UK Outsourced IT Services Market Size, Share, Trends and Forecast by Service, Location, Enterprise Size, End Use, and Region, 2025-2033

UK Outsourced IT Services Market Overview:

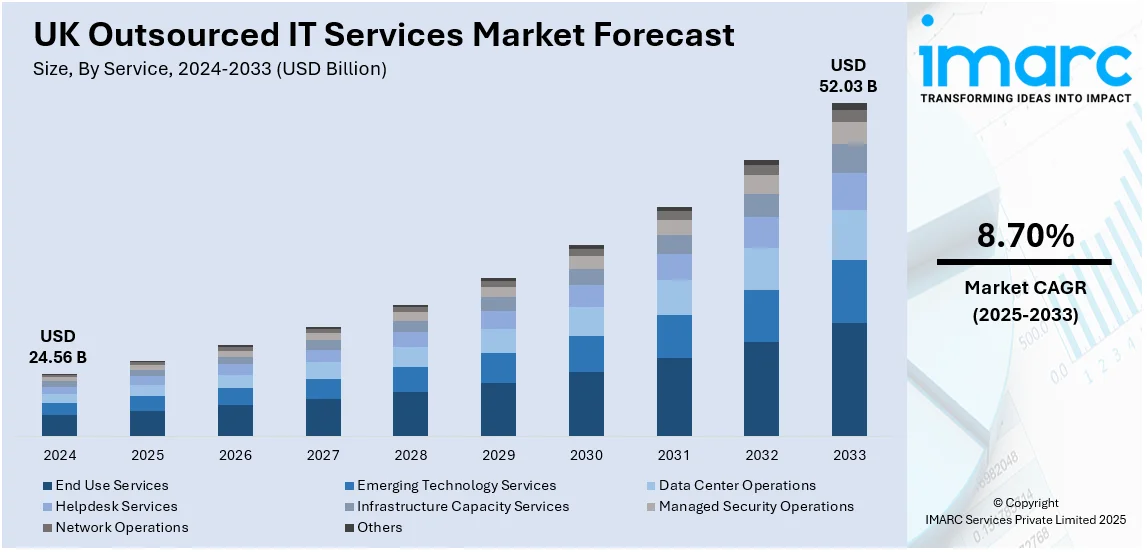

The UK outsourced IT services market size reached USD 24.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 52.03 Billion by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The UK outsourced IT services market share is expanding, driven by the rising need for cost efficiency, encouraging collaboration between IT firms and specialized service providers to allocate resources effectively, along with the increasing access to expertise and advanced tools that aid businesses in enhancing their IT capabilities and improving service delivery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.56 Billion |

| Market Forecast in 2033 | USD 52.03 Billion |

| Market Growth Rate 2025-2033 | 8.70% |

UK Outsourced IT Services Trends:

Growing Need for Cost Efficiency

The increasing need for cost efficiency is impelling the UK outsourcing IT services market growth. These services allow businesses to significantly reduce operational costs by avoiding the expenses associated with maintaining in-house IT infrastructure, technology, and staffing. By partnering with specialized service providers, companies can leverage economies of scale, avoid capital expenditure, and benefit from predictable operational costs. This cost-effective approach enables businesses to allocate resources more effectively and focus on their core competencies. For instance, in September 2023, Marex, the diversified worldwide financial services platform in the UK, stated that it reached an agreement to purchase Cowen’s legacy prime brokerage and outsourced trading operations, as it aimed to broaden and diversify its services and client portfolio. Cowen’s legacy prime brokerage and outsourced trading operations represented a top service provider, delivering a comprehensive suite of services, such as multi-asset-class custody, financing options, security lending, high and low touch execution, and associated technology solutions, along with capital introduction. This acquisition strengthened Marex's offering of critical market infrastructure that linked clients to markets and granted it an expanded existing client base of asset managers. The deal further branched out Marex’s operations, as it kept growing into financial market items and services, greatly enhancing its range of products and asset class coverage.

Rising Access to Expertise and Advanced Technology

The rapidly evolving technology landscape requires businesses to stay competitive by utilizing the latest innovations and specialized skills, which is offering a favorable UK outsourcing IT services market outlook. Outsourced IT services provide access to cutting-edge technologies and highly skilled professionals without the need for extensive internal investment. This access to expertise and advanced tools helps businesses to enhance their IT capabilities, improve service delivery, and stay agile in a fast-paced market, ultimately supporting the market growth and efficiency. For instance, in 2024, Digital Space was one of the first managed security service providers to unveil ‘Unified secure access service edge (SASE)’ to the UK mid-market. This was a huge advancement for corporate businesses, as they aimed to adopt a managed Unified SASE solution that intended to meet their additional needs like flexibility, scalability, simplicity, and resources. SASE is no longer ‘reserved’ for the enterprise world or only offered by global IT giants. Digital Space is always developing and refining its product portfolio to provide customers with innovative and modern solutions that enable them to stay ahead of the curve.

