UK Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

UK Steel Tubes Market Overview:

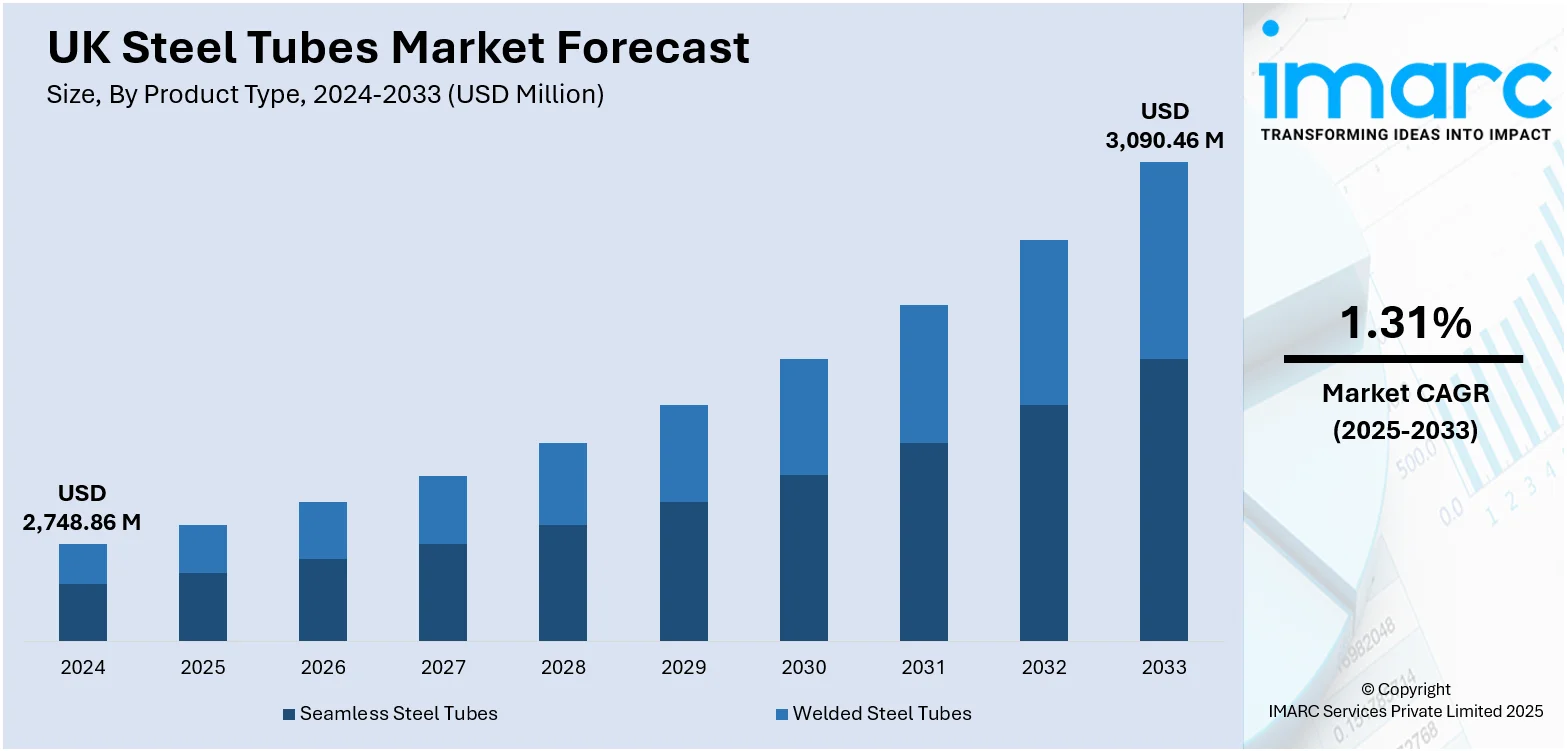

The UK steel tubes market size reached USD 2,748.86 Million in 2024. The market is projected to reach USD 3,090.46 Million by 2033, exhibiting a growth rate (CAGR) of 1.31% during 2025-2033. The market is witnessing steady expansion, driven by heightened demand in critical sectors such as infrastructure, construction, energy, and automotive. Major manufacturers are enhancing performance with advanced fabrication techniques, corrosion-resistant coatings, and tailored alloys to meet evolving sector needs. Regional sourcing and strengthened local supply chains are improving lead times and boosting operational resilience. A growing emphasis on sustainable manufacturing and compliance with tightening environmental regulations is reshaping production priorities. These dynamics point to a growing importance in the UK steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,748.86 Million |

