UK Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2026-2034

UK Seeds Market Summary:

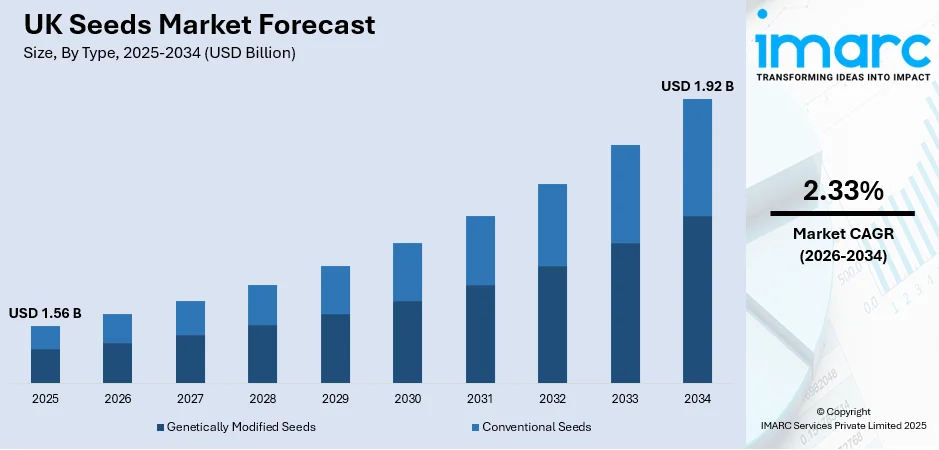

The UK seeds market size was valued at USD 1.56 Billion in 2025 and is projected to reach USD 1.92 Billion by 2034, growing at a compound annual growth rate of 2.33% from 2026-2034.

The market is experiencing transformative growth driven by the implementation of precision breeding regulations enabling gene-edited crop varieties, expansion of regenerative agriculture programs supporting sustainable farming practices, and government initiatives promoting climate-resilient seed development. Increased investment in drought-tolerant and disease-resistant seed varieties, coupled with modernized regulatory frameworks for seed procurement, is creating opportunities for innovation throughout the supply chain. The growing emphasis on food security alongside environmental sustainability goals continues to shape UK seeds market share.

Key Takeaways and Insights:

- By Type: Conventional seeds dominate the market with a share of 97% in 2025, maintaining dominance through established farming practices, proven yield performance, and cost-effectiveness.

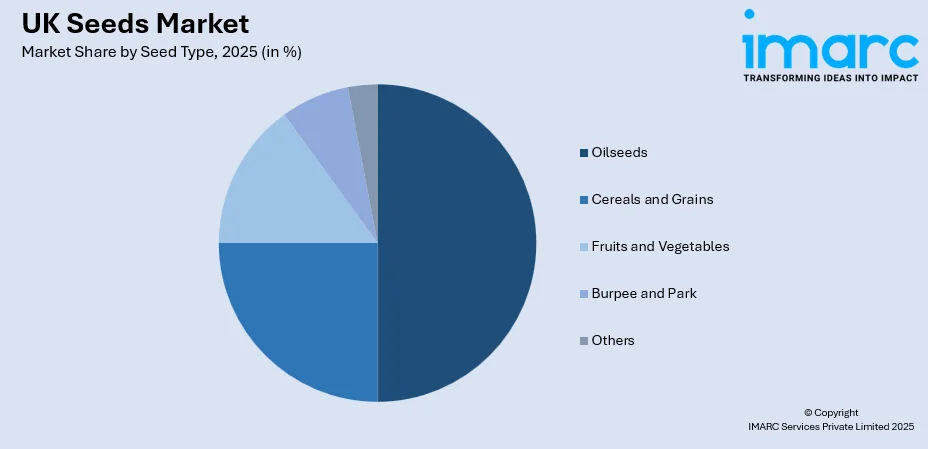

- By Seed Type: Cereals and grains lead the market with a share of 50% in 2025, driven by wheat production volumes and barley cultivation areas expanding, supported by consistent domestic demand and export opportunities.

