UK Open Banking Market Size, Share, Trends and Forecast by Services, Deployment, Distribution Channel, and Region, 2026-2034

UK Open Banking Market Summary:

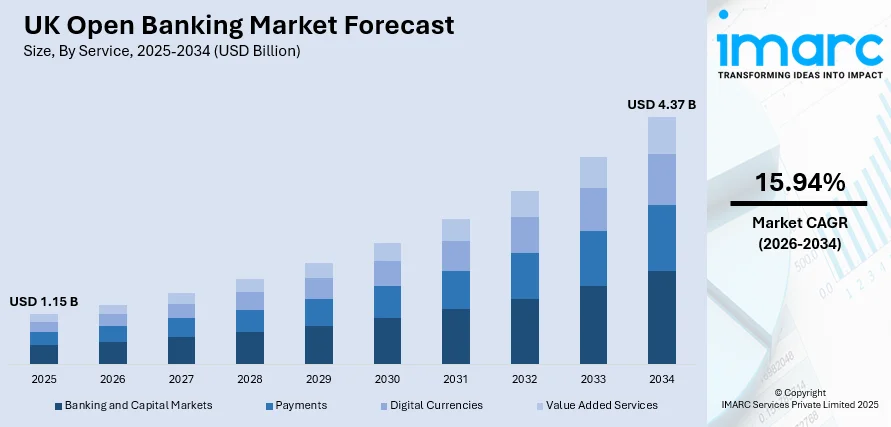

The UK open banking market size was valued at USD 1.15 Billion in 2025 and is projected to reach USD 4.37 Billion by 2034, growing at a compound annual growth rate of 15.94% from 2026-2034.

The region market is experiencing dynamic growth as digital transformation reshapes financial services, enhancing accessibility and efficiency. Advanced service offerings in banking and capital markets, combined with widespread cloud-based deployments, enable secure and scalable operations. Strong distribution channels ensure seamless delivery of innovative solutions to consumers and businesses. Continuous improvements in API infrastructure, integration of intelligent technologies, and focus on user-centric experiences are driving the evolution of the market, fostering a robust ecosystem for modern financial services and open finance initiatives.

Key Takeaways and Insights:

- By Service: Banking and capital markets hold the largest market share at 40% in 2025, establishing themselves as the primary driver of open banking adoption as traditional banks integrate API-based financial ecosystems and third-party provider partnerships.

- By Deployment: Cloud-based solutions dominate the market with 75% share in 2025, enabling scalable API infrastructure, cost-efficient operations, and rapid deployment of open banking services across financial institutions and fintech providers.

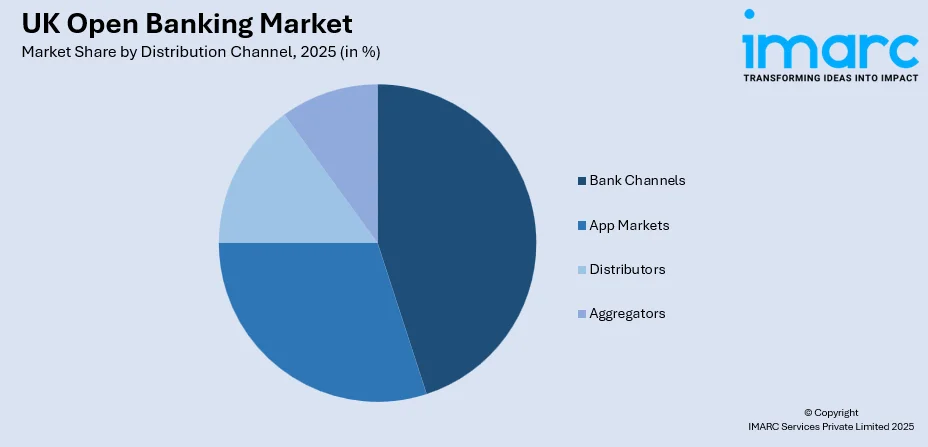

- By Distribution Channel: Bank channels lead the market with 40% share in 2025, reflecting the strategic importance of established banking networks in delivering open banking services directly to consumers and businesses.

- Key Players: The UK open banking market features intense competition among technology providers, payment platforms, and financial institutions, with established players investing heavily in API development, security enhancements, and strategic partnerships to strengthen market positioning.

To get more information on this market, Request Sample

The regional market is witnessing a transformation driven by the adoption of interconnected financial platforms and modern digital solutions. Enhanced cloud infrastructures enable agile service deployment and reliable access across multiple channels. Emphasis on user-centric design and secure data sharing supports personalized financial management. In March 2025, Lloyds Banking Group migrated major data science and AI platforms to Google Cloud’s Vertex AI, enabling faster AI deployment, personalised financial services, and reducing mortgage income verification from days to seconds. Furthermore, collaboration among diverse financial and technology providers fosters innovative product development, efficient transaction processing, and seamless integration of advanced tools. As the ecosystem matures, it encourages broader participation, promotes operational efficiency, and cultivates a forward-looking environment that adapts to evolving consumer needs and emerging trends in the financial services sector.

