UK Telehealth Market Size, Share, Trends and Forecast by Component, Communication Technology, Hosting Type, Application, End User, and Region, 2025-2033

UK Telehealth Market Size and Share:

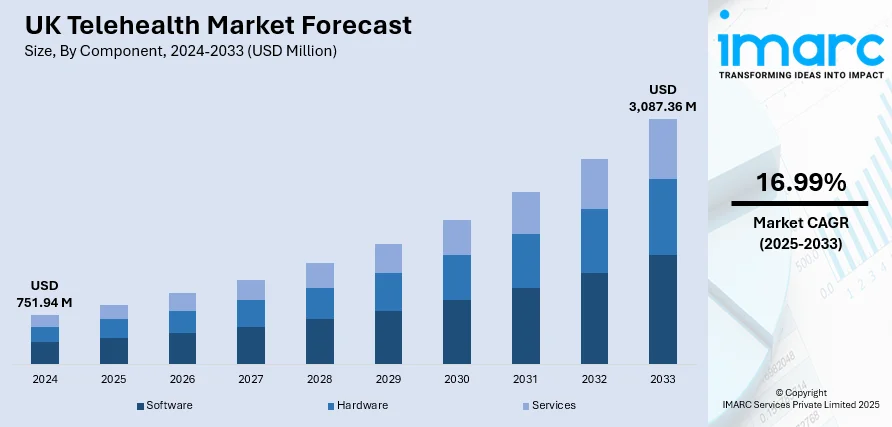

The UK telehealth market size was valued at USD 751.94 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,087.36 Million by 2033, exhibiting a CAGR of 16.99% during 2025-2033. London currently dominates the market share, holding a significant share in 2024. The market is driven by changing patient priorities, need of effective healthcare delivery, and universal digital uptake. Greater smartphone usage and internet penetration have also increased the availability of virtual consultations, especially for general checkups and mental well-being. Healthcare professionals and their need to minimize waiting times and optimize patient management, along with government funding of digital transformation in the NHS, further helps drive adoption while adding to the growth and competitiveness of the UK telehealth market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 751.94 Million |

|

Market Forecast in 2033

|

USD 3,087.36 Million |

| Market Growth Rate 2025-2033 | 16.99% |

The UK telehealth market is witnessing growth due to several prominent factors such as the increasing use of digital health technologies, including smartphones, wearable devices, and internet connectivity, which has made telehealth services easily accessible to the masses. This is very useful for people residing in rural and underserved areas, where healthcare access may be limited. Moreover, increasing demand for remotely operated healthcare services, in chronic disease management, has further fueled the market. Telehealth solutions provide cost-efficient alternatives to standard face-to-face consultation, cutting down on travel and hospital costs. Government incentives and policy reforms, such as funding and telehealth-friendly reimbursement policies, have also contributed to market growth. Apart from this, technological innovation continues to drive the development of the UK telehealth market growth.

To get more information on this market, Request Sample

The introductionof artificial intelligence (AI) and data analytics in telehealth platforms makes diagnosis more accurate and allows for customized planning of treatment. Remote patient monitoring, provided through wearable technology and IoT-based sensors, enables constant monitoring of physiological parameters like blood pressure, heart rate, and blood glucose. Telepsychiatry and mental health services expansion meet the increasing need for online counseling and therapy, availing timely care to affected people. In addition, advancements in easy-to-use teleconsultation apps and platforms have enhanced immediate communication between patients and medical professionals. Hence, these technologies facilitate greater efficiency and efficacy of telehealth services while also creating a more patient-centered healthcare system.

UK Telehealth Market Trends:

Increasing Demand for Remote Healthcare

One of the key drivers of the UK telehealth market is the growing demand for remote healthcare services. Telemedicine has a lot of promise, and its varied uses benefit both patients and healthcare institutions. For instance, according to a study on telemedicine for mental health, 81% of clinical staff thought that telemedicine consultations were of good or exceptional quality. Simultaneously, the COVID-19 pandemic has forced providers to adopt telehealth solutions, dramatically accelerating the adoption of digital health platforms. The COVID-19 epidemic expedited the development of telemedicine, as both patients and healthcare providers attempted to reduce physical contact and follow social distancing protocols. This highlighted telehealth's convenience and effectiveness in providing medical consultations, follow-up care, and even certain types of therapy. Remote healthcare services have proven to be particularly useful for controlling chronic diseases, mental health issues, and post-operative care. Patients welcome the reduction in travel and waiting times, while healthcare providers may reach a larger patient base and streamline operations.

