UK Professional Services Automation Market Size, Share, Trends and Forecast by Deployment Mode, Type, End User Industry, and Region, 2025-2033

UK Professional Services Automation Market Overview:

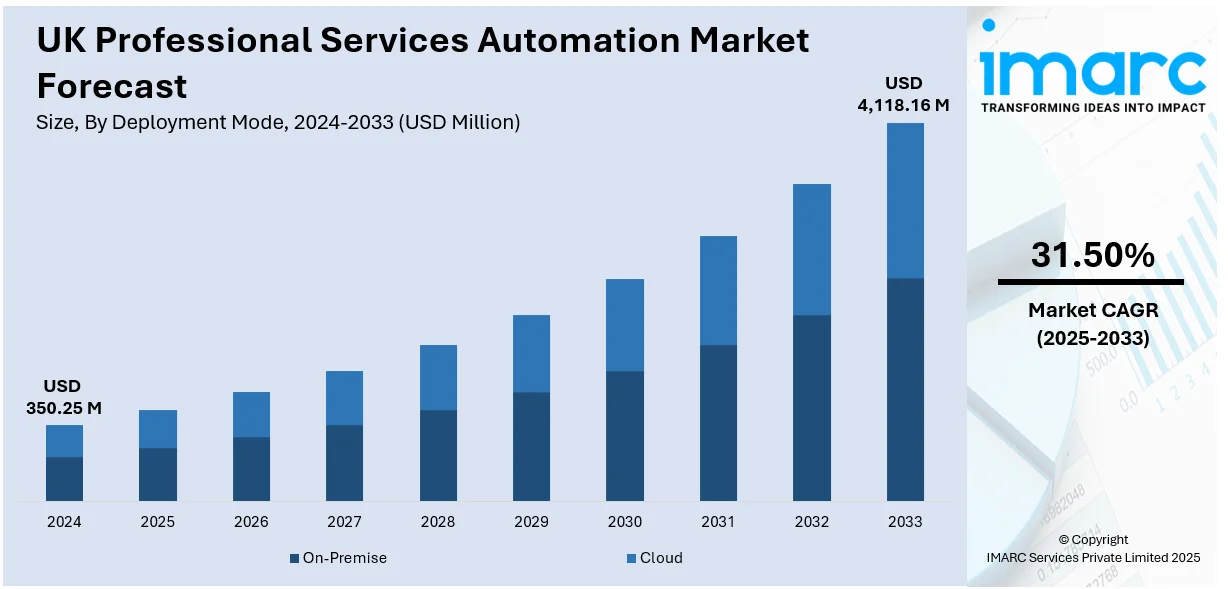

The UK professional services automation market size reached USD 350.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,118.16 Million by 2033, exhibiting a growth rate (CAGR) of 31.50% during 2025-2033. The market is experiencing significant growth mainly driven by the rising demand for streamlined project management, resource allocation and operational efficiency. The adoption of cloud-based PSA platforms, AI-driven solutions, and integration with other business tools are also contributing positively to the market growth across the UK.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 350.25 Million |

| Market Forecast in 2033 | USD 4,118.16 Million |

| Market Growth Rate (2025-2033) | 31.50% |

UK Professional Services Automation Market Trends:

Rising Adoption of AI and Automation

AI is transforming the project and resource management practices of firms within the UK Professional Services Automation (PSA) market through its adoption. AI-enabled tools enhance the precision of resource allocation, streamline scheduling and optimize workforce assignment based on skills and project requirements. These tools come with predictive analytics that help the firm predict bottlenecks in project execution and adjust strategies accordingly. Integrating AI into workflows eliminates repetitive tasks like tracking time and invoicing, thus raising operational efficiency. AI-supported decision-making tools generate insights that enhance business productivity in real-time and facilitate data-driven business decisions for firms. For instance, in July 2023, KPMG and Microsoft announced the expansion of their global partnership to incorporate AI solutions in professional services. The alliance includes a multibillion-dollar commitment from KPMG in Microsoft cloud and AI services over the next 5 years. This collaboration aims to enhance client engagements, supercharge the employee experience, and empower KPMG's workforce. The alliance will also benefit KPMG's core business areas, such as audit and tax, with the integration of Microsoft technologies.

Cloud Based PSA Solutions

The shift towards cloud-based PSA solutions in the UK market is propelled by the pressing demand for higher levels of flexibility and scalability among professional services firms. Due to the cloud platforms, companies have real-time access to data from any location, enhance team collaboration, and ensure adherence to project timelines. The scalable nature of these solutions allows firms to increase their capabilities in tandem with their growth without hefty upfront infrastructure costs. Cloud-based PSA guarantees features like automatic updates to serve its users better, security, and compatibility with several other cloud applications, making them ideal for modern organizations. For instance, in July 2024, the City of Birmingham Symphony Orchestra (CBSO) announced the selection of iplicit's cloud accounting software to manage its finances. The orchestra, known for its global performances and recordings, found that implicit solutions perfectly met its needs.