UK Open Banking Market Trends:

Digital Payment Adoption

Across the UK, regional markets are witnessing accelerated adoption of digital payment methods, driven by consumer demand for efficiency and convenience. In June 2025, Open Banking Limited and UK regulators outlined plans to launch Commercial Variable Recurring Payments (cVRPs), allowing limited-scope recurring account-to-account payments for consumers and businesses via APIs. Moreover, open banking APIs are enabling seamless integration with local financial services, allowing instant account-to-account transfers, mobile payments, and frictionless transactions. This shift is modernising everyday monetary interactions, enhancing financial accessibility, and supporting businesses and consumers in adopting faster, more secure, and user-friendly payment solutions across diverse regions.

Regional Fintech Collaboration

Collaboration between banks and local fintech ecosystems is strengthening regional financial markets. Partnerships foster innovation, enabling the development of advanced payment tools, data-driven solutions, and personalised financial services. Knowledge sharing and joint initiatives support modern infrastructure, improve operational efficiency, and encourage widespread adoption of new technologies. This cooperative approach accelerates digital transformation, enhances financial accessibility, and builds resilient, future-ready financial ecosystems across urban and emerging regional hubs. In October 2024, Open Banking Limited met Scottish fintech leaders, banks, and regulators to collaboratively discuss open banking, smart data adoption, and partnerships, fostering innovation, streamlined services, and improved consumer financial experiences.

Expansion of Smart Data Services

The adoption of smart data services is reshaping the UK financial landscape. By analysing consumer spending, payment patterns, and transactional behaviour, financial platforms deliver personalised insights, budgeting tools, and tailored investment guidance. This enables more informed financial decisions, fosters engagement between consumers and service providers, and supports regional markets in creating adaptive, data-driven ecosystems that prioritise efficiency, convenience, and enhanced user experience. In May 2024, Stripe launched its first UK open banking-powered payment method, Pay by Bank, enabling real-time, low-cost payments and faster manual payouts for businesses.

Market Outlook 2026-2034:

The UK open banking market is poised for sustained expansion as regulatory support, technological innovation, and consumer adoption converge to drive growth. The rollout of commercial variable recurring payments, expansion into e-commerce applications, and transition toward open finance will unlock new revenue streams. In October 2025, Yavrio CEO John Lewis celebrated the fintech’s recognition as one of CNBC’s Top UK Fintechs 2025, following a $2.4M Seed round led by Fuel Ventures, highlighting its leadership in embedded banking and enterprise finance. Further, continued investment in API infrastructure, cloud capabilities, and security technologies will enhance service reliability and consumer trust, supporting mainstream adoption across retail and business banking segments. The market generated a revenue of USD 1.15 Billion in 2025 and is projected to reach a revenue of USD 4.37 Billion by 2034, growing at a compound annual growth rate of 15.94% from 2026-2034.

UK Open Banking Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service | Banking and Capital Markets | 40% |

| Deployment | Cloud-based | 75% |

| Distribution Channel | Bank Channels | 40% |

Service Insights:

- Banking and Capital Markets

- Payments

- Digital Currencies

- Value Added Services

The banking and capital markets dominates with a market share of 40% of the total UK open banking market in 2025.

Banking and capital markets segment forms the backbone of open banking services, driving integration between traditional banks and fintech providers. This segment enables secure access to account information, payment initiation, and financial management tools, supporting personalised solutions. Collaboration across institutions fosters innovation, operational efficiency, and enhanced customer experiences within the UK’s financial ecosystem. In October 2024, Santander UK partnered with Token.io to enable real-time account-to-account payments for credit card repayments, streamlining processes and enhancing customer experience through open banking.

This segment is essential for implementing advanced payment systems, data-driven financial analytics, and third-party provider partnerships. Banks leverage APIs to expand service offerings, improve transparency, and meet evolving regulatory standards. The synergy between legacy institutions and emerging fintech firms in this segment strengthens the overall financial infrastructure, supporting sustainable growth and fostering a competitive and innovative market environment.

Deployment Insights:

- Cloud-based

- On-premises

The cloud-based leads with a share of 75% of the total UK open banking market in 2025.

