UK Quantum Computing Market Size, Share, Trends and Forecast by Offering, Deployment, Application, End User, and Region, 2026-2034

UK Quantum Computing Market Overview:

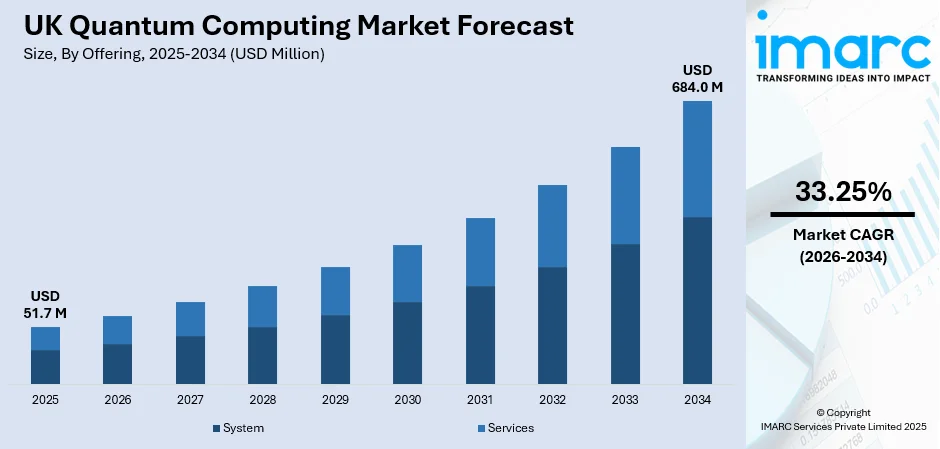

The UK quantum computing market size reached USD 51.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 684.0 Million by 2034, exhibiting a growth rate (CAGR) of 33.25% during 2026-2034. The market is experiencing steady growth driven by substantial government and private investment, strong academia-industry collaboration, rapid commercialization of quantum computing applications, and supportive regulatory frameworks. The UK government will invest over £500 Million, about USD 672 Million, in quantum computing over four years to strengthen national security and economic resilience, while the UK quantum industry currently contributes £1.7 Billion in GVA to the economy, positioning the country as a leader in quantum computing UK innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 51.7 Million |

| Market Forecast in 2034 | USD 684.0 Million |

| Market Growth Rate (2026-2034) | 33.25% |

UK Quantum Computing Market Trends:

Increasing Investment in Quantum Technology

In the UK, significant investments from the public and private sectors are fueling the market's strong expansion and favoring market growth. Moreover, the UK government quantum computing strategy acknowledges the potential of quantum technologies as a crucial area of strategic relevance for both economic growth and national security. Initiatives such as the UK National Quantum Technologies Programme underscore commitment to advancing this sector. Along with this, private investments are also increasing, with numerous quantum computing startups UK and established tech companies accelerating their quantum research. This financial backing supports the commercialization of quantum computing UK applications and speeds the transition from theoretical to market-ready solutions.

To get more information on this market, Request Sample

Favorable Government Policies and Regulatory Support

Government policy and regulatory frameworks are majorly driving the market. The UK government is proactive in creating a favorable environment for quantum computing UK through supportive regulations and policies. These policies protect intellectual property, encourage quantum computing startups UK, and facilitate international partnerships. In July 2024, the UK government announced plans to invest in five quantum hubs across major cities, funded by over £100 Million. These hubs will advance practical quantum applications such as medical imaging, secure communication, and positioning systems, highlighting long-term government commitment to scaling the UK government quantum computing ecosystem.

AI Impact

Artificial intelligence (AI) integration is becoming a major accelerator for the quantum computing UK market. AI techniques improve error correction, optimize quantum algorithms, and enhance simulation outcomes. This synergy is especially relevant in finance, drug discovery, and logistics optimization. The UK government quantum computing agenda increasingly emphasizes AI-quantum convergence to ensure leadership in high-value applications. Academic institutions and industry collaborations are investing in hybrid quantum-classical frameworks where AI guides qubit control and system calibration. Meanwhile, quantum computing startups UK are leveraging AI to improve performance reliability and to target specialized markets. As demand for faster, more accurate computational models rises, AI-driven quantum applications are expected to shape the trajectory of the market. In combination, these technologies promise breakthroughs in cryptography, material science, and healthcare modeling, reinforcing the UK’s long-term resilience in the global quantum economy.

