UK Paneer Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

UK Paneer Market Overview:

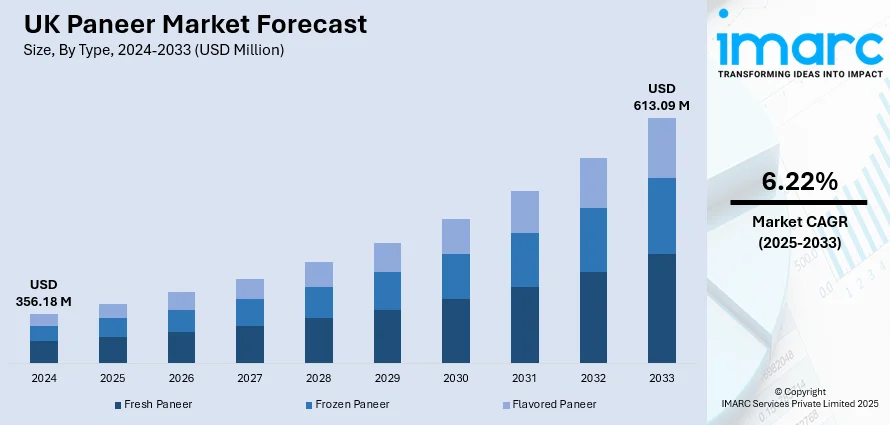

The UK paneer market size reached USD 356.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 613.09 Million by 2033, exhibiting a growth rate (CAGR) of 6.22% during 2025-2033. Rising demand from the South Asian diaspora, growing vegetarian population, expanding retail presence, increasing popularity of Indian cuisine, and higher disposable incomes are some of the factors contributing to the UK paneer market share. Health perceptions around high-protein dairy and the convenience of ready-to-cook paneer products are also supporting its growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 356.18 Million |

| Market Forecast in 2033 | USD 613.09 Million |

| Market Growth Rate 2025-2033 | 6.22% |

UK Paneer Market Trends:

Surge in Local Artisanal Paneer Production

A growing segment of UK-based food entrepreneurs is tapping into the demand for fresh, minimally processed paneer by offering small-batch, locally produced options. Independent dairies and family-run businesses are marketing their paneer as preservative-free and handmade, often highlighting British milk as a selling point. This has appealed to younger consumers who care about short supply chains and are willing to pay extra for quality. Many of these businesses operate through farmers' markets, independent grocery stores, and direct-to-door delivery models. They're also gaining attention through social media, with recipe videos, behind-the-scenes footage, and collaborations with local chefs. As a result, these artisanal products are slowly edging into restaurant kitchens and boutique delis. Unlike standard frozen imports, this fresh paneer is positioned as a premium product that aligns with evolving food preferences—especially among health-conscious urban buyers and vegetarians seeking variety beyond tofu or halloumi. These factors are intensifying the UK paneer market growth.

To get more information on this market, Request Sample

Rising Paneer Imports Driven by Convenience Foods

UK retailers are stocking more frozen and pre-cubed paneer, most of it imported from India. The primary driver is the growth in ready-to-cook Indian meals and curry kits, especially among non-South Asian households looking to replicate restaurant-style dishes at home. Supermarket chains have expanded their “world foods” sections, and paneer is now more commonly included alongside chicken tikka kits or butter chicken sauces. This trend is also tied to the growth of frozen Indian food brands that include paneer as a key protein component in curries and wraps. For many buyers, convenience is the deciding factor; microwavable saag paneer or pre-grilled tikka cubes save time and reduce cooking effort. These products often come with long shelf lives and aggressive pricing, making them more appealing for bulk purchases. Imports have allowed mainstream brands to fill this gap at scale, reducing dependence on local supply and meeting the expectations of a wider demographic that sees paneer as a novelty ingredient for occasional indulgence.

UK Paneer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Fresh Paneer

- Frozen Paneer

- Flavored Paneer

The report has provided a detailed breakup and analysis of the market based on the type. This includes fresh paneer, frozen paneer, and flavored paneer.

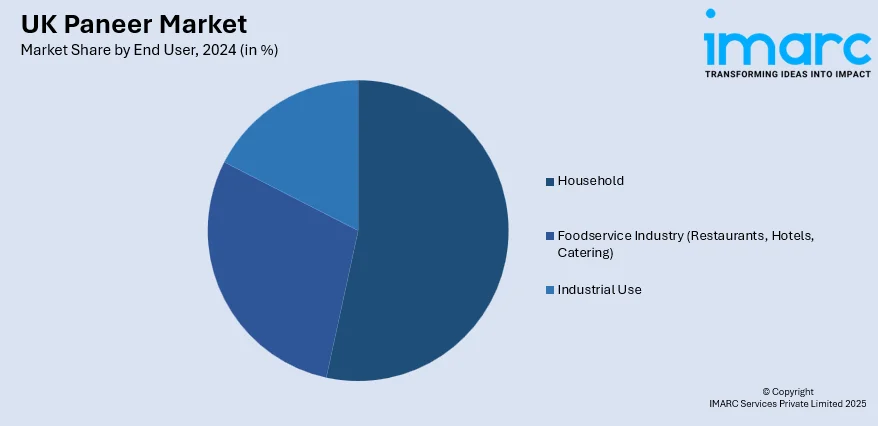

End User Insights:

- Household

- Foodservice Industry (Restaurants, Hotels, Catering)

- Industrial Use

The report has provided a detailed breakup and analysis of the market based on the end user. This includes household, foodservice industry (restaurants, hotels, catering), and industrial use.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Paneer Market News:

- In June 2025, startup All The Aunties launched three paneer products made with British dairy, aiming to reposition paneer as a protein-rich ingredient beyond Indian cuisine. Inspired by Patel’s mother and aunties, the brand features their faces on its packaging. It enters the UK market with a push for mainstream appeal, targeting broader culinary uses and promoting paneer as a versatile protein choice.

UK Paneer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fresh Paneer, Frozen Paneer, Flavored Paneer |

| End Users Covered | Household, Foodservice Industry (Restaurants, Hotels, Catering), Industrial Use |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK paneer market performed so far and how will it perform in the coming years?

- What is the breakup of the UK paneer market on the basis of type?

- What is the breakup of the UK paneer market on the basis of end user?

- What is the breakup of the UK paneer market on the basis of distribution channel?

- What is the breakup of the UK paneer market on the basis of region?

- What are the various stages in the value chain of the UK paneer market?

- What are the key driving factors and challenges in the UK paneer market?

- What is the structure of the UK paneer market and who are the key players?

- What is the degree of competition in the UK paneer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK paneer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK paneer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK paneer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)