Cloud-based deployment dominates open banking infrastructure, offering scalable, flexible, and cost-efficient solutions for financial institutions and fintech providers. It enables rapid integration of APIs, enhances operational reliability, and supports real-time processing, while facilitating seamless data sharing across diverse platforms. In September 2024, GoCardless completed the acquisition of Nuapay, boosting its account-to-account payment offerings and enabling expansion across payroll, utilities, insurance, and gaming sectors. Moreover, cloud adoption drives innovation and strengthens the digital financial ecosystem.

This deployment model allows institutions to manage high-volume transactions and integrate advanced technologies like AI and ML. Cloud infrastructure ensures secure and resilient operations, improves accessibility, and supports collaboration across banks and technology partners. Its flexibility fosters experimentation with new financial products, enhancing customer experience and accelerating open banking adoption across the market.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Bank Channels

- App Markets

- Distributors

- Aggregators

The bank channels exhibits a clear dominance with a 40% share of the total UK open banking market in 2025.

Bank channels remain the primary route for delivering open banking services to consumers and businesses. In May 2024, Stripe launched its first open banking-powered payment method, Pay by Bank, in the UK, enabling businesses to offer direct bank payments with lower costs and real-time processing. Moreover, established relationships, regulatory compliance, and trusted interfaces allow banks to facilitate secure data sharing, payment initiation, and personalised financial services. This channel strengthens consumer confidence and drives mainstream adoption of digital banking solutions.

Leveraging bank channels, institutions can integrate third-party solutions directly into existing banking platforms, offering a seamless user experience. This channel supports widespread access to innovative services while maintaining regulatory oversight and data security. By connecting traditional banks with digital providers, it ensures consistent, reliable, and convenient delivery of open banking products to end-users.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London drives advancement through its dense fintech ecosystem, strong regulatory environment, and early adoption of secure digital services. Banks, startups, and technology firms collaborate extensively, enabling smoother payments, personalised financial tools, and widespread use of data-driven solutions across both consumer and business segments.

The South East contributes through its expanding financial services base, rising digital participation, and growing acceptance of innovative financial tools. Strong regional connectivity, skilled talent, and established institutions encourage collaboration that enhances payment efficiency, financial transparency, and the adoption of modern data-sharing capabilities among households and enterprises.

The North West supports growth through its established financial hubs, active technology communities, and increasing demand for seamless digital transactions. Regional businesses and consumers are steadily integrating advanced tools, encouraging a more connected financial environment that promotes efficiency, transparency, and better management of personal and commercial finances.

The East of England advances progress through improving digital infrastructure, rising interest in modern financial applications, and strong participation from businesses seeking smarter financial insights. Collaboration between technology firms and financial institutions encourages innovation, enabling more flexible services and secure user experiences for a diverse regional population.

The South West contributes through expanding digital adoption, growing fintech engagement, and heightened interest in secure electronic payments. Local enterprises and consumers increasingly rely on streamlined tools that improve financial control, while partnerships between institutions support broader access to reliable and user-friendly digital services.

Scotland plays a leading role with its historic financial sector, vibrant fintech clusters, and strong commitment to secure digital innovation. Businesses and consumers actively adopt new financial tools, supported by robust infrastructure and collaborative initiatives that strengthen trust, enhance efficiency, and encourage widespread regional participation.

The West Midlands drives development through increased digital readiness, strengthened business involvement, and expanding integration of innovative tools that support financial planning. Collaboration among institutions, technology providers, and local organisations enhances user experiences, improves operational efficiency, and broadens access to flexible, secure financial solutions across the region.

Yorkshire and The Humber support expansion through growing fintech activity, rising awareness of digital services, and local enterprises seeking efficient payment methods. The region’s evolving financial landscape fosters collaboration and innovation, helping to deliver more accessible, reliable, and tailored financial tools for both consumers and businesses.

The East Midlands contributes by embracing digital financial platforms, encouraging fintech participation, and supporting broader use of tools that improve decision-making. Strengthened connectivity and regional cooperation enable smoother transactions, greater transparency, and enhanced financial management capabilities for various consumer and business groups.

Other regions collectively reinforce national progress by developing digital infrastructure, encouraging widespread adoption of secure technologies, and supporting innovation across local financial ecosystems. Their combined efforts promote efficiency, improve user confidence, and ensure that modern, accessible solutions reach communities of different sizes and economic profiles.

Market Dynamics:

Growth Drivers:

Why is the UK Open Banking Market Growing?

Technological Integration Driving Market Expansion

The growth of the region market is driven by the integration of advanced technologies within financial services. Enhanced API frameworks, cloud infrastructure, and automation tools enable seamless data exchange and real-time processing. As per sources, in July 2025, Open Banking in the UK reached over 15.16 million users, with services used 2.04 billion times, driven largely by payments and rising consumer trust. Further, this foundation allows providers to offer personalised solutions, improve operational efficiency, and foster innovative products that meet evolving consumer and business needs. Continuous technological adoption positions the region as a hub for efficient, modern, and scalable financial ecosystems.

