UK Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

UK Running Gear Market Overview:

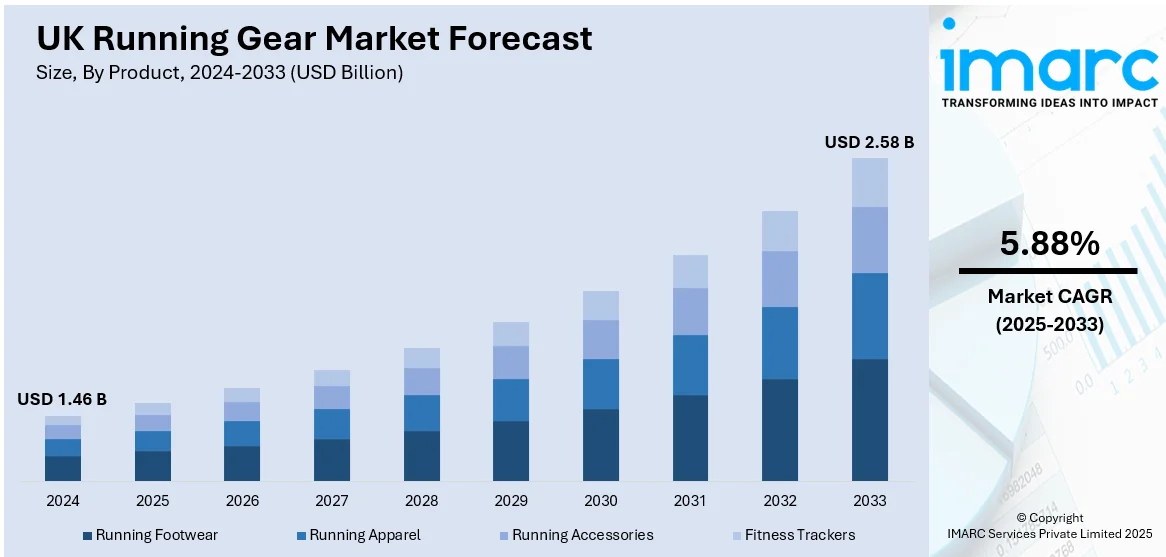

The UK running gear market size reached USD 1.46 Billion in 2024. Looking forward, the market is projected to reach USD 2.58 Billion by 2033, exhibiting a growth rate (CAGR) of 5.88% during 2025-2033. The market is driven by increased recreational running adoption tied to health, wellness, and daily commuting habits. Continuous innovation in performance footwear and eco-conscious activewear keeps consumer interest high. A mature omni-channel retail structure and digitally engaged population are further augmenting the UK running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.46 Billion |

| Market Forecast in 2033 | USD 2.58 Billion |

| Market Growth Rate 2025-2033 | 5.88% |

UK Running Gear Market Trends:

Health-Conscious Consumers and Running as a Lifestyle Habit

The UK has witnessed a sustained increase in recreational running, driven by public health awareness, fitness tracking culture, and a desire for low-cost, high-impact exercise. Government campaigns such as ‘Couch to 5K,’ alongside charity marathons and community park runs, have successfully motivated a diverse demographic, across age and fitness levels, to adopt running as a daily or weekly habit. In 2024, 1 in 5 UK adults ran at least monthly, with men (20.76%) slightly ahead of women (17.98%). Participation peaked among 35–44-year-olds (30.12%) and was lowest in the 55+ group (8.3% in 2025). The activity’s accessibility and minimal entry barriers have expanded its appeal across urban and suburban population. As more individuals run for mental clarity, cardiovascular health, or weight management, demand for high-performance yet comfortable gear is growing. This includes technical footwear, weather-adapted apparel, and minimalist accessories. Particularly in cities like London, Manchester, and Edinburgh, running doubles as both transport and wellness routine, reinforcing its integration into daily life. Brands are capitalizing on this shift by offering personalized fit assessments, gait analysis, and running-specific clothing lines. The popularity of smartwatches, fitness apps, and digital goal-tracking also feeds into a broader ecosystem of performance-focused engagement. These consumer behaviors form the foundation of a growing, fitness-oriented apparel segment. The UK running gear market growth is closely tied to this shift in lifestyle priorities, where wellness and function dictate purchasing decisions.

