UK Online Marketplaces Market Size, Share, Trends and Forecast by Business Model, Product, Payment Mode, Platform Type, End User, and Region, 2026-2034

UK Online Marketplaces Market Summary:

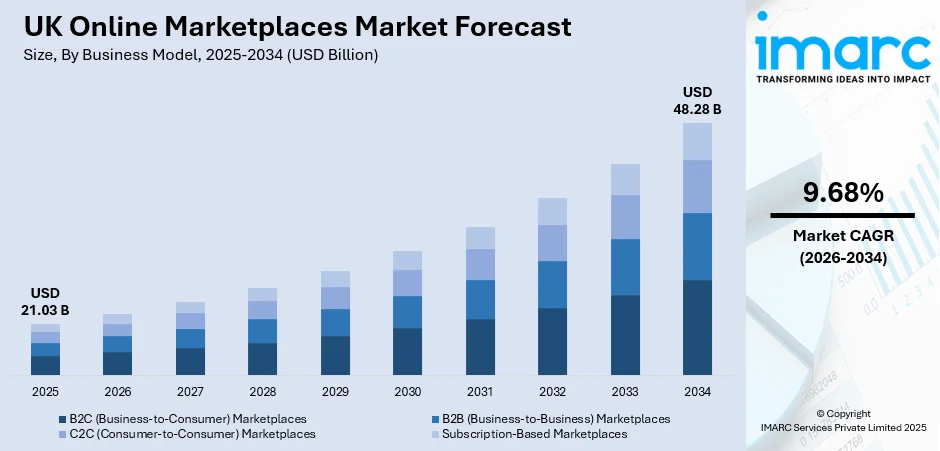

The UK online marketplaces market size was valued at USD 21.03 Billion in 2025 and is projected to reach USD 48.28 Billion by 2034, growing at a compound annual growth rate of 9.68% from 2026-2034.

The UK online marketplaces industry is witnessing tremendous growth driven by the surge in mobile commerce adoption, increasing smartphone penetration rates, and evolving consumer preferences toward convenient digital shopping experiences. The rising demand for sustainable and second-hand products continues to reshape purchasing behaviors across demographic segments. Innovative payment technologies including digital wallets and buy-now-pay-later services are transforming transaction preferences. Social commerce platforms are gaining significant traction among younger consumers, creating new engagement channels. These converging factors are propelling sustained expansion across the UK online marketplaces market share.

Key Takeaways and Insights:

- By Business Model: B2C dominates the market with a share of 58% in 2025, driven by growing individual consumer adoption of digital shopping platforms and increasing preference for convenient online purchasing experiences across diverse product categories.

- By Product: Fashion and apparel leads the market with a share of 28% in 2025, supported by the rising influence of social media trends, fast fashion demand among younger demographics, and seamless mobile shopping experiences.

- By Payment Mode: Credit/Debit cards represent the largest segment with a market share of 45% in 2025, owing to established consumer trust, widespread merchant acceptance, and enhanced security protocols including contactless payment options.

- By Platform Type: Mobile app-based exhibits clear dominance with a 52% share in 2025, reflecting the shift toward smartphone-centric shopping habits and improved mobile user experiences across marketplace applications.

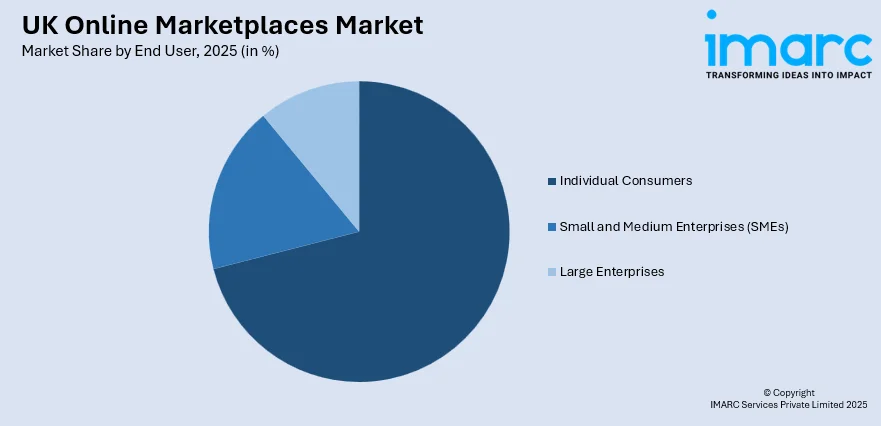

- By End User: Individual consumers hold the largest share of 71% in 2025, attributed to increasing digital literacy, convenience-driven purchasing behaviors, and expanded product accessibility through online platforms.