Rising Demand for Consumer-Centric Services

Increasing demand for personalised, convenient, and secure financial experiences is fueling market growth. Consumers seek tailored payment options, account management tools, and data-driven financial insights aligned with individual needs. In July 2025, Snoop’s budgeting app and new Easy Access Savings Account leveraged open banking data to deliver personalised insights, helping UK users build savings habits and improve financial wellbeing. Moreover, providers focus on delivering user-friendly interfaces, intuitive digital solutions, and flexible products, enhancing engagement, accessibility, and satisfaction, which fosters long-term adoption and loyalty across personal and business financial segments.

Supportive Regulatory Frameworks Encouraging Innovation

Regulatory support is promoting the development and expansion of the regional financial market. Clear guidelines, open banking mandates, and secure data sharing policies create a reliable environment for innovation. These frameworks empower financial institutions and fintech providers to launch new services and implement advanced infrastructure confidently, driving market growth while ensuring compliance, security, and consumer protection within a transparent ecosystem.

Market Restraints:

What Challenges the UK Open Banking Market is Facing?

Data Privacy and Security Concerns

Stringent data privacy and security requirements can restrain the region market by limiting the speed of adoption and implementation of new services. Protecting sensitive financial and personal information requires robust encryption, monitoring, and governance measures. Compliance with evolving security standards adds complexity to operations, increasing costs and slowing innovation while ensuring consumer trust remains intact.

Infrastructure and System Limitations

Legacy infrastructure and uneven technology deployment can impede market growth. Outdated systems may struggle to support modern digital services, leading to slower processing, reduced reliability, and limited scalability. These limitations necessitate continuous investment in upgrades and integration, making it challenging for smaller providers to compete effectively and deliver seamless experiences across diverse financial channels.

Complex Regulatory and Compliance Requirements

Navigating multifaceted regulatory frameworks can restrict market flexibility and innovation. Compliance demands require thorough reporting, secure data handling, and adherence to operational standards, which can increase operational complexity. Providers must allocate significant resources to maintain regulatory alignment, potentially diverting focus from product development and slowing the rollout of new financial solutions within the region.

Competitive Landscape:

The UK open banking market exhibits a highly competitive landscape characterised by the presence of established financial technology providers, payment platforms, and infrastructure specialists. Leading companies are focusing on expanding API capabilities, enhancing security features, and developing innovative payment solutions to differentiate their offerings. Strategic partnerships between traditional banks and fintech providers are accelerating product development and market expansion. Investment in cloud infrastructure, artificial intelligence integration, and variable recurring payment functionality represents key competitive priorities. Market participants are also prioritising regulatory compliance, consumer protection measures, and seamless user experiences to build trust and drive adoption across retail and business segments.

Recent Developments:

- In October 2025, The Financial Conduct Authority announced a partnership with Raidiam to accelerate delivery of open finance in the UK. The collaboration will provide Smart Data Sprint participants with access to a testing environment mirroring real-world conditions, supporting development of mortgage and SME finance use cases.

- In May 2025, Cardstream partnered with Mastercard to enhance its Payment Facilitation-as-a-Service platform, enabling UK merchants to accept open banking payments alongside cards, supporting single immediate and variable recurring payments, and providing secure, seamless bank connectivity to expand payment options for businesses and consumers.

- In September 2024, the CMA confirmed the full completion of the UK Open Banking Roadmap, with all nine mandated banks implementing required functionalities, including variable recurring payments, enhancing financial control, smarter payments, and enabling fintech innovation across the UK’s open banking ecosystem.

UK Open Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Banking and Capital Markets, Payments, Digital Currencies, Value Added Services |

| Deployments Covered | Cloud-based, On-premises |

| Distribution Channels Covered | Bank Channels, App Markets, Distributors, Aggregators |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK open banking market size was valued at USD 1.15 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 15.94% from 2026-2034 to reach USD 4.37 Billion by 2034.

Banking and capital markets holds the largest revenue share of 40%, driven by the foundational role of traditional banks in enabling API-based financial ecosystems and regulatory mandates requiring data access through third-party providers.

Key factors driving UK open banking market growth are robust regulatory frameworks, increasing consumer and business adoption, advanced API and cloud technologies, expansion of variable recurring payments, enhanced security, and the transition toward open finance solutions.

Major challenges include fraud and cybersecurity vulnerabilities across the interconnected ecosystem, limited consumer awareness of open banking terminology and benefits, infrastructure performance disparities between providers, and the complexity of establishing commercially sustainable frameworks for new services.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)