| Market Forecast in 2033 | USD 3,090.46 Million |

| Market Growth Rate 2025-2033 | 1.31% |

UK Steel Tubes Market Trends:

Domestic Output Stability and Structural Recalibration

On May 2024, UK steel sources confirmed that the sector directly employed approximately 33,700 people, reinforcing the structural importance of the tubing and pipe segment within manufacturing. While overall crude steel output remains modest relative to major markets, capacity supports a baseline feedstock level for domestic tube production focused on built environment and infrastructure applications. Government procurement strategy now emphasizes locally sourced steel for bridges, transport, and public buildings, underpinning stability in tube demand. This alignment between public spending and domestic feedstock helps sustain fabrication lines oriented toward welded and mechanical tube profiles. With import competition rising, particularly from Europe and Asia, emphasis on specification, traceability, and engineering tolerances becomes vital. Producers are pivoting from volume-based strategies to higher compliance and quality standards supported by government pipeline guidance. These signals suggest that structural adjustment is underway as tube manufacturing in the UK consolidates around precision and public-demanded profiles rather than expansion. Overall, this evolution supports UK steel tubes market growth through more refined domestic alignment and procurement synergy.

To get more information on this market, Request Sample

Import Surge Spurs Niche and Specification Pivot

In November 2024, UK reported that cast iron and steel tubes and pipes imports reached table series value of 88 for that quarter, showing elevated dependency on external suppliers even as domestic production remains limited. Imports overall rose steadily, especially for welded tube profiles and structural sections. This increased reliance on foreign tubing has prompted manufacturers to recalibrate their upstream-downstream linkages investing in tighter engineering specifications, higher grade alloys, and finishing processes that justify domestic sourcing over imported alternatives. The shift favors tube lines serving rail, offshore, and mechanical sectors where traceability or steel provenance matters more than price. Government steel procurement guidance reinforces preference for certified local supply, thereby strengthening specification-sensitive domestic tube lines. Whereas commodity imports may satisfy basic volume needs, producers are aligning around high-spec niche products where domestic capability can compete more effectively. As UK consumption becomes more nuanced, tube fabricators are leaning into this premium orientation. This strategic repositioning reflects emerging UK steel tube market trends shaped by import pressures and a shift toward premium production.

Policy-Driven Stability via Strategic National Support

In April 2025, Parliament fast‑tracked the Steel Industry (Special Measures) Act granting government authority to direct operations to preserve UK blast furnace capability and ensure ongoing tubing feedstock supply. This legislative action preserves critical steelmaking infrastructure in Scunthorpe, safeguarding a domestic supply chain that feeds into structural tube fabrication, especially for national infrastructure and defense pipelines. Government intervention emphasizes long‑term supply resilience over short‑term collapse, ensuring tube producers can rely on local steel rather than inconsistent imports. This structural underpinning encourages a refocus toward engineered tube production, including seamless tubing, mechanically graded profiles, and specification-sensitive coatings aligned with national requirements. The legislation signals a move toward industrial self-reliance in vital steel segments. For tube fabricators, this translates to a more stable downstream environment and clearer strategic direction for specification-led output. Overall, this policy-backed continuity supports premium fabrication alignment and positions the UK industry to reliably deliver high-grade tubing solutions even amid volatile global steel markets.

