UK Online Music Streaming Market Size, Share, Trends and Forecast by Service, Revenue Model, Platform, Content Type, End User, and Region, 2025-2033

UK Online Music Streaming Market Size and Share:

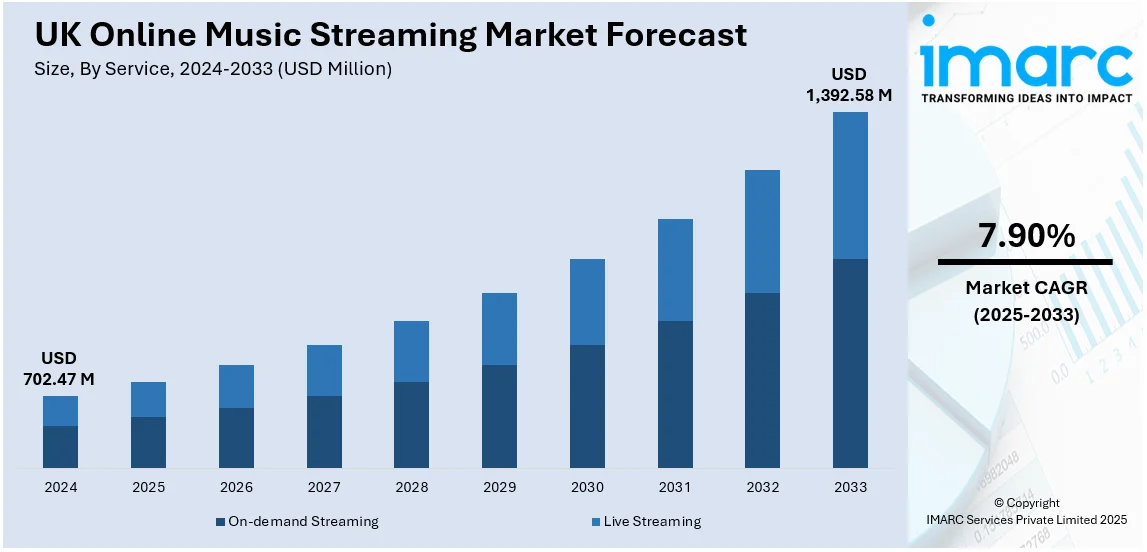

The UK online music streaming market size reached USD 702.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,392.58 Million by2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is growing due to regulatory changes ensuring fair artist compensation, transparent payments, and AI-generated music policies. Live streaming and virtual concerts are driving engagement and revenue, with platforms leveraging digital performances, interactive features, and immersive technologies to expand audience reach and monetization opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 702.47 Million |

| Market Forecast in 2033 | USD 1,392.58 Million |

| Market Growth Rate (2025-2033) | 7.90% |

UK Online Music Streaming Market Trends:

Regulatory and Licensing Agreements

Changing regulatory policies and licensing agreements are shaping the framework of the UK online music streaming industry. Copyright regulations, artist earnings, and equitable compensation systems are central to the ongoing discussions among platforms, record companies, and musicians. The regulatory bodies and governing authority are examining policies concerning equitable compensation for musicians, focusing on discussions about larger revenue shares for artists and clearer payment structures. Streaming services are reworking licensing agreements to align with new regulations while maintaining a viable revenue strategy. Moreover, direct artist licensing and autonomous distribution methods are becoming more popular, enabling musicians to circumvent conventional labels and secure greater revenue percentages. New conversations regarding music produced by artificial intelligence (AI) and intellectual property rights are influencing industry regulations. As regulatory frameworks evolve, streaming services face compliance challenges while striving for profitability and fair artist compensation, which affects future market strategies and revenue distribution models. In 2023, the UK music sector committed to enhancing music streaming metadata to guarantee precise and prompt recognition of songwriters and creators. This voluntary accord sought to improve the standard of metadata for new recordings within two years, incorporating feedback from different industry organizations. The deal was part of the government’s effort to tackle problems in the music streaming industry.

Live Streaming and Virtual Concerts

The combination of live streaming and virtual concerts has improved user interaction in the UK's online music streaming industry. Top platforms are partnering with artists to provide unique live shows, exclusive behind-the-scenes footage, and virtual album releases. The move to digital concerts gained momentum during the pandemic and has persisted as a revenue-generating strategy, enabling artists to connect with global audiences without geographical constraints. Ticketed live broadcasts and pay-per-view occasions have offered artists extra revenue, while interactive elements like live chat and fan interaction tools have strengthened artist-audience bonds. Certain platforms are additionally integrating augmented reality (AR) and virtual reality (VR) experiences, providing more engaging live performances. With artists and record labels seeking innovative ways to profit from digital concerts, live streaming is emerging as a crucial factor that sets music platforms apart, enhancing both audience interaction and revenue opportunities. In 2024, Amazon Music revealed intentions to broaden its City Sessions live music streaming initiative globally, featuring UK performances later in the year. This project sought to provide close-up performances to fans throughout the UK.

