UK Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2025-2033

UK Pro AV Market Overview:

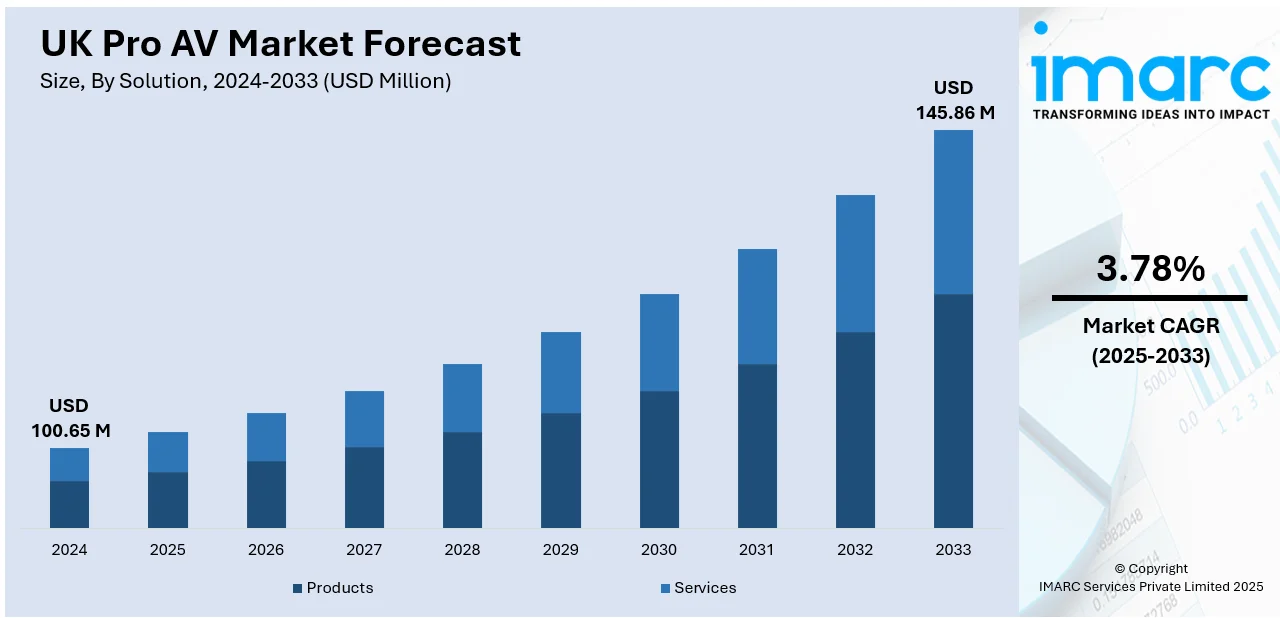

The UK pro AV market size reached USD 100.65 Million in 2024. The market is projected to reach USD 145.86 Million by 2033, exhibiting a growth rate (CAGR) of 3.78% during 2025-2033. The market is expanding due to increasing demand for integrated AV solutions across corporate, education, and public sectors. Additionally, the shift toward hybrid workspaces and energy-efficient technologies continues to strengthen the UK Pro AV market share across key end-user industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 100.65 Million |

| Market Forecast in 2033 | USD 145.86 Million |

| Market Growth Rate 2025-2033 | 3.78% |

UK Pro AV Market Trends:

Hybrid Collaboration Driving Demand

The shift towards hybrid work environments and blended learning models is a key force behind the UK Pro AV market growth. Companies are increasingly investing in advanced audio-visual tools to connect in-office and remote teams. This includes video conferencing systems, interactive whiteboards, and wireless presentation solutions that allow for smooth communication regardless of location. Schools and universities are also adopting digital AV tools to enhance learning both inside and outside the classroom. Additionally, the healthcare sector is using AV systems for virtual consultations and training. The rising use of immersive technologies like augmented and virtual reality is helping sectors deliver more engaging content and training. Around mid-2024, various universities and offices in the UK upgraded to smarter AV platforms powered by artificial intelligence, which improved interaction and streamlined system operations. Falling prices of AV equipment, the growing use of cloud-based AV tools, and demand for multi-user setups are all contributing to steady market progress. These changes are not only meeting current communication needs but are also laying the groundwork for long-term digital collaboration, making professional AV solutions an essential part of modern business, education, and healthcare settings across the United Kingdom.