UK Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

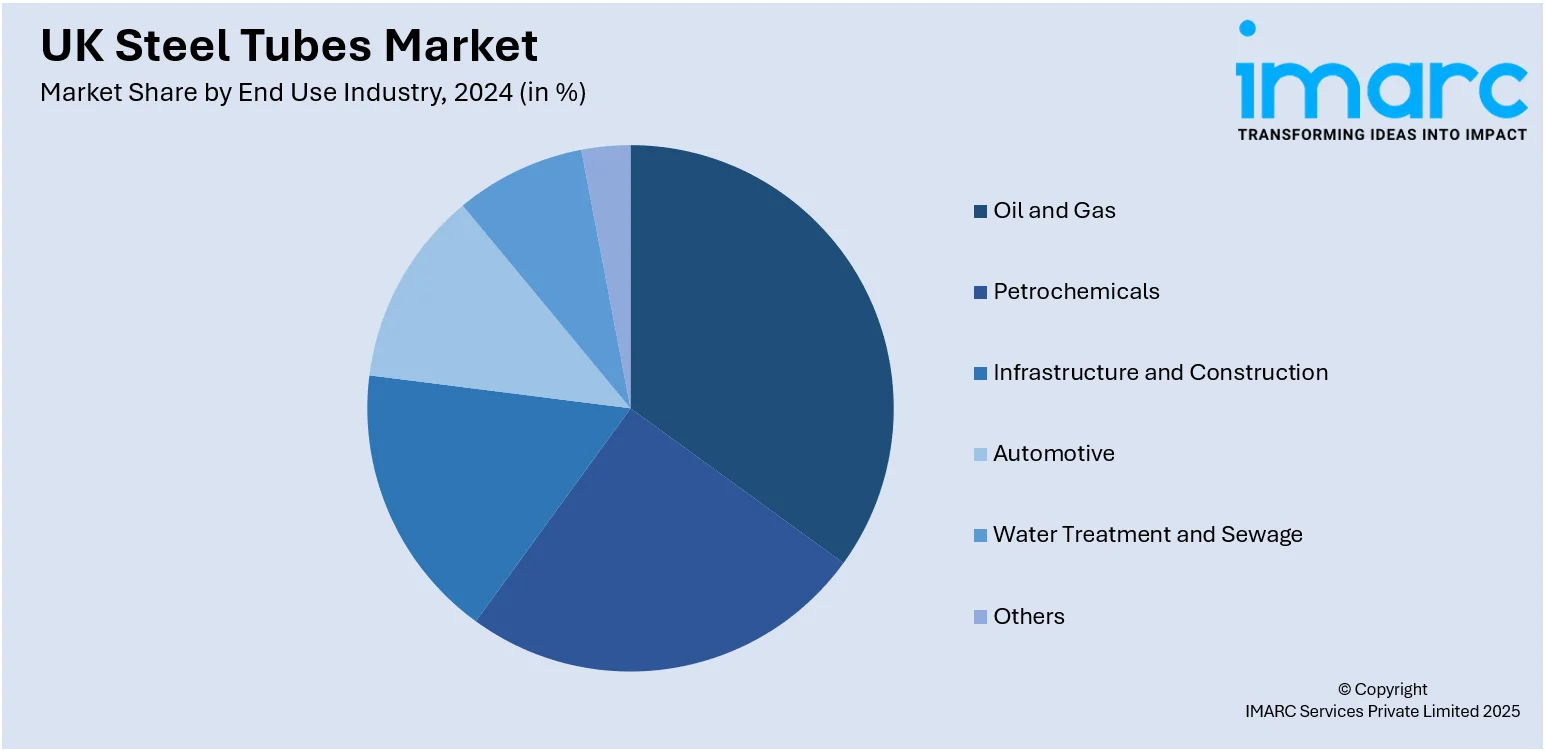

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the UK steel tubes market on the basis of product type?

- What is the breakup of the UK steel tubes market on the basis of material type?

- What is the breakup of the UK steel tubes market on the basis of end use industry?

- What is the breakup of the UK steel tubes market on the basis of region?

- What are the various stages in the value chain of the UK steel tubes market?

- What are the key driving factors and challenges in the UK steel tubes market?

- What is the structure of the UK steel tubes market and who are the key players?

- What is the degree of competition in the UK steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)