UK Quantum Computing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on offering, deployment, application, and end user.

Offering Insights:

- System

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes system and services.

Deployment Insights:

- On-premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premises and cloud.

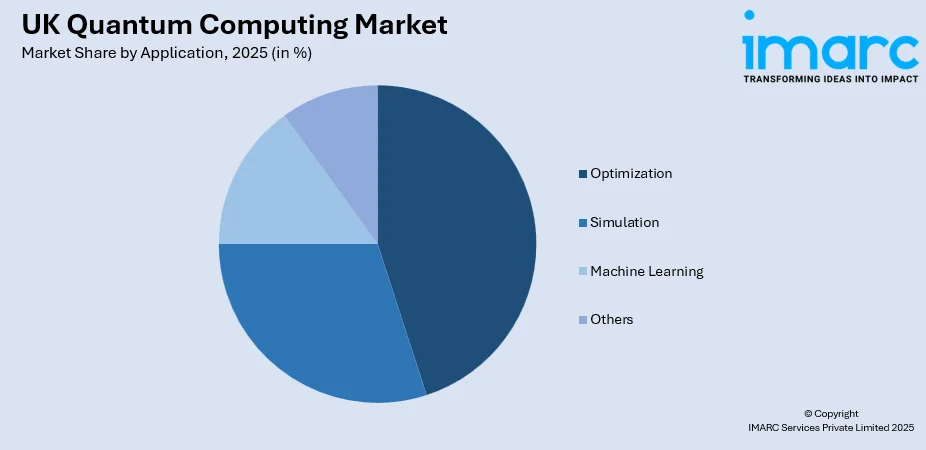

Application Insights:

- Optimization

- Simulation

- Machine Learning

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes optimization, simulation, machine learning, and others.

End User Insights:

- Aerospace and Defense

- BFSI

- Healthcare

- Automotive

- Energy and Power

- Chemical

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes aerospace and defense, BFSI, healthcare, automotive, energy and power, chemical, government, and others.

Region Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

UK Quantum Computing Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Quantum Computing Market News:

- February 2024: The UK government invested £45 million in quantum technologies, aiming to transform sectors like healthcare, energy, and transport. £30 million will fund quantum computing prototypes, while £15 million supports public sector adoption. Projects include quantum-enabled brain scanners for neurological disorders and quantum sensors for safer train navigation. This initiative is part of the UK's goal to become a quantum-enabled economy by 2033, positioning the country as a global leader in quantum advancements.

- July 2024: Oxford Ionics, a pioneering quantum computing company based in Oxford, United Kingdom, unveiled the 'Pivotal' quantum computing chip. The chip, which can be mass-produced, is designed to control trapped ions, a key technology needed for quantum computing, offering more than double the performance of previous attempts. This new technology enables very complex calculations to be made extremely quickly and solves problems too difficult for regular computers.

- April 2024: Rigetti and Oxford Instruments announced the successful completion of their Innovate UK project to build one of the first UK-based quantum computers. The project, supported by a £10 Million consortium, aimed to advance quantum computing commercialization in the UK through a 32-qubit quantum computer. Hosted at Oxford Instruments, the system is now used for quantum applications in machine learning, materials simulation, and finance, marking a significant milestone for UK quantum computing capabilities.

UK Quantum Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | System, Services |

| Deployments Covered | On-premises, Cloud |

| Applications Covered | Optimization, Simulation, Machine Learning, Others |

| End Users Covered | Aerospace and Defense, BFSI, Healthcare, Automotive, Energy and Power, Chemical, Government, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK quantum computing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK quantum computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK quantum computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The quantum computing market in UK was valued at USD 51.7 Million in 2025.

The UK quantum computing market is projected to exhibit a CAGR of 33.25% during 2026-2034, reaching a value of USD 684.0 Million by 2034.

The UK quantum computing market is driven by strong government support, increasing R&D investments, and growing collaboration between academia and technology firms. Rising demand for advanced computing in sectors such as finance, healthcare, and defense, along with the emergence of quantum startups, is further boosting market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)