To get more information on this market, Request Sample

Eco-Friendly AV Technologies on the Rise

Sustainable technology adoption is becoming a defining trend in the UK Pro AV sector. With rising energy expenses and stronger environmental policies, both suppliers and buyers are turning to eco-conscious AV solutions. Products like low-energy LED screens, energy-efficient projectors, and smart lighting systems are becoming more common across offices, schools, and public venues. Buyers are also considering the environmental impact of their AV choices, seeking systems that support lower emissions and meet green building standards. Integrators are designing setups that use less power while still delivering high performance. Features such as motion sensors, automatic shut-off, and remote control access are helping reduce unnecessary energy use. In the second half of 2024, some leading AV brands introduced new ranges made with recyclable parts and built-in energy-saving functions aimed at large enterprises. Public sector bodies are also updating their infrastructure to align with the UK’s long-term climate goals, often with government-backed funding. As reducing carbon emissions becomes a major focus across industries, demand for sustainable AV products is expected to grow. These environmentally friendly systems not only support climate action but also help organizations save money on energy bills, making them a practical and responsible investment.

UK Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

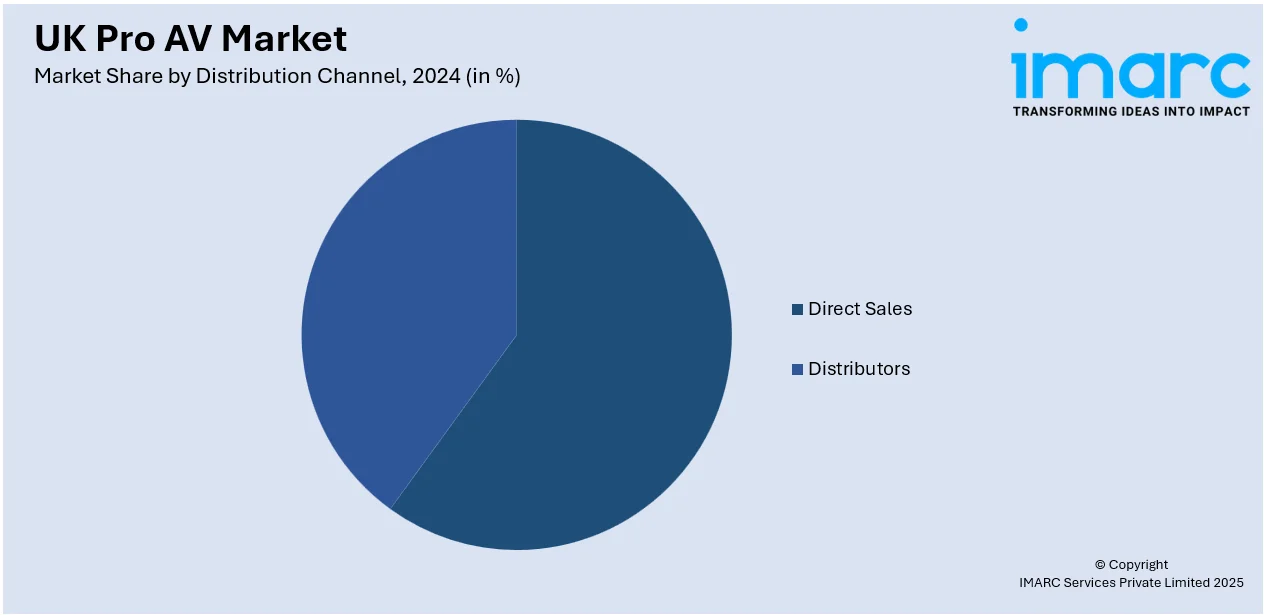

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Pro AV Market News:

- July 2025: Pro Integration Future Europe (PIFE) hosted its launch party in London ahead of its inaugural event scheduled for April 2026 at NEC Birmingham. Organized by Nineteen Group, the initiative aimed to boost innovation, integration, and collaboration within the UK pro AV ecosystem.

UK Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the UK pro AV market on the basis of solution?

- What is the breakup of the UK pro AV market on the basis of distribution channel?

- What is the breakup of the UK pro AV market on the basis of application?

- What is the breakup of the UK pro AV market on the basis of region?

- What are the various stages in the value chain of the UK pro AV market?

- What are the key driving factors and challenges in the UK pro AV market?

- What is the structure of the UK pro AV market and who are the key players?

- What is the degree of competition in the UK pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)