UK Solar Energy Market Report by Technology (Solar Photovoltaic (PV), Concentrated Solar Power (CSP)), Application (On-grid, Off-grid), End User (Residential, Commercial, Industrial), and Region 2025-2033

UK Solar Energy Market Overview:

The UK solar energy market size reached USD 9,003.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25,160.6 Million by 2033, exhibiting a growth rate (CAGR) of 12.1% during 2025-2033. There are several factors that are driving the market, which include favorable government initiatives, increasing solar photovoltaic (PV) installations, rising focus on maintaining environmental sustainability, integration of advanced technologies, and energy independence and security.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,003.5 Million |

| Market Forecast in 2033 | USD 25,160.6 Million |

| Market Growth Rate 2025-2033 | 12.1% |

UK Solar Energy Market Trends:

Favorable Government Initiatives

Governing agencies in the UK are implementing several favorable initiatives to promote the growth and adoption of solar energy. These initiatives are aimed at incentivizing both residential and commercial solar energy projects and supporting the country's commitment to reducing carbon emissions. They are introducing schemes that encourage the adoption of small-scale renewable and low-carbon electricity generation technologies, including solar PV. They are providing payments to owners of solar PV systems for the electricity they generate and export to the grid. They are also introducing stricter building regulations and standards that encourage the incorporation of renewable energy technologies, including solar PV, in new buildings. As per the UK Parliament, the governing agencies set a legally binding target to reduce the UK’s greenhouse gas (GHG) emissions by 100% by 2050. It also aims to achieve 70 gigawatts (GW) of solar power by 2035. UK renewable energy market policies continue to evolve in support of these goals.

Increasing Solar PV Installations

Rising public awareness and concerns about climate change are catalyzing the demand for renewable energy solutions, including solar PV. Many businesses are adopting solar energy to meet their sustainability targets and reduce their carbon footprint. Solar PV systems provide a renewable energy source that helps reduce reliance on fossil fuels and enhances energy security. Solar PV systems support decentralized energy generation, reducing transmission losses and improving grid resilience. In addition, technological advancements are leading to the development of more efficient solar panels UK, allowing for greater energy generation from smaller surface areas. Innovations such as bifacial panels, which capture sunlight on both sides, and flexible panels, suitable for various applications, expanded the possibilities for solar installations. Furthermore, governing agencies in the country are focusing on increasing solar PV installations to lower their carbon footprint and align with sustainability goals. According to Solaradvice,15.8 GW of solar capacity was distributed across 1,468,652 installations as of February 2024.

Push for Energy Security and Emissions Reduction

UK policymakers and businesses are treating solar energy as a double win, for cutting carbon and reducing reliance on imported fuels. With energy prices volatile and climate targets looming, there's growing urgency to build domestic capacity. Solar is increasingly integrated into national energy planning, and the government has lifted several regulatory barriers to speed up deployment. Public sector projects, corporate sustainability targets, and local councils are all contributing to this momentum. The appeal goes beyond just economics; many see solar as a way to future-proof the grid and keep communities resilient. Even small-scale installations are gaining popularity as households seek insulation from future energy price shocks, aligning with recent solar energy UK statistics that show increasing household adoption.

Land-Based Solar Expansion Picks Up Speed

Ground-mounted solar farms are growing faster than rooftop setups in the UK. Developers are turning to underutilized farmland, brownfield sites, and rural land parcels to build larger utility-scale installations. Planning applications for ground-mounted arrays have surged since 2023, supported by clearer approval processes and long-term power purchase agreements (PPAs). These systems can take advantage of economies of scale, making them more cost-effective. Projects of 50 MW and higher are now more common, especially in southern England. Storage is being paired more often to improve grid stability. These installations often come with biodiversity initiatives like wildflower meadows, helping to ease local opposition.

Monocrystalline Dominance with Emerging Alternatives

Monocrystalline silicon panels continue to dominate the UK solar market, holding about 65% share in 2024 thanks to their efficiency and long-term performance. However, alternatives like thin-film panels and tunnel oxide passivated contact (TOPCon) cells are becoming more visible. Thin-film is attractive for projects needing lighter materials or installations on irregular surfaces. TOPCon, meanwhile, appeals to utility-scale developers aiming for even higher energy yields. Manufacturers are beginning to offer hybrid solutions or bifacial modules that can work in low-light conditions. Although monocrystalline still sets the standard, competitive pricing and performance improvements are giving new technologies a real shot at scaling.

Niche Solar Formats Gaining Market Attention

New formats like agrivoltaics and floating solar are catching interest as land competition and water resource challenges grow. Agrivoltaic setups allow solar panels and agriculture to coexist, using adjustable mounts to preserve crop yields while generating electricity. Some UK farms are running pilots with sheep grazing under solar arrays or growing shade-tolerant crops. Meanwhile, floating solar is emerging at water reservoirs and abandoned quarries, particularly in regions where land availability is constrained. These projects help reduce evaporation and keep panels cool, improving efficiency. While still a small share of total installations, both models are drawing support from planners and researchers.

UK Solar Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

To get more information on this market, Request Sample

- Solar Photovoltaic (PV)

- Concentrated Solar Power (CSP)

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solar photovoltaic (PV) and concentrated solar power (CSP).

Application Insights:

- On-grid

- Off-grid

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes on-grid and off-grid.