Government Policies

Government funding and policy actions have a substantial impact on the UK telehealth market outlook. The National Health Service (NHS) has actively promoted the use of telehealth to improve healthcare accessibility and lessen the demand on physical healthcare facilities. During the pandemic, the UK government implemented several measures to encourage the rapid adoption of telehealth, including regulatory changes that increased flexibility in telehealth services and reimbursement regulations. Besides, the U.K.'s National Health Service AI Lab launched its National Strategy for AI in Health and Social Care to support the development of AI-driven technologies. The government has also invested in strengthening digital infrastructure to facilitate telehealth services, particularly in rural and underserved areas. Initiatives like the NHS Long Term Plan emphasize the relevance of digital health solutions in modernizing the healthcare system and improving patient care.

Use of Remote Patient Monitoring (RPM) Technologies

Another trend contributing to growth and development, according to the UK telehealth market forecast is the quick uptake of remote patient monitoring (RPM) technologies. Blood pressure, glucose levels, and heart rate are among the vital signs that RPM continuously monitors for patients using wearable technologies and online platforms. This makes it possible for medical personnel to monitor patients in real time, facilitating prompt interventions and early detection of possible health issues. Their effectiveness is further increased with the inclusion of AI and data analytics in RPM platforms through the identification of patterns and health risk prediction. For example, the NHS has introduced initiatives such as Edith, an AI-powered breast screening program, which will help to decrease waiting times and increase early detection rates. Moreover, Scotland's home blood pressure monitoring schemes have also managed to release about 400,000 GP appointments, attesting to the cost-effectiveness and efficacy of RPM. With these technologies further developing, RPM has the potential to be at the forefront of reshaping healthcare delivery in the UK, with more individualized, forward-thinking, and convenient care being available for patients.

UK Telehealth Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK telehealth market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, communication technology, hosting type, application, and end user.

Analysis by Component:

- Software

- Hardware

- Services

Software stands as the largest component in 2024, holding around 55.6% of the market. The increasing demand for scalable, user-friendly digital health platforms has made software the most popular component segment in the UK telehealth market. These software applications provide virtual consultations, electronic health record (EHR) integration, remote patient monitoring, and AI-powered diagnostics. Telehealth software is being used by providers more frequently to increase patient engagement, boost operational effectiveness, and provide individualized care. Cloud-based platforms facilitate safe, instantaneous communication between medical staff and patients, promoting continuity of care and decreasing the strain on physical infrastructure. The dominance of software is further reinforced by the growing need for mobile health applications, interoperable systems, and data analytics. Strong telehealth software continues to be the cornerstone of virtual care delivery in the UK as digital transformation speeds up in both the NHS and private healthcare.

Analysis by Communication Technology:

- Video Conferencing

- mHealth Solutions

- Others

Video conferencing leads the market with around 62.2% of market share in 2024. In the UK telehealth market, video conferencing has become the most popular communication tool, transforming interactions between patients and providers. Platforms that facilitate real-time, in-person communication between clinicians and patients, such as Zoom, Microsoft Teams, and NHS's Attend Anywhere, have become essential for conducting remote consultations. The COVID-19 pandemic hastened the adoption of these technologies; between January 2021 and January 2022, NHS Scotland's "Near Me" initiative enabled over 985,000 video consultations, greatly lowering patient travel and related emissions. Clinical workflows and patient engagement are improved by these platforms' support for several features, such as screen sharing, secure messaging, and integration with electronic health records. The NHS Long Term Plan's commitment toward the transformation of digital health essentially drives the growth of video conferencing in healthcare, with the goal of enhancing access, cutting down on wait times, and delivering equitable care throughout the country. Video conferencing continues to be a vital component of the UK's telehealth infrastructure as technology advances, enabling effective and easily accessible healthcare delivery.