- Key Players: The UK online marketplaces market exhibits a highly competitive landscape characterized by the dominance of global e-commerce giants alongside emerging domestic platforms. Established multinational corporations maintain substantial market presence through extensive product offerings, advanced logistics networks, and integrated payment solutions, while homegrown marketplaces are gaining traction through localized strategies and niche category specialization.

To get more information on this market Request Sample

The UK online marketplaces ecosystem represents one of Europe's most mature and sophisticated digital commerce environments, characterized by high consumer digital literacy and robust e-commerce infrastructure. The market benefits from internet penetration rate, creating an extensive addressable consumer base across urban and rural regions. According to UK Finance, over 57% of UK adults are now registered mobile wallet users, with adoption rates among individuals aged 65 and over increasing from 14% in 2023 to 25% in 2024, highlighting broadening demographic participation in digital commerce. This bidirectional engagement underscores the platforms' evolution from pure retail channels to comprehensive commerce ecosystems supporting diverse transaction types and participant roles.

UK Online Marketplaces Market Trends:

Rise of Social Commerce and Live Shopping Platforms

Social commerce is fundamentally transforming how British consumers discover and purchase products online, with platforms integrating seamless shopping experiences directly within social media environments. The platform hosts live shopping events daily in the UK market, demonstrating the format's resonance with consumers seeking interactive purchasing experiences. This trend reflects broader shifts toward content-driven commerce where product discovery occurs through entertainment rather than traditional search-based shopping.

Accelerating Mobile Commerce Adoption

Mobile commerce has established itself as the dominant channel for online marketplace transactions, fundamentally reshaping platform development priorities and consumer engagement strategies. UK Finance reports that mobile banking has become the most common method of account access, used by 75% of UK adults, driving corresponding increases in mobile commerce activity. Marketplace operators are responding through enhanced mobile application functionality, streamlined checkout processes, and mobile-optimized product discovery features.

Sustainable Shopping and Second-Hand Marketplace Expansion

Environmental consciousness is driving significant growth in sustainable commerce and second-hand marketplace platforms across the UK. British consumers saved £5.6 billion by purchasing pre-owned products in 2024, with average monthly spending on second-hand goods increasing from £58.40 five years prior to £124.80 currently. Over 199 million products remained in circulation through sales of used, open-box, and refurbished items in 2024, demonstrating substantial environmental impact through extended product lifecycles. Platforms specializing in resale and refurbished goods are experiencing accelerated user growth, particularly among younger demographics who view second-hand purchasing as both economically sensible and environmentally responsible.

Market Outlook 2026-2034:

The UK online marketplaces market is positioned for sustained revenue growth during the forecast period, supported by continued digital adoption, technological innovation, and evolving consumer behaviors. The integration of emerging technologies including augmented reality, voice commerce, and artificial intelligence will enhance shopping experiences and drive engagement across platform types. Expansion of omnichannel retail strategies will blur boundaries between physical and digital commerce, creating integrated purchasing journeys. Growing emphasis on sustainability and ethical consumption will influence marketplace offerings and consumer preferences. Cross-border commerce opportunities and regional logistics investments will extend market reach while addressing delivery expectations. The regulatory environment supporting consumer protection and fair competition will foster marketplace confidence and participation. The market generated a revenue of USD 21.03 Billion in 2025 and is projected to reach a revenue of USD 48.28 Billion by 2034, growing at a compound annual growth rate of 9.68% from 2026-2034.

UK Online Marketplaces Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Business Model | B2C (Business-to-Consumer) Marketplaces | 58% |

| Product | Fashion & Apparel | 28% |

| Payment Mode | Credit/Debit Cards | 45% |

| Platform Type | Mobile App-Based | 52% |

| End User | Individual Consumers | 71% |

Business Model Insights:

- B2C (Business-to-Consumer) Marketplaces

- B2B (Business-to-Business) Marketplaces

- C2C (Consumer-to-Consumer) Marketplaces

- Subscription-Based Marketplaces

The B2C (business-to-consumer) marketplaces segment dominates the UK online marketplaces market with a 58% share in 2025.

The business-to-consumer segment maintains commanding market leadership driven by established consumer purchasing habits and comprehensive platform ecosystems that facilitate seamless product discovery, transaction processing, and fulfillment services. The segment benefits from substantial investments in user experience optimization, personalized recommendation engines, and integrated loyalty programs that encourage repeat purchasing behavior. Major marketplace operators continue expanding product category coverage and seller networks to capture increasing shares of consumer discretionary spending.