To get more information on this market, Request Sample

Omni-Channel Retailing and Digital Integration

The UK’s advanced retail infrastructure and digital maturity make it an ideal market for omni-channel selling in the running gear sector. Traditional sports stores, branded outlets, department stores, and specialty boutiques offer curated running collections, while online platforms provide expansive catalogues and easy navigation. E-commerce is particularly important in this segment, as runners often seek detailed product specifications, user reviews, and size guidance. Leading retailers integrate physical and digital experiences through click-and-collect services, AR fitting rooms, loyalty apps, and seamless returns. Mobile-friendly platforms and real-time inventory visibility are now expected by UK consumers, especially millennials and Gen Z. Social media marketing, influencer endorsements, and brand-led virtual running communities drive discovery and repeat engagement. In 2025, searches for trail gear and running clubs have surged over 100% year-on-year. Interest in competitive events stays strong too, with over half of runners training for races, half marathons seeing up to 91% growth in searches, and ultramarathon interest climbing fast. In parallel, in-person retail events such as gait analysis clinics, group runs, and pop-ups provide touchpoints that reinforce brand trust and customer loyalty. This retail synergy ensures that product availability, personalization, and convenience converge in a coherent customer journey. As omni-channel strategies mature, brands with the ability to bridge digital reach and physical experience stand to gain competitive advantage and sustained market penetration.

UK Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

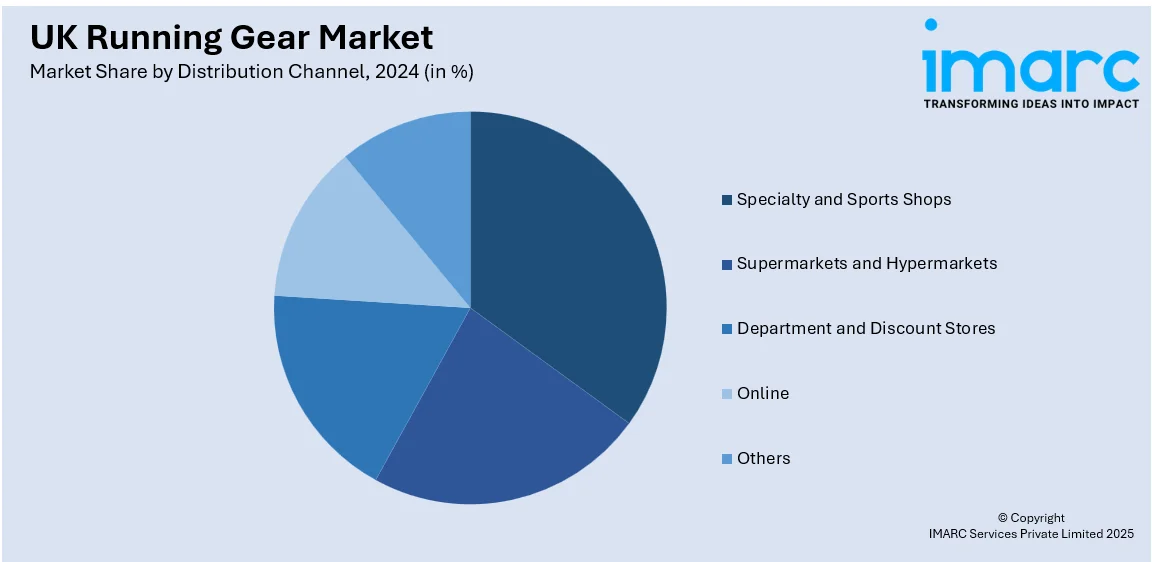

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Running Gear Market News:

- On June 11, 2025, Crew Clothing announced the launch of its first technical sportswear line, Crew Sport, expanding into activewear with a dedicated range for running and other fitness activities. The new collection includes men’s and women’s running jackets, gilets, and shorts, with prices ranging from GBP 25 to GBP 65 (USD 32–83). This move positions Crew to tap into the growing UK running gear market by offering versatile, performance-focused apparel across 41 stores and online from June 17, 2025.

UK Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the UK running gear market on the basis of product?

- What is the breakup of the UK running gear market on the basis of gender?

- What is the breakup of the UK running gear market on the basis of distribution channel?

- What is the breakup of the UK running gear market on the basis of region?

- What are the key driving factors and challenges in the UK running gear market?

- What is the structure of the UK running gear market and who are the key players?

- What is the degree of competition in the UK running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)