UK Ride-Sharing Market Size, Share, Trends and Forecast by Service Type, Booking Mode, Membership Type, Commute Type, and Region, 2025-2033

UK Ride-Sharing Market Overview:

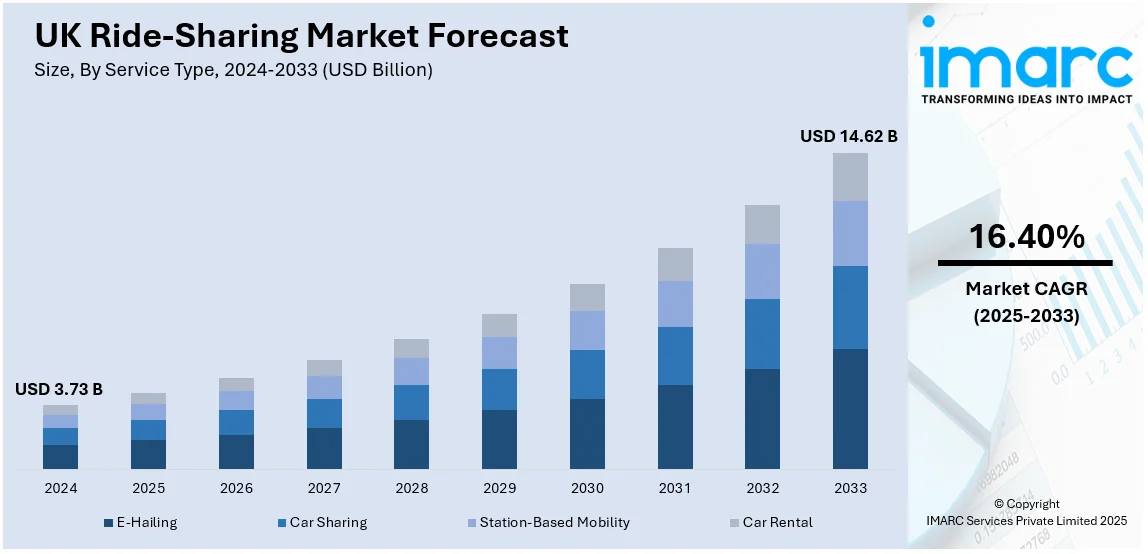

The UK ride-sharing market size reached USD 3.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.62 Billion by 2033, exhibiting a growth rate (CAGR) of 16.40% during 2025-2033. The UK ride-sharing market share is expanding, driven by the increasing traffic congestion and limited parking, which is encouraging people to opt for ride-sharing as a convenient and affordable substitute for owning a car, along with the growing implementation of government initiatives aimed at reducing carbon emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.73 Billion |

| Market Forecast in 2033 | USD 14.62 Billion |

| Market Growth Rate (2025-2033) | 16.40% |

UK Ride-Sharing Market Trends:

Rapid Urbanization and Traffic Congestion

Rapid urbanization activities and rising traffic congestion are offering a favorable UK ride-sharing market outlook. As cities grow, increased traffic congestion and limited parking encourage people to opt for ride-sharing as a practical and cost-effective alternative to having a car. For instance, in June 2024, INRIX, Inc., a leading company in transportation analytics and data, released the 2023 Global Traffic Scorecard that recognized and ranked congestion in almost 950 cities across 37 nations based on their 'Impact Ranking', which reflected the total effect of traffic jams in relation to population size. London ranked first in Europe's Traffic Scorecard and came in third worldwide, with motorists wasting 99 hours in traffic congestion, highlighting a 3% increase over pre-pandemic delays and a 2% rise compared to 2022. The overall expense for London amounted to £3.8 Billion, equating to an average of £902 for each driver. For the UK, the nation faced a loss of £7.5 Billion, which was £718 Million greater than in 2022. In 2023, the typical driver in the UK lost 61 hours because of traffic jams, marking a 7% rise from 2022’s 57 hours lost, with roughly 50% of the country's traffic delays occurring in the capital. These statistics are reflective of the imminent need for an economical solution, particularly pertaining to daily commutation.

Increasing Environmental Concerns

The rising awareness among the masses about climate change is impelling the UK ride-sharing market growth. Government incentives for reducing carbon emissions encourage people to choose eco-friendly and shared transportation solutions. For instance, in May 2024, FREENOW, the prominent taxi app, was said to be making significant strides toward sustainability, striving to achieve a net-zero platform. The company set science-oriented short-term targets to guarantee its greenhouse gas (GHG) emission reduction objectives meet top industry standards. A thorough evaluation of their actions was carried out to further minimize their carbon footprint. Over the last year, 46% of FREENOW journeys were completed with zero-emission (ZEV) or hybrid taxis and private hire vehicles (PHV). In 2023, there was a significant 34% increase in zero-emission taxis and PHVs compared to 2022. The company claimed to have the highest quantity of electric options in significant cities like London and Dublin. The company’s growing multi-mobility services further strengthened its sustainability initiatives. Significantly, 78% of all trips made using shared vehicles on the platform, which encompassed eScooters, eMopeds, eBikes, and carsharing, involved zero-emission vehicles. This program led to a reduction of 2,067 Tons of CO2 through the use of electric shared vehicles.