The B2C marketplace model leverages network effects where increasing seller participation drives product variety expansion, attracting additional consumer traffic and creating self-reinforcing growth dynamics. Platform operators are implementing advanced technologies including artificial intelligence-powered search functionality, augmented reality product visualization, and voice commerce capabilities to enhance shopping experiences and differentiate from competitors. The segment's growth trajectory reflects broader structural shifts in British retail where digital channels capture increasing shares of total commerce activity. B2B e-commerce channels, while representing smaller current market share, demonstrate accelerating growth rates as corporate buyers migrate procurement activities to self-service digital platforms.

Product Insights:

- Electronics & Appliances

- Fashion & Apparel

- Home and Furniture

- Groceries & FMCG

- Automotive Parts & Accessories

- Books & Stationery

- Health & Wellness

- Others

The fashion & apparel segment leads the UK online marketplaces market with a 28% share in 2025.

Fashion and apparel maintains its position as the leading product category within UK online marketplaces, driven by strong consumer engagement with digital fashion discovery channels and the category's natural compatibility with social commerce formats. The segment benefits significantly from ongoing platform innovations including virtual try-on capabilities, detailed size guidance tools, and user-generated content integration that effectively address traditional barriers to online apparel purchasing. Visual merchandising excellence and influencer partnerships further strengthen fashion marketplace performance across demographic segments.

The fashion category demonstrates particular strength in social commerce channels where visual content formats align naturally with apparel presentation. TikTok Shop's rapid growth has been substantially driven by fashion and beauty categories, with content creators demonstrating products through engaging video formats that drive purchasing decisions. The segment also leads in second-hand and resale marketplace activity, with fashion items representing the most frequently bought and sold category on peer-to-peer platforms. Consumer interest in sustainable fashion is driving growth in circular marketplace models where pre-owned clothing extends product lifecycles while offering price-conscious shoppers access to quality items.

Payment Mode Insights:

- Credit/Debit Cards

- Digital Wallets

- Buy Now, Pay Later (BNPL)

- Cryptocurrency Payments

- Others

Credit/Debit cards hold the largest share with 45% of the UK online marketplaces market in 2025.

Credit and debit cards maintain dominant payment mode positioning within UK online marketplaces, reflecting established consumer trust and widespread merchant acceptance across digital commerce platforms. Card payments benefit from enhanced security protocols including 3D Secure authentication and tokenization technologies that protect sensitive transaction data. The segment's strength reflects British consumers' familiarity with card-based payments and the associated consumer protections that provide transaction dispute resolution mechanisms. In October 2024, UK cardholders made 2.3 billion debit card transactions spending £67.4 Billion, while credit cards recorded 385.6 million transactions worth £21.1 Billion.

While cards maintain market leadership, digital wallets and buy-now-pay-later services demonstrate the fastest growth trajectories within the payment mode segment. Digital wallets have gained substantial adoption among UK consumers for e-commerce payments, with usage rates particularly strong among younger demographics who value the convenience of biometric authentication and streamlined checkout experiences. Buy-now-pay-later usage has increased significantly in recent years according to UK Finance, driven primarily by fashion purchases where BNPL represents a substantial portion of transactions as consumers seek flexible payment options for apparel and accessories.

Platform Type Insights:

- Website-Based Marketplaces

- Mobile App-Based Marketplaces

- Omnichannel Marketplaces

Mobile app-based marketplaces dominates the UK online marketplaces market with a 52% share in 2025.

Mobile application-based marketplace platforms have established clear market leadership, reflecting the fundamental shift toward smartphone-centric commerce behaviors among British consumers. The UK e-commerce market size is projected to reach USD 1,483.7 Billion by 2033, exhibiting a growth rate (CAGR) of 18.1% during 2025-2033, with dedicated marketplace applications offering enhanced functionality including push notifications, personalized recommendations, and streamlined checkout processes.

Marketplace operators are prioritizing mobile application development investments to capture growing smartphone commerce volumes, implementing features including augmented reality product visualization, voice search capabilities, and integrated social sharing functionality. The mobile-first approach aligns with consumer expectations for immediate access to shopping functionality and supports impulse purchasing behaviors that drive incremental transaction volumes. Application-based platforms also facilitate enhanced data collection and customer relationship management through persistent user identification and behavioral tracking capabilities that inform personalization strategies.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Individual consumers accounts for the highest revenue with 71% share of the UK online marketplaces market in 2025.

Individual consumers represent the dominant end user segment within UK online marketplaces, driven by widespread digital commerce adoption and evolving purchasing preferences toward online channels. Consumer engagement with marketplace platforms spans diverse product categories from fashion and electronics to groceries and home goods, with convenience and price comparison capabilities serving as primary adoption drivers.