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

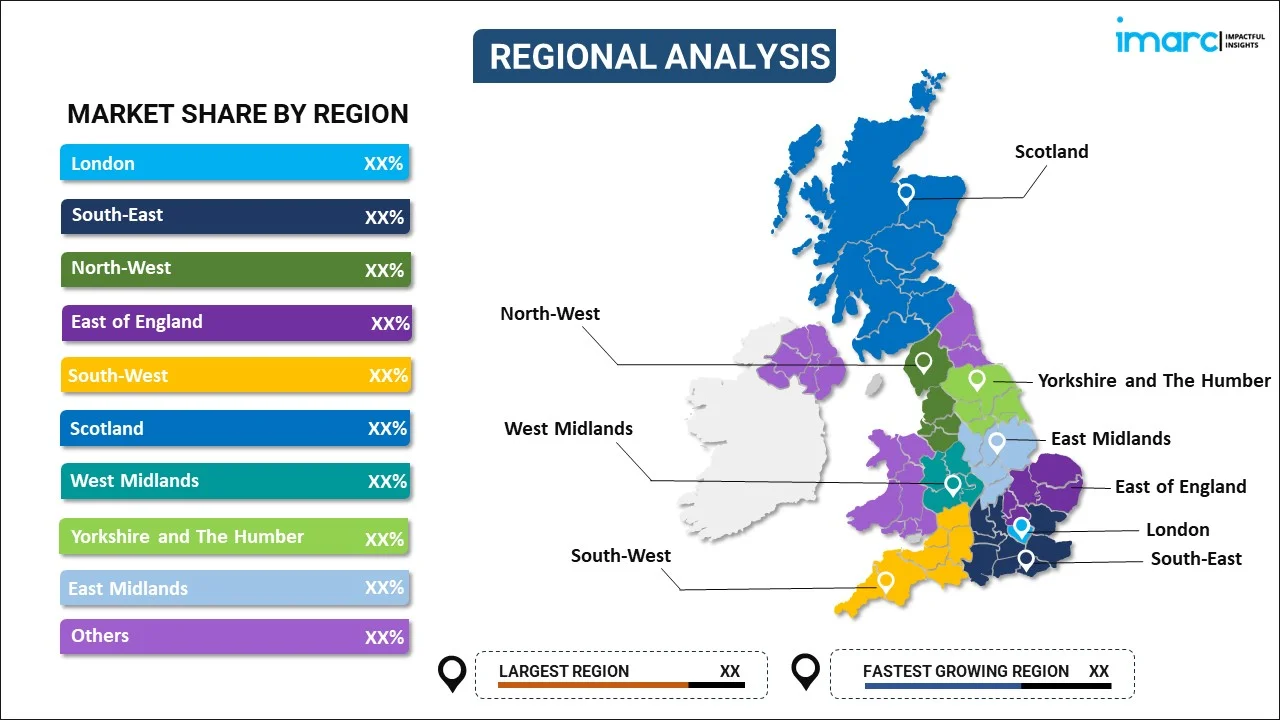

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others.

Solar Energy Companies in the UK:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Solar Energy Market News:

- In June 2025, the UK government and Solar Energy UK released a new Solar Roadmap aiming for 45–47 GW of solar capacity by 2030. The plan outlines steps to expand low-cost power, cut emissions, and support biodiversity, all while creating up to 35,000 jobs. It emphasizes practical actions and land efficiency, targeting under 0.5% of UK land for solar development.

- In June 2025, TotalEnergies acquired 350 MW of solar and 85 MW of battery storage projects in southern England from Low Carbon. Aimed to be operational by 2028, the projects are expected to generate over 350 GWh annually, enough to power 100,000 UK homes. This move strengthens TotalEnergies’ growing UK renewable portfolio, which already includes offshore wind, gas turbines, and over 600 MW of solar developments underway.

- In March 2025, statistics released by the government confirmed that renewables generated a record 50.8% of the UK’s electricity in 2024, surpassing the halfway mark for the first time. Solar accounted for 5.2% (14.8 TWh), with total clean power reaching 144.7 TWh. Low carbon sources hit 65%, while fossil fuel generation dropped to 31.5%, the lowest share since the 1950s.

- In August 2024, Oxford University physicists developed a flexible, high-efficiency solar material that could reshape the UK solar energy market. Achieving over 27% efficiency without using silicon, the material can be applied to everyday surfaces like cars and buildings. Its versatility and performance, validated by Japan's AIST, signal a potential shift toward lightweight, adaptable solar solutions, supporting the UK's push for cleaner energy and broader solar adoption across urban infrastructure.

UK Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Solar Photovoltaic (PV), Concentrated Solar Power (CSP) |

| Applications Covered | On-grid, Off-grid |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK solar energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK solar energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK solar energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar energy market in the UK was valued at USD 9,003.5 Million in 2024.

The UK solar energy market is projected to exhibit a CAGR of 12.1% during 2025-2033, reaching a value of USD 25,160.6 Million by 2033.

The UK solar energy market is growing due to stable government support, lower installation costs, and strong climate commitments. Planning reforms and incentives for rooftop and storage projects encourage wider adoption. Rising electricity prices are pushing businesses and households to invest in solar, making it a more competitive and appealing option.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)