UK Ride-Sharing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service type, booking mode, membership type, and commute type.

Service Type Insights:

- E-Hailing

- Car Sharing

- Station-Based Mobility

- Car Rental

The report has provided a detailed breakup and analysis of the market based on the service types. This includes e-hailing, car sharing, station-based mobility, and car rental.

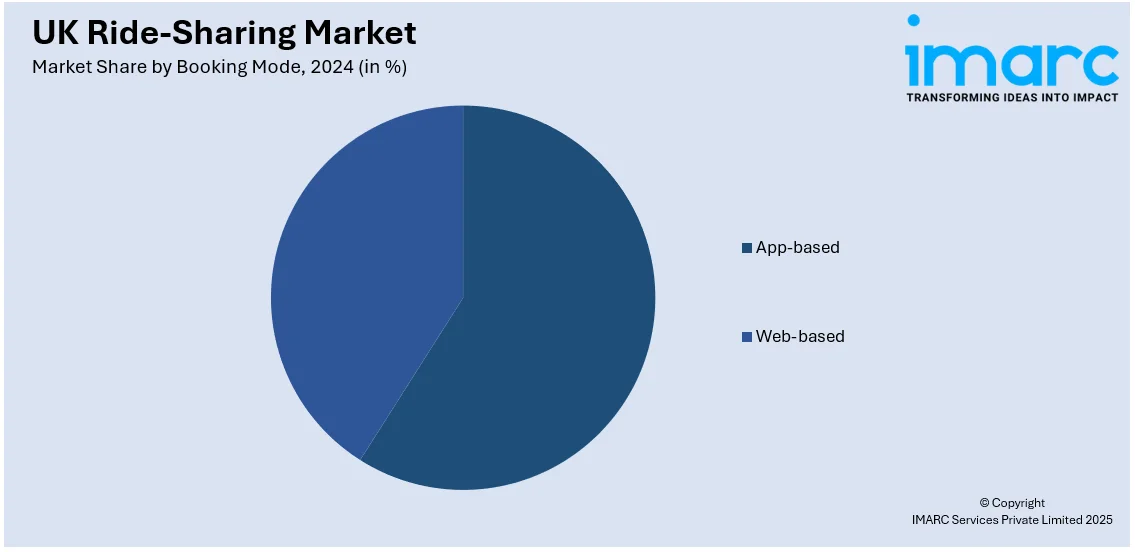

Booking Mode Insights:

- App-based

- Web-based

A detailed breakup and analysis of the market based on the booking modes have also been provided in the report. This includes app-based and web-based.

Membership Type Insights:

- Fixed Ridesharing

- Dynamic Ridesharing

- Corporate Ridesharing

The report has provided a detailed breakup and analysis of the market based on the membership types. This includes fixed ridesharing, dynamic ridesharing, and corporate ridesharing.

Commute Type Insights:

- ICE Vehicle

- Electric Vehicle

- CNG/LPG Vehicle

- Micro Mobility Vehicle

A detailed breakup and analysis of the market based on the commute types have also been provided in the report. This includes ICE vehicle, electric vehicle, CNG/LPG vehicle, and micro mobility vehicle.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Ride-Sharing Market News:

- In April 2024, Uber, the popular ride-sharing service announced plans to launch in Swansea, south Wales, and Stockton, north-east England. Uber restarted launches in UK towns and cities following the collapse of the Local Car scheme in late 2023. Uber highlighted that there was high demand for the service. In Stockton, more than 4,500 residents were opening the Uber app every week, while the numbers in Swansea were similar at around 4,000.

- In December 2023, Liftango, the well-known provider of on-demand shared transport systems, established one of the largest B2B car-sharing networks in the UK. Liftango offered a tailored car share platform aimed at decreasing individual car usage and encouraging shared mobility. The platform sought to offer the ‘My Journey Workplaces’ network customized business dashboards for managing and reporting on usage, alongside measuring carbon emissions.

UK Ride-Sharing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | E-Hailing, Car Sharing, Station-Based Mobility, Car Rental |

| Booking Modes Covered | App-based, Web-based |

| Membership Types Covered | Fixed Ridesharing, Dynamic Ridesharing, Corporate Ridesharing |

| Commute Types Covered | ICE Vehicle, Electric Vehicle, CNG/LPG Vehicle, Micro Mobility Vehicle |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK ride-sharing market performed so far and how will it perform in the coming years?

- What is the breakup of the UK ride-sharing market on the basis of service type?

- What is the breakup of the UK ride-sharing market on the basis of booking mode?

- What is the breakup of the UK ride-sharing market on the basis of membership type?

- What is the breakup of the UK ride-sharing market on the basis of commute type?

- What are the various stages in the value chain of the UK ride-sharing market?

- What are the key driving factors and challenges in the UK ride-sharing ?

- What is the structure of the UK ride-sharing market and who are the key players?

- What is the degree of competition in the UK ride-sharing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK ride-sharing market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK ride-sharing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK ride-sharing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)