The individual consumer segment benefits from marketplace platform investments in user experience optimization, including personalized product recommendations, flexible payment options, and convenient delivery services. Younger consumer demographics including Gen Z and Millennials demonstrate particularly high engagement with social commerce features and mobile-first shopping experiences, while older demographics increasingly adopt digital purchasing behaviors across diverse product categories. Consumer value sensitivity remains elevated following cost-of-living pressures, driving engagement with price comparison features and promotional offers across marketplace platforms.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the largest regional market for UK online marketplaces, benefiting from high population density, elevated disposable income levels, and advanced digital infrastructure. The capital's concentration of young professionals and tech-savvy consumers drives substantial marketplace transaction volumes across premium and mass-market categories.

South East ranks as a leading regional market characterized by affluent suburban populations and high e-commerce penetration rates. The region benefits from proximity to major distribution centers and logistics hubs facilitating rapid delivery services that enhance marketplace appeal among convenience-focused consumers.

North West demonstrates strong marketplace engagement driven by major metropolitan centers including Manchester and Liverpool. The region's growing digital economy and expanding logistics infrastructure support accelerating e-commerce adoption among diverse demographic segments across urban and suburban areas.

East of England contributes substantial marketplace activity supported by proximity to major ports and distribution facilities. The region's mix of urban centers and commuter communities generates consistent transaction volumes across household goods, fashion, and consumer electronics categories.

South West exhibits growing marketplace adoption driven by improving last-mile delivery coverage and expanding mobile connectivity. Consumer research indicates residents demonstrate above-average preference for online purchasing, with one in five stating preference to make all purchases through digital channels.

Scotland presents a distinct regional market with strong preference for online shopping among digitally engaged populations. The region benefits from marketplace investments in expanded delivery networks that address geographic coverage challenges and enhance service accessibility across dispersed communities.

West Midlands represents a significant marketplace opportunity centered on Birmingham and surrounding metropolitan areas. The region's demographic diversity and growing e-commerce infrastructure support marketplace growth across multiple product categories including fashion, electronics, and home furnishings.

Yorkshire and The Humber demonstrates consistent marketplace engagement supported by major urban centers including Leeds and Sheffield. The region's established retail heritage and evolving consumer preferences drive adoption across both established marketplace platforms and emerging social commerce channels.

East Midlands contributes to marketplace growth through a combination of urban and rural consumer populations. The region benefits from central geographic positioning within UK logistics networks, facilitating competitive delivery services that support marketplace competitiveness against physical retail alternatives.

Market Dynamics:

Growth Drivers:

Why is the UK Online Marketplaces Market Growing?

Rising Smartphone Penetration and Mobile Commerce Adoption

The proliferation of smartphones and associated mobile commerce capabilities represents a fundamental driver of UK online marketplace expansion, creating ubiquitous access to digital shopping platforms and enabling commerce interactions throughout daily activities. The UK maintains approximately 97.8% internet penetration, with smartphone ownership approaching universal levels among working-age populations. Mobile devices now generate the majority of marketplace traffic and a substantial share of completed transactions, reflecting consumer preference for convenient, on-demand shopping experiences accessible from any location. Marketplace operators have responded through substantial investments in mobile application functionality, implementing features including one-click purchasing, biometric authentication, and personalized notification systems that drive engagement and conversion. The mobile-first transformation extends beyond transaction completion to encompass product discovery, price comparison, and social sharing activities that influence purchasing decisions throughout the consumer journey.

Innovative Payment Solutions and Financial Technology Integration

The rapid evolution of payment technologies including digital wallets, buy-now-pay-later services, and open banking solutions is driving marketplace growth by reducing transaction friction and expanding consumer purchasing power. Digital wallets have achieved mainstream adoption with UK Finance confirming UK adults now registered as mobile wallet users, enabling fast, secure transactions through biometric authentication. Open banking innovations are enabling direct bank-to-bank transactions that reduce processing costs while enhancing security through bank-grade authentication protocols. Payment service providers are developing embedded solutions that simplify merchant integration and streamline consumer checkout experiences across marketplace platforms. These financial technology advances collectively reduce abandoned cart rates and expand the addressable consumer base by accommodating diverse payment preferences and financial circumstances.

Growing Consumer Demand for Sustainable and Second-Hand Products

Environmental consciousness and cost-of-living pressures are converging to drive substantial growth in sustainable commerce and second-hand marketplace platforms across the UK. These trends reflect fundamental shifts in consumer values where environmental responsibility and value optimization increasingly influence purchasing decisions. Marketplace platforms are responding through dedicated resale features, authenticity verification services, and circular economy initiatives that facilitate extended product lifecycles. The combination of affordability benefits and environmental positioning creates compelling value propositions that attract diverse consumer segments including younger demographics who view second-hand purchasing as both economically sensible and socially responsible.