- By Traits: Herbicide-tolerant (HT) represents the largest segment with a market share of 55% in 2025, reflecting farmer preference for weed management efficiency and crop protection capabilities that reduce labor costs and enable precision agriculture practices.

- By Availability: Commercial seeds dominate the market with a share of 80% in 2025, as professional farmers prioritize certified seed quality, genetic purity, and performance consistency over saved seed alternatives despite higher upfront costs.

- Key Players: The UK seeds market exhibits moderate competitive intensity, with multinational agrochemical corporations competing alongside regional seed breeding companies across price segments and crop specializations.

To get more information on this market Request Sample

The UK seeds market landscape is undergoing significant transformation following the implementation of precision breeding legislation in November 2025, which enables farmers and researchers to cultivate gene-edited crops that demonstrate enhanced disease resistance and nutritional value. The John Innes Centre successfully developed vitamin D-fortified tomatoes through precision breeding techniques that modify natural pathways to accumulate provitamin D3, representing commercial applications of advanced plant biotechnology. Regenerative agriculture initiatives are gaining momentum, with key market players partnering with various farmers to implement soil health practices and reduce pesticide dependency across farms. ADM's regenerative agriculture program enrolled over 260 farmers throughout 2024, focusing on oilseed rape and milling wheat production with emphasis on carbon sequestration and biodiversity enhancement.

UK Seeds Market Trends:

Precision Breeding Technology Regulatory Implementation

The UK positioned itself as a global leader in agricultural biotechnology through the November 2025 implementation of Genetic Technology (Precision Breeding) Regulations, enabling commercialization of gene-edited crop varieties previously restricted under genetic modification frameworks. The legislation permits farmers to cultivate crops with targeted genetic modifications that could occur through traditional breeding or natural processes, accelerating development timelines that conventionally require decades. The John Innes Centre demonstrated practical applications by developing tomatoes engineered to accumulate elevated provitamin D3 concentrations, addressing vitamin D deficiency concerns affecting public health outcomes. Researchers successfully modified wheat varieties to reduce acrylamide formation during processing, mitigating carcinogen exposure risks associated with baked and toasted products.

Regenerative Agriculture Program Expansion

Sustainable farming practices are gaining substantial traction as major food corporations invest in regenerative agriculture initiatives aimed at improving soil health metrics and reducing carbon footprints throughout agricultural supply chains. Unilever launched its inaugural UK regenerative agriculture project in February 2024, collaborating with English Mustard Growers and Norfolk Mint Growers to implement cover cropping strategies, low-carbon fertilizer applications, and precision irrigation scheduling across production areas serving Colman's brand products. Research institutions developed automated systems for vertical farming facilities while advancing remote sensing technologies for pest detection and environmental monitoring to support precision agriculture transitions.

Post-Brexit Trade Infrastructure Adaptation

The UK seeds sector continues navigating complex post-Brexit phytosanitary requirements that fundamentally altered import-export procedures for plant materials following separation from European Union regulatory frameworks. The Border Target Operating Model introduced in April 2024 mandated phytosanitary certificates and border control inspections for medium-risk and high-risk plant products, creating documentation burdens and processing delays that particularly impact small seed companies lacking dedicated compliance teams. The government reformed sugar beet seed procurement procedures in June 2024, enabling direct transactions between growers and suppliers to enhance market flexibility and variety selection beyond previous centralized distribution systems.

Market Outlook 2026-2034:

The UK seeds market is positioned for steady expansion driven by precision breeding technology adoption, climate adaptation priorities, and sustainable agriculture program scaling throughout the forecast period. The market generated a revenue of USD 1.56 Billion in 2025 and is projected to reach a revenue of USD 1.92 Billion by 2034, growing at a compound annual growth rate of 2.33% from 2026-2034. The commercialization of gene-edited crop varieties with enhanced disease resistance, nutritional profiles, and climate resilience characteristics will create differentiation opportunities for seed companies investing in biotechnology research and development capabilities.

UK Seeds Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Conventional Seeds | 97% |

| Seed Type | Cereals and Grains | 50% |

| Traits | Herbicide-Tolerant (HT) | 55% |

| Availability | Commercial Seeds | 80% |

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

Conventional seeds dominate with a market share of 97% of the total UK seeds market in 2025.