UK Professional Services Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on deployment mode, type, and end user industry.

Deployment Mode Insights:

- On-Premise

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premise and cloud.

Type Insights:

- Solutions

- Billing Invoice

- Project Management

- Expense Management

- Others

- Services

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes solutions (billing invoice, project management, expense management, and others) and services.

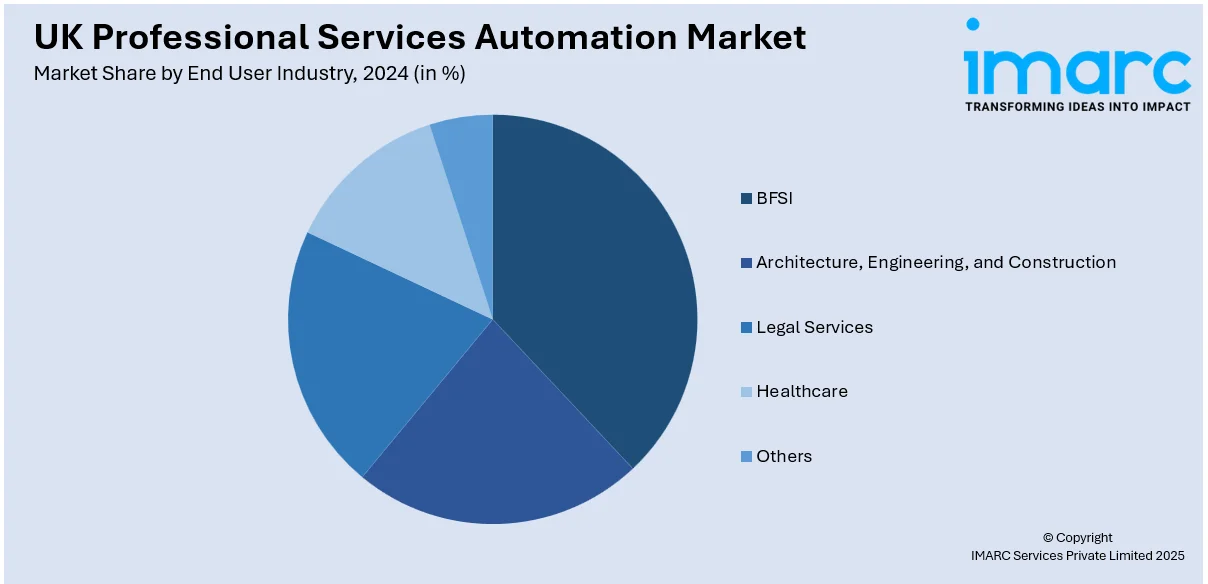

End User Industry Insights:

- BFSI

- Architecture, Engineering, and Construction

- Legal Services

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes BFSI, architecture, engineering, and construction, legal services, healthcare, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Professional Services Automation Market News:

- In January 2024, PwC UK announced their partnership with Quantexa to utilize its Decision Intelligence Platform, aiming to offer clients a comprehensive view of their business relationships. Quantexa's platform integrates disparate data sources to enhance operational performance and analytical model resolution. The collaboration intends to empower PwC to deliver detailed insights to clients, enabling informed decision-making in areas such as supply chain risk, financial crime, and customer intelligence.

- In May 2024, CLA, the eighth-largest accounting firm in the United States, announced the acquisition of Engine B, a UK-based technology company specializing in generative AI solutions for the professional services industry. This strategic move marks CLA's first global acquisition and demonstrates its commitment to leveraging cutting-edge technology to enhance client service. Engine B's AI technology aims to transform the way accounting professionals work, providing deeper business and financial insights for clients.

UK Professional Services Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premise, Cloud |

| Types Covered |

|

| End User Industries Covered | BFSI, Architecture, Engineering, and Construction, Legal Services, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK professional services automation market performed so far and how will it perform in the coming years?

- What is the breakup of the UK professional services automation market on the basis of deployment mode?

- What is the breakup of the UK professional services automation market on the basis of type?

- What is the breakup of the UK professional services automation market on the basis of end user industry?

- What is the breakup of the UK professional services automation market on the basis of region?

- What are the various stages in the value chain of the UK professional services automation market?

- What are the key driving factors and challenges in the UK professional services automation?

- What is the structure of the UK professional services automation market and who are the key players?

- What is the degree of competition in the UK professional services automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK professional services automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK professional services automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK professional services automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)