UK Outsourced IT Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service, location, enterprise size, and end use.

Service Insights:

- End Use Services

- Emerging Technology Services

- Data Center Operations

- Helpdesk Services

- Infrastructure Capacity Services

- Managed Security Operations

- Network Operations

- Others

The report has provided a detailed breakup and analysis of the market based on the services. This includes end use services, emerging technology services, data center operations, helpdesk services, infrastructure capacity services, managed security operations, network operations, and others.

Location Insights:

- On-shore

- Off-shore

A detailed breakup and analysis of the market based on the locations have also been provided in the report. This includes on-shore and off-shore.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises (SME’s)

The report has provided a detailed breakup and analysis of the market based on the enterprise sizes. This includes large enterprises and small and medium enterprises (SME’s).

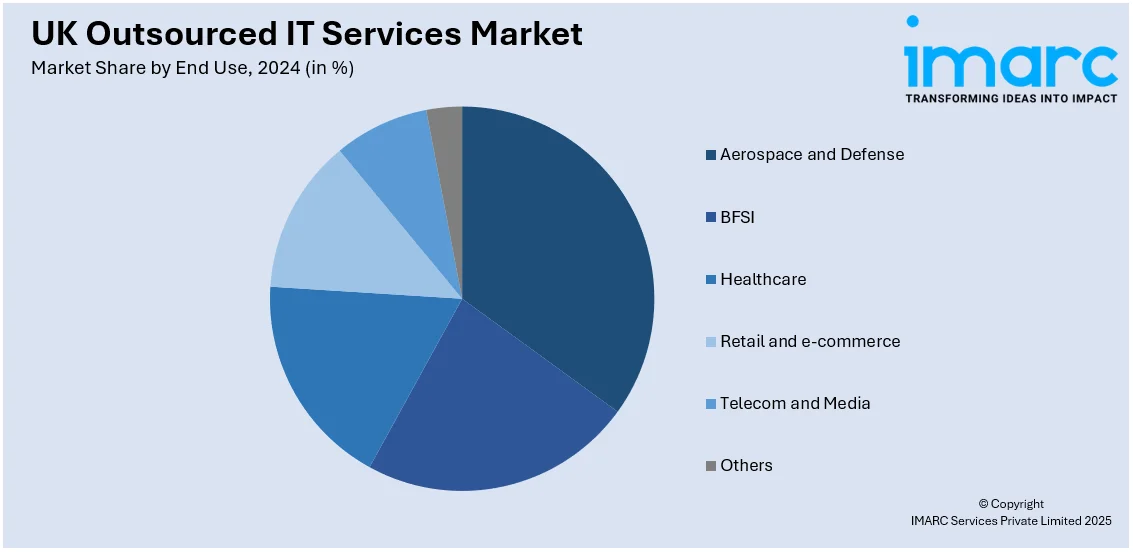

End Use Insights:

- Aerospace and Defense

- BFSI

- Healthcare

- Retail and e-commerce

- Telecom and Media

- Others

A detailed breakup and analysis of the market based on the end uses have also been provided in the report. This includes aerospace and defense, BFSI, healthcare, retail and e-commerce, telecom and media, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Outsourced IT Services News:

- In July 2024, Wipro Holdings (UK) moved its complete stake in Wipro Financial Outsourcing Services Ltd to Wipro IT Services UK Societas, in a bid to streamline and simplify the overall group structure. Consequently, Wipro IT Services UK Societas would own a complete 100% stake in Wipro Financial Outsourcing Services.

UK Outsourced IT Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | End Use Services, Emerging Technology Services, Data Center Operations, Helpdesk Services, Infrastructure Capacity Services, Managed Security Operations, Network Operations, Others |

| Locations Covered | On-shore, Off-shore |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises (SME’s) |

| End Uses Covered | Aerospace and Defense, BFSI, Healthcare, Retail and e-commerce, Telecom and Media, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK outsourced IT services market performed so far and how will it perform in the coming years?

- What is the breakup of the UK outsourced IT services market on the basis of service?

- What is the breakup of the UK outsourced IT services market on the basis of location?

- What is the breakup of the UK outsourced IT services market on the basis of enterprise size?

- What is the breakup of the UK outsourced IT services market on the basis of end use?

- What are the various stages in the value chain of the UK outsourced IT services market?

- What are the key driving factors and challenges in the UK outsourced IT services?

- What is the structure of the UK outsourced IT services market and who are the key players?

- What is the degree of competition in the UK outsourced IT services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK outsourced IT services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK outsourced IT services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK outsourced IT services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)