Conventional seeds maintain overwhelming market dominance through established farmer familiarity, proven agronomic performance across UK climatic conditions, and regulatory clarity compared to genetically modified alternatives facing consumer resistance and labeling requirements. The segment benefits from extensive breeding programs that continuously improve yield potential, disease resistance, and stress tolerance through traditional selection methodologies without genetic engineering interventions. Commercial seed companies invest heavily in conventional variety development, conducting multi-year field trials across diverse UK regions.

Traditional plant breeding techniques enable seed companies to develop varieties adapted to specific UK growing conditions, including regional temperature patterns, soil types, and rainfall distributions that influence crop success rates. Conventional seeds support organic farming systems that prohibit genetically modified organism usage, catering to premium market segments emphasizing natural production methods and environmental stewardship principles. The regulatory pathway for conventional seed varieties remains straightforward compared to biotechnology products requiring extensive safety assessments.

Seed Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

Cereals and grains lead with a share of 50% of the total UK seeds market in 2025.

Cereals and grains high demand is driven by wheat production volumes, establishing the crop as fundamental to domestic food security and export revenue generation. Barley cultivation expanded, reflecting farmer confidence in market demand from malting industries, animal feed sectors, and brewing applications. Cereal seed varieties undergo continuous improvement through breeding programs targeting yield enhancement, disease resistance against threats including fusarium head blight and yellow rust, and quality characteristics affecting milling performance and end-product specifications.

The Agricultural and Horticultural Development Board (AHDB) anticipates a nearly 30% rise in the UK’s cultivated area of oilseed rape for 2025/26 compared to the prior year. UK farmers favor planting barley and rapeseed varieties demonstrating winter hardiness, early vigor, and lodging resistance characteristics that protect yield potential under challenging weather conditions including excessive rainfall and strong winds. Cereal seeds represent substantial farm investment decisions influencing annual profitability outcomes, motivating producers to prioritize certified varieties offering genetic purity, germination guarantees, and agronomic support from seed company representatives.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

Herbicide-tolerant (HT) exhibits a clear dominance with a 55% share of the total UK seeds market in 2025.

Herbicide-tolerant traits dominate the UK seeds market as farmers seek efficient weed management solutions reducing labor requirements, tillage operations, and chemical application costs while maintaining crop yield potential. Precision agriculture adoption amplifies herbicide-tolerant seed value by enabling variable-rate herbicide applications based on weed density mapping. In 2025, with the secondary legislation for the Precision Breeding Act approved, England is set to leverage its top-notch research foundation in plant sciences and enhance sustainability in agriculture. The concluding execution of the Genetic Technology (Precision Breeding) Act signifies the launch of a new regulatory framework in England for precision-bred plants created through biotechnology to induce genetic alterations that could happen naturally or via traditional breeding methods.

The regulatory framework supporting herbicide-tolerant varieties provides market certainty for seed companies investing in trait development and farmer education programs explaining optimal herbicide selection and application techniques. UK agricultural advisors recommend herbicide-tolerant varieties for fields experiencing problematic weed infestations that threaten crop establishment and yield performance, particularly under reduced tillage systems emphasizing soil conservation and carbon sequestration objectives aligned with climate mitigation goals.

Availability Insights:

- Commercial Seeds

- Saved Seeds

Commercial seeds lead with a share of 80% of the total UK seeds market in 2025.

Commercial seeds maintain commanding market position through professional quality assurance programs, genetic improvement investments, and performance consistency that professional farmers prioritize over cost savings from saved seed alternatives. Seed companies conduct extensive field testing, disease screening, and germination testing to ensure commercial seed lots meet stringent quality standards protecting farmer investments in crop establishment. The segment benefits from continuous varietal improvement through breeding programs incorporating latest agronomic research, pest resistance mechanisms, and yield enhancement traits.

