UK Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

UK Paper Packaging Market Overview:

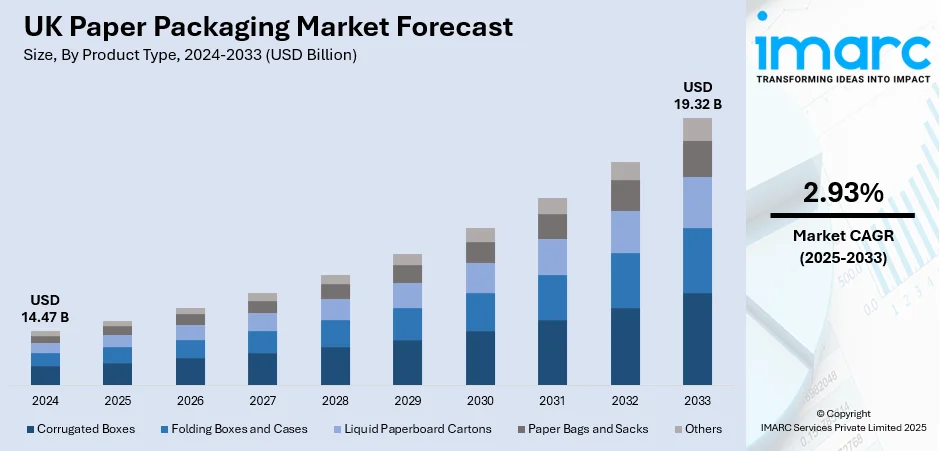

The UK paper packaging market size reached USD 14.47 Billion in 2024. The market is projected to reach USD 19.32 Billion by 2033, exhibiting a growth rate (CAGR) of 2.93% during 2025-2033. The market is driven by growing sustainability demands and tighter government regulations that are encouraging businesses to adopt recyclable, biodegradable packaging as a cost‑effective way to comply with environmental rules and meet consumer expectations. Moreover, the rapid expansion of e‑commerce and evolving retail models are increasing the need for durable, lightweight, and customizable paper solutions that enhance both protection and the unboxing experience thus strengthening the UK paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.47 Billion |

| Market Forecast in 2033 | USD 19.32 Billion |

| Market Growth Rate 2025-2033 | 2.93% |

UK Paper Packaging Market Trends:

Sustainability & Government Regulation

Sustainability has become one of the strongest forces driving the market growth in the UK paper packaging market trends. Paper and cardboard already account for about 50% of all packaging used in the UK, with over 80% being recycled, underscoring their critical role in the circular economy. Growing environmental awareness among consumers has accelerated the shift from plastic to recyclable, biodegradable paper-based alternatives. This shift is reinforced by government initiatives and regulations aimed at reducing packaging waste, including stricter producer responsibility requirements and levies on less eco‑friendly materials. These measures make paper packaging a cost‑effective, compliant choice while enhancing companies’ public image. Retailers and manufacturers are increasingly prioritizing solutions that meet regulatory standards, align with corporate sustainability goals, and appeal to environmentally aware consumers. As these pressures mount, paper packaging continues to expand across sectors as an environmentally responsible and practical solution.

To get more information on this market, Request Sample

Surge in E‑Commerce & Retail Demand

The rapid expansion of e‑commerce and evolving retail landscapes are major drivers for paper packaging in the UK. As online shopping becomes an integral part of consumer behavior, the need for protective, lightweight, and sustainable packaging has increased significantly. Corrugated cartons, paper mailers, and other paper-based solutions are widely favored for their ability to protect goods in transit while being environmentally friendly. Retailers are also seeking packaging that offers a satisfying unpacking experience, combining functionality with appealing design. Paper packaging meets these needs by offering strength, flexibility, and opportunities for customization. Its renewable nature and recyclability make it an obvious choice for companies balancing cost efficiency, product safety, and brand perception. As digital retail continues to expand, paper-based solutions are increasingly positioned as the go‑to option for both primary and secondary packaging needs thus aiding the UK paper packaging market growth.

