UK Technology Market Size, Share, Trends and Forecast by Technology Type, Enterprise Size, Deployment Mode, Industry Vertical, and Region, 2025-2033

UK Technology Market Overview:

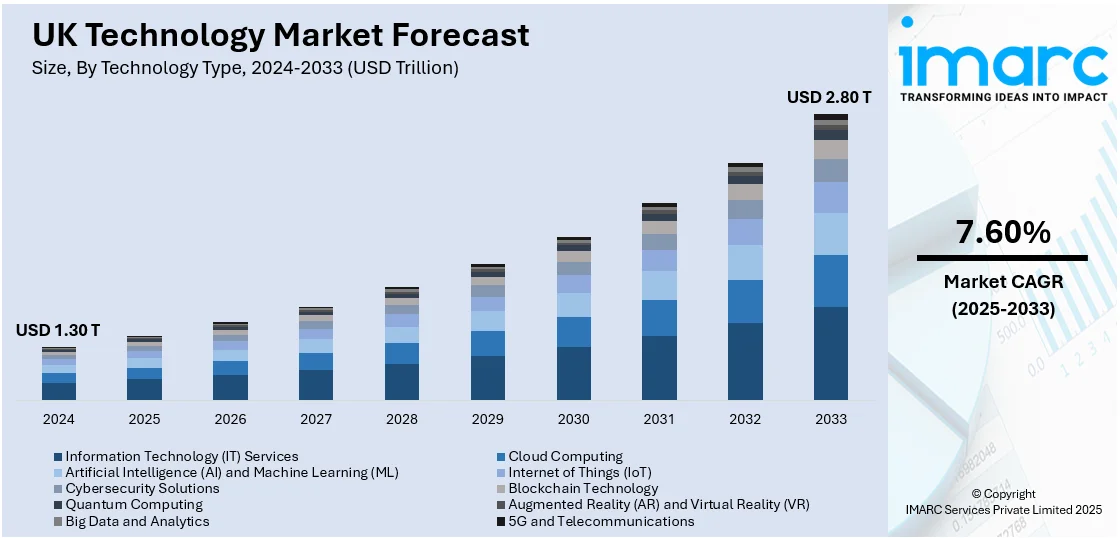

The UK technology market size reached USD 1.30 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.80 Trillion by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The market is thriving, fueled by digital transformation, AI, and 5G advancements. Increased investments in green technology and cybersecurity are ensuring sustainable growth. The UK has a third of Europe's unicorns, with more than 40% being developed in the past 3 years, and have crossed the valuation of nearly USD 1 Billion. Additionally, the nation has more than 200 future unicorns, further reinforcing its market prospect with over 150 unicrons, surpassing France, Sweden, and Germany.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Trillion |

| Market Forecast in 2033 | USD 2.80 Trillion |

| Market Growth Rate 2025-2033 | 7.60% |

UK Technology Market Trends:

Rising Adoption of Artificial Intelligence and Machine Learning

Machine learning and artificial intelligence in the UK, are influencing the tech industry toward radical transformation, contributing significantly to the UK tech market. AI-based diagnostics and personalized treatment plans are being embraced by healthcare to help improve patient outcomes. In finance, the use of AI in algorithmic trading, fraud detection, and customer service through chatbots, as well as for process automation is being witnessed. In retail, AI is being used with predictive analytics and personalized shopping, while AI-powered automation is being applied in manufacturing to optimize operational efficiency. Such technologies also contribute critically to cybersecurity for fast threat detection and response. For example, in April 2024, the U.S. and British governments announced a new partnership to jointly address safety concerns around AI. Key areas of this partnership will include advanced testing for AI models and sharing critical information regarding AI risks and capabilities. The emergence of this partnership comes amid heightened concerns surrounding the extent to which advanced AI models may pose risks. The two countries will conduct joint exercises and advocate for creating similar partnerships with other countries. This would serve to further bolster the UK tech market size, contributing to its continued growth and global competitiveness.