Commercial seed distribution networks provide farmers convenient access to certified varieties through agricultural merchants and seed suppliers offering technical support, planting recommendations, and agronomic guidance throughout growing seasons. Saved seeds experience resurgence among small-scale producers and organic farmers valuing genetic diversity preservation, local adaptation, and seed sovereignty principles that challenge corporate seed industry consolidation trends affecting variety availability and pricing structures. In 2025, Winnow Farm Seeds launched their new seed catalogue comprising few varieties which are not available in the UK. Six fresh seed assortments filled with beautiful heirloom seeds and enclosed in a recycled cotton pouch is available in the gift collection.

Seed Treatment Insights:

- Treated

- Untreated

Treated seeds continue gaining adoption as farmers recognize value from protective seed coatings delivering fungicides, insecticides, and biostimulants directly to germinating seedlings during vulnerable establishment phases. Seed treatment technologies enable precise chemical application rates targeting specific pests and diseases while minimizing environmental exposure compared to broadcast field applications.

Untreated seed options serve organic farming systems prohibiting synthetic chemical applications and conventional producers implementing integrated pest management strategies emphasizing biological controls and cultural practices over chemical interventions. They offer an affordable option for farmers to grow a wide variety of crops.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London's seed market centers on urban agriculture, community gardens, and peri-urban horticultural operations serving metropolitan food production initiatives. Demand focuses on vegetable varieties supporting allotment cultivation, rooftop gardens, and small-scale organic enterprises supplying local restaurants and farmers' markets. The region hosts agricultural biotechnology research institutions developing precision breeding innovations and seed technology commercialization programs.

South East England commands substantial market share through diverse agricultural systems spanning cereal production, oilseed cultivation, and extensive horticultural operations across Kent, Sussex, Hampshire, and surrounding counties. Favorable chalk downland soils and maritime climate support productive wheat, barley, and oilseed rape cultivation serving milling industries and export channels.

North West England's seed market emphasizes forage varieties supporting extensive dairy and beef enterprises across Lancashire, Cumbria, and Cheshire counties experiencing higher rainfall and challenging topography limiting arable crop cultivation. Grassland agriculture dominates, requiring productive ryegrass cultivars, clover species, and diverse forage mixtures for intensive grazing management and silage production programs.

East of England represents the UK's premier arable region, commanding dominant cereal and oilseed seed market share across Lincolnshire, Norfolk, Cambridgeshire, and Suffolk. Sandy loam soils, moderate rainfall, and established infrastructure support extensive wheat, barley, and rapeseed cultivation achieving exceptional yields through precision farming technologies. Regional demand emphasizes high-yielding winter wheat for milling quality grain, malting barley cultivars serving brewing industries, and oilseed rape hybrids delivering premium oil specifications.

South West England exhibits diverse agricultural landscape supporting dairy enterprises, livestock production, and mixed farming across Cornwall, Devon, Somerset, Dorset, and Gloucestershire. Grassland seed demand serves extensive cattle operations requiring productive varieties and herbal leys supporting rotational grazing and conservation agriculture practices. Cereal cultivation focuses on feed grain production utilizing spring barley and winter wheat adapted to moderate rainfall and varied soil types.

Scotland holds strategic importance for certified seed potato production, benefiting from cooler temperatures and reduced aphid pressure supporting disease-free multiplication programs serving UK and international markets. Diverse agricultural zones encompass intensive arable operations in eastern lowlands producing cereals and oilseeds, extensive livestock systems throughout uplands requiring resilient forage varieties, and specialized horticultural enterprises.

West Midlands demonstrates balanced agricultural portfolio combining arable crop production, livestock enterprises, and horticultural operations across Shropshire, Staffordshire, Worcestershire, Warwickshire, and Herefordshire. Mixed farming systems integrate cereal cultivation with dairy operations requiring both crop seeds and forage varieties supporting rotation management programs. Fertile soils support productive wheat, barley, and oilseed rape cultivation serving regional processing facilities.

Yorkshire and The Humber combine extensive arable farming in lowland areas with upland livestock systems, creating substantial cereal, oilseed, and forage seed markets. The region produces significant wheat, barley, and oilseed rape volumes across East Riding, North Yorkshire, and South Yorkshire benefiting from favorable growing conditions. Potato production maintains regional importance, requiring certified seed potato sourcing supporting processing industry requirements.