Market Restraints:

What Challenges the UK Online Marketplaces Market is Facing?

Rising Returns Management Costs and Serial Returner Challenges

Returns management represents a significant operational challenge constraining marketplace profitability. Fashion categories experience particularly elevated return rates driven by sizing uncertainties and bracket purchasing behaviors. Retailers face difficult trade-offs between customer experience expectations for convenient returns and the substantial costs associated with reverse logistics, inspection, and restocking activities.

Escalating Fraud and Cybersecurity Threats

Marketplace platforms face increasingly sophisticated fraud tactics that erode profitability and undermine consumer trust. Returns fraud, account takeover attacks, and promotional abuse represent growing concerns as fraudsters adapt to enhanced checkout security measures by targeting pre-purchase and post-purchase vulnerabilities. Cybersecurity investments and fraud prevention technologies create ongoing operational cost pressures for marketplace operators.

Intense Competition and Price Pressure from Ultra-Budget Platforms

The UK marketplace landscape exhibits intense competitive dynamics as established operators face growing pressure from ultra-budget platforms offering aggressive pricing strategies. Transparent pricing tools and value-conscious consumer behaviors following cost-of-living pressures funnel traffic toward lowest-price options, compressing gross margins across product categories. Mid-tier marketplace operators face particular challenges differentiating their value propositions against both premium experience-focused platforms and pure-price competitors, creating strategic positioning difficulties.

Competitive Landscape:

The UK online marketplaces market exhibits a highly competitive environment characterized by the dominance of global e-commerce platforms alongside a diverse ecosystem of specialist and emerging operators. Market leaders maintain substantial competitive advantages through extensive seller networks, comprehensive logistics infrastructure, and integrated payment processing capabilities that create formidable barriers to entry. Established multinational corporations leverage brand recognition, customer trust, and vast product selection breadth to capture commanding market positions across multiple product categories. Domestic marketplace platforms are successfully competing through localized strategies, category specialization, and value propositions emphasizing ethical practices and community engagement. The competitive landscape is undergoing transformation as social commerce platforms gain significant traction, traditional retailers launch marketplace extensions, and second-hand specialists capture growing shares of environmentally conscious consumer spending. Strategic priorities include artificial intelligence implementation for personalized experiences, mobile application functionality enhancement, and sustainable commerce positioning to address evolving consumer expectations.

Recent Developments:

- November 2025: PayPal relaunched in the UK with the introduction of PayPal+, the company's first global loyalty program offering British customers points on purchases made with PayPal balance, linked cards, or Buy Now Pay Later. The relaunch includes new PayPal Debit and Credit Card products enabling both online and in-store transactions with integrated rewards accumulation.

UK Online Marketplaces Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | B2C (Business-to-Consumer) Marketplaces, B2B (Business-to-Business) Marketplaces, C2C (Consumer-to-Consumer) Marketplaces, and Subscription-Based Marketplaces |

| Products Covered | Electronics & Appliances, Fashion & Apparel, Home & Furniture, Groceries & FMCG, Automotive Parts & Accessories, Books & Stationery, Health & Wellness, Others |

| Payment Modes Covered | Credit/Debit Cards, Digital Wallets, Buy Now, Pay Later (BNPL), Cryptocurrency Payment, Others |

| Platform Types Covered | Website-Based Marketplaces, Mobile App-Based Marketplaces, Omnichannel Marketplaces |

| End Users Covered | Individual Consumers, Small & Medium Enterprises (SMEs), Large Enterprises |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK online marketplaces market size was valued at USD 21.03 Billion in 2025.

The UK online marketplaces market is expected to grow at a compound annual growth rate of 9.68% from 2026-2034 to reach USD 48.28 Billion by 2034.

The B2C segment dominated the market with a 58% share in 2025, driven by widespread consumer adoption of digital shopping platforms and comprehensive marketplace ecosystems facilitating convenient product discovery, transaction processing, and fulfillment services across diverse product categories.

Key factors driving the UK online marketplaces market include rising smartphone penetration and mobile commerce adoption, innovative payment solutions including digital wallets and buy-now-pay-later services, growing consumer demand for sustainable and second-hand products, and the emergence of social commerce platforms.

Major challenges include rising returns management costs, escalating fraud and cybersecurity threats, intense competition from ultra-budget platforms compressing margins, and operational complexities in delivery logistics and fulfilment infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)