Technological Innovation & Smart Packaging

Innovation in packaging materials and design is reshaping the UK paper packaging sector. Advancements in barrier technologies, coatings, and material strength are enabling paper to replace plastics in applications previously considered unsuitable. Manufacturers are also developing lightweight yet durable options, helping reduce material use without compromising product protection. Digital printing and on‑demand packaging technologies are empowering businesses to create customized, brand‑focused packaging with minimal waste. Additionally, the integration of smart features, such as quick response (QR) codes and interactive designs, is transforming paper packaging into a tool for customer engagement, product traceability, and tamper detection. These innovations not only meet functional needs but also help brands stand out in competitive markets. By combining environmental benefits with cutting‑edge performance and personalization, technological progress is driving the continued adoption and evolution of paper‑based packaging solutions across industries.

UK Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

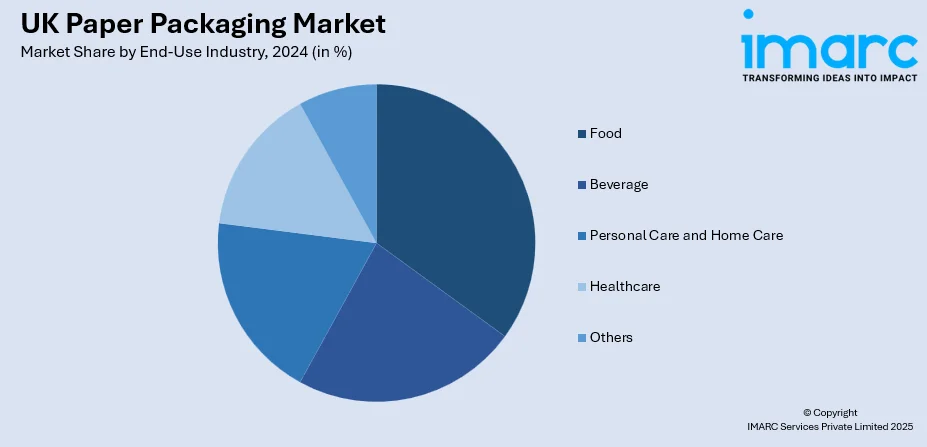

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Paper Packaging Market News:

- In May 2025, Amazon plans to invest the most in sustainable packaging in Europe by installing 18 new automated packaging machines throughout its fulfillment centers in the UK. These machines create made‑to‑fit cardboard boxes and paper bags, reducing excess materials, waste, and delivery emissions while improving vehicle space efficiency. With over 70 machines planned for Europe this year, Amazon aims to enhance sustainability and packaging efficiency for millions of customer deliveries.

- In May 2025, In collaboration with ZARELO, Mondi introduced a recyclable paper-based container for fireplace and barbeque starts that uses Mondi's re/cycle FunctionalBarrier Paper 95/5. The FSC™ and PEFC-certified paper provides moisture protection, puncture resistance, and durability, ensuring product safety during storage and transport. Available in multiple pack sizes, the packaging supports automated filling, improves efficiency, and enhances retail visibility with high-quality printing, while being recyclable in existing European paper recycling streams.

- In September 2024, Marigold Health Foods partnered with Sonoco to launch a fully recyclable can for its plant-based products, including stock cubes, sauces, and meat alternatives. The new packaging, made from 95% paper with a paper-based base and 60% post-consumer recycled fibre, replaces the previous metal-bottom design. It is kerbside recyclable in the UK paper stream and features the OPRL recycling logo, aligning with UK and European sustainability regulations while improving the packaging’s environmental footprint.

- In April 2024, Flora launched the world’s first plastic‑free paper tub for its Flora Plant range in the UK, available from 17 April 2024 in 386 Sainsbury’s stores. Developed by parent company Upfield, the tubs are made from compressed wet paper fibres, fully recyclable without plastic liners, and designed for easy disposal with household paper waste. This innovation supports Upfield’s goal to cut plastic use by 80% by 2030, encouraging sustainable consumer choices.

UK Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the UK paper packaging market on the basis of product type?

- What is the breakup of the UK paper packaging market on the basis of grade?

- What is the breakup of the UK paper packaging market on the basis of packaging level?

- What is the breakup of the UK paper packaging market on the basis of end-use industry?

- What is the breakup of the UK paper packaging market on the basis of region?

- What are the various stages in the value chain of the UK paper packaging market?

- What are the key driving factors and challenges in the UK paper packaging market?

- What is the structure of the UK paper packaging market and who are the key players?

- What is the degree of competition in the UK paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)