East Midlands represents significant arable farming region producing cereals, oilseeds, and pulses across Nottinghamshire, Leicestershire, Northamptonshire, and Derbyshire supported by productive soils and established marketing infrastructure. Wheat cultivation dominates serving milling industries, livestock feed markets, and export opportunities through grain marketing cooperatives.

Other UK regions including Wales and Northern Ireland exhibit distinct characteristics emphasizing livestock production over intensive arable cultivation. Welsh agriculture focuses predominantly on sheep farming and beef enterprises across upland areas requiring resilient grass species and hardy forage varieties balancing productivity with landscape conservation. Grassland seed markets dominate serving permanent pasture establishment and upland grazing improvements utilizing mixtures adapted to acidic soils and high rainfall.

Market Dynamics:

Growth Drivers:

Why is the UK Seeds Market Growing?

Advanced Precision Breeding Technologies Enabling Crop Innovation

The implementation of Genetic Technology (Precision Breeding) Regulations in November 2025 represents a major moment enabling UK researchers and seed companies to develop and commercialize gene-edited crop varieties with enhanced traits addressing climate challenges, nutritional deficiencies, and pest resistance requirements. The regulatory framework distinguishes precision breeding from genetic modification by restricting acceptable genetic changes to those achievable through traditional breeding or natural processes, accelerating variety development timelines that conventionally span decades. The BOFIN field trial commenced in 2024 across 25 commercial farms evaluating precision-bred wheat varieties exhibiting reduced acrylamide formation during baking processes, addressing food safety concerns associated with carcinogen formation in toasted and baked products.

Climate Resilience and Food Security Imperatives

Climate change impacts including increasing drought frequency, temperature extremes, and rainfall variability are driving urgent demand for climate-resilient seed varieties capable of maintaining yield stability under challenging environmental conditions threatening UK agricultural productivity. Government food security strategies emphasize domestic production capacity enhancement through improved crop genetics that reduce reliance on agricultural imports vulnerable to supply chain disruptions and geopolitical uncertainties. In 2024, Cope launched its expanding range by introducing three new high-yield varieties, providing farmers throughout the UK remarkable performance and greater flexibility. Now included on the AHDB Recommended List, Everlong spring wheat provided the best yield and specific weight among all spring wheat options, winter barley candidate Aretha achieved high yields and the earliest maturity available, and spring pea candidate Marler is the top-yielding white pea of any listed or candidate varieties.

Sustainable Agriculture and Regenerative Farming Program Expansion

Corporate sustainability commitments and consumer demand for environmentally responsible food production are accelerating regenerative agriculture adoption requiring specialized seed varieties supporting soil health, biodiversity, and carbon sequestration objectives. Unilever's partnership with English Mustard Growers and Norfolk Mint Growers initiated in February 2024 demonstrates food industry engagement in supply chain sustainability, investing in regenerative practices including low-carbon fertilizer adoption, companion planting systems, and precision irrigation technologies that reduce environmental footprints while maintaining product quality specifications. Regenerative agriculture requires seed varieties exhibiting robust early vigor, disease resistance, and competitive ability against weeds in reduced-chemical input systems, creating market opportunities for breeding programs.

Market Restraints:

What Challenges the UK Seeds Market is Facing?

Post-Brexit Phytosanitary Requirements and Trade Complexities

The implementation of Border Target Operating Model in 2024 introduced substantial phytosanitary documentation requirements and border inspection protocols that disrupted seed import procedures and increased costs for agricultural businesses sourcing plant materials from European Union suppliers. Small seed companies face disproportionate administrative burdens managing phytosanitary certificate applications, customs declarations, and organic certification documentation that large corporations handle through dedicated compliance departments, reducing competitive viability for independent seed merchants serving niche markets and specialized crop sectors.

