yorkshire and The Humber Offshore Wind Market Trends:

Yorkshire and The Humber are central to offshore wind logistics, with their extensive coastline and strategic port facilities. The region’s emphasis on infrastructure development and skilled labor supports wind farm construction and maintenance, solidifying its position as a key player in the UK’s offshore wind market.

East Midlands Offshore Wind Market Trends:

The East Midlands contributes to the offshore wind sector through its manufacturing and engineering capabilities. Despite its inland location, it supplies essential components for wind farm projects, supported by efficient transport networks. The region’s research collaborations further reinforce its role in advancing the renewable energy supply chain.

Competitive Landscape:

The UK offshore wind market is highly competitive, characterized by a mix of established players and emerging firms driving growth through innovation and strategic investments. The market is shaped by increasing project sizes, advancements in turbine technology, and cost reduction strategies that enhance profitability. Collaborative partnerships and joint ventures are common, enabling stakeholders to pool resources and expertise for large-scale developments. For instance, in December 2024, Ørsted secured £75–100 million in contracts to UK companies for the Hornsea 3 offshore wind farm. The project will generate 2.9 GW of electricity, powering over 3.3 million homes. JDR Cable Systems, Severfield, and Smulders will supply key components, supporting more than 300 jobs and strengthening the UK renewable energy sector. Additionally, the market’s focus on floating wind technology and grid integration solutions is intensifying the competition as participants strive to secure leadership in emerging areas of the sector.

UK Offshore Wind Market Segmentation Coverage

- On the basis of the component, the market has been categorized into turbine, substructure, electrical infrastructure, and others. Turbines, the primary energy-generating units, include advanced designs for maximum efficiency. Substructures provide support, comprising fixed foundations or floating platforms based on site conditions. Electrical infrastructure encompasses cables, substations, and grid connections to transmit generated power. These components work together to ensure reliable, efficient energy production and distribution, driving the UK's renewable energy transition.

- Based on the foundation type, the market is classified into fixed foundation and floating foundation. Fixed foundations, such as monopiles and jacket structures, are anchored to the seabed and are suitable for shallow and mid-depth waters. Moreover, floating foundations, designed for deeper waters, use mooring systems and anchors to remain stable. This segmentation enables efficient wind farm deployment across varying marine conditions, supporting the UK’s expansion of offshore wind capacity.

- On the basis of the capacity, the market has been divided into less than 5 MW and greater than or equal to 5 MW. Turbines with less than 5 MW capacity are typically used in smaller projects or older installations. Turbines with capacities of 5 MW or more dominate modern developments, offering higher efficiency and scalability. This segmentation reflects the industry’s shift toward larger, more powerful turbines to optimize energy output and cost-effectiveness.

- Based on the location, the market is segregated into shallow water, transitional water, and deep water. Shallow water installations, typically up to 30 meters deep, use fixed foundations and are cost-effective for nearshore projects. Meanwhile, transitional water, ranging from 30 to 60 meters, accommodates both fixed and floating foundations. Deep water projects, exceeding 60 meters, rely on advanced floating foundations, enabling access to stronger, more consistent wind resources further offshore.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 8.16 Billion |

| Market Forecast in 2033 | USD 35.21 Billion |

| Market Growth Rate 2025-2033 | 17.63% |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Turbine, Substructure, Electrical Infrastructure, Others |

| Foundation Types Covered | Fixed Foundation, Floating Foundation |

| Capacities Covered | Less Than 5 MW, Greater than or Equal to 5 MW |

| Locations Covered | Shallow Water, Transitional Water, Deep Water |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)