Analysis by Hosting Type:

- Cloud-based and Web-based

- On-premises

Cloud-based and web-based leads the market with around 65.8% of market share in 2024. The UK telehealth market is dominated by web-based and cloud-based hosting owing to its affordability, scalability, and accessibility. Healthcare providers can store and manage patient data on distant servers using cloud-based solutions, which make it accessible from any location with an internet connection. This adaptability facilitates real-time monitoring, remote consultations, and smooth interaction with electronic medical records. By removing the need for specialized software installations, web-based applications—which run within internet browsers—further improve accessibility. In addition to providing strong data security measures, these hosting options guarantee adherence to healthcare laws. Cloud and web-based telehealth solutions have become more popular in the UK due to its dedication to digital health transformation, which is demonstrated by programs like the NHS Long Term Plan. These hosting models are anticipated to be crucial in determining the direction of telehealth in the UK as the need for remote medical services keeps growing.

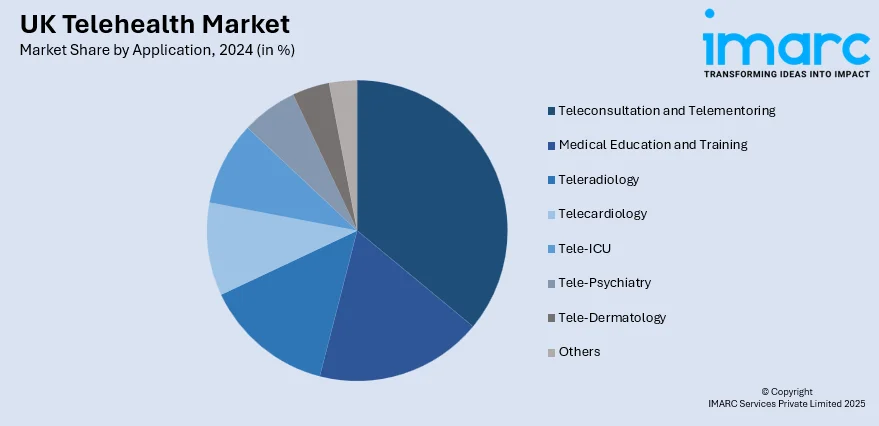

Analysis by Application:

- Teleconsultation and Telementoring

- Medical Education and Training

- Teleradiology

- Telecardiology

- Tele-ICU

- Tele-Psychiatry

- Tele-Dermatology

- Others

Teleconsultation and telementoring leads the market with around 48.2% of market share in 2024. The primary application areas propelling the UK telehealth market's expansion are teleconsultation and telementoring. Patients can obtain medical advice and diagnosis remotely through teleconsultation, which eases the strain on medical facilities and enhances access, particularly in underserved or rural areas. It is now the go-to approach for managing chronic diseases, mental health support, and regular checkups. On the other hand, telementoring helps medical professionals by enabling experts to mentor or instruct colleagues in real time, frequently during difficult procedures or decision-making processes. This improves clinical standards and encourages knowledge exchange among NHS trusts. These applications are becoming essential to workforce development, care delivery, and service efficiency in primary and secondary care settings as the UK healthcare system places a strong emphasis on digital transformation.

Analysis by End User:

- Providers

- Patients

- Payers

Providers lead the market with around 52.3% of market share in 2024. The most significant end users in the UK telehealth market are healthcare providers, which include clinics, hospitals, and private practitioners. The growing use of telehealth services to improve efficiency, lower operating costs, and improve patient care is what is causing this dominance. Providers can monitor patients with chronic conditions, conduct remote consultations, and oversee care for patients in underserved or rural areas owingto telehealth. By using telehealth solutions, healthcare providers can expand their patient base, optimize resource utilization, and improve patient happiness. Additionally, the COVID-19 pandemic accelerated the use of telemedicine by highlighting its benefits in maintaining continuity of treatment and lowering the risk of contracting infectious diseases. Healthcare providers continue to be at the forefront of telehealth implementation as the healthcare landscape changes, spurring innovation and influencing how healthcare is delivered in the UK going forward.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

In 2024, London accounted for the largest market share. London's strong healthcare system, innovative technology, and diverse population makes it the most prominent regional market for telehealth in the United Kingdom. A collaborative environment for digital health innovation has been fostered by initiatives such as DigitalHealth. London, which is supported by NHS England, MedCity, and academic health science networks. These initiatives have improved patient care and operational efficiency throughout the capital by resulting in the creation and deployment of numerous telehealth solutions, including AI-driven diagnostic tools and remote monitoring programs. Furthermore, London's commitment to integrating technology into healthcare delivery is demonstrated by the fact that up to three out of four residents use websites for GP surgeries, online consultation forms, and the NHS App.