Limited Financial Viability of Domestic Seed Production Scaling

UK seed production infrastructure faces economic constraints limiting capacity to replace European imports, as domestic seed growers contend with high establishment costs, specialized equipment requirements, and extended production timelines that challenge profitability targets. Seed production requires certified organic land access, controlled pollination facilities, cleaning and sorting equipment, and drying infrastructure representing substantial capital investments that exceed financial resources available to small-scale producers contemplating entry into commercial seed markets. Training requirements for skilled seed production personnel, multi-season crop cycles for biennial species, and quality testing compliance add operational complexity and cost burdens that discourage agricultural diversification.

Regulatory Compliance and Market Access Barriers

Complex regulatory frameworks governing seed certification, variety registration, and organic standards create market entry barriers and ongoing compliance costs that particularly burden smaller seed companies and independent breeders competing against multinational corporations with established regulatory affairs departments. Organic seed regulations requiring first consignee certification for imported materials from European Union suppliers add logistical complexity and cost layers that threaten viability for specialty seed merchants serving organic farming sectors.

Competitive Landscape:

The UK seeds market demonstrates moderate competitive intensity characterized by multinational agrochemical corporations maintaining dominant market positions through extensive research and development capabilities, global supply chain infrastructure, and comprehensive product portfolios spanning field crops, vegetables, and specialty seed categories. International seed companies leverage technological advantages in hybrid seed development, trait integration, and breeding program scale to command premium pricing and market share across major commodity crop sectors. Regional seed companies serve specialized market segments through localized variety development, customer service differentiation, and niche crop focus areas including forage grasses, organic vegetables, and heritage variety preservation programs. The competitive landscape is evolving as precision breeding regulations enable public research institutions to commercialize gene-edited varieties, potentially democratizing access to advanced biotechnology and diversifying market participants beyond traditional corporate seed industry concentration.

Recent Developments:

- In October 2025, Sakata has obtained the onion and shallot seed operations of Allium Seeds Ltd, a UK company, broadening its breeding and research efforts in Europe. The action comes after a 12-year partnership between the two firms aimed at creating intermediate and long-day onion varieties for the UK and Irish markets.

- In September 2025, Unwins Seeds, a reliable name in gardening since 1903, presented its new Houseplant Seed Collection, a carefully selected assortment of eight indoor plant types designed to thrive in homes across the UK and Ireland. This launch marks Unwins’ inaugural houseplant seed category, addressing the growing consumer demand for indoor gardening.

- In October 2025, For the celebration of the 25th anniversary of the Millennium Seed Bank (MSB), Kew launched a new podcast series titled Unearthed: The need for seeds, featuring Ambassador for Wakehurst Cate Blanchett discussing the history, current state, and future of the world’s most crucial wild plant seed bank. In a sequence of activities in the following days, scientists and advocates of the seed bank united to emphasize the importance of the MSB and its collaborations in tackling the climate and biodiversity emergencies and to urge for £30 million to support the future of the Millennium Seed Bank’s efforts to avert plant extinction, rehabilitate ecosystems, and discover nature-based approaches to climate change.

UK Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK seeds market size was valued at USD 1.56 Billion in 2025.

The UK seeds market is expected to grow at a compound annual growth rate of 2.33% from 2026-2034 to reach USD 1.92 Billion by 2034.

Conventional Seeds dominated the market with 97% revenue share, owing to established farmer familiarity, proven agronomic performance across UK climatic conditions, and regulatory clarity compared to genetically modified alternatives facing consumer resistance and extensive approval requirements.

Key factors driving the UK Seeds market include implementation of precision breeding regulations enabling gene-edited crop commercialization, climate resilience imperatives requiring drought-tolerant and disease-resistant varieties, expansion of regenerative agriculture programs supporting sustainable farming transitions, and government food security initiatives promoting domestic agricultural productivity enhancement through improved crop genetics and breeding innovation.

Major challenges include post-Brexit phytosanitary requirements creating documentation burdens and import delays particularly for EU seed sourcing, limited financial viability for scaling domestic seed production infrastructure requiring substantial capital investments and specialized expertise, regulatory compliance complexities affecting market access for smaller seed companies, and organic certification requirements adding logistical complexity for specialty seed merchants serving sustainable agriculture sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)