UK Online Music Streaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service, revenue model, platform, content type, and end user.

Service Insights:

- On-demand Streaming

- Live Streaming

The report has provided a detailed breakup and analysis of the market based on the service. This includes on-demand streaming and live streaming.

Revenue Model Insights:

- Subscription

- Non-Subscription

A detailed breakup and analysis of the market based on the revenue model have also been provided in the report. This includes subscription and non-subscription.

Platform Insights:

- App

- Browser

The report has provided a detailed breakup and analysis of the market based on the platform. This includes app and browser.

Content Type Insights:

- Audio

- Video

A detailed breakup and analysis of the market based on the content type have also been provided in the report. This includes audio and video.

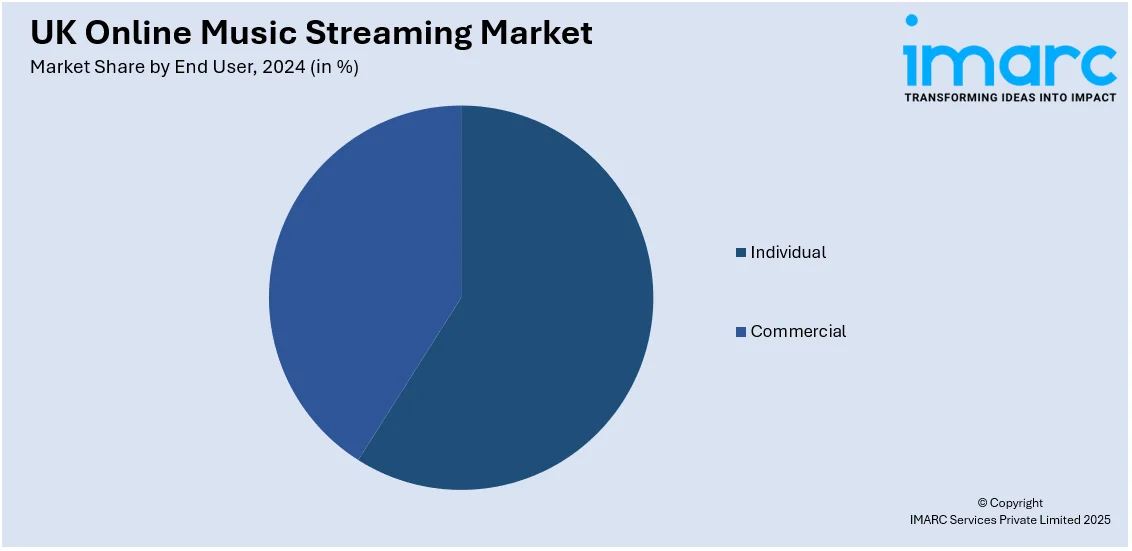

End User Insights:

- Individual

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual and commercial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Online Music Streaming Market News:

- In November 2024, Nintendo introduced the Nintendo Music app for Switch Online subscribers, featuring classic video game soundtracks from series such as Super Mario, The Legend of Zelda, and Animal Crossing. The application enabled users in the UK and various other nations to stream and download music, assemble customized playlists, and share them with others.

- In October 2023, Amigo Holdings, a subprime lender based in the UK, revealed intentions to enter the music and film streaming arena by negotiating an agreement with Craven House Capital. The agreement pertained to acquiring streaming platforms such as ONE Bas.com and TV Zinos in return for shares in Amigo.

UK Online Music Streaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | On-demand Streaming, Live Streaming |

| Revenue Models Covered | Subscription, Non-Subscription |

| Platforms Covered | App, Browser |

| Content Types Covered | Audio, Video |

| End Users Covered | Individual, Commercial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK online music streaming market performed so far and how will it perform in the coming years?

- What is the breakup of the UK online music streaming market on the basis of service?

- What is the breakup of the UK online music streaming market on the basis of revenue model?

- What is the breakup of the UK online music streaming market on the basis of platform?

- What is the breakup of the UK online music streaming market on the basis of content type?

- What is the breakup of the UK online music streaming market on the basis of end user?

- What is the breakup of the UK online music streaming market on the basis of region?

- What are the various stages in the value chain of the UK online music streaming market?

- What are the key driving factors and challenges in the UK online music streaming market?

- What is the structure of the UK online music streaming market and who are the key players?

- What is the degree of competition in the UK online music streaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK online music streaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK online music streaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK online music streaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)