To get more information on this market, Request Sample

Expansion of 5G Network

The introduction of 5G networks in the UK is rapidly improving network connectivity with faster data speeds, low latencies, and reliable sustainability of the network. For the transport sector, 5G will provide real-time monitoring, navigation, data exchange, and safety for the advancement of autonomous vehicles. It also provides smart city-infrastructure facilities for optimized traffic management, energy efficiency solutions, and better public services. This technological leap is a significant factor contributing to the growth of the United Kingdom technology market, enhancing innovation and shaping the future of multiple sectors. Furthermore, the healthcare industry is embracing new and advanced health solutions enabled by 5G, where faster diagnosis can happen through remote monitoring and telemedicine. Improved connectivity is going to be the driving force of innovation and sectoral growth across these emerging sectors, further boosting the UK technology market share. For example, in May 2024, Nokia announced a private 5G-network deal in the UK with CGI, followed by Northern Ireland. CGI will be selling Nokia's "Digital Automation Cloud" along with other modular private wireless products and mission-critical industrial edge computing platforms. They are also targeting Industry 4.0 customers and will help develop smart manufacturing test beds. The Smart Nano NI project - insured by UK government funding - will look at and test different use cases on the private 5G network, propelling the market growth.

Digital Transformation

Digital transformation is a major force shaping the UK tech market growth. Cloud computing, AI, machine learning, and other cutting-edge technologies are being embraced by businesses more and more in an effort to increase operational effectiveness, optimize workflows, and improve consumer experiences. Government policies that support digital projects, encourage entrepreneurship, and stimulate tech-related investments all demonstrate the UK's dedication to innovation and digital growth. Businesses may automate tedious operations, obtain deeper insights, and develop customized products for their customers as they use digital tools. This change was further hastened by the COVID-19 pandemic, which led to an unprecedented demand for internet services, e-commerce solutions, and remote working technology. Furthermore, traditional sectors are changing due to the emergence of Industry 4.0, which is fueled by developments in IoT (Internet of Things) and smart manufacturing. Businesses in the UK are using these digital tools more and more to maintain their competitiveness in a market that is always changing. This rapid adoption of digital technologies places the UK at the forefront of digital transformation in Europe, presenting abundant opportunities for tech companies to innovate and thrive in an increasingly digital world, further shaping the England technology market and its role in global innovation.

Vibrant Startup Ecosystem

The UK is renowned for having a vibrant and dynamic startup scene, especially in the technology industry. Technology entrepreneurs are drawn to the UK because of its innovative landscape, venture capital availability, and benevolent regulatory framework. Large cities that provide an environment conducive to creativity, such as London, Cambridge, and Manchester, are important hubs for tech companies. Thanks to government incentives and financial programs that support business growth, the UK's startup sector has drawn talent and investors from around the world. In addition, the nation is home to more than 150 unicorn tech businesses, with a total valuation of over USD 1 billion, more than any other European nation, including Sweden, Germany, and France. This growing pool of high-value startups is supported by the UK’s strong emphasis on research and development, particularly in AI, fintech, and cybersecurity. The rise of these technology-driven companies is further encouraged by the collaborative environment between businesses, academia, and government entities. With over 200 future unicorns poised for growth, the UK’s startup ecosystem remains a powerhouse of innovation and technological advancement, shaping the UK tech market view and driving its continued expansion.

UK Technology Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology type, enterprise size, deployment mode, and industry vertical.

Technology Type Insights:

- Information Technology (IT) Services

- Cloud Computing

- Artificial Intelligence (AI) and Machine Learning (ML)

- Internet of Things (IoT)

- Cybersecurity Solutions

- Blockchain Technology

- Quantum Computing

- Augmented Reality (AR) and Virtual Reality (VR)

- Big Data and Analytics

- 5G and Telecommunications

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes Information Technology (IT) services, cloud computing, artificial intelligence (AI) and machine learning (ML), internet of things (IoT), cybersecurity solutions, blockchain technology, quantum computing, augmented reality (AR) and virtual reality (VR), big data and analytics, and 5G and telecommunications.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises, small and medium enterprises (SMEs).

Deployment Mode Insights:

- On-Premise

- Cloud-Based

- Hybrid Solutions

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premise, cloud-based, and hybrid solutions.

