UK Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UK Peanut Butter Market Overview:

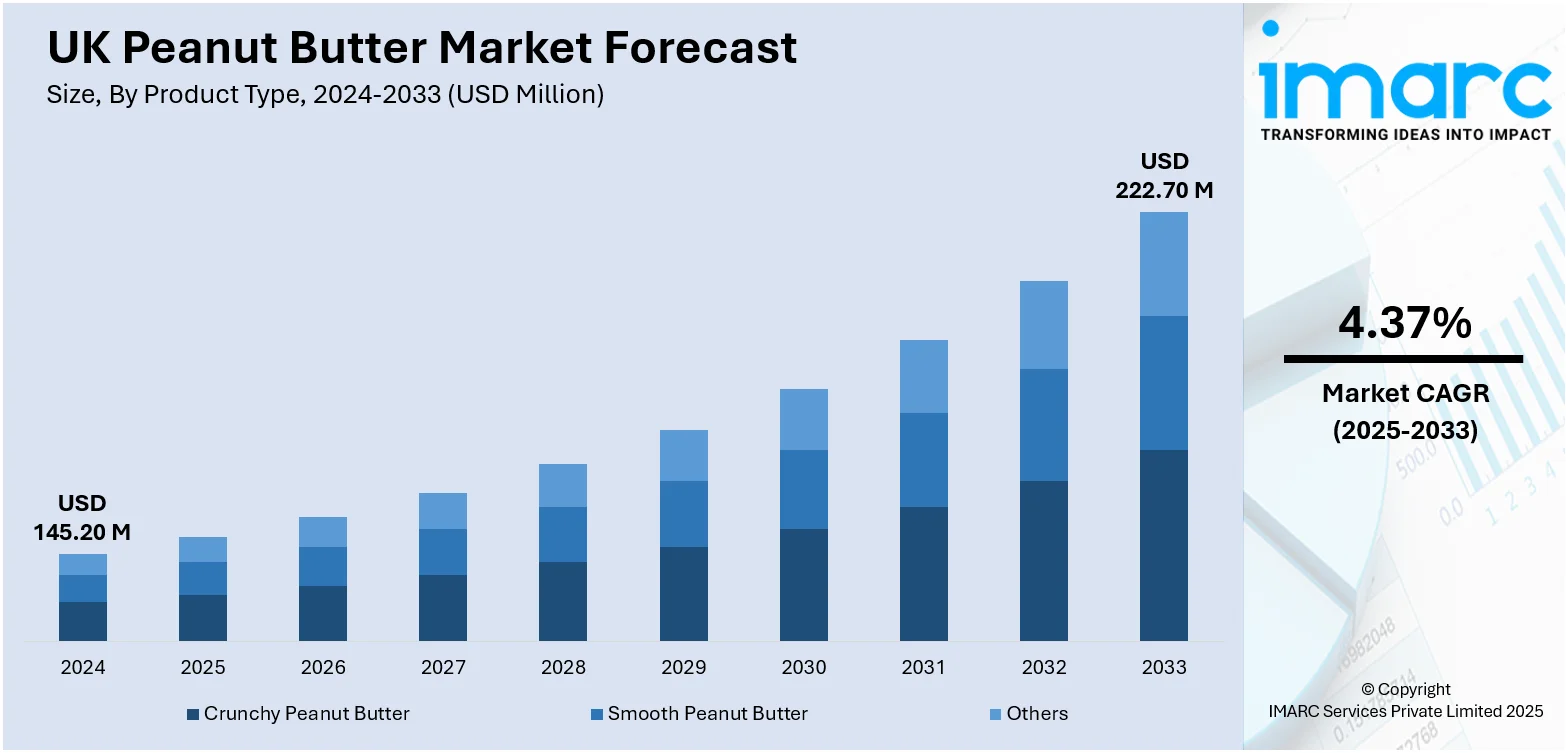

The UK Peanut Butter market size reached USD 145.20 Million in 2024. Looking forward, the market is projected to reach USD 222.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The market is experiencing consistent growth driven by rising consumer demand for plant-based protein and healthy snacking options. Innovative flavor variants, sugar-reduced and craft-style formulations, along with expanded supermarket and online distribution, are broadening appeal to both traditional and niche audiences. Private-label offerings and brand collaborations are further enriching product variety, reinforcing the competitive landscape and increasing market penetration, thereby strengthening UK peanut butter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.20 Million |

| Market Forecast in 2033 | USD 222.70 Million |

| Market Growth Rate 2025-2033 | 4.37% |

UK Peanut Butter Market Trends:

Growth of Reduced‑Sugar and Low‑Salt Peanut Butter Variants

The peanut butter market in the UK is experiencing significant growth, influenced by a shift in consumer preferences toward healthier options such as reduced-sugar, no-added-sugar, and low-salt varieties. An increasing number of consumers are examining nutritional labels closely and choosing cleaner, minimally processed spreads that align with lower-calorie and lower-sodium diets. In response, manufacturers are reformulating traditional recipes using natural sweeteners like stevia or fruit extracts, decreasing added sugar levels, and reducing sodium content without sacrificing flavor. For instance, in July 2025, Wilkin and Sons launched its first Tiptree Nut Butter range, featuring smooth and crunchy peanut butter, as well as almond butter, the products contain no artificial colors, flavorings, palm oil, or added sugar, and are suitable for vegans. These innovations meet the rising demand for healthier snacking choices, particularly among fitness-minded and health-conscious individuals. Retailers are increasingly offering these premium options in both mainstream and specialized health sections, while direct-to-consumer brands highlight clean ingredients and transparent sourcing through online platforms. As demand grows, these products are playing a significant role in UK peanut butter market growth.

To get more information on this market, Request Sample

Artisan, Organic, and Flavored Innovations

The UK peanut butter market is undergoing significant changes as consumer interest shifts towards artisan, organic, and uniquely flavored options. Shoppers are increasingly attracted to premium products that provide more than just traditional flavors—they are looking for natural ingredients, small-batch production, and bold, innovative options like chocolate-infused varieties, spicy blends, or unique nut combinations (such as almond-peanut or hazelnut-peanut mixes). For instance, in November 2024, Whole Earth launched a new Salted Caramel Drizzler, expanding its popular squeezy peanut butter range. This innovative flavor features a golden roasted peanut butter base, combining indulgent taste with healthier ingredients. Organic certifications and simple ingredient lists resonate with health-conscious and ethically minded consumers. These developments reflect a growing trend towards personalization and culinary exploration in everyday food items. Brands are responding to this demand with appealing packaging, compelling stories about sourcing, and enhanced flavor experiences. The rise of these premium categories is leading to greater shelf space in both large retailers and independent shops, reinforcing brand uniqueness and consumer loyalty. This trend is transforming the perception of quality and variety in the UK peanut butter market.

UK Peanut Butter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes crunchy peanut butter, smooth peanut butter, and others.