Competitive Landscape:

Major stakeholders in the UK telehealth industry are leading its development with innovative strategies, collaborations, and technology-enabled models of services. Babylon Health, Livi, and Push Doctor have led the way with virtual consultations, making primary care accessible through simple mobile-based platforms. These companies are heavily investing in artificial intelligence and data analytics to improve diagnostic quality and patient-centricity. Babylon, for example, combines symptom checking and digital triage within its offering to simplify patient pathways and ease pressure on NHS resources. Livi, meanwhile, has partnered with NHS providers to provide GP services virtually, increasing reach without decreasing the quality of care. Push Doctor has also partnered with NHS trusts to increase efficiency and accessibility through joined-up digital solutions. Telehealth companies are increasingly collaborating with wearable tech companies to facilitate remote monitoring and chronic disease management. Furthermore, NHS Digital support and initiatives such as DigitalHealth. London offer structure and mentorship for scaling promising solutions. These synergy-driven endeavors enhance patient outcomes and lower healthcare expenditures while also creating a strong digital health ecosystem in the UK. Together, the efforts and investments of these major players are critical in driving telehealth take-up and charting the future course of the UK's healthcare delivery scene.

The report provides a comprehensive analysis of the competitive landscape in the UK telehealth market with detailed profiles of all major companies, including:

Latest News and Developments:

- November 2024: The UK witnessed the launch of Doctorsa, a global telehealth platform that links tourists with nearby physicians in five minutes. The platform is available to visitors and UK residents in need of urgent care, which is medical care for non-life-threatening conditions or injuries that need to be attended to right away. This is especially helpful for those who must wait a long time for a GP appointment or who require assistance outside of regular business hours. Doctorsa has served over 100,000 users to date and is presently operational in 33 countries with a network of 500 doctors.

- April 2025: Neko Health launched its largest health center in London's Spitalfields Market, focusing on preventive care through advanced telehealth services. The GBP 299 Neko Body Scan employs over 70 sensors to collect 50 million data points, assessing risks for conditions like heart disease and skin cancer. Results are delivered within an hour during a doctor-led consultation, enhancing early detection and proactive health management.

- April 2025: London-based digital healthcare provider Doctor Care Anywhere partnered with global health AI firm Huma to expand telehealth access in the UK and ease NHS appointment bottlenecks. The collaboration utilizes Huma’s myGP app, an independent NHS GP booking platform, to meet rising demand for digital General Practitioner (GP) services.

- February 2025: HealthKey launched a strategic partnership with Endurance Zone in the UK, offering over 200 healthcare services, including telehealth access, through a fitness rewards platform. The tie-up intensified competition in the telehealth upsell space, targeting fitness club members with services like private GP visits, cancer screenings, and nutritional support.

- January 2025: UK-based Releaf launched a USD 2.54 million telehealth tech platform to streamline access to medical cannabis, addressing barriers since its 2018 legalization. The system enables real-time consultations, prescribing, and home delivery, aiming to ease patient struggles across the UK.

UK Telehealth Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Communication Technologies Covered | Video Conferencing, mHealth Solutions, Others |

| Hosting Types Covered | Cloud-based and Web-based, On-premises |

| Applications Covered | Teleconsultation and Telementoring, Medical Education and Training, Teleradiology, Telecardiology, Tele-ICU, Tele-Psychiatry, Tele-Dermatology, Others |

| End Users Covered | Providers, Patients, Payers |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK telehealth market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK telehealth market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK telehealth industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK telehealth market was valued at USD 751.94 Million in 2024.

The UK telehealth market is projected to exhibit a CAGR of 16.99% during 2025-2033, reaching a value of USD 3,087.36 Million by 2033.

The UK telehealth market is driven by growing demand for remote consultations, improved digital infrastructure, and greater acceptance of virtual care by both patients and providers. NHS initiatives promoting digital health and advancements in AI-powered diagnostics further support adoption, making telehealth an increasingly integral part of UK healthcare delivery.

London currently dominates the UK telehealth market, driven by NHS digital initiatives, strong public-private partnerships, and rapid technological innovation. Local startups, AI integration, and targeted health equity programs enhance accessibility and efficiency. Supportive ecosystems like DigitalHealth. London further accelerate adoption, making London a leading hub for digital healthcare transformation in the UK.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)