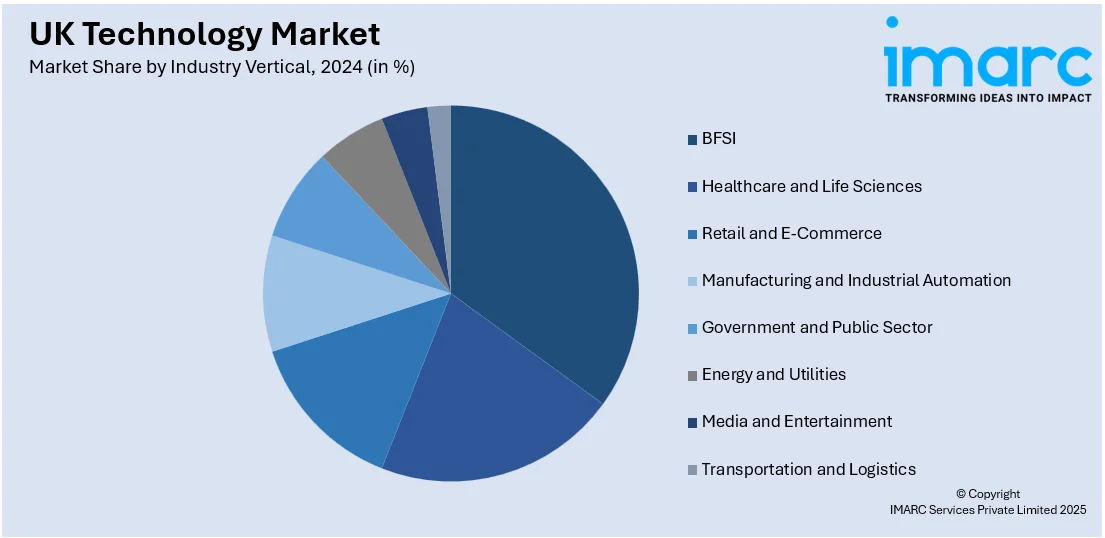

Industry Vertical Insights:

- BFSI

- Healthcare and Life Sciences

- Retail and E-Commerce

- Manufacturing and Industrial Automation

- Government and Public Sector

- Energy and Utilities

- Media and Entertainment

- Transportation and Logistics

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, healthcare and life sciences, retail and e-commerce, manufacturing and industrial automation, government and public sector, energy and utilities, media and entertainment, and transportation and logistics.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Technology Market News:

- In April 2025, Ancoris and Sundown Solutions merged to form Telana, an end-to-end provider for applied innovation. Telana will focus on delivering business outcomes through AI, data, software development, and cloud engineering. Serving global enterprises and the UK public sector, Telana aims to provide solutions on the technology platform that best suits its customers. Telana has partnerships with Google Cloud and Microsoft.

- In September 2024, SecurityHQ and Bechtle UK partnered to provide managed cybersecurity services. Bechtle UK, a subsidiary of Europe’s largest IT provider, will incorporate SecurityHQ’s services into its offerings, enhancing its ability to deliver comprehensive IT solutions. The partnership leverages SecurityHQ's threat detection and response capabilities with Bechtle's broad IT service portfolio, benefiting mid-to-enterprise-sized businesses by improving their security

UK Technology Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Information Technology (IT) Services, Cloud Computing, Artificial Intelligence (AI) and Machine Learning (ML), Internet of Things (IoT), Cybersecurity Solutions, Blockchain Technology, Quantum Computing, Augmented Reality (AR) and Virtual Reality (VR), Big Data and Analytics, 5G and Telecommunications |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises (SMEs) |

| Deployment Modes Covered | On-Premise, On-Cloud, Hybrid Solutions |

| Industry Verticals Covered | BFSI, Healthcare and Life Sciences, Retail and E-Commerce, Manufacturing and Industrial Automation, Government and Public Sector, Energy and Utilities, Media and Entertainment, Transportation and Logistics |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK technology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK technology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The technology market in UK was valued at USD 1.30 Trillion in 2024.

The UK technology market is projected to exhibit a CAGR of 7.60% during 2025-2033, reaching a value of USD 2.80 Trillion by 2033.

Key factors driving the UK technology market include digital transformation, advancements in AI and 5G, strong government support, a thriving startup ecosystem, significant venture capital investments, and growing demand for cybersecurity and green technology, all fostering innovation and market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)