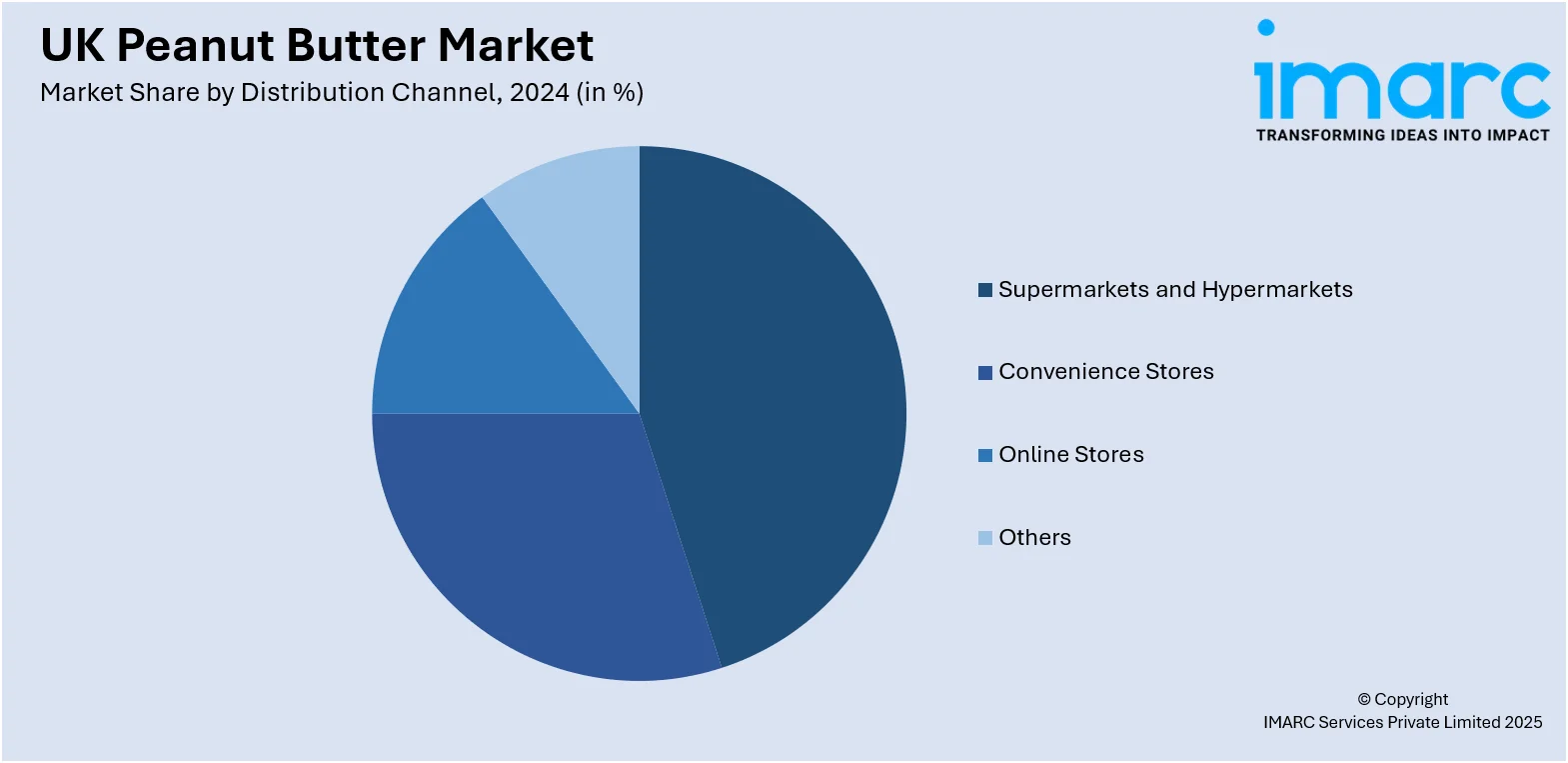

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Peanut Butter Market News:

- In June 2025, Barebells introduced its highly sought-after peanut butter protein bar to the UK. Featuring 20 grams of protein, no added sugar, creamy peanut butter, and crispy peanut pieces, this indulgent treat promises to satisfy cravings while being HFFS-compliant.

- In February 2025, Meridian Foods introduced a 10kg tub of palm-oil-free crunchy peanut butter, capable of making 300 sandwiches. The launch follows a successful social media giveaway that showcased public demand.

- In March 2024, Whole Earth, the UK's leading peanut butter brand, launched Whole Earth Protein Crunch, a high-protein variant featuring crunchy pea protein pieces. Celebrating its partnership with Team GB for the Paris 2024 Olympics, the limited-edition product supports healthier lifestyles.

UK Peanut Butter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Crunchy Peanut Butter, Smooth Peanut Butter, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK Peanut Butter market performed so far and how will it perform in the coming years?

- What is the breakup of the UK Peanut Butter market on the basis of product type?

- What is the breakup of the UK Peanut Butter market on the basis of distribution channel?

- What is the breakup of the UK Peanut Butter market on the basis of region?

- What are the various stages in the value chain of the UK Peanut Butter market?

- What are the key driving factors and challenges in the UK Peanut Butter market?

- What is the structure of the UK Peanut Butter market and who are the key players?

- What is the degree of competition in the UK Peanut Butter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK peanut butter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK peanut butter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK peanut butter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)